Are you tired of high trading fees and limited liquidity on traditional exchanges? Look no further! The 1inch DEX Aggregator is here to revolutionize the way you trade cryptocurrencies.

What is the 1inch DEX Aggregator?

The 1inch DEX Aggregator is a decentralized exchange aggregator that connects you to multiple liquidity sources in the crypto market, ensuring the best possible prices for your trades. Unlike traditional exchanges, the 1inch DEX Aggregator pools liquidity from various decentralized exchanges, optimizing your trading experience by reducing slippage and maximizing your profits.

The Advantages of 1inch DEX Aggregator:

- Lower Trading Fees: Traditional exchanges often charge high fees, eating into your profits. With 1inch DEX Aggregator, you can enjoy significantly lower trading fees, saving you money with every trade.

- Unlimited Liquidity: Traditional exchanges rely on their own liquidity pools, which can result in limited availability, especially during peak trading hours. The 1inch DEX Aggregator sources liquidity from various decentralized exchanges, ensuring unlimited liquidity for your trades.

- Best Available Prices: By connecting you to multiple liquidity sources, the 1inch DEX Aggregator scans the market and executes your trades at the best available prices. Say goodbye to missed opportunities and hello to optimal trading.

- Security and Privacy: With the 1inch DEX Aggregator, you can trade with peace of mind. Your funds remain securely in your own wallet, and you retain full control of your private keys, eliminating the risk of hacks or data breaches.

Don’t miss out on the future of trading! Join the 1inch DEX Aggregator revolution and experience the benefits of decentralized trading today.

Understanding the 1inch DEX Aggregator

The 1inch DEX Aggregator is a revolutionary tool in the world of cryptocurrency trading. It is designed to provide users with the best possible rates and optimal efficiency when trading across multiple decentralized exchanges (DEXs).

With the growing popularity and adoption of decentralized finance (DeFi), finding the best prices and liquidity for trading various tokens can be a challenging and time-consuming process. Traditional exchanges often lack the ability to offer the best rates due to limited liquidity. Additionally, traders have to navigate through multiple platforms, resulting in high fees and potential slippage.

How does the 1inch DEX Aggregator work?

