If you are looking for a decentralized exchange (DEX) aggregator that offers high liquidity and low slippage, look no further than 1inch. But what sets 1inch apart from other DEX aggregators? The answer lies in its innovative approach to yield farming.

Yield farming, also known as liquidity mining, has become a popular way for investors to earn passive income in the cryptocurrency space. It involves providing liquidity to decentralized exchanges and earning rewards in the form of tokens. 1inch takes this concept to the next level by optimizing yield farming strategies to maximize profitability for its users.

Through its automated market maker (AMM) protocol, 1inch pools liquidity from multiple DEXs, allowing users to access the best prices and swap tokens with minimal slippage. But what makes 1inch truly unique is its integration of yield farming into its platform. By providing liquidity to 1inch, users can earn additional tokens as rewards.

This innovative approach to yield farming has made 1inch a preferred choice among DeFi enthusiasts. Not only can users benefit from high liquidity and low slippage, but they can also earn passive income while doing so. With 1inch’s optimized yield farming strategies, users can maximize their earnings and take advantage of the potential for high returns.

If you are tired of traditional exchanges and want to explore the world of decentralized finance, give 1inch a try. Experience the power of yield farming and take your crypto investments to new heights with 1inch’s cutting-edge DEX aggregator. Start earning passive income today!

The Role of Yield Farming

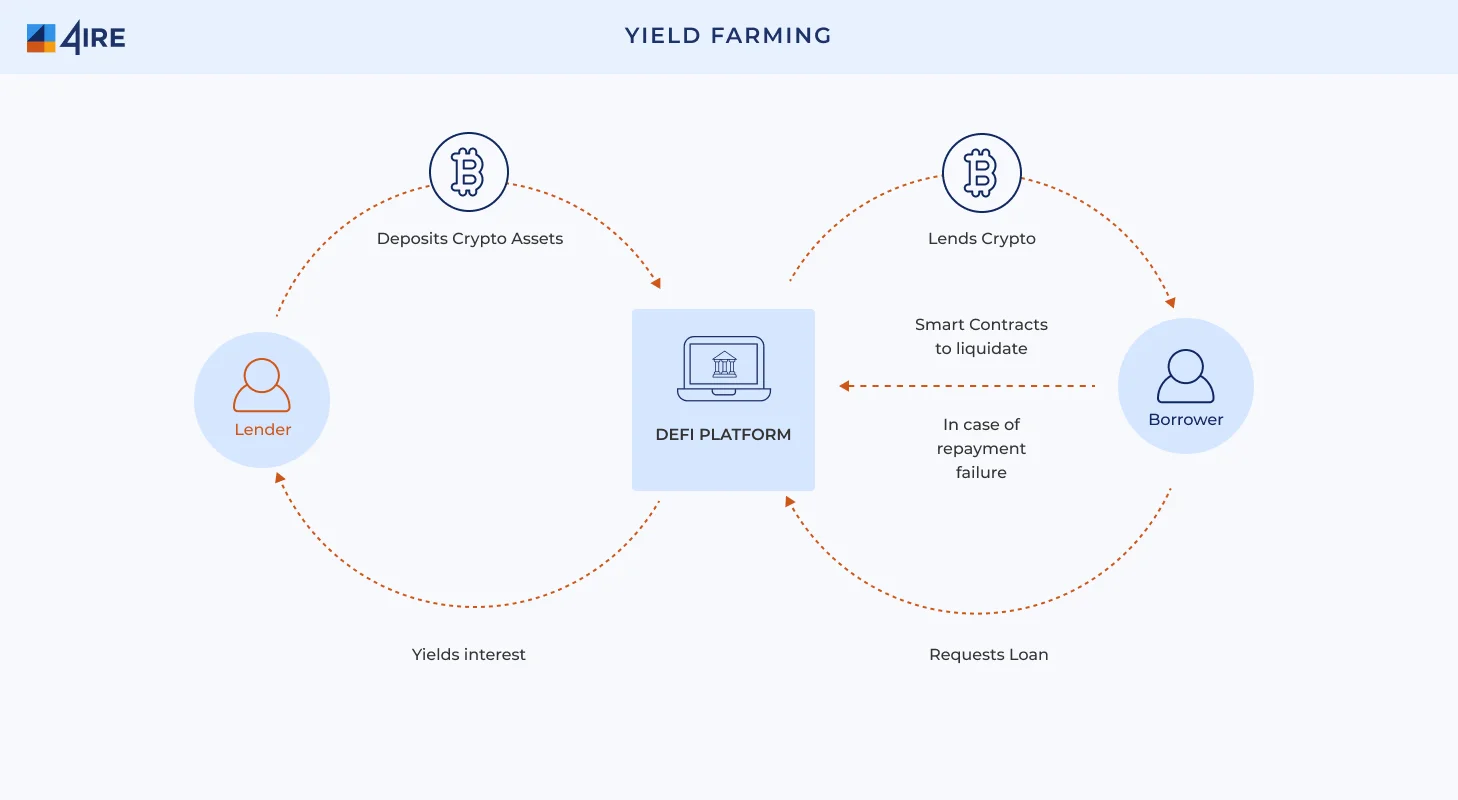

Yield farming has become a crucial element in the success of 1inch Dex Aggregator. Yield farming involves the practice of locking up cryptocurrencies in decentralized finance (DeFi) protocols to earn additional rewards or yield. This process helps users leverage their existing assets to generate passive income.

In the context of 1inch Dex Aggregator, yield farming plays a vital role in attracting liquidity to the platform. Liquidity is essential for the smooth and efficient functioning of any decentralized exchange. By participating in yield farming, users provide liquidity to different pools, which in turn allows for seamless trading and price discovery on the platform.

Benefits of Yield Farming on 1inch Dex Aggregator

1. Increased Returns: Yield farming on 1inch Dex Aggregator provides users with the opportunity to earn additional rewards on top of the trading fees. By staking their tokens, users can earn yield in the form of the platform’s native token or other tokens available in the liquidity pools.

2. Diversification of Assets: Yield farming allows users to diversify their holdings by staking different tokens in various liquidity pools. This diversification helps to spread the risks and potentially increase the overall returns.

3. Community Participation: Yield farming encourages active participation from the community. It creates an incentive for users to engage with the platform and contribute to its growth. This increased engagement strengthens the ecosystem and fosters a sense of belonging among the community members.

