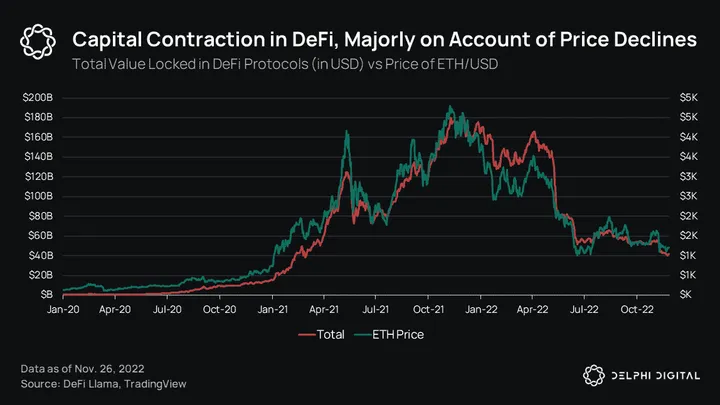

Decentralized Finance (DeFi) has revolutionized the financial industry by introducing trustless and permissionless protocols that enable users to transact and earn interest without intermediaries. However, one of the challenges faced by DeFi platforms is the lack of efficient price discovery mechanisms, which can lead to suboptimal trading conditions and potential arbitrage opportunities.

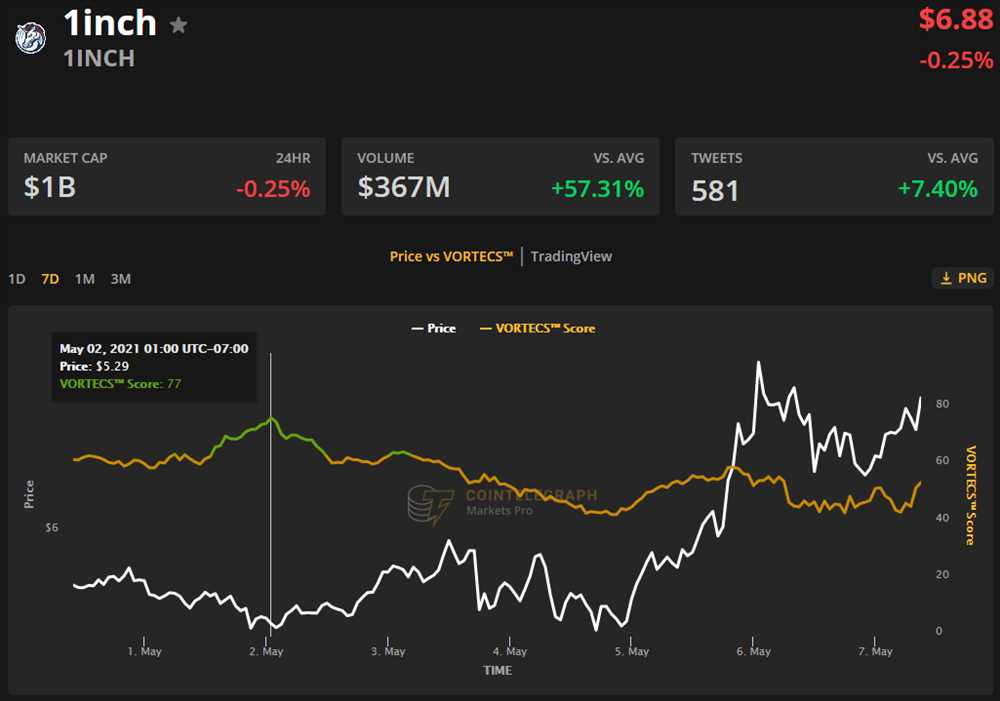

Addressing this issue, 1inch, a leading decentralized exchange aggregator, has developed a solution that enhances price discovery in DeFi. By leveraging its advanced algorithms and smart contract technology, 1inch is able to aggregate liquidity from multiple decentralized exchanges and provide users with the best possible prices for their trades.