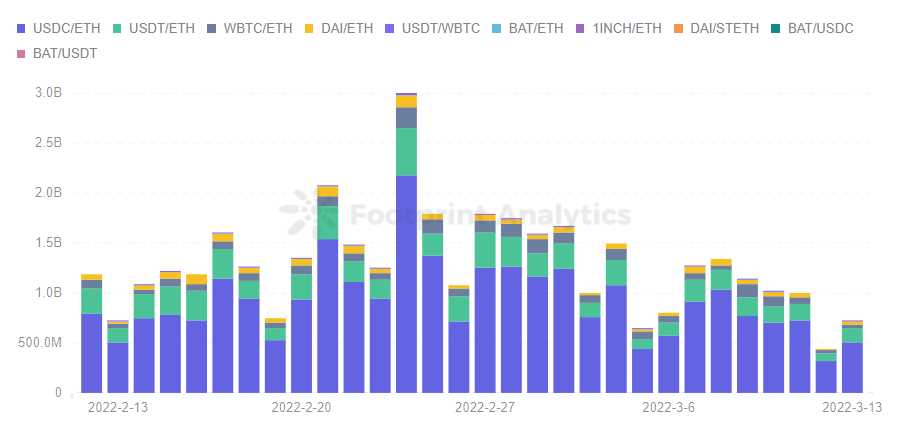

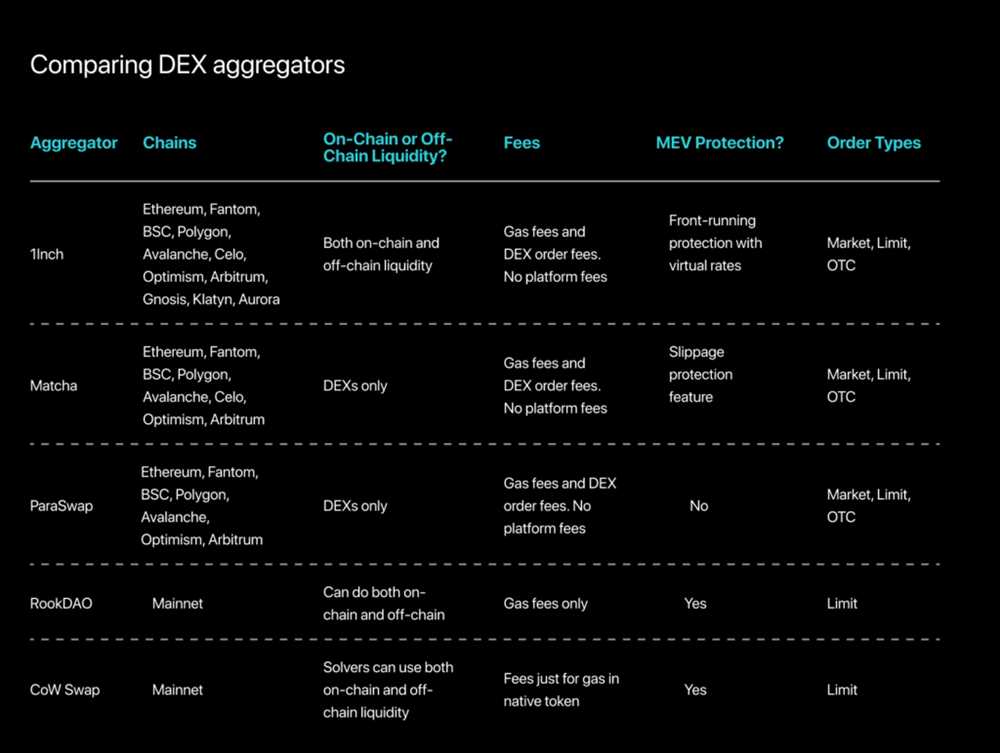

The 1inch DEX Aggregator is a smart contract protocol that sources liquidity from numerous DEXs, including popular platforms like Uniswap, SushiSwap, and Balancer. It analyzes the available liquidity across these exchanges and splits the user’s trade into smaller, optimized transactions to achieve the best possible rates.

By combining liquidity from multiple DEXs, the 1inch DEX Aggregator minimizes slippage and maximizes the user’s trading value. It leverages complex algorithms, such as Pathfinder and Chi-Squared, to calculate the most efficient trading paths and execute the trades with minimal impact on the market.

Advantages of using the 1inch DEX Aggregator

There are several key advantages to using the 1inch DEX Aggregator:

- Optimal rates: The 1inch DEX Aggregator ensures that traders get the best possible rates by leveraging the available liquidity across multiple DEXs.

- Reduced slippage: By splitting trades into smaller transactions, the 1inch DEX Aggregator minimizes slippage and helps traders retain more value.

- Convenience: Traders can access multiple DEXs through a single interface, saving time and effort in searching for liquidity and executing trades.

- Improved liquidity: The 1inch DEX Aggregator pools the liquidity from various DEXs, which can result in improved liquidity for trading.

| Traditional Exchanges | 1inch DEX Aggregator |

|---|---|

| May have limited liquidity | Accesses liquidity from multiple DEXs |

| Higher fees | Optimizes trades to reduce fees |

| Time-consuming to navigate through multiple platforms | Single interface for accessing multiple DEXs |

| Potential slippage | Minimizes slippage through optimized trading paths |

In conclusion, the 1inch DEX Aggregator offers a superior trading experience compared to traditional exchanges by providing optimal rates, reducing slippage, and offering convenience through a single interface for accessing multiple DEXs. It is a powerful tool for traders looking to maximize their trading value in the decentralized finance ecosystem.

Benefits of the 1inch DEX Aggregator

The 1inch DEX Aggregator offers numerous benefits over traditional exchanges, making it the go-to choice for cryptocurrency traders and investors:

1. Enhanced Liquidity: The 1inch DEX Aggregator combines liquidity from multiple decentralized exchanges, providing users with access to a much larger pool of liquidity. This results in better execution prices and reduced slippage for trades.

