Choosing the right liquidity pool can be a critical decision for any investor looking to maximize their returns. With the growing popularity of decentralized finance, there are now various options available on platforms like App.1inch. However, not all liquidity pools are created equal, and it is essential to understand the factors that can make a pool more suitable for your investment goals.

1. Understand the Pool’s Assets

Before diving into a liquidity pool, it is crucial to thoroughly understand the assets being pooled. Different tokens have different risk profiles and market dynamics, so it is essential to choose assets that align with your risk tolerance and investment strategy. With App.1inch, you can easily access information about the tokens in a pool, their historical performance, and any associated risks.

2. Consider the Pool’s Liquidity

The liquidity of a pool plays a crucial role in determining its attractiveness to investors. Higher liquidity means lower slippage and better trading opportunities. When choosing a pool, look for pools with robust liquidity that can accommodate your trading volume without significant price impact. App.1inch provides detailed liquidity information, including the pool’s total liquidity, slippage, and trading fees.

3. Evaluate the Pool’s APR

The Annual Percentage Rate (APR) is a key indicator of a liquidity pool’s potential returns. Higher APR means higher potential rewards, but it also comes with increased risk. Be sure to evaluate the pool’s historical APR and consider factors such as token price volatility and impermanent loss. App.1inch provides comprehensive APR data to help you make an informed decision.

4. Take Security Measures

Security should always be a top priority when it comes to investing in liquidity pools. Look for pools that are audited by reputable firms and have robust security measures in place, such as multi-signature wallets and insurance coverage. App.1inch has a strong track record for security and partners with trusted auditing firms to ensure the safety of its users.

By following these tips and conducting thorough research, you can increase your chances of choosing the right liquidity pool on App.1inch and making informed investment decisions in the dynamic world of decentralized finance.

Understanding Liquidity Pools

When it comes to decentralized exchanges (DEXs), liquidity pools play a vital role in facilitating smooth and efficient trading. In simple terms, a liquidity pool is a pool of tokens that are locked into a smart contract. These pools supply liquidity to the DEX, allowing users to trade assets without the need for a traditional order book.

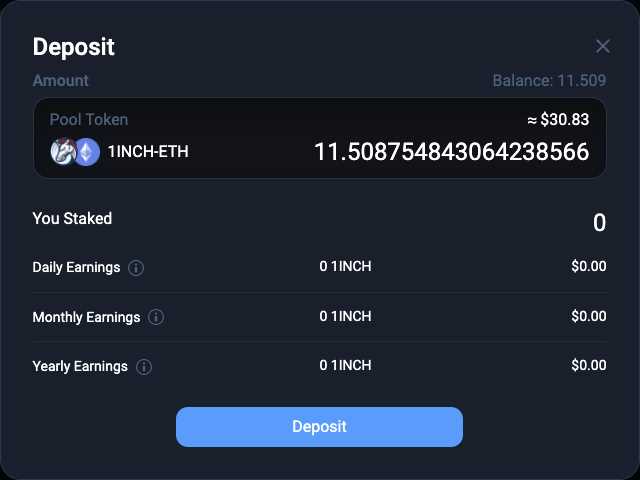

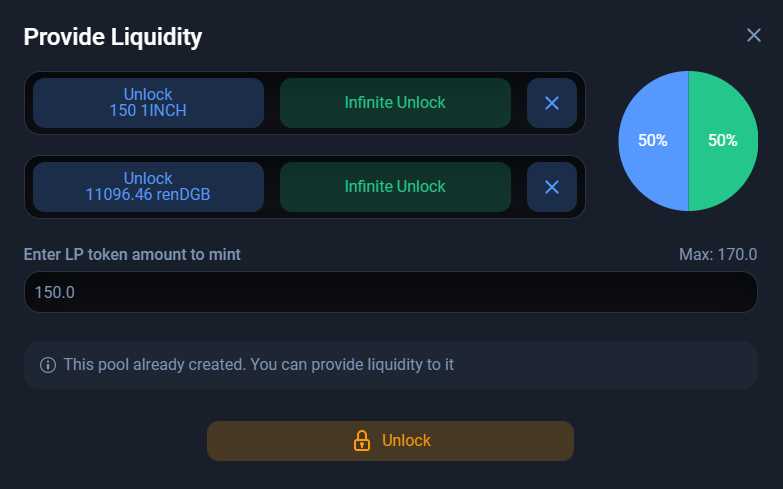

Liquidity pools are created by liquidity providers who deposit their tokens into the pool. In return, they receive pool tokens that represent their share of the pool. These pool tokens can be redeemed at any time for the underlying tokens plus a portion of the trading fees collected by the DEX.

