Decentralized exchanges (DEXs) have been gaining significant traction in the cryptocurrency industry, offering users a way to trade digital assets without relying on traditional centralized platforms. One of the leading players in this space is 1inch, a decentralized exchange aggregator that connects various DEXs to provide users with the best possible trading opportunities.

However, as DEXs like 1inch continue to grow in popularity, they face a growing challenge: regulation. The decentralized nature of these platforms raises important questions about compliance with existing financial regulations, especially when it comes to anti-money laundering (AML) and know-your-customer (KYC) requirements.

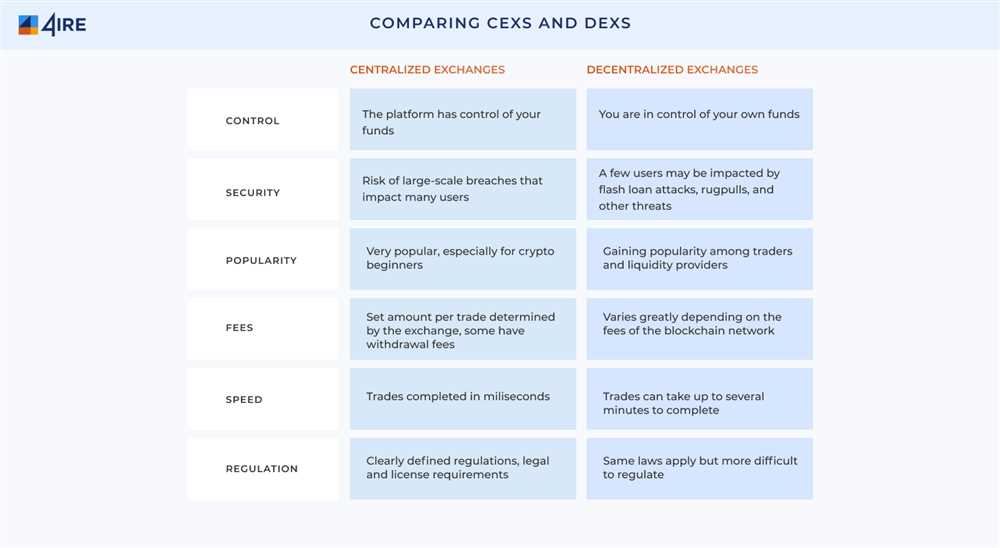

While centralized exchanges are often subject to strict regulations and oversight, DEXs operate on blockchain networks and are designed to be autonomous and censorship-resistant. This poses a dilemma for regulators, who must balance the need to protect investors with the desire to foster innovation and decentralization in the cryptocurrency market.

1inch and other DEXs are actively working to address these regulation challenges. They are exploring various approaches, such as implementing voluntary KYC procedures and partnering with compliance-focused projects to ensure they meet regulatory requirements without compromising user privacy and security. However, finding a regulatory framework that strikes the right balance remains an ongoing challenge.

The Challenges of Regulating 1inch and Other DEXs

As the popularity and usage of decentralized exchanges (DEXs) such as 1inch continue to grow, regulators face a number of significant challenges in effectively regulating these platforms. DEXs present a unique set of challenges due to their decentralized nature and the anonymity they offer to users.

One of the main challenges regulators face when it comes to DEXs is determining the appropriate regulatory framework. Traditional financial regulations, designed for centralized exchanges and intermediaries, may not be well-suited to the decentralized nature of DEXs. Regulators will need to develop new frameworks and guidelines specifically tailored to DEXs that address the unique risks and characteristics of these platforms.

Another challenge is enforcing these regulations. With DEXs operating on the blockchain, it can be difficult for regulators to identify and go after those who are not complying with the rules. Traditional enforcement mechanisms, such as freezing accounts or seizing assets, may not be as effective in the decentralized context. Regulators will need to explore new ways to enforce regulations and hold individuals accountable for any wrongdoing.

Additionally, the global nature of DEXs presents challenges in terms of jurisdiction and cooperation between regulators. DEXs can be accessed by users from anywhere in the world, and it can be challenging for regulators to assert jurisdiction over these platforms. Coordinating efforts and sharing information between regulators from different countries will be crucial in effectively regulating DEXs on a global scale.

Furthermore, the anonymity provided by DEXs poses challenges for regulators in combating money laundering, fraud, and other illicit activities. Without the same level of KYC (Know Your Customer) and AML (Anti-Money Laundering) procedures as traditional exchanges, DEXs can be attractive to individuals looking to engage in illegal activities. Regulators will need to find ways to balance the privacy and anonymity benefits of DEXs with the need to prevent and detect financial crimes.

Overall, the challenges of regulating 1inch and other DEXs are multifaceted and require innovative and adaptive approaches from regulators. Balancing the need for regulation with the benefits of decentralization is a delicate task that will require collaboration between regulators, industry participants, and the wider cryptocurrency community.