2. Competitive Rates: As the 1inch DEX Aggregator sources liquidity from various platforms, it can offer competitive rates for trading. Users can take advantage of the best available rates across different exchanges, maximizing their trading returns.

3. Reduced Fees: By aggregating liquidity, the 1inch DEX Aggregator reduces the need for multiple transactions across various exchanges, ultimately leading to lower fees. Users can save on transaction costs and increase their overall profitability.

4. Efficient Trading Experience: The 1inch DEX Aggregator simplifies the trading process for users. Instead of manually searching and executing trades on different exchanges, users can access a wide range of liquidity through a single platform. This saves time and effort, allowing users to focus on their trading strategy.

5. Access to Unique Tokens: The 1inch DEX Aggregator connects users to a diverse range of tokens and assets. Users can access and trade tokens that may not be available on traditional exchanges, offering opportunities for diversification and exposure to new investment options.

6. Secure and Non-Custodial: The 1inch DEX Aggregator prioritizes user security by implementing a non-custodial model. This means that users retain full control over their funds throughout the trading process, reducing the risk of hacks or security breaches often associated with centralized exchanges.

7. Transparency: The 1inch DEX Aggregator operates on a decentralized network, providing users with transparency regarding exchange rates and liquidity sources. Users can verify the data and ensure they are getting the best possible rates and access to liquidity.

Overall, the 1inch DEX Aggregator offers a more efficient, cost-effective, and secure trading experience, making it an ideal choice for traders and investors looking to navigate the decentralized finance landscape.

Comparison with Traditional Exchanges

When it comes to trading cryptocurrencies, traditional exchanges have been the preferred choice for many investors. However, with the emergence of decentralized finance (DeFi) platforms like 1inch DEX Aggregator, the landscape has started to change.

Here are some key advantages that 1inch DEX Aggregator offers over traditional exchanges:

- Liquidity: Traditional exchanges often rely on order books to match buyers and sellers, which may result in low liquidity for certain cryptocurrencies. 1inch DEX Aggregator, on the other hand, taps into multiple liquidity sources across various decentralized exchanges, providing users with greater liquidity and better trading opportunities.

- Lower Trading Fees: Traditional exchanges typically charge higher trading fees, which can eat into your profits. 1inch DEX Aggregator operates on a decentralized network, where fees are often much lower, allowing traders to save money on their transactions.

- Transparent and Trustless: One of the key advantages of DeFi platforms like 1inch DEX Aggregator is their transparency and trustlessness. Traditional exchanges often require users to trust them with their funds, whereas 1inch DEX Aggregator operates on smart contracts, providing users with full control over their assets.

- Fast and Efficient: Traditional exchanges can sometimes suffer from issues like slow trading execution and withdrawal delays. 1inch DEX Aggregator leverages the power of blockchain technology to offer fast and efficient trading, ensuring that users can execute their trades quickly and securely.

- Access to Unique Tokens: 1inch DEX Aggregator gives users access to a wide range of tokens that may not be available on traditional exchanges. This opens up new investment opportunities and allows traders to diversify their portfolios.

In conclusion, while traditional exchanges have long been the go-to option for cryptocurrency trading, 1inch DEX Aggregator offers a compelling alternative. With its enhanced liquidity, lower fees, transparency, speed, and access to unique tokens, it presents traders with a new way to engage with the crypto market.

Limitations of Traditional Exchanges

While traditional exchanges have long been the go-to option for trading and investing, they do come with some limitations that can impact traders and investors. Understanding these limitations is crucial for individuals looking to explore alternative options such as the 1inch DEX Aggregator.

Limited Access

Traditional exchanges often have strict listing requirements, meaning that only a limited number of assets are available for trading. This can be frustrating for traders who are looking to diversify their portfolios or explore new investment opportunities. In contrast, the 1inch DEX Aggregator provides access to a wide range of decentralized exchanges, allowing users to trade a vast array of tokens and assets.

