Decentralized Finance (DeFi) has emerged as one of the most exciting and transformative sectors in the blockchain industry. With its promise of revolutionizing traditional financial systems, DeFi projects have seen significant growth and adoption.

One of the key factors for the success of DeFi projects is liquidity provision. Liquidity is crucial for the efficient functioning of decentralized exchanges and lending platforms, as it allows users to easily buy, sell, and lend their assets. However, providing liquidity in the decentralized ecosystem can be challenging, as it often involves fragmented markets and high transaction costs.

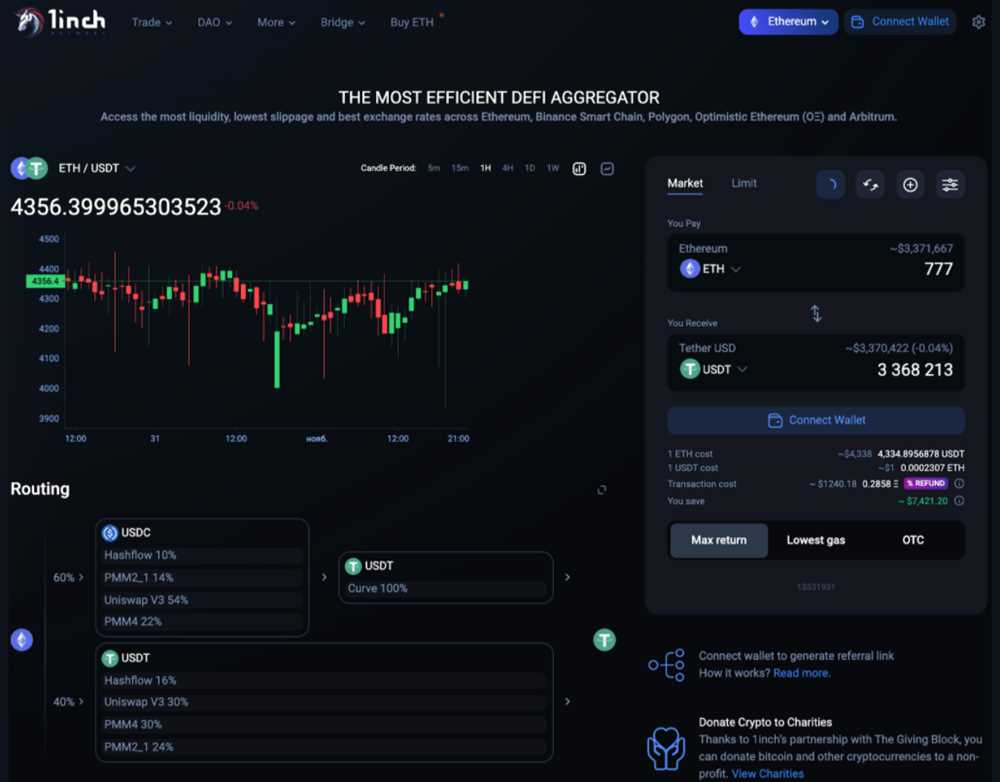

1inch, a leading decentralized exchange aggregator, is tackling these challenges and enhancing liquidity provision for DeFi projects. Through its innovative platform, 1inch is connecting various decentralized exchanges and liquidity sources to offer users the best possible prices and low slippage.

By splitting a user’s order across multiple decentralized exchanges, 1inch ensures that users get the most favorable rates and the least amount of slippage. This greatly improves the overall trading experience for users and enhances liquidity provision for DeFi projects.

inch: Improving Liquidity Provision in DeFi

DeFi projects rely heavily on liquidity provision to ensure that users can easily trade and access the assets they need. However, liquidity fragmentation across different decentralized exchanges (DEXs) can pose a challenge for both users and projects. 1inch, a decentralized exchange aggregator, is working to solve this problem by improving liquidity provision in the DeFi space.

Why Liquidity Provision Matters

Liquidity provision is crucial for the success of DeFi projects. It allows users to easily buy and sell assets, ensures the stability of prices, and enables efficient trading. Without sufficient liquidity, trading becomes difficult, prices can be easily manipulated, and users may have to pay higher fees.

However, liquidity in the DeFi space is often fragmented across different DEXs. This means that users have to manually search and compare prices on multiple platforms, resulting in higher transaction costs and slower trading. In addition, projects may struggle to attract liquidity providers if their platform is not easily accessible or does not offer competitive trading terms.

The Role of 1inch

1inch is addressing the challenges of liquidity provision in DeFi by offering a decentralized exchange aggregator. The platform aggregates liquidity from various DEXs, allowing users to access the best prices and execute trades quickly and efficiently.

Through its advanced algorithm, 1inch analyzes liquidity across different DEXs and splits a user’s trade across multiple exchanges to optimize for price and minimize slippage. This ensures that users get the best possible execution for their trades, while also improving overall liquidity for the DeFi ecosystem.

In addition to aggregating liquidity, 1inch also incentivizes liquidity providers to join its platform by offering competitive terms and rewards. This helps attract more liquidity to the DeFi space, benefiting both users and projects.

