1inch Finance is a revolutionary platform that provides users with a seamless and efficient way to engage in yield farming. With its advanced technology and user-friendly interface, 1inch Finance offers a range of benefits that make it the preferred choice for crypto enthusiasts.

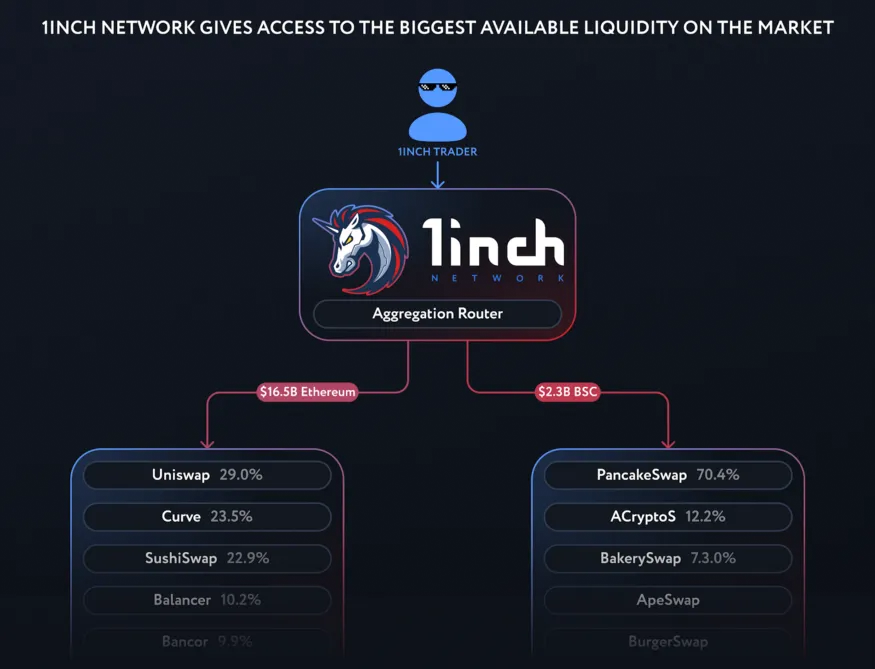

One of the key advantages of using 1inch Finance for yield farming is its liquidity aggregation feature. This innovative technology allows users to access the best available liquidity across multiple decentralized exchanges, ensuring optimized trading conditions and reduced slippage. Say goodbye to manually searching for the best rates and let 1inch Finance do the work for you.

Additionally, 1inch Finance offers gas optimization strategies that allow users to minimize transaction costs. By intelligently routing transactions through gas-efficient channels, users can save on fees and maximize their yield farming profits. This means more earnings and less expenses.

Moreover, 1inch Finance prioritizes security and trust, with rigorous security protocols in place to protect user funds. It utilizes smart contract audits and partners with top security firms to ensure the safety of user assets. Rest assured that your funds are in good hands when using 1inch Finance for yield farming.

Furthermore, 1inch Finance is committed to providing users with a seamless and intuitive experience. Its user-friendly interface and comprehensive analytics tools make it easy for both beginner and experienced users to navigate the platform and make informed decisions. Get started with yield farming on 1inch Finance and unlock your crypto potential.

In conclusion, 1inch Finance offers a range of advantages that make it the go-to platform for yield farming. From liquidity aggregation and gas optimization to enhanced security and user-friendly interface, 1inch Finance has everything you need to optimize your yield farming experience. Start farming with 1inch Finance today and take your crypto earnings to new heights.

What is Yield Farming?

Yield farming is a popular strategy in the world of decentralized finance (DeFi) that allows investors to earn passive income on their cryptocurrency holdings. It involves leveraging various DeFi protocols to earn high returns on cryptocurrency assets, such as tokens or stablecoins.

The concept of yield farming revolves around providing liquidity to decentralized exchanges (DEXs) or lending platforms. By locking up their cryptocurrencies in these platforms, investors can participate in various liquidity pools and lending markets, where they can earn interest or additional tokens as rewards.

Yield farming typically involves staking or depositing cryptocurrency assets into liquidity pools. These pools allow borrowers to take out loans and pay interest, which is then distributed among the liquidity providers. The rewards can come in the form of additional cryptocurrency tokens, governance tokens, or other incentives provided by the platform.

