Decentralized Finance (DeFi) has emerged as one of the most exciting developments in the world of cryptocurrencies. It promises to revolutionize traditional financial services by removing intermediaries and enabling peer-to-peer transactions. However, despite its potential, DeFi trading has faced several challenges, including high fees, limited liquidity, and fragmented markets.

Enter 1inch. This innovative platform is on a mission to solve these issues and create a seamless trading experience for DeFi users. Powered by smart contracts, 1inch aggregates liquidity from various decentralized exchanges (DEXs) into one user-friendly interface, ensuring the best possible prices and minimizing slippage.

What sets 1inch apart is its unique algorithm, which splits large orders across multiple DEXs to optimize trading efficiency. This approach not only allows users to access deeper liquidity but also minimizes impact on the market, preventing price manipulation.

Additionally, 1inch boasts a highly secure and transparent protocol. By leveraging the power of blockchain technology, all transactions and trades on the platform are recorded on the Ethereum network, ensuring immutability and eliminating the need for trust in third parties.

In conclusion, 1inch is revolutionizing DeFi trading by providing a decentralized, efficient, and secure solution. With its innovative approach and user-friendly interface, 1inch has quickly gained popularity among traders and is poised to reshape the future of decentralized finance.

The Origins of 1inch Protocol

The 1inch protocol was created by Sergej Kunz and Anton Bukov in 2020. It was designed to solve the problem of high slippage and liquidity fragmentation in decentralized finance (DeFi) trading.

Understanding the Problem

In DeFi trading, users often face challenges when trying to execute trades across multiple decentralized exchanges (DEXs). These challenges include high slippage, which occurs when the price of an asset changes significantly during the execution of a trade, and liquidity fragmentation, which happens when liquidity is spread across various DEXs.

High slippage can result in traders paying more than they expect for an asset, while liquidity fragmentation makes it difficult for traders to find the best prices and execute trades efficiently.

The Birth of 1inch Protocol

To address these problems, Kunz and Bukov developed the 1inch protocol. The protocol aggregates liquidity from multiple DEXs, providing users with the best prices for their trades. It uses an algorithm that splits the user’s trade across multiple DEXs, ensuring optimal execution with minimal slippage.

Since its launch, the 1inch protocol has grown in popularity and has become one of the leading decentralized exchange aggregators in the DeFi space. It has also expanded its services to include features such as yield farming and staking.

Key Features of 1inch Protocol:

- Liquidity Aggregation: 1inch aggregates liquidity from various DEXs, allowing users to access the best prices for their trades.

- Optimal Execution: The protocol splits trades across multiple DEXs, ensuring optimal execution and minimizing slippage.

- Gas Fee Optimization: 1inch uses smart contract technology to optimize gas fees, reducing transaction costs for users.