Risks and Considerations

While yield farming presents lucrative opportunities, it is important for users to be aware of the associated risks. These risks include impermanent loss, smart contract vulnerabilities, and potential market volatility.

Users should carefully evaluate the risks and rewards before participating in yield farming. It is recommended to conduct thorough research, understand the mechanisms of the protocols, and make informed decisions.

Overall, yield farming plays a critical role in the success of 1inch Dex Aggregator by attracting liquidity, increasing returns, and fostering community participation. However, users should approach yield farming with caution, taking into account the risks and rewards involved.

In the Success of 1inch Dex Aggregator

Yield farming has played a pivotal role in the remarkable success of the 1inch Dex aggregator. By leveraging the power of yield farming, 1inch has been able to provide its users with enhanced liquidity, improved trading efficiency, and higher returns on their investments.

Yield farming, also known as liquidity mining, involves the process of staking and lending digital assets to earn additional rewards. This innovative practice has revolutionized the decentralized finance (DeFi) space, allowing users to earn passive income by participating in various liquidity pools.

1inch has leveraged yield farming to create a sustainable ecosystem for its users. By partnering with top decentralized exchanges (DEXs) such as Uniswap, SushiSwap, and Balancer, 1inch is able to aggregate liquidity across multiple platforms, providing users with access to the best available prices for their trades.

Enhanced Liquidity

One of the key benefits of yield farming for 1inch is the increased liquidity it brings to the platform. By incentivizing users to provide liquidity to various pools, 1inch ensures that there is a constant supply of assets available for trading. This, in turn, improves the overall trading experience for users, allowing them to execute trades quickly and at competitive prices.

Improved Trading Efficiency

Yield farming also improves the trading efficiency on the 1inch platform. By aggregating liquidity from multiple DEXs, 1inch minimizes slippage and maximizes trading opportunities. Users can take advantage of better prices and lower fees, ultimately resulting in higher profits.

The 1inch DEX aggregator also utilizes intelligent routing algorithms to ensure optimal execution of trades. By analyzing various liquidity pools and smart contracts, 1inch automatically routes trades to the most efficient and cost-effective options, further improving the trading experience for its users.

Higher Returns on Investments

Yield farming allows users to earn additional rewards on their investments. By staking their assets in liquidity pools, users can earn additional tokens or fees generated by the protocol. This incentivizes users to hold their tokens and participate in the growth of the 1inch ecosystem, resulting in higher returns.

