Trading in the cryptocurrency market can be both exciting and challenging. One platform that has gained popularity among traders is 1inch, which offers unique features and opportunities for investors. However, before diving into trading on 1inch, it is crucial to understand the risks and rewards involved.

Risks: Trading cryptocurrencies inherently involves risks, and 1inch is no exception. The volatile nature of the cryptocurrency market can result in significant price fluctuations within short periods. Therefore, it is essential for traders to be prepared for the possibility of incurring substantial losses. It is crucial to take into account factors such as market trends, liquidity, and potential regulatory changes that can impact the value of cryptocurrencies traded on 1inch.

Another risk associated with trading on 1inch is the possibility of encountering fraudulent or unreliable projects. While 1inch strives to list legitimate and reputable cryptocurrencies, the decentralized nature of the platform means that it is not impervious to scams. Traders must conduct thorough research and due diligence to identify potential red flags and avoid falling victim to fraudulent schemes.

Rewards: Despite the risks involved, trading on 1inch also presents numerous opportunities for traders. The platform offers access to a wide range of cryptocurrencies, allowing users to explore different investment options. 1inch also provides competitive pricing and low slippage trading, ensuring that traders can execute trades efficiently and at optimal prices.

In addition, 1inch has established partnerships and integrations with other decentralized finance (DeFi) platforms, expanding the possibilities for traders to engage in yield farming, liquidity provision, and other yield-generating activities. This opens up avenues for users to earn passive income and maximize their returns.

Ultimately, trading on 1inch requires a thorough understanding of the risks and rewards. Traders should exercise caution, stay informed about market trends, and make well-informed decisions based on their risk tolerance and investment goals. By doing so, traders can navigate the cryptocurrency market effectively and potentially reap the rewards offered by 1inch.

inch Trading: Risks and Rewards

Trading on 1inch can be both a risky and rewarding venture. It is important for traders to understand the potential risks and rewards associated with inch trading before getting involved in the market.

Risks of Trading on 1inch

While inch trading offers significant earning potential, it also comes with inherent risks. Some of the key risks include:

- Market Volatility: The cryptocurrency market is known for its high volatility, and inch trading is no exception. Prices can fluctuate dramatically within short periods of time, leading to potential losses for traders.

- Impermanent Loss: When providing liquidity to 1inch pools, traders are exposed to impermanent loss. This occurs when the value of the provided assets deviates from the value of the pool. Traders may end up with fewer assets than they initially invested.

- Smart Contract Risks: 1inch operates on smart contracts, which are prone to bugs and vulnerabilities. Traders must be cautious and perform due diligence before trading to minimize the risks associated with potential smart contract exploits.

Rewards of Trading on 1inch

Despite the risks involved, inch trading can offer attractive rewards for traders who navigate the market effectively. Some of the potential rewards include:

- Liquidity Provision Rewards: Traders who provide liquidity to 1inch pools can earn rewards in the form of transaction fees and platform tokens. By participating in liquidity mining programs, traders can earn additional rewards over time.

- Arbitrage Opportunities: As an aggregator, 1inch consolidates liquidity from various decentralized exchanges, creating potential arbitrage opportunities. Traders who can identify these opportunities and execute trades at the right time can profit from price differences between exchanges.

- Access to Wide Range of Tokens: 1inch supports a wide range of tokens, providing traders with access to various markets. This opens up opportunities to diversify portfolios and potentially profit from different asset classes.

Overall, inch trading can be a lucrative activity for traders who understand and manage the associated risks effectively. It is crucial for traders to stay informed, use risk management strategies, and continuously adapt to the ever-changing market conditions.

Understanding the Volatility of 1inch Tokens

Trading on 1inch can offer significant opportunities for profit, but it’s important to understand the volatility of 1inch tokens. Volatility refers to the rapid and substantial changes in price that frequently occur in the cryptocurrency market.

1inch tokens can experience high levels of volatility due to a variety of factors. One of the biggest factors is the relatively low liquidity of the token. Since 1inch is a decentralized exchange aggregator, it aggregates liquidity from multiple exchanges. This means that the liquidity available for 1inch tokens can be influenced by the liquidity of the underlying exchanges it aggregates from. Any sudden changes in liquidity in these underlying exchanges can result in price swings for 1inch tokens.

Market Influences on 1inch Token Volatility

In addition to liquidity, there are other market influences that can contribute to the volatility of 1inch tokens. These can include:

- Market sentiment: Cryptocurrency markets are often driven by investor sentiment. If investors have positive sentiment towards 1inch and believe it has strong growth potential, it can drive up demand and increase the volatility of the token.

- Regulatory news: Regulatory news and developments can greatly impact the cryptocurrency market as a whole, including 1inch tokens. Any new regulations or government actions that are perceived as negative can cause significant price fluctuations.

