Decentralized exchanges (DEXs) have emerged as a crucial component of the cryptocurrency ecosystem. Unlike traditional centralized exchanges, DEXs operate on a peer-to-peer network, allowing users to trade cryptocurrencies directly without the need for intermediaries. One of the most innovative and popular DEXs is 1inch.

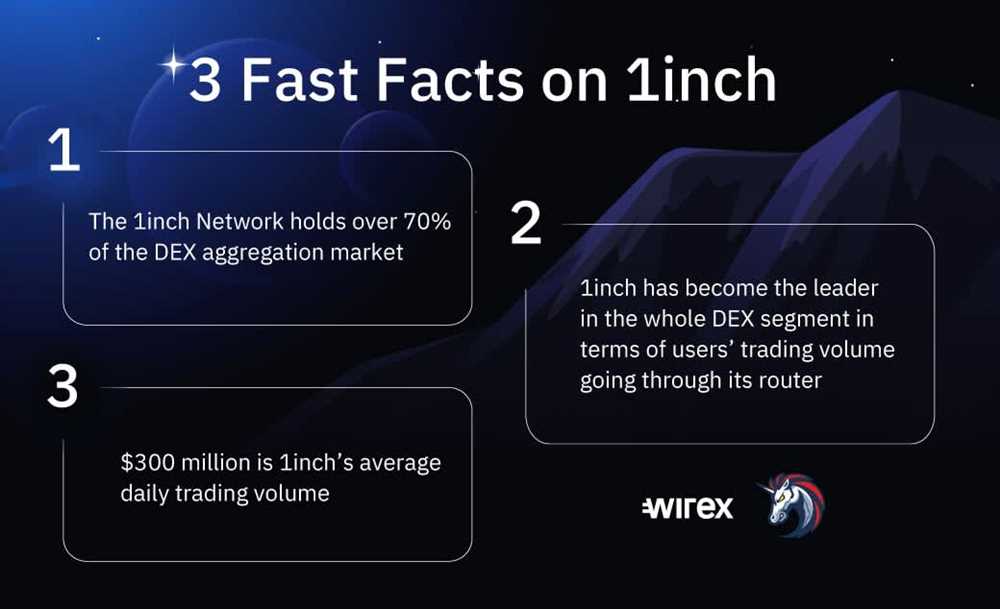

1inch is a decentralized exchange aggregator that sources liquidity from various DEXs to provide users with the best possible trading prices. It leverages smart contract technology on the Ethereum blockchain to ensure secure and transparent transactions. With its user-friendly interface and efficient trading algorithms, 1inch has gained significant traction within the crypto community.

The importance of decentralized exchanges like 1inch cannot be overstated. Firstly, DEXs offer enhanced security compared to centralized exchanges. Since users retain control over their funds throughout the trading process, the risk of hacking or theft is significantly reduced. Additionally, the use of smart contracts ensures that transactions occur exactly as intended, without the possibility of manipulation or fraud.

Furthermore, 1inch and other DEXs promote financial inclusivity and accessibility. Traditional exchanges often have stringent requirements for user registration, such as KYC procedures, which can exclude individuals from certain regions or with limited documentation. DEXs, on the other hand, often have no or minimal registration requirements, allowing anyone with an internet connection to participate in the crypto market.

In conclusion, decentralized exchanges like 1inch play a critical role in the cryptocurrency ecosystem. They provide enhanced security, promote financial inclusivity, and offer transparent and efficient trading. As the crypto industry continues to evolve, DEXs are likely to become even more integral in facilitating the decentralized finance revolution.

The Importance of Decentralized Exchanges

Decentralized exchanges (DEXs) play a crucial role in the cryptocurrency ecosystem. Unlike centralized exchanges, which rely on intermediaries to facilitate transactions, DEXs enable users to trade directly with each other, cutting out the need for middlemen and reducing the risk of hacking, fraud, and manipulation.

One of the key advantages of decentralized exchanges is their ability to provide users with greater financial sovereignty and control over their funds. Since DEXs operate on decentralized blockchain networks, users retain ownership of their private keys and have full control over their assets. This eliminates the need to trust a centralized entity with sensitive personal information and reduces the risk of funds being frozen or seized.

Another important aspect of decentralized exchanges is their ability to promote financial inclusivity. Traditional centralized exchanges often require users to go through extensive KYC (Know Your Customer) procedures, which can be exclusionary for individuals without formal identification or those living in countries with limited access to financial services. DEXs, on the other hand, typically have no or minimal KYC requirements, allowing anyone with an internet connection to participate in global financial markets.

Decentralized exchanges also contribute to the overall security and robustness of the cryptocurrency ecosystem. By distributing trading activities across a network of nodes, DEXs make it more difficult for hackers to compromise the entire system. Additionally, the use of smart contracts and cryptographic protocols ensures that transactions on DEXs are transparent, immutable, and resistant to censorship.

