The rise of decentralized finance (DeFi) has revolutionized the way we trade and invest. With the introduction of smart contracts and blockchain technology, individuals now have the ability to directly engage in financial activities without the need for intermediaries. This has led to greater transparency, lower costs, and increased accessibility for users around the world.

One project that has emerged as a leader in the DeFi space is 1inch. Founded in 2019, 1inch is an innovative decentralized exchange aggregator that allows users to access liquidity across various platforms. By utilizing a combination of smart contract technology and an intuitive user interface, 1inch has simplified the trading process and provided users with the best possible trading outcomes.

The 1inch whitepaper, titled “Unleashing the Power of DeFi Trading,” aims to provide a comprehensive overview of the platform’s features, benefits, and future development plans. The whitepaper outlines the problem of fragmented liquidity in DeFi, discusses the limitations of existing DEX protocols, and introduces the concept of “pathfinder” algorithms that ensure users get the best possible trading rates.

Through its unique aggregation and routing algorithms, 1inch is able to split a user’s trade across multiple decentralized exchanges, taking advantage of the best available rates. This not only saves users time and money, but also maximizes their potential returns. The whitepaper dives deep into the intricacies of these algorithms, highlighting how they work and why they are superior to other approaches.

Overall, the 1inch whitepaper serves as an essential guide for anyone looking to understand the inner workings of the platform and the potential it holds for the future of DeFi trading. As the cryptocurrency ecosystem continues to evolve, 1inch remains at the forefront of innovation, constantly searching for new ways to enhance the trading experience for its users.

What Is 1inch Whitepaper: Understanding the Basics of DeFi Trading

If you’ve been keeping up with the world of decentralized finance (DeFi), you’ve likely come across the term “1inch.” But what exactly is the 1inch whitepaper and how does it relate to DeFi trading? In this article, we’ll break down the basics of the 1inch whitepaper and explore its significance in the DeFi ecosystem.

The 1inch whitepaper serves as a comprehensive guide to understanding the inner workings of the 1inch protocol. The protocol is a decentralized exchange (DEX) aggregator that sources liquidity from various DEXs to provide users with the best possible trading rates. The 1inch whitepaper explains in detail how the protocol achieves this and outlines its unique features.

One of the core concepts explained in the 1inch whitepaper is the concept of “path splitting.” This refers to the algorithm used by 1inch to split a user’s trade across multiple DEXs in order to achieve the most favorable rates. By breaking up a trade into smaller parts, 1inch is able to access deeper liquidity pools and minimize slippage for users.

In addition to path splitting, the 1inch whitepaper also delves into the mechanics behind the 1inch token (1INCH). The 1INCH token serves multiple purposes within the 1inch ecosystem, including governance rights and liquidity mining rewards. The whitepaper provides a detailed explanation of how these mechanisms work and how users can participate in the governance and earning potential of the 1INCH token.

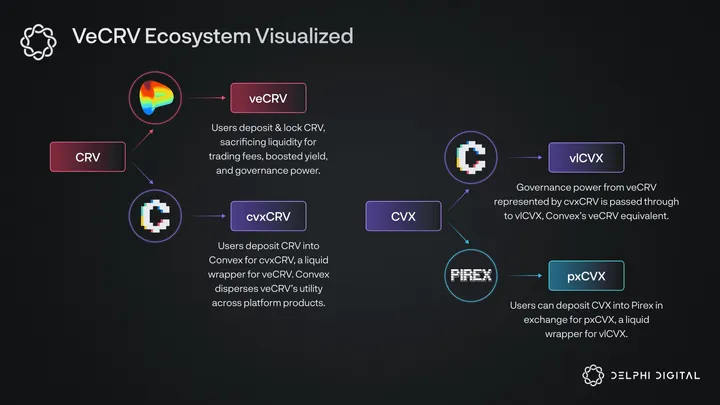

Furthermore, the 1inch whitepaper explores the concept of “multi-chain” trading. As the DeFi ecosystem expands across multiple blockchains, the ability to trade seamlessly between different chains becomes increasingly important. The whitepaper outlines how the 1inch protocol enables cross-chain trading and the challenges that arise from this complex process.

Overall, the 1inch whitepaper is an essential resource for anyone looking to gain a deeper understanding of the 1inch protocol and the principles of DeFi trading. It provides valuable insights into the innovative strategies and mechanisms employed by 1inch to optimize trading efficiency and improve user experience.

As the DeFi landscape continues to evolve, it is important to stay informed about the latest advancements and protocols. The 1inch whitepaper is a valuable tool for both novice and experienced traders alike, offering a comprehensive overview of the principles and technologies that drive the 1inch protocol and the broader DeFi ecosystem.

