In the ever-changing landscape of decentralized finance (DeFi), 1inch Exchange has emerged as a pioneering platform that has revolutionized the way users interact with various decentralized exchanges (DEXs). What started as a DeFi aggregator has evolved into a full-fledged DEX that offers users unparalleled access to liquidity, optimal prices, and advanced trading features.

1inch Exchange was founded in 2019 by Sergej Kunz and Anton Bukov with the mission to provide users with the best possible trading experience in the fast-growing DeFi space. Initially, the platform acted as an aggregator, combining liquidity from multiple DEXs to offer users the most favorable rates and lowest slippage. This innovative approach quickly gained popularity among DeFi enthusiasts who were looking for an efficient way to navigate the fragmented DEX ecosystem.

As the DeFi industry continued to mature, 1inch Exchange saw an opportunity to further enhance its platform and expand its offerings. In December 2020, the team introduced the 1inch Liquidity Protocol, transforming the platform into a decentralized exchange. The Liquidity Protocol uses an automated market maker (AMM) model, enabling users to trade directly on the platform without the need for an external exchange.

The evolution of 1inch Exchange from a DeFi aggregator to a DEX has been a game-changer for users. By combining the strengths of an aggregator and a DEX, 1inch Exchange offers users the best of both worlds. They can access liquidity from multiple DEXs, ensuring optimal prices and minimizing slippage, while still enjoying the seamless trading experience of a DEX. With its user-friendly interface, advanced trading tools, and robust security measures, 1inch Exchange has become a go-to platform for traders and liquidity providers in the DeFi space.

The Evolution of 1inch Exchange

1inch Exchange has come a long way since its launch in 2020. What started as a DeFi aggregator quickly transformed into a full-fledged decentralized exchange (DEX) with its own native token, governance system, and liquidity protocol.

The journey of 1inch Exchange began with the idea of solving the problem of fragmented liquidity in the DeFi space. By aggregating liquidity from various decentralized exchanges, 1inch enabled users to find the best prices and execute trades efficiently.

As demand for decentralized exchanges grew, 1inch realized the need to innovate further and provide a more seamless trading experience. This led to the development of their own DEX, powered by an automated market maker (AMM) algorithm called Mooniswap.

With Mooniswap, 1inch Exchange introduced a number of unique features, such as virtual balances and anti-slippage mechanisms, that enhanced liquidity and reduced impermanent loss for liquidity providers.

In 2021, 1inch Exchange underwent a major upgrade with the launch of the 1inch Network. The network introduced the 1inch Liquidity Protocol, a next-generation AMM protocol that significantly improved capital efficiency and reduced gas fees.

Furthermore, the 1inch Network introduced the 1INCH token, which serves as the governance and utility token of the platform. Holders of 1INCH can participate in voting on protocol upgrades and changes, as well as earn rewards through liquidity mining.