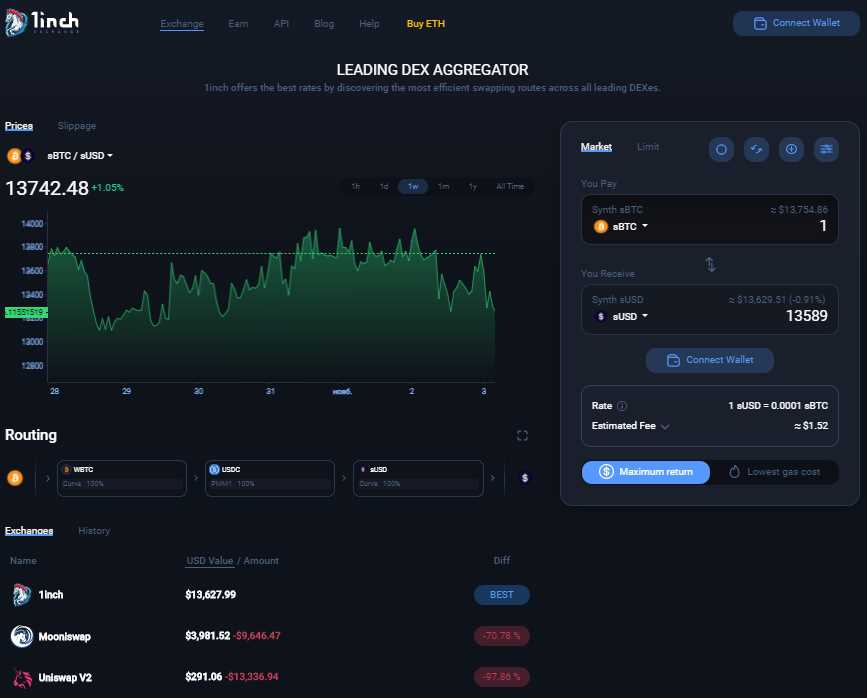

The 1inch platform analyzes the order books and liquidity pools of various decentralized exchanges in real-time, allowing users to access the most competitive prices across the DeFi ecosystem. This not only improves the trading experience for users but also increases the efficiency and effectiveness of the overall DeFi market.

Moreover, 1inch’s solution incorporates intelligent routing mechanisms that split large trades across multiple decentralized exchanges, minimizing slippage and maximizing trading profits. By automatically executing trades on the most favorable exchanges, 1inch ensures that users can achieve the best possible outcomes for their transactions.

With its innovative approach to price discovery, 1inch is driving the evolution of DeFi by creating a more transparent and efficient financial ecosystem. By providing users with access to the most competitive prices and optimizing trading execution, 1inch is leveling the playing field and empowering users to make the most of their decentralized finance experience.

Decentralized Finance Price Discovery

Price discovery is a crucial aspect in decentralized finance (DeFi), as it determines the fair market value of digital assets and facilitates efficient trading. Traditional centralized exchanges rely on order books and matching algorithms to determine asset prices. However, in DeFi, where trades are executed on various decentralized platforms, the lack of a central authority creates challenges in price discovery.

Decentralized finance platforms, like 1inch, aim to improve price discovery in DeFi by leveraging data from multiple sources. These platforms aggregate liquidity from various decentralized exchanges (DEXs), enabling users to access the best available prices for their trades.

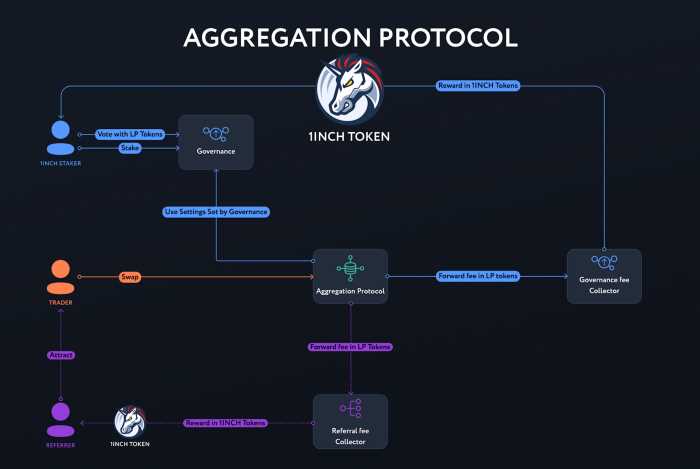

1inch’s solution to improve price discovery involves employing a smart contract-powered algorithm that splits a trade into multiple smaller trades across different DEXs. By distributing the trade across various liquidity sources, 1inch aims to achieve the most competitive prices and ensure minimal slippage.

Moreover, 1inch utilizes a combination of on-chain and off-chain data to determine the optimal prices for trades. On-chain data, such as current order book information and transaction history, is used to assess liquidity and market trends. Off-chain data, obtained from various data providers, is used to further refine price discovery and ensure accurate and up-to-date pricing information.

The use of decentralized oracles is another crucial aspect of price discovery in DeFi. Oracles serve as bridges between the blockchain and real-world data, providing essential inputs for determining asset prices. By utilizing decentralized oracles, DeFi platforms can access price feeds from multiple sources, reducing the risk of manipulation and providing more accurate price discovery.