The Evolution of Decentralized Finance: A Brief History

Decentralized Finance (DeFi) has revolutionized the traditional financial system by providing open, permissionless, and trustless financial services. In this brief history, let’s explore the major milestones that led to the emergence and growth of DeFi.

Early Beginnings: Decentralized finance can be traced back to the launch of Bitcoin, the first decentralized cryptocurrency, in 2009. Bitcoin introduced the concept of peer-to-peer electronic cash and laid the foundation for decentralized, trustless transactions.

Smart Contracts: Ethereum, launched in 2015, took decentralization a step further with the introduction of smart contracts. Smart contracts are self-executing agreements with predefined conditions, removing the need for intermediaries. This innovation opened up a world of possibilities for decentralized finance.

The Rise of DeFi DApps: Starting in 2017, the DeFi ecosystem witnessed the emergence of decentralized applications (DApps) built on the Ethereum blockchain. These DApps offered various financial services, such as lending, borrowing, and decentralized exchanges, eliminating the need for traditional intermediaries.

Automated Market Makers: In 2020, Uniswap, an automated market maker (AMM), gained popularity for its innovative way of enabling decentralized trading. AMMs use algorithms to automatically provide liquidity for trading pairs, creating an efficient and trustless trading experience.

Tokenization and Yield Farming: The year 2020 also saw the rise of tokenization and yield farming in the DeFi space. Tokenization allowed assets, such as real estate or commodities, to be represented as digital tokens on the blockchain. Yield farming, on the other hand, enabled users to earn interest or rewards by providing liquidity to DeFi protocols.

Interoperability and Aggregators: As DeFi grew in popularity, the need for interoperability between different protocols became evident. In response, projects like 1inch developed aggregator platforms that allow users to access various liquidity sources and protocols, improving efficiency and reducing costs.

The Future of DeFi: The evolution of decentralized finance continues, with new innovations and challenges on the horizon. As DeFi becomes more accessible and user-friendly, it has the potential to disrupt traditional financial systems and empower individuals worldwide.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always do your own research before engaging in any financial transactions.

Understanding the Problem: Limitations of Traditional Trading Platforms

Traditional trading platforms have long been the go-to choice for traders looking to buy and sell assets. However, these platforms are not without their limitations, which can hinder traders’ ability to efficiently navigate the market and make informed decisions. In this section, we will explore some of the key limitations of traditional trading platforms.

Limited Access to Liquidity

One major limitation of traditional trading platforms is the limited access to liquidity. These platforms often rely on centralized exchanges, which only provide access to a limited number of liquidity pools. As a result, traders may face difficulties in finding the best prices for their trades and may be forced to settle for suboptimal deals.

High Fees and Slippage

Another drawback of traditional trading platforms is the high fees and slippage associated with trading. These platforms often charge significant fees for trading activities, which can eat into traders’ profits. Additionally, due to the centralized nature of these platforms, slippage can occur, causing traders to receive a different price than the one they initially expected.

Lack of Transparency

Transparency is crucial in the trading world, as traders need access to real-time information to make informed decisions. Unfortunately, traditional trading platforms often lack transparency, with limited or delayed access to market data. This lack of transparency can put traders at a disadvantage and prevent them from quickly adapting to market changes.

Security Risks

While traditional trading platforms may offer certain security measures, they are not immune to security risks. These platforms often require traders to deposit their funds into centralized wallets, making them susceptible to hacks and theft. This poses a significant risk, as traders could potentially lose all their funds if the platform is compromised.

Limited Customization and Flexibility

Traditional trading platforms often have limited customization options, making it difficult for traders to tailor the platform to their specific needs. Additionally, these platforms may lack flexibility in terms of trading strategies and options, limiting the traders’ ability to explore different trading approaches and maximize their potential profits.

Overall, the limitations of traditional trading platforms can hinder traders’ ability to fully exploit the opportunities presented by the market. This is where decentralized finance (DeFi) and platforms like 1inch aim to address these limitations and unlock the full potential of trading in the new era of finance.

Solving the Problem: 1inch Protocol and DeFi Trading

In the world of decentralized finance (DeFi), one of the key challenges faced by traders is the fragmentation of liquidity across different protocols and platforms. This presents a significant hurdle for traders as they need to monitor and execute trades across multiple platforms in order to achieve the best price.

The 1inch Protocol, developed by the 1inch team, has emerged as a solution to this problem. Using a combination of smart contracts and innovative algorithms, the protocol aggregates liquidity from various decentralized exchanges (DEXs) to provide users with the best possible trading rates.