The Benefits for DeFi

By improving liquidity provision, 1inch is making it easier for users to trade assets and access the liquidity they need. This enhances the overall user experience and reduces transaction costs.

For DeFi projects, 1inch provides a solution to the liquidity fragmentation problem. By aggregating liquidity from different DEXs, projects can ensure that their platforms have sufficient liquidity and attract more users.

Overall, 1inch is playing a vital role in improving liquidity provision in the DeFi space. Its decentralized exchange aggregator helps users access the best prices and execute trades efficiently, while also benefiting projects by providing them with the liquidity they need to thrive.

Enhancing Liquidity for DeFi Projects with 1inch protocol

The 1inch protocol has emerged as a game-changer in the decentralized finance (DeFi) space by providing seamless liquidity provision for DeFi projects. With its cutting-edge technology and innovative solutions, 1inch is revolutionizing the way liquidity is provided in the DeFi ecosystem.

DeFi projects often face challenges when it comes to liquidity. Traditional exchanges have centralized liquidity pools, making it difficult for smaller projects to attract liquidity and offer competitive rates. This is where 1inch comes in, offering a decentralized liquidity protocol that solves these liquidity challenges.

Through its protocol, 1inch aggregates liquidity from various decentralized exchanges, including popular ones like Uniswap, Balancer, and Kyber Network. This aggregation of liquidity enables users to access the best rates and optimal liquidity for their trades.

But 1inch goes beyond just aggregating liquidity. It also utilizes sophisticated algorithms to split trades across multiple decentralized exchanges, optimizing gas fees and minimizing slippage. By intelligently routing trades, 1inch ensures that users get the best possible outcomes for their trades, saving them money and increasing their overall returns.

Furthermore, 1inch also offers liquidity providers the opportunity to earn competitive returns by supplying liquidity to the protocol. Liquidity providers can deposit their assets into the 1inch liquidity pool and earn fees from users who trade on the platform. This incentivizes liquidity providers to contribute more liquidity, thereby enhancing the overall liquidity available for DeFi projects.

By combining liquidity aggregation, smart order routing, and rewarding liquidity providers, 1inch is taking liquidity provision for DeFi projects to the next level. It is revolutionizing the DeFi landscape by making it easier for projects to attract liquidity, offering users the best rates and reducing costs, and incentivizing liquidity providers to contribute more liquidity.

In conclusion, the 1inch protocol is enhancing liquidity provision for DeFi projects by revolutionizing the way liquidity is accessed and provided in the DeFi ecosystem. Its innovative solutions are streamlining the liquidity process, benefiting both projects and users alike. With 1inch, DeFi projects have a powerful tool to enhance their liquidity and unlock their full potential in the rapidly evolving DeFi space.

Benefits of 1inch for DeFi Liquidity Providers

1inch is a decentralized exchange (DEX) aggregator that offers several benefits for liquidity providers in the DeFi space. Here are some of the key advantages of using 1inch:

1. Increased liquidity: 1inch combines liquidity from various decentralized exchanges into one platform, allowing liquidity providers to access a larger pool of funds. This results in increased liquidity for their trades and potentially higher profits.

2. Reduced slippage: By aggregating liquidity, 1inch reduces the impact of slippage on trades. Liquidity providers can ensure that their trades are executed at more favorable rates, minimizing losses due to price fluctuations.

3. Simplified trading process: 1inch simplifies the trading process for liquidity providers by automatically routing their trades to the most favorable trading venues. This saves time and effort for liquidity providers, allowing them to focus on other aspects of their trading strategies.

4. Competitive rates: 1inch constantly monitors and compares rates across different exchanges to provide liquidity providers with the most competitive rates for their trades. This ensures that they get the best value for their assets and maximizes their potential profits.

5. Gas optimization: 1inch optimizes gas costs for liquidity providers by splitting trades into multiple fragments and routing them through the most cost-effective paths. This helps reduce transaction fees and allows liquidity providers to save on gas costs.

6. Access to multiple protocols: 1inch supports various DeFi protocols, allowing liquidity providers to interact with different platforms and diversify their investment strategies. This provides them with more opportunities to earn yield and maximize their returns.

Overall, 1inch offers liquidity providers a range of benefits, including increased liquidity, reduced slippage, simplified trading, competitive rates, gas optimization, and access to multiple protocols. These advantages make 1inch an attractive option for liquidity providers looking to enhance their trading strategies and maximize their profits in the DeFi space.

Question-answer:

What is 1inch?

1inch is a decentralized exchange aggregator that sources liquidity from various decentralized exchanges to provide users with the best possible trading rates.

How does 1inch enhance liquidity provision for DeFi projects?

1inch enhances liquidity provision for DeFi projects by aggregating liquidity from multiple decentralized exchanges, enabling users to access a larger pool of liquidity and get better trading rates.

Why is enhancing liquidity provision important for DeFi projects?

Enhancing liquidity provision is important for DeFi projects because it allows users to easily and efficiently trade their assets, providing them with the liquidity they need to participate in decentralized finance.

What are the benefits of using 1inch for liquidity provision?

Using 1inch for liquidity provision offers several benefits, including accessing a larger pool of liquidity, getting better trading rates, and minimizing the slippage when executing trades.