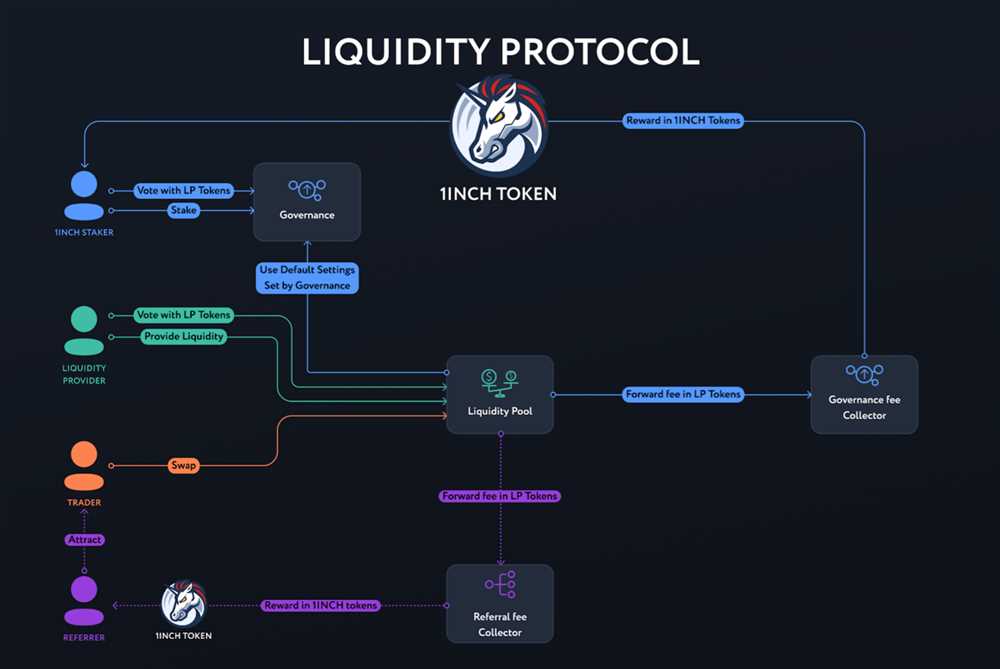

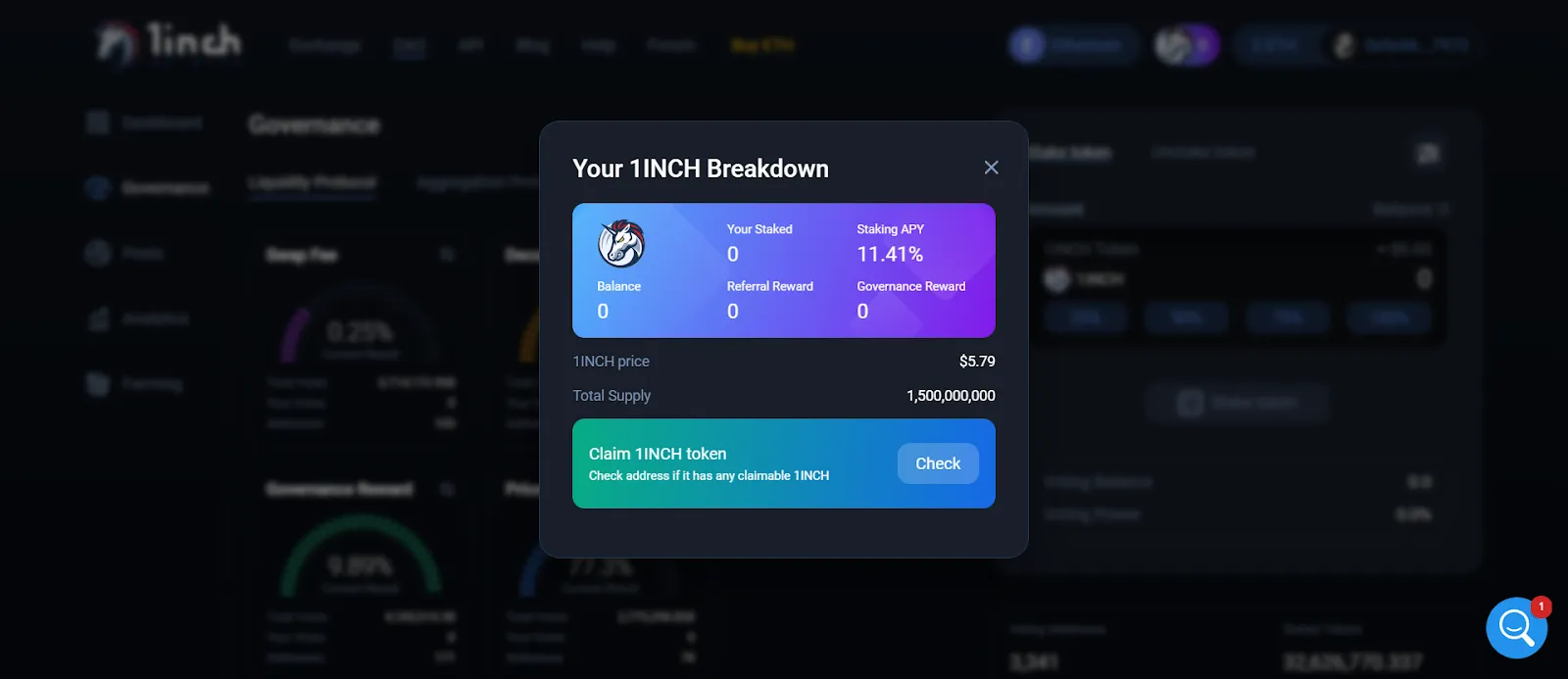

- Yield Farming and Staking: In addition to trading, users can also participate in yield farming and staking activities on the 1inch platform.

With its innovative approach to decentralized trading, the 1inch protocol has revolutionized DeFi and continues to drive the growth of the ecosystem by providing users with improved trading experiences.

Decentralized Finance Trading

Decentralized Finance (DeFi) trading refers to the practice of trading financial products in a decentralized manner using blockchain technology. Unlike traditional centralized exchanges, DeFi trading platforms operate without intermediaries, allowing users to have full control over their funds and trades.

One of the key advantages of DeFi trading is the elimination of third-party trust. By utilizing smart contracts on the blockchain, trades are executed automatically and transparently, eliminating the need to rely on a centralized exchange or broker. This enables users to trade directly with each other, removing the risk of counterparty default.