Benefits of Liquidity Pools

1. Increased Liquidity: Liquidity pools help ensure that there is always enough liquidity available for traders. By pooling together tokens from various liquidity providers, DEXs can offer deep liquidity for a wide range of trading pairs.

2. Lower Slippage: Slippage is the difference between the expected price of a trade and the executed price. Liquidity pools help reduce slippage by maintaining a balanced ratio of tokens in the pool and minimizing market impact.

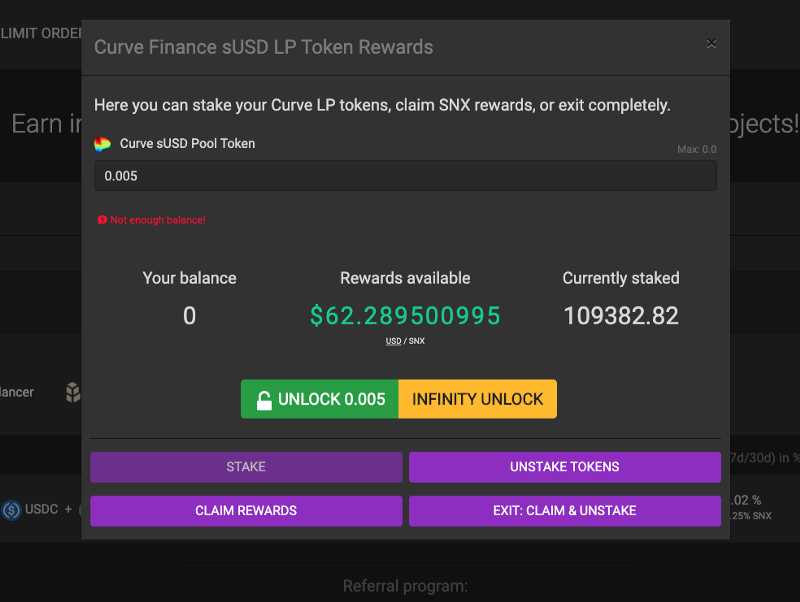

3. Staking Rewards: Liquidity providers can earn staking rewards by depositing their tokens into a liquidity pool. These rewards typically come from the trading fees collected by the DEX and can provide an additional source of income.

Considerations for Choosing Liquidity Pools

1. Asset Pair: When choosing a liquidity pool, consider the asset pairs you want to trade. Ensure that the pool supports the tokens you wish to trade to ensure smooth transactions.

2. Pool Size: The size of the liquidity pool can affect liquidity and trading volume. Larger pools generally offer better liquidity, but they may also have higher competition for staking rewards.

3. Fees: Different liquidity pools may have different fee structures. Consider the fees charged by the pool and how they align with your trading and investment goals.

4. Trustworthiness: Before depositing your tokens into a liquidity pool, research the DEX and the pool’s reputation. Look for audits, security measures, and user feedback to ensure that your funds are safe.

In conclusion, understanding liquidity pools is essential for navigating the world of decentralized exchanges. By choosing the right liquidity pool, you can enjoy the benefits of increased liquidity, lower slippage, and potential staking rewards.

Factors to Consider

When choosing liquidity pools on App.1inch, there are several factors that you should consider:

- Transaction Fees: One of the most important factors to consider is the transaction fees associated with each liquidity pool. Higher fees can eat into your profits, so it’s important to choose pools with lower fees.

- Liquidity Providers: Another factor to consider is the number and size of liquidity providers in a pool. Pools with more providers and higher total liquidity are generally considered safer and more reliable.