Furthermore, decentralized exchanges pave the way for the development of innovative financial products and services. Through the use of automated market-making algorithms, liquidity pools, and decentralized lending platforms, DEXs enable users to generate passive income, participate in yield farming, and explore new investment opportunities. These offerings create a more dynamic and diverse cryptocurrency ecosystem, attracting more participants and advancing the adoption of decentralized finance (DeFi) solutions.

In conclusion, decentralized exchanges are crucial for the advancement of the cryptocurrency ecosystem. They provide users with greater financial sovereignty, promote financial inclusivity, enhance security, and foster innovation. As the popularity of decentralized finance continues to grow, the importance of DEXs in facilitating peer-to-peer transactions and expanding the possibilities of the crypto space will only become more apparent.

Understanding Decentralization in the Financial World

In the world of finance, decentralization refers to the shift away from traditional centralized financial systems and towards decentralized networks and platforms. This shift is driven by the belief that centralized systems introduce unnecessary middlemen, increase costs, and pose potential risks to the users’ security and privacy.

Decentralization in the financial world is seen as a way to empower individuals and provide them with control over their own financial activities. It allows for direct peer-to-peer transactions, eliminates the need for intermediaries, and enables users to have full ownership and control over their assets.

The Benefits of Decentralization

Decentralized financial systems offer several benefits. First and foremost, decentralization enhances security by removing the single point of failure that exists in centralized systems. In a decentralized system, data is distributed across a network of nodes, making it less vulnerable to hacking or manipulation.

Secondly, decentralized systems promote transparency. Since all transactions are recorded on a public blockchain, anyone can verify and audit the transactions, ensuring a high level of trust and accountability.

Furthermore, decentralization enables greater inclusivity. Traditional financial systems often exclude individuals and communities who lack access to banking services. Decentralized platforms, on the other hand, are accessible to anyone with an internet connection.

Decentralized Exchanges (DEXs)

One of the key components of decentralization in the financial world is decentralized exchanges, or DEXs. These platforms allow users to trade digital assets directly with each other, without the need for a centralized intermediary. DEXs use smart contracts and automated market-making algorithms to facilitate these peer-to-peer transactions.

DEXs provide several advantages over traditional centralized exchanges. They eliminate the risk of hacking and theft, as user funds are held in their own wallets rather than on a centralized exchange. Additionally, DEXs offer lower fees and faster transactions since there are no intermediaries involved.

| Advantages of DEXs | Disadvantages of DEXs |

|---|---|

| Increased security | Limited liquidity |

| Lower fees | Complex user interface |

| Greater privacy | Slower transaction speed |

Overall, by embracing decentralization in the financial world, individuals can achieve greater control, security, and inclusivity in their financial activities. Decentralized exchanges, like 1inch, are at the forefront of this movement, revolutionizing the way people trade and interact with digital assets.

Introducing 1inch: A Revolutionary Decentralized Exchange

Decentralized exchanges (DEX) have become a popular alternative to centralized exchanges in the cryptocurrency market. One of the pioneers in the DEX space is 1inch, a platform that offers users a unique and revolutionary decentralized exchange experience.

What is 1inch?

1inch is a decentralized exchange aggregator that sources liquidity from various exchanges and liquidity protocols to offer users the best available prices for their trades. It was launched in 2019 by two Russian developers, Sergej Kunz and Anton Bukov, with the aim of addressing the limitations of existing DEX platforms and providing users with a more efficient trading experience.

How does 1inch work?

1inch operates on the Ethereum blockchain and uses smart contracts to execute trades. The platform automatically splits users’ orders across multiple DEXs to ensure they get the best prices for their trades. This innovative approach allows users to take advantage of the liquidity pools from different exchanges and protocols, resulting in lower slippage and better overall trading outcomes.

1inch also employs a unique Pathfinder algorithm that scans liquidity on multiple platforms, including Ethereum-based DEXs like Uniswap, SushiSwap, and Balancer, as well as other liquidity protocols, such as Kyber Network and Mooniswap. This comprehensive liquidity search ensures that users always have access to the most favorable trading options available.

Benefits of using 1inch

- Improved liquidity: By aggregating liquidity from various sources, 1inch provides users with access to a larger pool of liquidity, resulting in improved trading conditions and reduced slippage.

- Lower fees: 1inch aims to minimize trading fees for users by searching for the best available prices across multiple exchanges and protocols, ensuring they get the most competitive rates for their trades.

- Enhanced user experience: The user-friendly interface and intuitive design of the 1inch platform make it easy for both novice and experienced users to navigate and execute trades seamlessly.

- Increased security: As a decentralized exchange, 1inch operates on the blockchain, eliminating the need for users to trust a centralized entity with their funds. This reduces the risk of hacks and other security breaches commonly associated with centralized exchanges.

