Decentralized exchanges (DEXs) have gained significant popularity in the world of cryptocurrency trading. They allow users to trade directly with each other, without the need for intermediaries or centralized authorities. However, one of the main challenges faced by DEXs is the issue of liquidity. Liquidity refers to the ease with which an asset can be bought or sold without impacting its price. In order to improve liquidity in DEXs, various solutions have been developed, and 1inch is one of the leading platforms in this space.

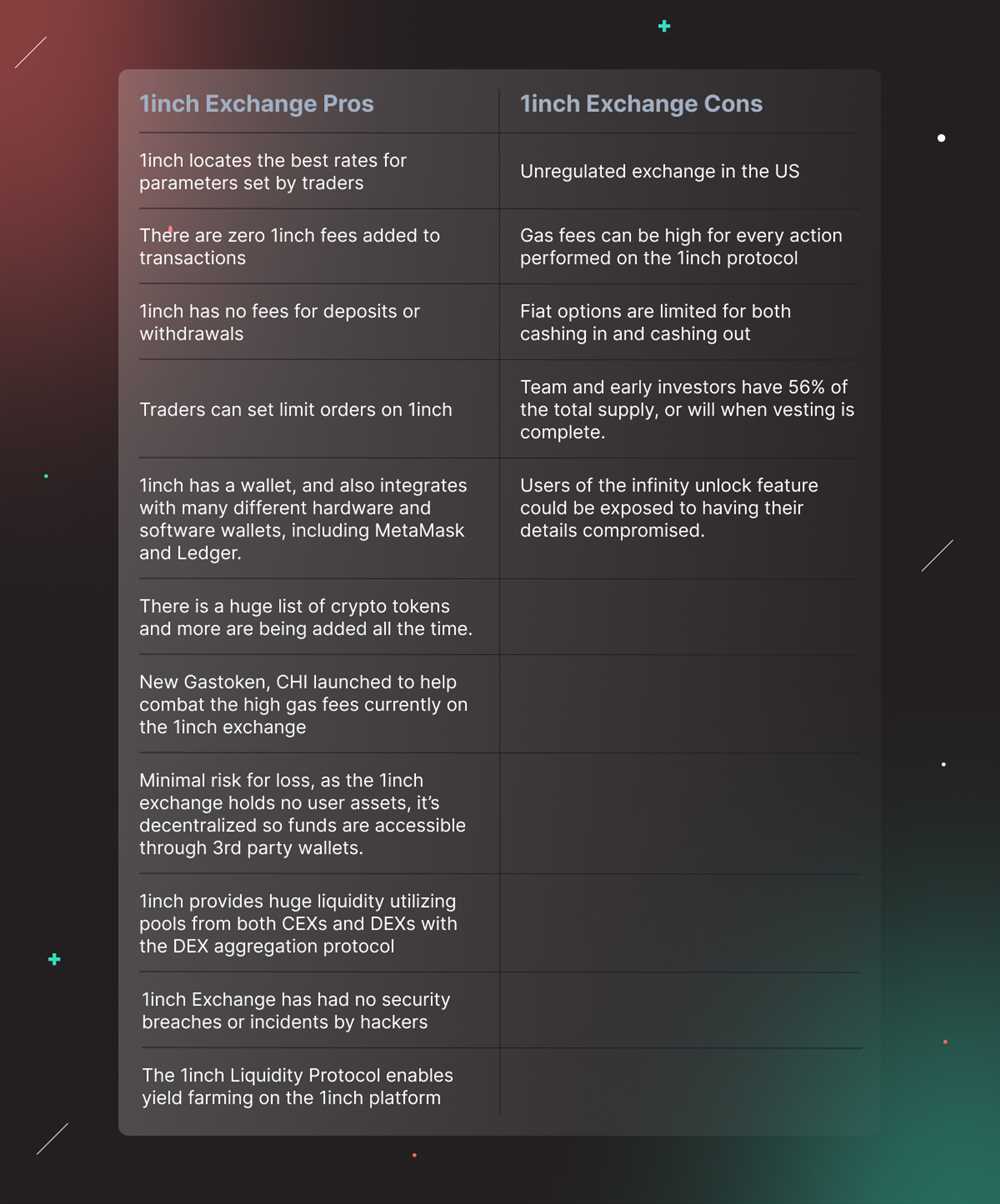

1inch is a decentralized exchange aggregator that operates across multiple blockchains. It sources liquidity from various DEXs, including Uniswap, SushiSwap, and Kyber, and finds the best trading routes to get users the most favorable rates. By splitting a trade across multiple DEXs, 1inch can optimize liquidity and reduce slippage, which is the difference between the expected price of a trade and the executed price.

One of the key features of 1inch is its Pathfinder algorithm, which efficiently calculates the most cost-effective trading paths. The algorithm takes into account various factors, such as gas costs, trading fees, and available liquidity, to ensure that users get the best possible rates. Moreover, 1inch also offers a feature called Chi GasToken, which allows users to save on gas fees by optimizing the use of Ethereum’s gas limits.

Overall, 1inch plays a crucial role in optimizing liquidity in decentralized exchanges. By aggregating liquidity from multiple DEXs and leveraging advanced algorithms, 1inch is able to provide users with better trading rates and reduce the impact of slippage. As the popularity of DEXs continues to grow, platforms like 1inch will play an increasingly important role in improving the overall trading experience in the decentralized finance ecosystem.

The Importance of Liquidity in Decentralized Exchanges

Liquidity is a fundamental aspect of any financial market, and decentralized exchanges (DEXs) are no exception. In fact, liquidity is even more crucial in DEXs due to their decentralized nature.

Decentralized exchanges operate on the basis of smart contracts, enabling users to trade cryptocurrencies directly from their wallets without the need for intermediaries. However, unlike traditional centralized exchanges, DEXs do not have a central order book that matches buyers and sellers.

