Algorithmic trading has revolutionized the way financial markets operate, bringing automation and efficiency to the trading process. One of the key players in this space is App.1inch, a decentralized exchange aggregator and liquidity provider that uses advanced algorithms to optimize trades across multiple platforms.

App.1inch’s algorithmic trading system is designed to maximize returns for users by taking advantage of price discrepancies across different exchanges. By analyzing market data in real-time, the system identifies the best possible trading opportunities and executes trades automatically on behalf of users. This allows users to take advantage of the best prices and liquidity available, while minimizing transaction costs and slippage.

One of the key features of App.1inch’s algorithmic trading system is its ability to split orders across multiple exchanges. This allows the system to access a larger pool of liquidity and find the best possible prices for each trade. By dynamically routing orders based on market conditions, the system ensures that users always get the best execution for their trades.

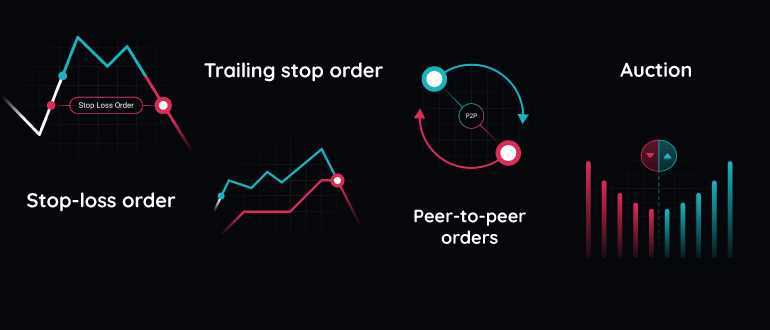

In addition to split orders, App.1inch’s algorithmic trading system also incorporates other advanced trading strategies, such as arbitrage and smart routing. These strategies allow the system to take advantage of price differences across different markets and optimize trades to achieve the best possible outcomes. By continuously analyzing market data and adjusting its trading strategy, the system is able to adapt to changing market conditions and maximize returns for users.

Overall, App.1inch’s algorithmic trading system is a powerful tool that allows users to leverage the benefits of algorithmic trading in the decentralized finance space. By automating the trading process and optimizing trades across multiple exchanges, the system maximizes returns while minimizing transaction costs and slippage. Whether you are a professional trader or a retail investor, App.1inch’s algorithmic trading system can help you achieve your trading goals in the fast-paced world of decentralized finance.

What is App.1inch?

App.1inch is a decentralized exchange (DEX) aggregator platform that optimizes trades for the best available prices across various decentralized exchanges. It was launched in 2020 and has quickly gained popularity among crypto traders and investors.

The platform is built on the Ethereum blockchain and operates using smart contracts. It allows users to swap tokens directly from their wallets without the need for intermediaries.

App.1inch utilizes an algorithmic trading mechanism to split orders across multiple DEXs in order to find the most favorable prices. This process is known as “DEX aggregation” and helps users get the best possible trading outcomes by combining liquidity from different exchanges.

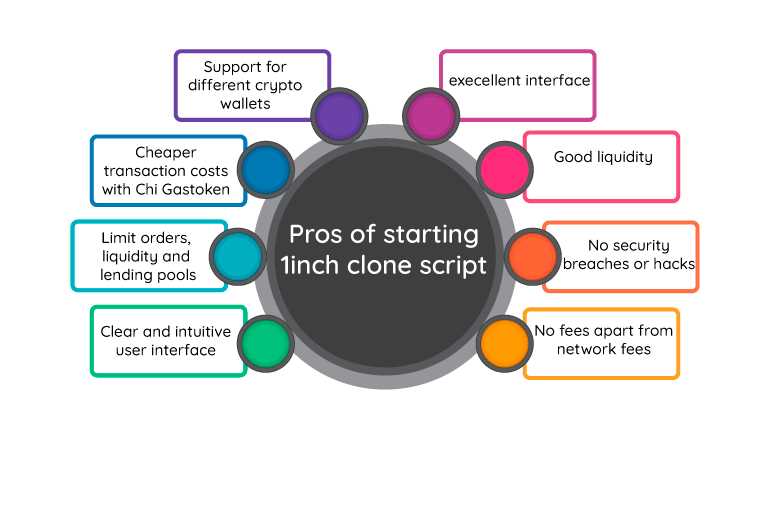

The platform also includes various features and tools to enhance the trading experience, such as limit orders, gas optimization, and liquidity mining. It aims to provide users with a seamless trading experience while ensuring the best possible prices and minimal slippage.