In addition, DeFi trading platforms offer a wide range of financial products, including cryptocurrencies, stablecoins, derivatives, lending and borrowing platforms, and decentralized exchanges. These platforms leverage various mechanisms such as liquidity pools, automated market makers, and decentralized oracles to provide efficient and seamless trading experiences.

Another important aspect of DeFi trading is its permissionless nature. Anyone with an internet connection can access DeFi protocols and start trading, without needing to go through a lengthy and centralized registration process. This opens up opportunities for individuals who may be excluded from traditional financial systems, providing them with access to global markets and financial services.

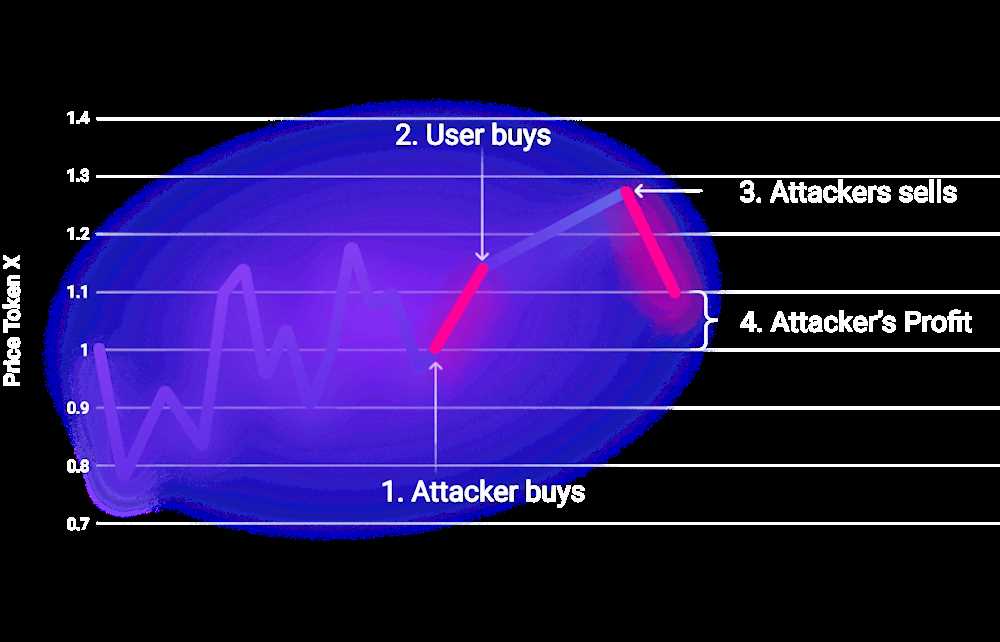

However, it is important to note that DeFi trading is still in its early stages, and there are challenges to overcome. The decentralized nature of these platforms can also lead to risks such as smart contract vulnerabilities, price manipulation, and lack of regulatory oversight. As the DeFi ecosystem continues to evolve, it is crucial for participants to stay informed and exercise caution when engaging in DeFi trading.

In conclusion, decentralized finance trading has the potential to revolutionize the traditional financial system by offering open, transparent, and permissionless trading opportunities. Through smart contracts and blockchain technology, DeFi trading platforms enable users to trade directly with each other, eliminating intermediaries and providing greater control over funds. While there are challenges to address, the rapid growth and innovation in the DeFi space indicate its potential to reshape the future of global finance.

inch Protocol’s Features

The 1inch Protocol stands out in the DeFi trading landscape due to its unique set of features. Here are some key features that make it a popular choice among traders:

- Aggregation: The 1inch Protocol aggregates liquidity from multiple decentralized exchanges, allowing users to access the best prices and reduce slippage.

- Smart Routing: The protocol intelligently routes trades across different liquidity sources to optimize for price, ensuring users get the most favorable rates.

- Gas Optimization: With 1inch Protocol, users can save on gas fees by utilizing the gas token feature, which helps offset transaction costs.

- Limit Orders: The protocol enables users to set limit orders, giving them more control over their trades and allowing them to execute them automatically when the desired conditions are met.

- Security: 1inch Protocol prioritizes security and ensures that users’ funds are protected. The protocol has undergone extensive audits to identify and address any vulnerabilities.

- User Experience: The protocol offers a user-friendly interface and seamless trading experience, making it easy for both beginners and experienced traders to navigate and execute trades.

These features make the 1inch Protocol a powerful tool for decentralized trading, enhancing user experience and providing traders with access to the best opportunities in the DeFi space.