Without sufficient liquidity, DEXs can face several challenges:

Slippage:

When liquidity is low, the execution of trades can result in significant price slippage. This means that the actual price at which a trade is executed can deviate significantly from the expected price, leading to suboptimal outcomes for traders.

Low Trading Volume:

Low liquidity often goes hand in hand with low trading volume. Without a vibrant ecosystem of buyers and sellers, there is limited interest and activity on the exchange. This creates a less attractive trading environment and reduces the potential for traders to find suitable counterparties.

Arbitrage Opportunities:

Insufficient liquidity also opens up opportunities for arbitrageurs to exploit price discrepancies between different exchanges. These arbitrageurs can take advantage of the lack of liquidity to buy low on one exchange and sell high on another, thereby profiting from market inefficiencies.

1inch recognizes the importance of liquidity in DEXs and has developed advanced algorithms to optimize liquidity across multiple decentralized exchanges. By aggregating liquidity from different sources and utilizing efficient trading routes, 1inch ensures that traders can access the best possible prices and minimize slippage.

Furthermore, 1inch’s liquidity protocols provide incentives for liquidity providers, attracting more liquidity to decentralized exchanges. This helps address the issue of low liquidity and enhances the overall trading experience on DEXs.

In conclusion, liquidity plays a vital role in the success of decentralized exchanges. Without sufficient liquidity, traders may experience slippage, low trading volume, and missed arbitrage opportunities. Platforms like 1inch are addressing these challenges by optimizing liquidity and incentivizing liquidity providers, thereby improving the overall efficiency and attractiveness of decentralized exchanges.

How 1inch Improves Liquidity

1inch plays a crucial role in optimizing liquidity in the decentralized exchange (DEX) ecosystem. Through its unique aggregation and optimization algorithms, 1inch effectively tackles the problem of fragmentation and illiquidity that plague many DEXs.