- Competition: The decentralized exchange space is highly competitive, with new platforms constantly entering the market. The introduction of new competitors or improvements in existing platforms can cause shifts in investor sentiment and increase the volatility of 1inch tokens.

Managing Risk in Volatile Markets

When trading 1inch tokens or any other highly volatile cryptocurrency, it is important to manage your risk effectively. Here are some strategies to consider:

- Diversify your portfolio: Instead of concentrating all your investments in 1inch tokens, consider spreading your investments across a range of different cryptocurrencies. This can help mitigate the impact of volatility in any one particular asset.

- Set stop-loss orders: A stop-loss order is a type of order that automatically sells a cryptocurrency when it reaches a certain price. Setting stop-loss orders can help protect your investments from significant losses in case of sudden price drops.

- Stay informed: Keep up to date with the latest news and developments in the cryptocurrency market. This can help you anticipate potential market movements and make more informed trading decisions.

Overall, while the volatility of 1inch tokens can present opportunities for profit, it is crucial to approach trading with caution and implement risk management strategies. Understanding the factors that contribute to volatility and staying informed can help you navigate the unpredictable nature of the cryptocurrency market.

Exploring the Benefits of 1inch Trading

1inch trading offers several benefits for traders looking to maximize their profits in the decentralized finance (DeFi) market. Here are some of the key advantages of using the 1inch platform:

1. Improved Liquidity

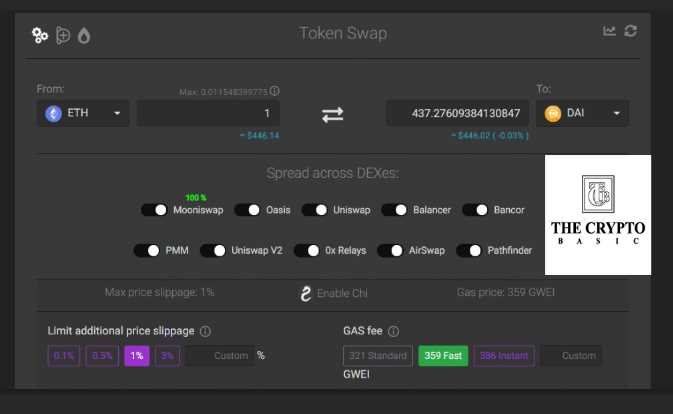

1inch aggregates liquidity from various decentralized exchanges (DEXs), allowing traders to access a larger pool of liquidity compared to trading directly on a single exchange. This helps to minimize slippage and ensures traders can execute trades at better prices.

2. Cost-Effective Trades

The 1inch platform scans multiple exchanges to find the most cost-effective trades for users. By utilizing smart contract technology, 1inch can split a trade across different DEXs to optimize the trade’s cost. This helps traders save on fees and maximize their returns.

3. Reduced Complexity

1inch simplifies the trading process by providing a user-friendly interface that allows users to access multiple exchanges from a single platform. Traders do not need to create accounts on different exchanges or manage multiple wallets, making it easier and more convenient to trade different DeFi assets.

Furthermore, the 1inch platform automatically finds the best trading routes, taking into account factors like gas fees and slippage, making it easier for traders to make informed decisions.

4. Gas Efficiency

1inch uses an algorithm that efficiently routes trades through different liquidity sources, reducing the cost of gas fees for traders. By optimizing the gas usage, 1inch helps traders save money and improve their overall trading experience.

These benefits make 1inch an attractive option for traders looking to maximize their profits while minimizing the costs and complexities associated with trading on decentralized exchanges. By leveraging the advantages of 1inch, traders can access improved liquidity, cost-effective trades, reduced complexity, and gas efficiency in the DeFi market.

Disclaimer: Trading in the cryptocurrency market involves significant risks. It is essential to conduct thorough research and exercise caution when trading on any platform, including 1inch. Always consider your risk tolerance and seek professional advice if needed.

Minimizing Risks with Proper Trading Strategies

Trading on 1inch can be a highly rewarding endeavor, but it also comes with its fair share of risks. However, by implementing proper trading strategies, investors can mitigate potential losses and maximize their chances of success.

1. Set Clear Trading Goals: Before entering any trade, it is essential to define your goals and risk tolerance. This includes determining the desired profit targets, acceptable loss limits, and time frames for trade execution. Having clear goals will help you stay focused and avoid impulsive decisions.

2. Diversify Your Portfolio: Spreading your investments across various assets will minimize the impact of any single asset’s performance on your overall portfolio. Diversification reduces risk by allocating investments to different asset classes, such as cryptocurrencies, stocks, or commodities.

3. Use Stop-Loss Orders: Implementing stop-loss orders is an effective risk management strategy. A stop-loss order automatically executes a trade when the asset’s price reaches a pre-determined level, limiting potential losses. This strategy helps protect your capital and prevents emotional decision-making.