In conclusion, yield farming has played a crucial role in the success of the 1inch Dex aggregator. By leveraging the power of yield farming, 1inch has been able to provide enhanced liquidity, improved trading efficiency, and higher returns for its users. As the DeFi space continues to evolve, yield farming will undoubtedly remain an integral part of the success and growth of platforms like 1inch.

Benefits of Yield Farming

Yield farming, also known as liquidity mining, has become a popular trend in the decentralized finance (DeFi) space. It offers numerous benefits to users who participate in this new form of investment.

- High Yield Potential: Yield farming allows investors to earn higher returns on their investments compared to traditional finance. By providing liquidity to decentralized platforms, users have the opportunity to earn not only trading fees but also additional tokens as rewards.

- Diversification: Yield farming offers a way to diversify one’s crypto portfolio. By participating in different liquidity pools and yield farming strategies, investors can spread their risk and potentially increase their overall return on investment.

- Access to New Projects: Yield farming provides early adopters with access to new and promising DeFi projects. By participating in liquidity mining, users have the chance to earn tokens from projects that may have limited initial circulation, creating an opportunity for significant long-term gains.

- Community Engagement: Participation in yield farming often requires active involvement in the project’s community. This engagement can lead to valuable networking opportunities, knowledge sharing, and a sense of belonging to a like-minded community of investors and enthusiasts.

- Token Governance: Many yield farming projects include a governance token as part of their reward system. Holding these tokens may give users the ability to participate in key decision-making processes such as voting on protocol upgrades, proposals, and changes.

Overall, yield farming offers a unique way for crypto investors to maximize their returns, diversify their portfolios, and engage with the DeFi community. However, it’s important to note that yield farming also comes with risks, including impermanent loss and smart contract vulnerabilities. It’s crucial for participants to thoroughly research and understand the risks involved before engaging in yield farming activities.

Strategies for Yield Farming with 1inch Dex Aggregator

Yield farming has emerged as a popular way for cryptocurrency holders to earn passive income on their digital assets. With the 1inch Dex Aggregator, users can optimize their yield farming strategies and maximize their returns.

1. Diversify Your Farming Pools

One key strategy is to diversify your farming pools to reduce risks and increase the potential for higher yields. With 1inch Dex Aggregator, users can access a wide range of liquidity pools across different decentralized exchanges, allowing for greater flexibility in choosing the most profitable options.

2. Monitor Gas Fees

Gas fees can eat into your profits when yield farming. It is important to monitor gas fees and choose farming opportunities that offer the best cost-to-reward ratio. 1inch Dex Aggregator provides users with real-time gas fee information, allowing for more informed decision making.

3. Follow the Yield

Yields can fluctuate significantly depending on market conditions. By staying up to date with the latest yield opportunities, users can adjust their farming strategies accordingly. 1inch Dex Aggregator offers a comprehensive dashboard that displays the current yields across various liquidity pools, making it easier to identify the most lucrative options.

4. Consider Impermanent Loss

When providing liquidity to decentralized exchanges, there is a risk of impermanent loss. It is important to carefully consider the potential for impermanent loss when farming on 1inch Dex Aggregator and choose pools with lower volatility or higher potential rewards to minimize this risk.

In conclusion, yield farming with 1inch Dex Aggregator offers users a range of strategies to optimize their returns. By diversifying farming pools, monitoring gas fees, following the yield, and considering impermanent loss, users can maximize their earning potential in the world of decentralized finance.

Question-answer:

What is 1inch Dex Aggregator?

1inch Dex Aggregator is a decentralized exchange aggregator that sources liquidity from various decentralized exchanges to provide the best possible rates for users.

How does yield farming contribute to the success of 1inch Dex Aggregator?

Yield farming plays an important role in the success of 1inch Dex Aggregator by incentivizing liquidity providers to deposit their assets into the aggregator’s liquidity pools. This helps to deepen the liquidity and improve the overall user experience on the platform.

Can you explain the concept of yield farming?

Yield farming is a process where users can earn additional tokens by providing liquidity to decentralized finance (DeFi) protocols. These users, often referred to as liquidity providers, lock up their assets in smart contracts and receive rewards, typically in the form of additional tokens, for providing liquidity to the protocol.