Smart Routing

One of the key features of 1inch is its smart routing capability, which allows it to split an order across multiple liquidity sources to achieve the best possible rates. By leveraging its integration with multiple DEXs and liquidity providers, 1inch can efficiently navigate the fragmented DEX landscape and find the best liquidity pools for a given trade.

Through its sophisticated algorithm, 1inch analyses the available liquidity on various DEX platforms, taking into account factors such as slippage, gas costs, and trading fees. It then intelligently routes the trade to the most optimal DEX or combination of DEXs to ensure the trader gets the best possible price.

Aggregation and Optimized Trading

In addition to smart routing, 1inch also employs aggregation and optimization strategies to improve liquidity. It aggregates liquidity from various DEXs and sources, combining them into a single, deeper liquidity pool. This aggregation process mitigates fragmentation and enables users to access larger liquidity pools, resulting in better prices and reduced slippage.

Moreover, 1inch’s optimization algorithms continuously monitor and update liquidity and trading data to ensure users are always trading at the best possible rates. It intelligently responds to market fluctuations, adjusting its routing and aggregation strategies in real-time to maximize liquidity and minimize trading costs.

By combining smart routing, aggregation, and optimization, 1inch provides users with a seamless trading experience on DEXs. Traders can access the best liquidity across multiple platforms and enjoy improved trading conditions, enhancing overall liquidity in the decentralized exchange ecosystem.

In conclusion, 1inch’s unique combination of smart routing, aggregation, and optimization strategies plays a significant role in improving liquidity in decentralized exchanges. It effectively addresses the issues of fragmentation and illiquidity, providing traders with better prices and improved trading conditions. As the decentralized finance ecosystem continues to evolve, 1inch remains at the forefront, facilitating efficient and liquid trading across multiple DEXs.-

The Benefits of Optimizing Liquidity with 1inch

Decentralized exchanges (DEXs) have gained significant popularity in the world of cryptocurrency trading, offering users increased privacy, security, and control over their funds. However, one common challenge with DEXs is the issue of liquidity, which can lead to higher slippage rates and less favorable trading conditions for users.

This is where 1inch comes in. 1inch is a decentralized exchange aggregator that aims to optimize liquidity by aggregating and splitting orders across multiple DEXs. By doing so, 1inch is able to offer users the following benefits:

1. Increased Liquidity: By aggregating liquidity from various DEX platforms, 1inch is able to provide users with access to a larger pool of liquidity. This helps to minimize price slippage and ensures that users are able to execute trades at more favorable rates.

2. Faster Execution: 1inch uses advanced algorithms to split orders across multiple DEXs, ensuring that trades are executed quickly and efficiently. This helps to reduce the time it takes to complete a trade, allowing users to take advantage of market opportunities before they disappear.

3. Access to Multiple DEXs: With 1inch, users can access liquidity from a wide range of decentralized exchanges, including Uniswap, SushiSwap, and Balancer, among others. This allows users to diversify their trading strategies and take advantage of the best liquidity options available on the market.

4. Lower Fees: By aggregating and splitting orders across multiple DEXs, 1inch is able to minimize fees and trading costs for users. This can lead to significant cost savings, especially for users who frequently trade large volumes of cryptocurrency.

5. Improved Price Discovery: With access to a larger pool of liquidity, 1inch helps to improve price discovery on decentralized exchanges. This means that the prices of assets listed on DEXs are more closely aligned with the broader market, reducing the risk of price manipulation and providing users with greater confidence in their trades.

In conclusion, 1inch plays a crucial role in optimizing liquidity in decentralized exchanges. By aggregating liquidity from multiple DEXs and using advanced algorithms, 1inch is able to provide users with increased liquidity, faster execution, access to multiple platforms, lower fees, and improved price discovery. As a result, users can enjoy a more seamless and efficient trading experience on decentralized exchanges.

The Future of Liquidity Optimization in Decentralized Exchanges

In recent years, decentralized exchanges (DEXs) have emerged as a powerful alternative to traditional centralized exchanges. These DEXs allow users to trade digital assets directly from their wallets, eliminating the need for intermediaries and reducing the risk of hacks and theft.