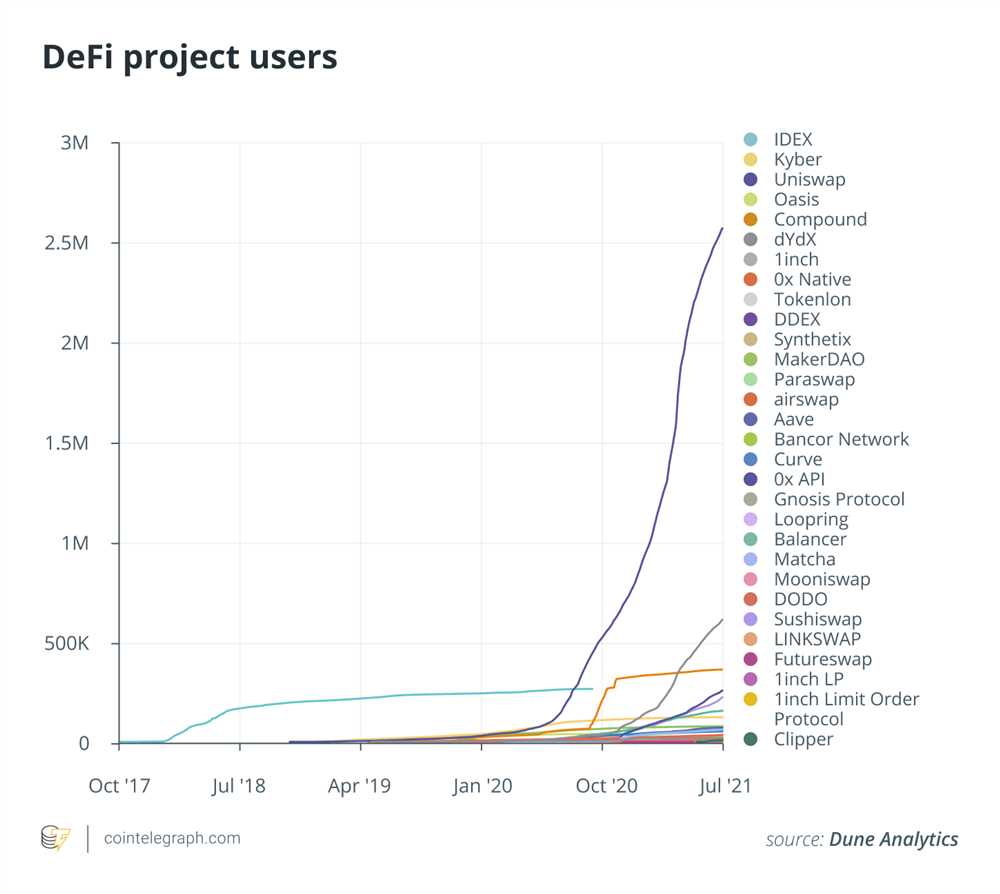

Today, 1inch Exchange continues to evolve and innovate in the decentralized finance space. With its user-friendly interface, competitive pricing, and comprehensive suite of trading tools, it has become one of the leading DEXs in the industry.

In conclusion, the evolution of 1inch Exchange showcases the rapid development and growth of the decentralized finance ecosystem. From a DeFi aggregator to a full-fledged DEX with its own governance system and liquidity protocol, 1inch has proven itself as a pioneer in the space.

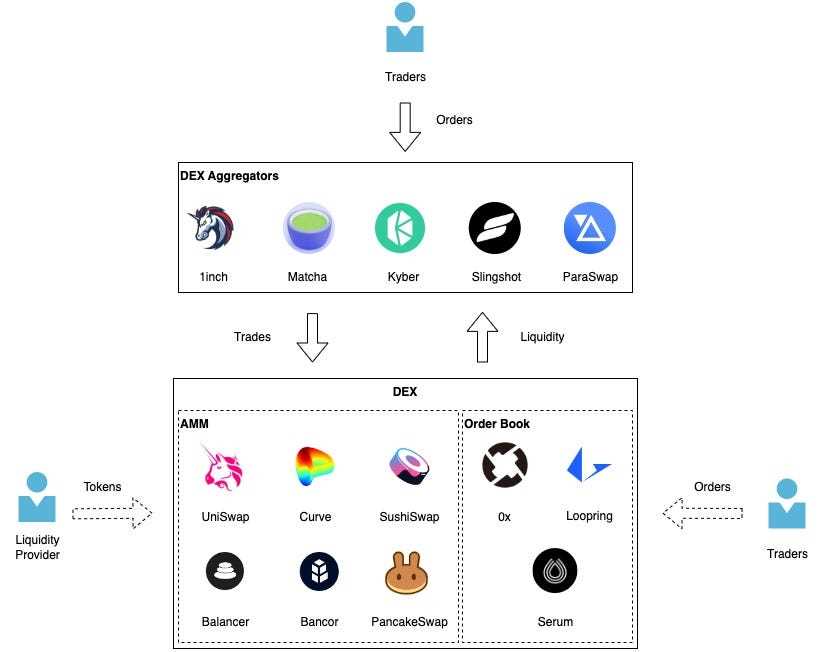

The Rise of DeFi Aggregators

The emergence of decentralized finance (DeFi) has revolutionized the way individuals interact with financial services. One of the key innovations in the DeFi space is the rise of DeFi aggregators. DeFi aggregators are platforms that aggregate liquidity from various decentralized exchanges (DEXs) and other protocols to provide users with the best prices and optimal trading routes.

DeFi aggregators, such as 1inch Exchange, have gained significant popularity in recent years due to their ability to offer users a seamless trading experience across multiple decentralized platforms. These platforms leverage smart contract technology to split a user’s trade across different liquidity sources, ensuring that they get the best possible price for their tokens.

The Benefits of DeFi Aggregators

DeFi aggregators offer several benefits to users looking to trade or invest in decentralized assets. Firstly, these platforms provide users with access to a wider range of liquidity pools, increasing the chances of finding the most favorable trading conditions. Secondly, DeFi aggregators enable users to save gas fees by finding the most cost-effective trading routes across multiple DEXs.

Furthermore, DeFi aggregators enhance price discovery by constantly monitoring and updating the prices of assets across different DEXs, ensuring users receive the most accurate and up-to-date prices. Additionally, these platforms reduce the risk of failed transactions by automatically routing trades to the most liquid and reliable DEXs.

The Role of 1inch Exchange

As one of the leading DeFi aggregators, 1inch Exchange has played a crucial role in the growth and development of the DeFi ecosystem. By offering users a seamless trading experience and optimizing liquidity utilization, 1inch Exchange has helped bridge the gap between different decentralized platforms and improve overall market efficiency.

1inch Exchange achieves this by leveraging its efficient routing algorithm and the integration of multiple DEXs and protocols. This allows users to access the deepest liquidity pools and reduces slippage, ensuring that traders get the best prices for their assets.

| Key Features of 1inch Exchange |

|---|

| Smart contract-based price discovery and trade execution |

| Multiple DEX integration for optimal liquidity |

| Gas fee optimization |

| Automated trade routing to minimize failed transactions |

| Intuitive user interface |

In conclusion, the rise of DeFi aggregators like 1inch Exchange has played a significant role in improving the trading experience for users in the decentralized finance space. These platforms offer a range of benefits, including access to the best prices, reduced gas fees, and minimized transaction risk. As the DeFi ecosystem continues to evolve, the role of DeFi aggregators will become even more important in facilitating efficient and seamless trades across different decentralized platforms.