Yield farming has gained popularity due to the potential for high returns compared to traditional investment options. However, it also carries risks, including smart contract vulnerabilities, impermanent loss, and price volatility. Therefore, it is important for investors to carefully research and understand the risks associated with each yield farming opportunity before participating.

How Does Yield Farming Work?

Yield farming works by utilizing decentralized finance protocols that operate on blockchain networks. These protocols typically use smart contracts to automate and govern the processes of providing liquidity and distributing rewards.

Investors begin by depositing their cryptocurrency assets, such as Ethereum (ETH) or stablecoins like USDT, into a liquidity pool. These pools are essentially smart contracts that facilitate the lending or trading of cryptocurrencies.

Once the assets are deposited, they become locked in the pool and are used to provide liquidity for other users of the platform. In return for depositing their assets, investors receive liquidity pool tokens, which represent their share of the total liquidity in the pool.

These liquidity pool tokens can be staked or further utilized in other DeFi protocols to earn additional rewards or participate in governance rights. The rewards earned through yield farming can vary depending on the protocols and their respective rules.

Yield farming can be a complex process that requires careful consideration of various factors, including the potential returns, risks, lock-up periods, and fees associated with each platform. It is important for investors to conduct thorough research and due diligence before participating in any yield farming opportunities.

Considerations for Yield Farming

While yield farming can provide attractive returns, it is essential to consider certain factors before getting involved:

| Risks | Rewards | Platform Reputation |

|---|---|---|

| Smart contract vulnerabilities | High potential returns | Trustworthiness of the platform |

| Impermanent loss | Additional tokens or governance rights | Security measures implemented |

| Price volatility | Opportunity to participate in DeFi ecosystem | User reviews and feedback |

By carefully considering these factors, investors can make informed decisions and mitigate the risks associated with participating in yield farming. It is important to remember that yield farming, like any investment strategy, carries inherent risks, and it is crucial to only invest what you can afford to lose.

The Importance of Yield Farming

Yield farming has become an essential part of the decentralized finance (DeFi) ecosystem. It provides users with the opportunity to earn passive income on their cryptocurrency holdings. The concept of yield farming involves staking or lending digital assets to earn additional tokens as rewards.

One of the main advantages of yield farming is that it allows users to generate a steady stream of income without relying on traditional financial institutions. With traditional investments, such as savings accounts or bonds, the returns are often low and can be subject to inflation. However, by participating in yield farming, individuals can earn significantly higher returns on their investments.

Maximizing Returns on Investments

Yield farming platforms, like 1inch Finance, offer users various strategies to maximize their returns. These strategies can include liquidity provision, where users can provide liquidity to decentralized exchanges and earn fees in return. Additionally, users can participate in yield aggregation, where platforms automate the process of finding the most profitable farming opportunities across different protocols.

By using yield farming platforms, individuals can take advantage of the ever-evolving DeFi ecosystem and capitalize on new opportunities. The constant innovation and development in the DeFi space open up possibilities for users to earn higher yields and discover new investment strategies.

Facilitating the Growth of DeFi

Yield farming plays a crucial role in expanding the reach and adoption of decentralized finance. By incentivizing users to engage with various DeFi protocols, yield farming encourages liquidity and activity in the ecosystem. This increased liquidity enhances the overall efficiency and functionality of DeFi platforms, making them more attractive to both users and investors.

Furthermore, yield farming fosters the development of new DeFi projects and incentivizes the creation of innovative financial solutions. As more users participate in yield farming and the liquidity in the ecosystem grows, it attracts developers and entrepreneurs who can build on top of existing protocols and contribute to the growth of DeFi as a whole.

| Benefits of Yield Farming |

|---|

| 1. Earn higher returns on investments |

| 2. Diversify crypto holdings |

| 3. Participate in the growing DeFi ecosystem |

| 4. Discover new investment opportunities |

Fast and Efficient Transactions

When it comes to yield farming, time is of the essence. With 1inch Finance, users can experience fast and efficient transactions that save both time and money.

Lightning-Fast Execution

1inch Finance utilizes a decentralized protocol that allows for lightning-fast transaction execution. This means that users can quickly and seamlessly swap between different assets and maximize their yield farming opportunities.