Features of App.1inch:

- DEX Aggregation: The platform aggregates liquidity from multiple DEXs to provide users with the best possible prices.

- Limit Orders: Users can set specific price targets for their trades and the platform will execute the order once the target is reached.

- Gas Optimization: App.1inch optimizes gas fees by splitting trades across different DEXs to minimize transaction costs.

- Liquidity Mining: Users can earn rewards by providing liquidity to the platform’s liquidity pools.

Advantages of Using App.1inch:

- Access to the best prices across multiple DEXs.

- Reduced slippage compared to trading on individual DEXs.

- Seamless user experience with easy-to-use interface and advanced trading features.

- Potential for earning rewards through liquidity mining.

Overall, App.1inch provides users with a powerful tool for executing trades on decentralized exchanges in a more efficient and cost-effective manner. It has gained popularity for its ability to optimize trading outcomes by aggregating liquidity from various DEXs and providing the best available prices.

What is algorithmic trading?

Algorithmic trading, also known as algo trading or automated trading, is the process of using computer algorithms to execute trades in financial markets. These algorithms are programmed to follow predefined rules and criteria in order to make trading decisions.

Algorithmic trading relies on various mathematical models and statistical analysis to identify patterns in market data and make profitable trading decisions. It involves the use of complex algorithms that can quickly analyze large amounts of data and execute trades at high speeds.

One of the key advantages of algorithmic trading is its ability to remove human emotions from the trading process. Emotions such as fear and greed can often cloud judgment and lead to poor trading decisions. Algorithmic trading eliminates this human error by using predefined rules and criteria to make trading decisions based solely on data and market conditions.

Algorithmic trading can be used in various types of financial markets, including stocks, bonds, commodities, and currencies. It is widely used by institutional investors such as banks and hedge funds, as well as individual traders.

Overall, algorithmic trading has revolutionized the way trading is conducted in financial markets. It has increased efficiency, reduced costs, and provided opportunities for more accurate and timely trading decisions.