Introducing 1inch Exchange

1inch Exchange is a decentralized exchange (DEX) aggregator that provides users with the best possible trading prices across multiple exchanges. It was launched in 2020 by Sergej Kunz and Anton Bukov and has since become one of the leading platforms in the decentralized finance (DeFi) space.

How does 1inch Exchange work?

1inch Exchange sources liquidity from various decentralized exchanges, such as Uniswap, Balancer, and Curve, to ensure that users get the best trading prices for their assets. The platform’s innovative algorithm splits orders across multiple markets to minimize slippage and maximize trading efficiency.

1inch Exchange also offers a unique feature called “Chi Gas Tokens” that allows users to save on Ethereum gas fees. By using Chi Gas Tokens, users can reduce their transaction costs by up to 50% without any additional complexity.

Key features of 1inch Exchange

- DEX aggregation: 1inch Exchange aggregates liquidity from multiple decentralized exchanges, ensuring users always get the best trading prices.

- Low slippage trading: The platform’s smart routing algorithm splits orders across multiple markets to minimize slippage and provide users with the most cost-effective trades.

- Chi Gas Tokens: 1inch Exchange’s Chi Gas Tokens offer users a way to save on Ethereum gas fees, reducing transaction costs without any additional complexity.

- Governance token: 1inch Exchange has its own governance token, called 1INCH, which allows token holders to participate in the platform’s decision-making processes and earn rewards.

Overall, 1inch Exchange has become a popular choice among DeFi users due to its efficient trading mechanisms, competitive prices, and innovative features. It continues to evolve and expand its offerings to meet the growing demands of the decentralized finance ecosystem.

The Transition to Decentralized Exchange (DEX)

As the 1inch Exchange evolved, it became increasingly clear that the future of decentralized finance (DeFi) lay in the hands of decentralized exchanges (DEX). These platforms allow users to trade tokens directly with each other without the need for intermediaries or a central authority. The transition to a DEX was a natural next step for 1inch, as it aligned with their mission to provide users with the best possible trading experience.

One of the key advantages of a DEX is the elimination of the need for a trusted third party. Traditional centralized exchanges often hold custody of user funds, which can be a significant risk factor. With a DEX, users retain control of their own funds and trade directly from their own wallets, reducing the risk of hacks or theft.

Additionally, DEXs are more resistant to censorship. Centralized exchanges can be subject to regulatory restrictions or forced to delist certain assets. This can limit user access and hinder market liquidity. In contrast, DEXs operate on a decentralized network of nodes, making it much harder for any single entity to control or restrict trading activity.

Furthermore, DEXs are often more cost-effective for users. Traditional exchanges typically charge substantial fees for trading and withdrawals. On the other hand, DEXs often have significantly lower trading fees and can offer users more control over the transaction process.

The Challenges of Transitioning to a DEX

While the benefits of a DEX are clear, the transition from a DeFi aggregator to a full-fledged DEX was not without its challenges for 1inch. One of the main hurdles was creating a user-friendly interface that would rival the convenience and ease of use of centralized exchanges. This involved designing a seamless trading experience while ensuring the security and privacy of user funds.

Another challenge was attracting liquidity to the platform. Centralized exchanges have historically been more attractive to traders due to their higher trading volumes and wider range of available assets. To address this, 1inch developed liquidity protocols that leverage the power of automated market-making (AMM) algorithms. These protocols incentivize liquidity providers to supply funds to the platform and ensure sufficient liquidity for users.

Despite these challenges, the transition to a DEX has been a significant milestone for 1inch. It has allowed them to take full advantage of the benefits of decentralization and offer users a more secure, cost-effective, and censorship-resistant trading experience.

The Future of 1inch as a DEX

With their transition to a DEX complete, 1inch is well-positioned to capitalize on the growing demand for decentralized finance. They continue to innovate and improve their protocols, aiming to provide users with the best possible trading experience.

One area of focus for 1inch is the integration of layer 2 solutions, such as Ethereum’s Optimistic Rollups. These solutions can significantly improve transaction scalability and reduce gas fees, making trading on 1inch more accessible and affordable for users.

Overall, the transition to a decentralized exchange has allowed 1inch to establish itself as a leader in the DeFi space. With their dedication to user experience and innovation, 1inch is poised to drive further adoption of decentralized finance and empower users to take control of their financial future.

Question-answer:

What is 1inch Exchange?

1inch Exchange is a decentralized exchange (DEX) aggregator that sources liquidity from various DEXs to provide users with the best possible trading rates. It was launched in 2019 and quickly gained popularity in the DeFi space.

How does 1inch Exchange work?

1inch Exchange works by splitting users’ trades across multiple DEXs to ensure they get the best possible rates. It scans multiple DEXs and liquidity protocols in real-time and routes the user’s trade through the most efficient path to minimize fees and slippage.