The Power of Aggregation

The 1inch Protocol tackles liquidity fragmentation by aggregating orders from multiple DEXs into a single interface. When a user submits a trade on the 1inch platform, the protocol splits the trade across different DEXs to ensure optimal execution. This enables users to access deeper pools of liquidity and obtain better prices.

Furthermore, the protocol also solves the issue of slippage, which is the difference between the expected price of a trade and the executed price. By splitting the trade across multiple DEXs, the 1inch Protocol minimizes slippage and helps traders maximize their returns.

Smart Contract Technology

Another key feature of the 1inch Protocol is its use of smart contracts. Smart contracts are self-executing contracts with the terms of the agreement directly written into code. In the context of the 1inch Protocol, smart contracts are used to automate the execution of trades across different DEXs.

This automation eliminates the need for manual trading and reduces the risk of human error. It also allows for the seamless integration of various DEXs into the 1inch platform, providing users with access to a wide range of liquidity sources.

| Benefits of the 1inch Protocol |

|---|

| 1. Efficient use of liquidity |

| 2. Minimized slippage |

| 3. Seamless integration of DEXs |

| 4. Automated execution of trades |

In conclusion, the 1inch Protocol is revolutionizing DeFi trading by solving the liquidity fragmentation problem. Through its innovative aggregation and smart contract technology, the protocol provides traders with access to optimal trading rates and minimizes slippage. With the 1inch Protocol, users can trade across multiple DEXs seamlessly and efficiently, unlocking the full potential of decentralized finance.

Unleashing the Power of 1inch Whitepaper: Benefits and Potential Impact

The 1inch Whitepaper outlines a revolutionary solution that aims to unleash the power of decentralized finance (DeFi) trading. By addressing the inherent challenges and limitations of current DeFi trading protocols, 1inch offers a range of benefits and has the potential to make a significant impact on the DeFi ecosystem.

One of the key benefits of the 1inch protocol is its ability to aggregate liquidity and provide users with the best possible trading rates across multiple decentralized exchanges (DEXs). This means that users can access the most competitive prices for their trades, resulting in reduced slippage and improved overall trading performance.

Additionally, 1inch offers users the ability to split their trades across multiple DEXs, further optimizing their trading strategies. This feature allows users to tap into the liquidity pools of different exchanges and maximize their trading opportunities.

Moreover, the 1inch protocol supports limit orders, enabling users to set specific price targets for their trades. This functionality gives traders more control over their transactions and allows them to execute trades automatically when the desired price level is reached.

The potential impact of the 1inch protocol on the DeFi ecosystem is significant. By facilitating improved liquidity aggregation and offering competitive trading rates, 1inch has the potential to attract more users to the DeFi space. This increased user adoption can lead to the development of more robust and liquid markets, ultimately elevating the overall efficiency and effectiveness of decentralized trading.

In addition, the ability to split trades and access liquidity across multiple DEXs can contribute to the decentralization of trading activity, reducing reliance on a single exchange and spreading liquidity across different platforms. This decentralization promotes a more resilient and secure trading environment, reducing the risk of manipulation and improving market stability.

Overall, the 1inch Whitepaper presents a breakthrough solution that addresses the limitations of existing DeFi trading protocols. By offering superior features such as liquidity aggregation, split trades, and limit orders, the 1inch protocol has the potential to unlock new opportunities for traders and significantly impact the DeFi ecosystem.

Question-answer:

What is 1inch Whitepaper about?

The 1inch Whitepaper is about unleashing the power of decentralized finance (DeFi) trading. It introduces 1inch, a decentralized exchange aggregator that sources liquidity from various exchanges to provide users with the best trading rates.

How does 1inch work?

1inch uses smart contract technology to split users’ trades across multiple decentralized exchanges, allowing them to get the best prices available. It aggregates the liquidity from different exchanges and routes trades through the most efficient paths, saving users time and money.

What benefits does 1inch offer to traders?

1inch offers several benefits to traders. Firstly, it provides access to the best trading rates available in the market by aggregating liquidity from multiple exchanges. Secondly, it offers low slippage and reduced fees compared to manually trading on individual exchanges. Finally, it saves traders time by automatically executing trades through the most optimal paths.

How does 1inch ensure the security of user funds?

1inch ensures the security of user funds through the use of smart contracts. Users’ funds remain in their wallets until a trade is executed, eliminating the need to deposit funds on the platform. Additionally, 1inch constantly monitors the decentralized exchanges it sources liquidity from to ensure they are trustworthy and secure.

Can anyone use 1inch?

Yes, anyone can use 1inch. It is a decentralized platform that is accessible to users from all over the world. All you need is an Ethereum wallet to connect to the platform and start trading.