One of the biggest challenges faced by DEXs is liquidity. Liquidity refers to the ease with which an asset can be bought or sold without significantly impacting its price. In decentralized exchanges, liquidity is often fragmented across different pools, leading to poor execution prices and slippage for traders.

The Role of 1inch

1inch is a decentralized exchange aggregator that aims to optimize liquidity by routing trades through various DEXs and liquidity protocols. By splitting large and complex orders into smaller parts and executing them across multiple platforms, 1inch is able to achieve better prices and lower slippage for traders.

1inch’s algorithm takes into account various factors such as liquidity depth, trading fees, and gas costs to determine the most optimal route for a trade. This ensures that traders get the best possible execution price while minimizing costs.

Furthermore, 1inch is constantly evolving and exploring new ways to improve liquidity optimization. The platform is actively working on integrating with Layer 2 solutions such as Polygon and Optimism to reduce transaction costs and improve scalability. This will further enhance liquidity and make decentralized exchanges more accessible to a wider range of users.

The Importance of Liquidity Optimization

Liquidity optimization is crucial for the growth and success of decentralized exchanges. It not only benefits traders by providing better prices and reducing slippage but also attracts more liquidity providers to participate in the ecosystem.

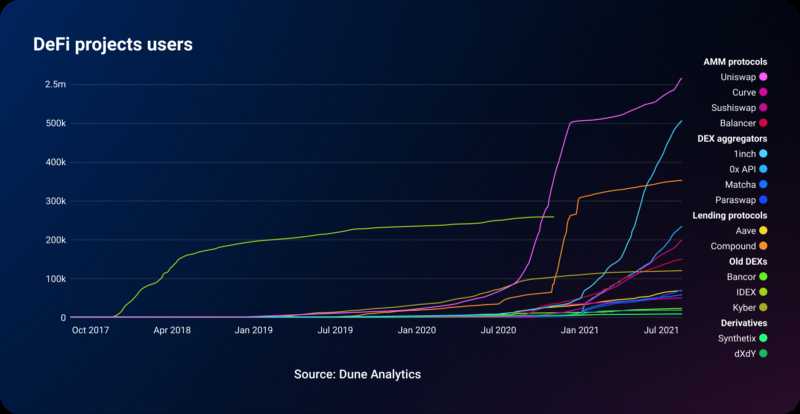

With the increasing popularity of decentralized finance (DeFi) and the growing number of users on DEXs, liquidity optimization will become more important than ever. As the competition heats up, DEXs that are able to offer the best liquidity and execution prices will be the ones that thrive.

In conclusion, the future of liquidity optimization in decentralized exchanges looks promising. Innovations like 1inch are playing a crucial role in improving liquidity and making DEXs more efficient. As the technology continues to evolve and new solutions are developed, we can expect liquidity optimization to become an integral part of the decentralized finance landscape.

Question-answer:

How does 1inch optimize liquidity in decentralized exchanges?

1inch optimizes liquidity in decentralized exchanges by splitting orders across multiple exchanges and finding the best prices for users. It uses an algorithm called Pathfinder to discover the most efficient paths for trading and executes trades across multiple liquidity sources to minimize slippage and maximize returns for users.

What is the role of 1inch in decentralized exchanges?

The role of 1inch in decentralized exchanges is to provide users with the best possible trading experience by optimizing liquidity. It finds the most efficient paths for trading across multiple exchanges, splits orders, and executes them in a way that minimizes slippage and maximizes returns for users. Additionally, 1inch also offers aggregation and swapping services for users.

How does the Pathfinder algorithm work?

The Pathfinder algorithm used by 1inch works by analyzing the order book data and liquidity pools of various decentralized exchanges. It identifies the most efficient trading paths by considering factors such as prices, slippage, and fees. The algorithm takes into account the available liquidity on different exchanges and splits the user’s order to execute it in a way that minimizes slippage and maximizes returns.