4. Stay Informed: Keeping up with market news, trends, and analysis is crucial to making informed trading decisions. Continuously educating yourself about the cryptocurrency market and the assets you are trading will help you identify potential risks and opportunities.

5. Start with Small Investments: When you are new to trading or testing a new strategy, it is advisable to start with small investments. This approach allows you to gain experience and assess the effectiveness of your strategy without putting significant capital at risk.

6. Avoid Emotional Trading: Making decisions based on fear, greed, or other emotions can lead to poor investment outcomes. It is essential to approach trading with a rational mindset and stick to your predetermined trading plan, rather than being influenced by short-term market fluctuations.

7. Regularly Review and Adjust Your Strategy: The cryptocurrency market is highly dynamic, and what works today may not work tomorrow. It is crucial to regularly review your trading strategy, analyze past trades, and adjust it as necessary. This continuous improvement approach will help you adapt to changing market conditions.

8. Seek Professional Advice: If you are unsure about certain trading strategies or need additional guidance, consider seeking advice from a professional financial advisor or trading expert. They can provide personalized insights and help you develop suitable trading strategies based on your individual circumstances and goals.

Remember, trading always carries a degree of risk, and even with the best strategies, losses can still occur. It is crucial to invest only what you can afford to lose and to constantly monitor your trades to ensure they align with your risk tolerance and objectives.

Diversification and Trading on 1inch: Achieving Financial Success

Diversification is a key strategy for achieving financial success in the trading world. By diversifying your investments across different asset classes, you can reduce the risk associated with any one investment and increase your chances of making profitable trades. When it comes to trading on 1inch, diversification can be achieved by trading a variety of tokens across different markets.

One way to diversify your trading on 1inch is by trading a mix of stablecoins and volatile tokens. Stablecoins, such as USDT or DAI, are pegged to a stable asset, like the US dollar, and their value remains relatively stable over time. Volatile tokens, on the other hand, can experience significant price fluctuations. By trading a combination of stablecoins and volatile tokens, you can balance out the potential risks and rewards of your trades.

Another way to diversify your trading is by trading tokens from various sectors or industries. Different sectors can exhibit different levels of volatility and correlation with the broader market. For example, tokens from the decentralized finance (DeFi) sector may have different risk profiles compared to tokens from the gaming or NFT sectors. By trading tokens from different sectors, you can spread your risk and take advantage of opportunities in different areas of the market.

Trading on 1inch offers a unique opportunity to diversify your trading strategies. 1inch is a decentralized exchange aggregator that sources liquidity from various decentralized exchanges. This means that you have access to a wide range of tokens and markets, allowing you to diversify your trades across different platforms and protocols. Additionally, trading on 1inch can provide you with better prices and lower slippage due to its smart routing algorithms.

However, it is important to note that diversification does not guarantee profits or protect against losses. It is still important to conduct thorough research, evaluate the potential risks, and only invest what you can afford to lose. Diversification is just one tool in a trader’s toolkit, and it should be used in conjunction with other risk management strategies.

In conclusion, diversification is a crucial aspect of achieving financial success in trading. By diversifying your investments across different asset classes and trading on platforms like 1inch, you can reduce risk and increase your chances of making profitable trades. Remember to always conduct your own research and use appropriate risk management techniques to protect your investments.

Question-answer:

What is 1inch and how does it work?

1inch is a decentralized exchange aggregator that allows users to trade across different decentralized exchanges. It works by splitting users’ trades across multiple exchanges to ensure they get the best possible price.

What are the risks of trading on 1inch?

The main risks of trading on 1inch include smart contract vulnerabilities, impermanent loss, and slippage. Smart contract vulnerabilities can lead to potential hacks and loss of funds, while impermanent loss occurs when the value of the tokens in a liquidity pool changes. Slippage can result in traders getting a different price than expected due to the volatility of the market.

Can I lose my funds while trading on 1inch?

Yes, there is a risk of losing funds while trading on 1inch. This can happen due to smart contract vulnerabilities or mistakes made by the user, such as entering incorrect addresses or transaction details. It is important to conduct thorough research and use caution when trading on any cryptocurrency platform.

What are the rewards of trading on 1inch?

The main rewards of trading on 1inch include access to a wide range of tokens and liquidity pools, the ability to get the best possible price for trades, and the potential for earning yield through liquidity provision. By utilizing the platform effectively, traders can take advantage of arbitrage opportunities and maximize their profits.

How can I mitigate the risks of trading on 1inch?

To mitigate the risks of trading on 1inch, you can follow several strategies. Firstly, ensure that you are using a secure wallet and be cautious when interacting with smart contracts. Additionally, consider diversifying your trades across multiple exchanges and liquidity pools to reduce the impact of impermanent loss. Lastly, continuously monitor the market for any potential changes or vulnerabilities to stay informed and mitigate risks effectively.