Aggregation of Liquidity

One of the core features of 1inch is the aggregation of liquidity. In traditional decentralized exchanges (DEXs), users have to manually search and compare different exchange platforms to find the best prices and liquidity for their trades. This can be a time-consuming and inefficient process.

However, 1inch solves this problem by aggregating liquidity from multiple DEXs into a single platform. By doing so, users can access a large pool of liquidity and find the best prices for their trades without the need to visit multiple exchanges.

To achieve this, 1inch utilizes smart contract technology to split user trades across multiple DEXs, ensuring the best possible outcome for each trade. The platform also employs an algorithm that considers factors such as slippage, fees, and other trading conditions to provide users with the most optimal trading experience.

Benefits of Liquidity Aggregation

The aggregation of liquidity offers several benefits for users:

- Best Prices: By combining liquidity from multiple DEXs, users can find the best prices for their trades, resulting in cost savings.

- Increased Liquidity: Aggregating liquidity from various sources creates a larger pool of available funds, ensuring that users can execute trades even for less liquid assets.

- Improved Trading Efficiency: With liquidity readily available in one place, users can quickly and efficiently execute trades without the need to navigate different platforms.

- Reduced Slippage: By splitting trades across multiple DEXs, 1inch minimizes slippage and provides users with better execution prices.

Overall, the aggregation of liquidity provided by 1inch revolutionizes DeFi trading by offering users access to a vast liquidity pool, enhanced trading efficiency, and improved price execution for their trades.

Benefits of Using 1inch

1inch is a decentralized exchange aggregator that offers a range of benefits for users in the DeFi space. Here are some of the key advantages of using 1inch:

1. Best Execution and Optimal Prices

1inch uses advanced algorithms and smart contracts to split and route trades across multiple decentralized exchanges to ensure users get the best possible execution prices. By aggregating liquidity from various exchanges, 1inch can offer more competitive prices than using a single exchange.

2. Reduced Slippage and Gas Costs

Slippage refers to the difference between the expected price of a trade and the actual price at which the trade is executed. By splitting trades across multiple exchanges, 1inch can reduce slippage and minimize the impact of large orders on the market. Additionally, 1inch employs gas optimization techniques, such as batching and swapping on different chains, to reduce transaction costs for users.

3. Access to Multiple Liquidity Sources

1inch provides access to liquidity from various decentralized exchanges, including Uniswap, SushiSwap, Balancer, and more. This allows users to find the best liquidity for their trades and access markets that may be fragmented across different exchanges.

4. User-Friendly Interface

1inch offers a user-friendly interface that makes it easy for both beginners and experienced traders to navigate the platform. The intuitive design and easy-to-use features allow users to easily execute trades and manage their DeFi assets.

5. Reduced Risk of Price Manipulation

By splitting trades across multiple exchanges, 1inch reduces the risk of price manipulation and front-running. This ensures that users get fair and transparent prices for their trades, without worrying about market manipulation.

- Overall, 1inch revolutionizes DeFi trading by offering better prices, reduced slippage and gas costs, access to multiple liquidity sources, a user-friendly interface, and reduced risk of price manipulation. Whether you are a DeFi enthusiast or a professional trader, 1inch provides a powerful tool to enhance your trading experience.

Reduced Slippage

One of the major challenges in decentralized finance (DeFi) trading is the issue of slippage. Slippage refers to the difference between the expected price of a trade and the executed price. It occurs when the market moves between the time a trade is initiated and the time it is executed, resulting in a higher price for the trader.

1inch aims to reduce slippage and provide traders with the best possible prices by aggregating liquidity from multiple decentralized exchanges. By sourcing liquidity from different platforms, 1inch can find the most optimal routes to execute trades and minimize slippage.

The platform uses an intelligent algorithm that analyzes various factors, such as available liquidity, trading fees, and price impact, to determine the most efficient trading paths. It then splits the trade into multiple smaller orders and executes them across different exchanges to minimize slippage.

In addition to aggregating liquidity, 1inch also offers other tools and features to further reduce slippage. One such feature is the implementation of price impact estimation, which helps traders gauge the potential impact a trade may have on the market and make more informed decisions.

Overall, 1inch’s focus on reducing slippage sets it apart from other decentralized trading platforms. By leveraging its advanced algorithm and liquidity aggregation capabilities, 1inch aims to provide traders with the best possible prices and improve the overall trading experience in the DeFi space.

Question-answer:

What is 1inch?

1inch is a decentralized exchange aggregator that sources liquidity from various exchanges to find users the best possible trading routes.

How does 1inch work?

1inch operates by splitting users’ trades across multiple DEXs to find the most efficient and cost-effective trading routes.