- Token Pairing: It’s also important to consider the token pairing options available in a liquidity pool. Some pools may offer more pairing options, which can provide more opportunities for trading and arbitrage.

- Historical Performance: Checking the historical performance of a liquidity pool can give you an indication of its stability and profitability. Look for pools that have consistently provided good returns and have a low risk of impermanent loss.

- Smart Contract Audits: Before investing in a liquidity pool, it’s crucial to check if the smart contract has been audited by a reputable firm. Audited contracts are generally considered safer and less prone to vulnerabilities.

- Community Feedback: Lastly, it’s always a good idea to check the community feedback and reviews for a liquidity pool. Users’ experiences and opinions can provide valuable insights into the pool’s performance and reliability.

By considering these factors and doing thorough research, you can make more informed decisions when choosing liquidity pools on App.1inch and maximize your trading profits.

Tips for Choosing the Best Liquidity Pool

When selecting a liquidity pool on App.1inch, it is important to consider a few key factors to ensure you are making the best choice. Here are some tips to help you choose the best liquidity pool for your needs:

1. Analyze Token Pair

Start by analyzing the token pair you are interested in. Look for tokens that have a stable trading volume and low volatility. It is important to choose tokens that are popular and have a strong market presence.

2. Check Pool Size

Check the size of the liquidity pool before making a decision. Larger pool sizes generally indicate higher liquidity and better trading conditions. Avoid smaller pools that may have limited liquidity, as this can lead to slippage and higher trading costs.

3. Consider Fees

Take into account the fees associated with the liquidity pool. Different pools may have different fee structures, so it is important to compare and choose a pool with reasonable fees. High fees can eat into your profits, so make sure to factor them in when making your decision.

4. Check Historical Performance

Review the historical performance of the liquidity pool. Look for pools that have a track record of stable returns and low volatility. Avoid pools with a history of significant price fluctuations or inconsistent performance.

5. Consider Pool Rewards

Some liquidity pools offer additional rewards in the form of tokens or fees. Consider pools that provide rewards as it can be an added incentive for liquidity providers. Compare the rewards offered by different pools and choose one that aligns with your investment goals.

| Factor | Tips |

|---|---|

| Analyze Token Pair | Choose stable tokens with high market presence. |

| Check Pool Size | Prefer larger pools for better liquidity. |

| Consider Fees | Compare fees and choose reasonable ones. |

| Check Historical Performance | Choose pools with stable returns and low volatility. |

| Consider Pool Rewards | Look for pools that offer additional rewards. |

Question-answer:

What is a liquidity pool?

A liquidity pool is a smart contract that contains a certain amount of cryptocurrency tokens. These tokens are used to facilitate decentralized trading on a decentralized exchange (DEX). Liquidity pools provide liquidity to traders by allowing them to swap tokens without the need for a traditional order book.

How can I choose the best liquidity pool on App.1inch?

When choosing a liquidity pool on App.1inch, there are several factors you should consider. First, you should look at the pool’s trading volume and liquidity. Higher trading volumes and larger liquidity pools generally indicate more active and stable markets. Additionally, you should consider the fees associated with the pool. Some pools may have higher fees than others, so it’s important to compare and choose a pool with fees that align with your trading strategy. Lastly, you should also consider the token pair being traded in the liquidity pool. Certain token pairs may have more trading activity and offer better opportunities for arbitrage, so it’s worth researching and selecting pools that offer these pairs.

What are some risks associated with liquidity pools on App.1inch?

While liquidity pools can be a great way to earn passive income and participate in decentralized trading, there are also some risks involved. One of the main risks is impermanent loss, which occurs when the value of the tokens in the pool changes over time. If the value of one token in the pool increases significantly compared to the other token, liquidity providers may experience a loss when removing their liquidity. Additionally, there is also the risk of smart contract vulnerabilities and security breaches. It’s important to do thorough research and select pools that have a good reputation and track record of security. Lastly, there is also the risk of a sudden drop in liquidity or market manipulation, which can affect the price and trading activity in the pool. It’s important to stay informed and monitor the performance of the pools you are invested in.