Overall, 1inch provides a revolutionary decentralized exchange experience by combining liquidity from various sources, optimizing trading fees, and enhancing user security and experience. With its innovative approach, 1inch is playing a crucial role in the development of the DEX ecosystem and the wider cryptocurrency market.

Advantages of Using 1inch for DeFi Trading

Decentralized Finance (DeFi) has gained significant popularity in the past few years, allowing individuals to access financial services without intermediaries. One of the key aspects of DeFi is decentralized exchanges, which provide users with the ability to trade cryptocurrencies directly from their wallets, without the need for a centralized intermediary. 1inch is one of the leading decentralized exchanges in the DeFi space, offering several advantages for users who want to engage in DeFi trading.

1. Liquidity Aggregation

One of the main advantages of using 1inch for DeFi trading is its liquidity aggregation feature. 1inch scans multiple decentralized exchanges to find the best rates for traders, ensuring that they get the most favorable prices for their trades. By aggregating liquidity from various sources, 1inch offers users access to a larger pool of liquidity, resulting in lower slippage and better execution prices.

2. Gas Optimization

Gas optimization is another key advantage of using 1inch for DeFi trading. Gas fees on the Ethereum network can be high during periods of high network congestion, leading to increased costs for users. However, 1inch utilizes various gas optimization techniques, such as utilizing the most efficient paths for transactions, to minimize gas fees for users. This makes trading on 1inch more cost-effective compared to other decentralized exchanges.

Overall, 1inch offers several advantages for users who want to engage in DeFi trading. Its liquidity aggregation feature allows users to access better rates and lower slippage, while its gas optimization techniques help minimize transaction costs. With its user-friendly interface and commitment to decentralization, 1inch is an excellent choice for users looking to trade cryptocurrencies in the DeFi space.

The Future of Decentralized Exchanges: 1inch Leading the Way

Decentralized exchanges (DEXs) have gained significant traction in the cryptocurrency world, offering users a more secure and transparent way to trade digital assets. As traditional centralized exchanges continue to face issues such as security breaches and high fees, the demand for decentralized alternatives has grown exponentially.

One of the leading players in this space is 1inch, a decentralized exchange aggregator that aims to provide users with the best possible trading experience. With a focus on liquidity and user-centric features, 1inch has quickly become a go-to platform for many crypto enthusiasts.

What sets 1inch apart from other DEXs is its unique aggregation algorithm. By splitting orders across multiple decentralized exchanges, 1inch is able to offer users the best possible rates and minimal slippage. This not only saves users money but also ensures that trades are executed with minimal impact on the market.

Another key feature of 1inch is its intuitive and user-friendly interface. Unlike some other DEXs that can be confusing or difficult to navigate, 1inch provides a simple and seamless trading experience. Users can easily connect their wallets, select the tokens they want to trade, and execute transactions with just a few clicks.

Looking to the future, 1inch has plans to further expand its ecosystem and improve its offerings. With the launch of the 1inch Network, users will have access to a wide range of DeFi services, including lending, staking, and governance. This will make 1inch a one-stop-shop for all decentralized finance needs.

Additionally, 1inch is actively exploring Layer 2 solutions to address the scalability challenges faced by DEXs. By leveraging technologies such as Ethereum’s Optimistic Rollups and other sidechains, 1inch aims to provide faster and more cost-effective transactions for its users.

| Benefits of 1inch | Future Developments |

|---|---|

| Incredible liquidity through decentralized exchanges aggregation | Expansion of the 1inch Network to offer a broader range of DeFi services |

| User-friendly interface for a seamless trading experience | Exploration of Layer 2 solutions for increased scalability |

| Minimal slippage and best possible rates for trades | Integration with other blockchains to expand market reach |

In conclusion, 1inch is at the forefront of the decentralized exchange revolution, offering users a superior trading experience compared to traditional centralized exchanges. With its innovative aggregation algorithm, user-friendly interface, and plans for future expansion, 1inch is paving the way for the future of decentralized finance.

Question-answer:

What is a decentralized exchange?

A decentralized exchange (DEX) is a type of cryptocurrency exchange that allows users to trade cryptocurrencies directly with one another without the need for an intermediary.

How does 1inch work?

1inch is a decentralized exchange aggregator that sources liquidity from various DEXs to find the best token swap prices for users. It splits a user’s trade across multiple DEXs to minimize slippage and maximize returns.

What are the advantages of using a decentralized exchange like 1inch?

Decentralized exchanges offer several advantages over traditional centralized exchanges. These include increased security, privacy, and control over funds, as well as lower fees and the ability to trade directly from cryptocurrency wallets. 1inch, in particular, offers the benefit of finding the best token swap prices by aggregating liquidity from multiple DEXs.