Lower Gas Fees

Gas fees can often eat into the profits generated from yield farming. However, by using 1inch Finance, users can enjoy lower gas fees, ensuring that more of their earnings are kept in their pockets.

1inch Finance achieves this by optimizing gas usage and routing transactions through multiple decentralized exchanges, finding the most cost-effective and efficient paths for users to transact.

Furthermore, 1inch Finance integrates with various layer 2 solutions such as Polygon and Loopring, further reducing gas costs and allowing for near-instant transactions.

Enhanced User Experience

With 1inch Finance, users can enjoy a seamless and intuitive interface that makes yield farming a breeze. The platform is designed to provide a smooth user experience, ensuring that even novice users can navigate through the process without any hassle.

Additionally, 1inch Finance offers detailed transaction history and analytics, allowing users to track their activities and monitor their performance in real-time.

Overall, the fast and efficient transactions provided by 1inch Finance make it the ideal platform for yield farming, giving users the ability to make the most of their investments and maximize their returns.

Lower Transaction Fees

When it comes to yield farming, transaction fees can significantly eat into your profits. However, when using 1inch Finance, you can enjoy the benefits of lower transaction fees compared to other platforms.

1inch Finance utilizes advanced algorithms to optimize swaps and find the most cost-effective routes for your transactions. This means that you can save money on gas fees and maximize your yield farming returns.

By leveraging the power of multiple decentralized exchanges, 1inch Finance is able to achieve lower slippage and lower fees. This allows users to optimize their transactions and minimize the impact on their overall profitability.

In addition, 1inch Finance constantly monitors the market and adjusts its algorithms to ensure that users are always getting the best possible rates and lowest fees. This commitment to continuous improvement sets 1inch Finance apart from its competitors.

Benefits of Lower Transaction Fees:

- Maximize your yield farming profits

- Save money on gas fees

- Optimize your transactions for lower slippage

- Stay ahead of the market with the best rates and lowest fees

With 1inch Finance, lower transaction fees are just one of the many advantages you can enjoy when yield farming. Start using 1inch Finance today and experience the difference for yourself.

Access to a Wide Range of Liquidity Sources

One of the key advantages of using 1inch Finance for yield farming is the access it provides to a wide range of liquidity sources. Whether you are a beginner or an experienced investor, having multiple liquidity options is crucial for maximizing your returns and minimizing risks.

With 1inch Finance, you can tap into a vast network of decentralized exchanges (DEXs), lending platforms, and other liquidity pools. This gives you the flexibility to choose the most suitable liquidity source based on factors such as token availability, transaction fees, and slippage.

Diversification

By accessing a wide range of liquidity sources, you can diversify your yield farming strategies and reduce reliance on a single platform or protocol. Diversification is key in minimizing the impact of potential risks and vulnerabilities associated with specific DeFi platforms.

1inch Finance allows you to easily switch between different liquidity sources, ensuring that your funds are not concentrated in one platform or protocol. This level of diversification can help protect your investments from potential hacks, smart contract vulnerabilities, or platform failures.

Optimized Yield Opportunities

Having access to multiple liquidity sources also opens up opportunities for optimized yield farming. By comparing the available interest rates, rewards, and fees across different platforms, you can identify the most profitable farming strategies.

1inch Finance provides you with detailed information on the potential yields and risks associated with different liquidity sources. This empowers you to make informed decisions and maximize your returns while minimizing the effort required to manage your yield farming positions.

Take advantage of the wide range of liquidity sources available through 1inch Finance for your yield farming needs. Diversify your strategies, optimize your yields, and take control of your DeFi investments with ease.

Question-answer:

What is 1inch Finance?

1inch Finance is a decentralized exchange aggregator that sources liquidity from various exchanges to provide users with the best possible trading rates. It also offers yield farming opportunities.

How does 1inch Finance help with yield farming?

1inch Finance helps with yield farming by aggregating liquidity from different platforms, finding the best yield farming opportunities, and automatically executing trades to optimize returns for users.

Can I trust 1inch Finance with my funds?

1inch Finance is a decentralized platform that operates via smart contracts on the Ethereum blockchain. While it is designed to be secure and transparent, it is important to note that all investments and transactions carry inherent risks. It is advisable to do your own research and consult with financial advisors before engaging in any investment activity.