Lack of Transparency

Transparency is a critical factor in the trading industry, as it helps build trust between traders and the exchange platform. Unfortunately, traditional exchanges often lack transparency, with opaque fee structures, hidden costs, and undisclosed information about order execution. On the other hand, the 1inch DEX Aggregator offers complete transparency, with clear and competitive pricing, as well as detailed information about the execution of trades.

| Limitations of Traditional Exchanges | Advantages of 1inch DEX Aggregator |

|---|---|

| Limited access to assets | Wide range of assets available for trading |

| Lack of transparency | Complete transparency in pricing and trade execution |

| High fees | Competitive and low-cost trading |

| Limited liquidity | Access to deep liquidity pools |

Note: These limitations are not meant to disparage traditional exchanges, but rather highlight the advantages that the 1inch DEX Aggregator offers for those seeking more diverse, transparent, and cost-effective trading options.

Advantages of 1inch DEX Aggregator over Traditional Exchanges

1inch DEX Aggregator offers several advantages over traditional exchanges, providing users with better trading experiences and opportunities:

1. Enhanced Liquidity

1inch DEX Aggregator aggregates liquidity from various decentralized exchanges, allowing users to access a larger pool of liquidity compared to traditional exchanges. This ensures better trade execution, reduced slippage, and improved price discovery.

2. Lower Fees

1inch DEX Aggregator aims to provide the lowest possible fees for traders. By smart routing and splitting orders across multiple exchanges, it minimizes trading costs and helps users to save on fees that are typically associated with traditional exchanges.

3. Improved Privacy

With 1inch DEX Aggregator, users can enjoy enhanced privacy as their trades are executed directly on decentralized exchanges without the need for KYC (Know Your Customer) verification. This eliminates the risk of sensitive personal information being exposed and protects user privacy.

4. Wide Range of Tokens

1inch DEX Aggregator supports a wide range of tokens, including both popular and lesser-known tokens. This opens up more opportunities for trading and allows users to access unique and niche markets that may not be available on traditional exchanges.

5. Non-Custodial Trading

Unlike traditional exchanges where users have to deposit funds and trust the exchange with their assets, 1inch DEX Aggregator enables non-custodial trading. Users have full control over their funds as trades are executed directly from their wallets, reducing the risk of hacks, theft, or loss of funds.

| Advantages | 1inch DEX Aggregator | Traditional Exchanges |

|---|---|---|

| Enhanced Liquidity | ✓ | ✗ |

| Lower Fees | ✓ | ✗ |

| Improved Privacy | ✓ | ✗ |

| Wide Range of Tokens | ✓ | ✗ |

| Non-Custodial Trading | ✓ | ✗ |

Question-answer:

What is 1inch DEX Aggregator?

1inch DEX Aggregator is a decentralized exchange aggregator that sources liquidity from multiple decentralized exchanges (DEXs) and provides users with the best price for their trades. It was created to address the issue of fragmented liquidity across different DEXs and aims to give users the most efficient and cost-effective trading experience.

How does 1inch DEX Aggregator work?

1inch DEX Aggregator works by splitting a user’s trade across multiple DEXs to find the best possible price. It uses an algorithm that takes into account factors such as gas fees, liquidity, and slippage in order to determine the most optimal route for executing a trade. By aggregating liquidity from various DEXs, 1inch is able to provide users with access to a larger pool of liquidity and better prices than they would get by trading on a single exchange.

What are the advantages of using 1inch DEX Aggregator over traditional exchanges?

There are several advantages of using 1inch DEX Aggregator over traditional exchanges. Firstly, 1inch offers better prices by aggregating liquidity from multiple DEXs, allowing users to get the best possible price for their trades. Secondly, 1inch is decentralized, meaning that users retain full control of their funds and do not need to trust a centralized exchange with their assets. Additionally, 1inch provides better privacy as it does not require users to create an account or provide KYC information. Finally, 1inch is also more efficient as it uses an algorithm to find the most optimal route for executing trades, minimizing gas fees and slippage.