Understanding the mechanics

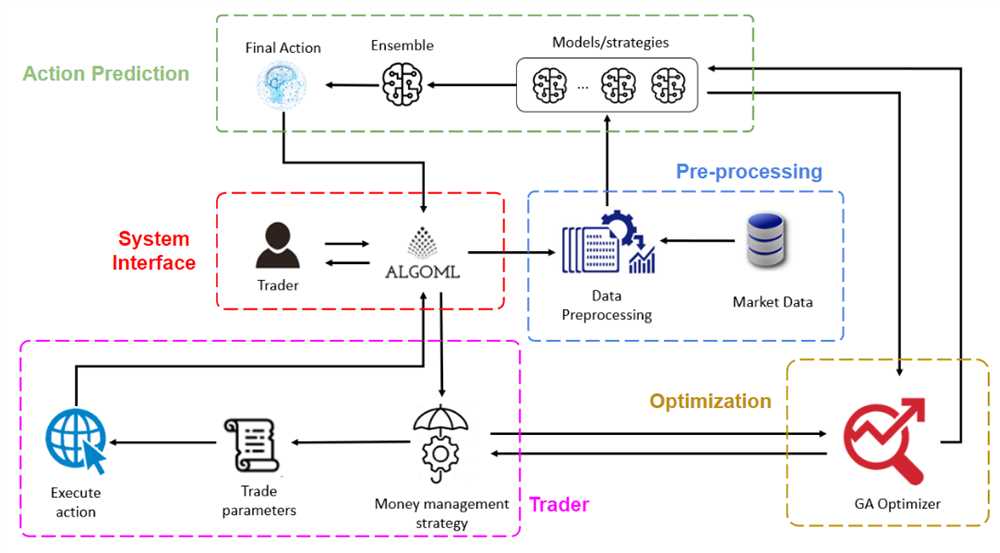

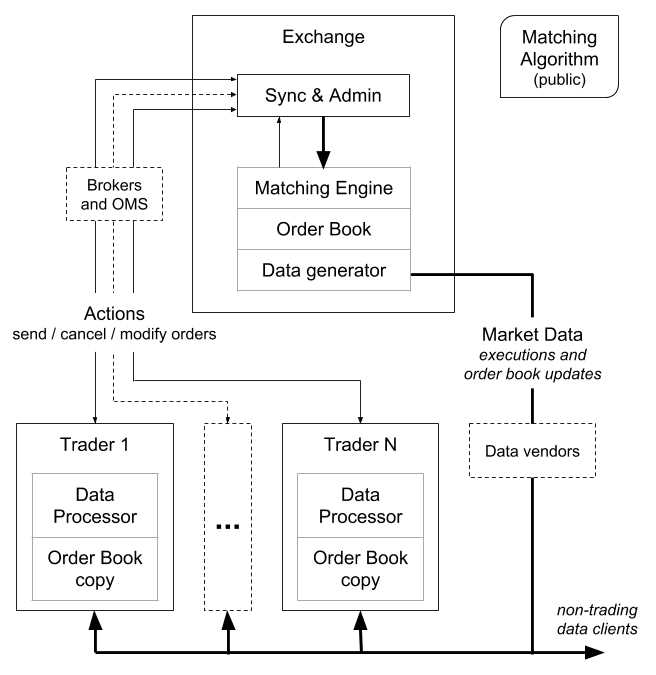

The mechanics of App.1inch’s algorithmic trading involves a complex process that aims to optimize the user’s trading experience and maximize their profits. To gain a better understanding of how this works, let’s take a closer look at the key components of the algorithmic trading system.

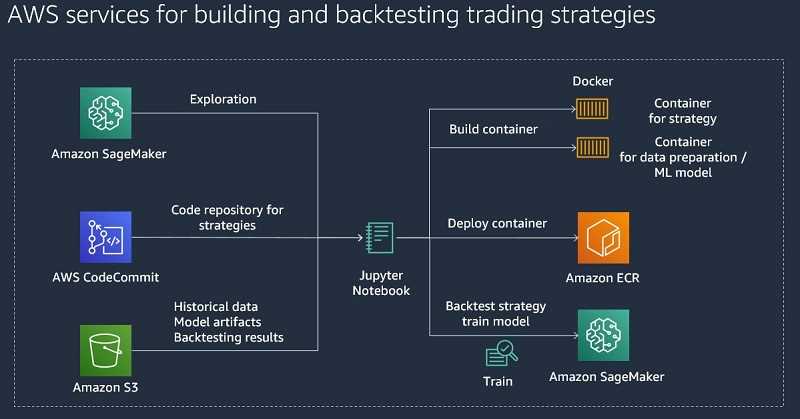

Data Analysis

The algorithmic trading system relies heavily on data analysis to make informed trading decisions. The system collects and analyzes vast amounts of market data, including prices, volumes, and liquidity information, from various decentralized exchanges. This data is then used to identify potential trading opportunities and execute trades.

Smart Routing

One of the key features of the App.1inch’s algorithmic trading system is its smart routing technology. This technology enables the system to split orders across multiple decentralized exchanges to ensure the best possible execution price. By routing orders intelligently, the system minimizes slippage and maximizes the user’s chances of getting the most favorable price.

| Benefit | Explanation |

|---|---|

| Reduced Slippage | By splitting orders across multiple exchanges, the system reduces slippage and ensures that the user gets the best possible price. |

| Increased Liquidity | Smart routing allows the system to tap into the liquidity pools of multiple exchanges, increasing the chances of finding suitable trading pairs. |

| Lower Trading Costs | By optimizing the execution process, the system aims to reduce trading costs and maximize the user’s profits. |

By employing smart routing, the App.1inch’s algorithmic trading system allows users to access better liquidity and potentially get better prices for their trades.

In conclusion, understanding the mechanics of App.1inch’s algorithmic trading system involves recognizing the importance of data analysis and smart routing. By leveraging these technologies, the system aims to provide users with the best possible trading experience and maximize their profits.

The role of smart contracts

Smart contracts play a crucial role in the operation of App.1inch’s algorithmic trading system. These contracts are self-executing agreements with the terms of the agreement written in code. They are powered by the Ethereum blockchain, which ensures transparency, security, and reliability.

When a user initiates a trade on App.1inch, the smart contract automatically executes the necessary actions to find and execute the best possible trade across multiple decentralized exchanges. The contract scans various liquidity sources, evaluates prices, and handles the exchange of assets, all in a trustless and automated manner.

One of the key benefits of smart contracts is their ability to eliminate intermediaries. Traditional trading systems often rely on centralized intermediaries, such as banks or exchanges, to facilitate transactions. With App.1inch’s algorithmic trading, smart contracts remove the need for such intermediaries, allowing users to interact directly with the decentralized financial infrastructure.

Moreover, smart contracts ensure that trades are executed exactly as intended by the user, without any possibility of tampering or manipulation. The terms of the trade are predefined within the contract, and once triggered, the contract automatically carries out the trade according to those terms. This eliminates the risk of fraud or human error that can occur in traditional trading systems.