Overall, decentralized finance price discovery relies on the aggregation of liquidity, smart contract-powered algorithms, on-chain and off-chain data, and decentralized oracles. These elements come together to enable efficient and accurate price discovery in the decentralized finance landscape.

The Challenge of Accurate Pricing

In decentralized finance (DeFi), accurate pricing is a crucial aspect that allows users to make informed decisions when executing trades or managing their assets. However, achieving accurate pricing in DeFi presents several challenges.

First and foremost, the lack of a central authority or intermediary means that there is no single source of truth for determining the prices of assets. Unlike traditional financial markets, where exchanges and market makers play a key role in setting prices, DeFi relies on automated algorithms and smart contracts to determine asset prices.

This decentralized nature of pricing leads to another challenge – the fragmentation of liquidity across multiple decentralized exchanges (DEXs). Each DEX has its own order books and liquidity pools, which can result in price discrepancies between different platforms. These discrepancies can be exploited by arbitrageurs to make profits, further complicating the task of accurately pricing assets in DeFi.

Moreover, the volatility and inherent complexity of cryptocurrency markets pose additional challenges for accurate pricing in DeFi. Cryptocurrencies are known for their price fluctuations, which can be sudden and drastic. This volatility makes it challenging to determine the fair value of assets, especially in fast-moving markets.

Additionally, the presence of illiquid markets and low trading volumes in DeFi can further impact the accuracy of pricing. Without sufficient liquidity, it becomes harder to determine the true market value of an asset, leading to wider bid-ask spreads and potentially inaccurate pricing.

To address these challenges, 1inch has developed innovative solutions that aim to improve price discovery in DeFi. By aggregating liquidity from multiple DEXs and implementing sophisticated algorithms, 1inch is able to offer users more competitive and accurate prices.

Furthermore, 1inch’s Pathfinder algorithm intelligently routes trades across different liquidity sources to optimize price execution. This helps to minimize slippage and ensure that users get the best possible price for their trades, even in highly volatile markets.

Overall, accurate pricing is a complex challenge in DeFi due to the decentralized nature of the ecosystem, fragmentation of liquidity, market volatility, and liquidity constraints. However, with innovative solutions like those developed by 1inch, the goal of improving price discovery in DeFi can be achieved, empowering users to make better-informed decisions and participate in the decentralized finance revolution.

How 1inch Improves Price Discovery

Price discovery is a crucial aspect of decentralized finance (DeFi). It refers to the process of determining the fair market value of an asset or token in an open and transparent manner. The more efficient the price discovery mechanism, the more accurate and reliable the prices are for traders and investors.

1inch is a leading decentralized exchange (DEX) aggregator that is focused on improving price discovery in DeFi. By leveraging various strategies and technologies, 1inch aims to provide users with the best prices for their trades.

Multi-DEX Integration

One of the key ways that 1inch improves price discovery is by integrating with multiple decentralized exchanges (DEXs). Rather than relying on a single DEX for liquidity, 1inch taps into a network of DEXs to find the best prices across different markets. This multi-DEX integration ensures that users can access the liquidity they need and avoid paying excessive fees.

Smart Contract Optimizations

1inch also employs smart contract optimizations to improve price discovery. By optimizing the routing strategies and gas costs associated with executing trades, 1inch can provide users with better prices and reduce the overall cost of transactions. This optimization enables users to trade more efficiently and maximize their returns in the DeFi ecosystem.

In conclusion, 1inch plays a vital role in improving price discovery in DeFi through its multi-DEX integration and smart contract optimizations. By providing users with the best prices and optimizing transaction costs, 1inch enhances the overall trading experience and increases the efficiency of the DeFi market.

Question-answer:

What is DeFi?

DeFi stands for Decentralized Finance, which refers to the use of blockchain technology and cryptocurrencies to recreate traditional financial systems in a decentralized manner. Through DeFi platforms, users can access various financial services such as lending, borrowing, trading, and more without relying on traditional intermediaries such as banks.

What is price discovery in DeFi?

In DeFi, price discovery refers to the process of determining the most accurate market price for a particular asset or cryptocurrency. It involves assessing the supply and demand dynamics in various liquidity pools and exchanges to find the best available price for trading. Price discovery is crucial for efficient and transparent trading in the DeFi ecosystem.

What is 1inch’s solution for improving price discovery in DeFi?

1inch is a decentralized exchange aggregator that aims to improve price discovery in DeFi. It achieves this by splitting a user’s trade across multiple liquidity sources, such as different decentralized exchanges and automated market makers. By doing so, 1inch finds the most optimal and competitive prices for users, ensuring that they get the best possible deal when trading in the DeFi market.