Overall, smart contracts are the backbone of App.1inch’s algorithmic trading system. They enable automated and secure trades across a variety of decentralized exchanges, while ensuring transparency and eliminating the need for intermediaries. By leveraging the power of the Ethereum blockchain, App.1inch is able to provide users with a seamless and trustworthy trading experience.

Liquidity Aggregation

Liquidity aggregation is a key component of App.1inch’s algorithmic trading. It is the process of combining liquidity from various sources, such as decentralized exchanges (DEXs), to provide users with the best possible prices for their trades.

How does liquidity aggregation work?

App.1inch’s liquidity aggregation algorithm scans multiple DEXs, analyzing their order books and identifying the most favorable trading opportunities. It takes into account various factors, such as price, slippage, and fees, to determine the optimal route for executing a trade.

The algorithm splits the user’s trade into multiple smaller orders across different DEXs to minimize slippage and improve the overall execution price. It also ensures that the aggregated liquidity is sufficient to fulfill the user’s order without causing significant market impact.

Benefits of liquidity aggregation

Liquidity aggregation offers several advantages for traders:

- Better prices: By combining liquidity from multiple DEXs, App.1inch can offer users access to the best available prices in the market.

- Reduced slippage: Splitting trades across different DEXs helps to minimize slippage, which is the difference between the expected price and the executed price.

- Improved execution: The liquidity aggregation algorithm finds the most optimal route for executing trades, taking into account various factors, such as fees and available liquidity.

- Access to more tokens: By aggregating liquidity from different DEXs, App.1inch allows users to trade a wide range of tokens, even those with low liquidity on individual exchanges.

Liquidity aggregation is a powerful tool that enables App.1inch to provide users with the best possible trading experience, ensuring they can access the liquidity they need at the most favorable prices.

The benefits of App.1inch’s algorithmic trading

App.1inch’s algorithmic trading offers a range of benefits that give traders a competitive edge in the market. Here are some of the key advantages:

- Efficiency: By leveraging advanced algorithms, App.1inch can execute trades faster and more efficiently than manual trading. This enables traders to take advantage of market opportunities and maximize profits.

- Liquidity: App.1inch’s algorithmic trading algorithms are designed to access a wide range of liquidity sources, ensuring that traders can always find the best prices for their trades. This helps reduce slippage and improve overall trading performance.

- Diversification: App.1inch’s algorithmic trading allows users to easily diversify their trading strategies and portfolios by simultaneously executing multiple trades across different exchanges and assets. This helps reduce risk and increase the chances of profitable trades.

- Automation: With App.1inch’s algorithmic trading, traders can set predefined rules and parameters for their trades. The algorithms will then automatically execute trades based on these rules, eliminating the need for constant monitoring and manual intervention.

- Data-driven decision making: App.1inch’s algorithmic trading algorithms are developed based on extensive data analysis and machine learning. This enables traders to make informed decisions backed by data-driven insights, increasing the chances of successful trades.

- Cost savings: App.1inch’s algorithmic trading eliminates the need for intermediary brokers, reducing transaction costs and potentially increasing profits. This makes algorithmic trading a cost-effective option for traders.

Overall, App.1inch’s algorithmic trading provides traders with the tools and capabilities to improve trading efficiency, maximize returns, and reduce risk. By leveraging advanced algorithms and data-driven insights, traders can gain a competitive edge in the market and enhance their overall trading performance.

Question-answer:

How does App.1inch’s algorithmic trading work?

App.1inch’s algorithmic trading utilizes various strategies and algorithms to automatically execute trades on decentralized exchanges. It analyzes market data, liquidity, and other factors to determine the best trading opportunities and executes trades accordingly.

What are the advantages of algorithmic trading?

Algorithmic trading offers several advantages over manual trading. It allows for faster trade execution, reduces the impact of emotions on trading decisions, and can automatically adjust trading strategies based on market conditions. It can also help in taking advantage of arbitrage opportunities and achieving better price execution.

How does App.1inch ensure the security of algorithmic trading?

App.1inch takes several measures to ensure the security of algorithmic trading. These include the use of audited smart contracts, integration with secure decentralized exchanges, and regular security audits. Additionally, users have full control over their funds and can disconnect their wallets from the service at any time.

Can App.1inch’s algorithmic trading be profitable?

While algorithmic trading can potentially be profitable, it is not guaranteed. The profitability depends on several factors, including the trading strategies used, market conditions, and the execution of trades. Users should carefully analyze and understand the risks involved before engaging in algorithmic trading.