The Growth of Decentralized Exchanges

Decentralized exchanges (DEXs) have experienced significant growth in recent years, becoming a popular alternative to traditional centralized exchanges. DEXs are platforms that allow users to trade cryptocurrencies directly from their wallets without the need for intermediaries or central authorities.

One of the main drivers behind the growth of DEXs is the increasing demand for privacy and control over personal data. With centralized exchanges, users usually have to deposit their funds onto the platform, which comes with the risk of hacks or data breaches. DEXs, on the other hand, allow users to retain full control over their funds, eliminating the need to trust a third party with their assets.

Another factor contributing to the growth of DEXs is the rise of decentralized finance (DeFi). DeFi refers to the use of blockchain technology and smart contracts to recreate traditional financial systems in a decentralized manner. DEXs play a crucial role in the DeFi ecosystem, facilitating various activities such as lending, borrowing, and liquidity provision.

The growth of DEXs has also been fueled by the increasing adoption of blockchain technology. As more people become familiar with cryptocurrencies and blockchain, the demand for decentralized solutions is on the rise. DEXs provide a transparent and trustless environment for users to trade assets, making them an attractive option for crypto enthusiasts.

Benefits of Decentralized Exchanges

- Improved privacy and security

- Elimination of central authorities

- Lower transaction fees

- Increased liquidity through automated market-making

Challenges and Regulation

While the growth of DEXs presents numerous benefits, it also poses regulatory challenges. As these platforms operate in a decentralized manner, it is difficult for regulators to enforce rules and protect investors. Additionally, DEXs face challenges with know-your-customer (KYC) and anti-money laundering (AML) regulations, as they often require users to only have a wallet address to trade.

Regulators are starting to pay more attention to DEXs, as they recognize the importance of maintaining investor protection and market stability. Various regulatory proposals and initiatives have been introduced to address these challenges and ensure that DEXs operate in a compliant manner.

Overall, the growth of DEXs indicates a shift towards decentralized and trustless financial systems. While regulation may pose challenges, it is crucial for DEXs to find a balance between innovation and compliance to ensure the long-term sustainability of the ecosystem.

The Need for Regulatory Frameworks

The decentralized nature of decentralized exchanges (DEXs) like 1inch poses unique challenges when it comes to regulation. As these platforms operate without a centralized authority, it becomes difficult for traditional regulatory structures to oversee and enforce compliance.

However, the need for regulatory frameworks in the DEX space is becoming increasingly apparent. Without proper regulation, there are risks of illicit activities such as money laundering, fraud, and market manipulation. A lack of oversight also raises concerns about user protection and investor confidence.

Regulatory frameworks can provide a level playing field for all participants in the DEX market. Clear guidelines and rules can help ensure fair competition and prevent monopolistic behavior. It can also help protect investors from scams and schemes that can flourish in the absence of regulation.

Another important aspect of regulatory frameworks is consumer protection. With traditional financial institutions, consumers have certain rights and avenues for recourse in case of disputes or fraudulent activities. Similar protections need to be extended to users of DEXs to ensure their safety and confidence in the platform.

Moreover, regulatory frameworks can help bridge the gap between traditional financial systems and decentralized exchanges. By establishing clear rules and standards, regulators can collaborate with DEX platforms to ensure compliance with existing laws while promoting innovation in the blockchain space. This can encourage more widespread adoption of DEXs and bring the benefits of decentralized finance to a larger audience.

To achieve effective regulation, it is crucial to strike a balance between oversight and innovation. While too much regulation can stifle the growth and development of the DEX market, a complete lack of regulation leads to potential risks and harms to users. Finding the right balance will require active collaboration between regulators, industry experts, and DEX platforms.

In conclusion, the need for regulatory frameworks in the DEX space is vital to address concerns related to illicit activities, user protection, and investor confidence. A well-designed regulatory framework can foster a fair, transparent, and secure environment for the decentralized exchange market to thrive while ensuring compliance with existing financial laws. Collaboration between regulators and industry participants will be key in navigating the regulatory challenges ahead for platforms like 1inch and other DEXs.

The Complexities of Regulating DEXs

Regulating decentralized exchanges (DEXs) presents a variety of complex challenges for regulators. Unlike centralized exchanges, DEXs operate on blockchain networks and do not have a central authority or control. This decentralized nature makes it difficult for regulators to enforce traditional regulatory frameworks.

One of the main complexities of regulating DEXs is determining jurisdiction. With traditional exchanges, regulators can easily identify the jurisdiction where the exchange is located and apply their regulations accordingly. However, DEXs can be accessed and used by anyone around the world, making it difficult to establish jurisdiction and enforce regulations.

Another challenge is the anonymity provided by DEXs. Users can trade assets on DEX platforms without revealing their true identities, making it challenging for regulators to monitor and trace illicit activities. This anonymity also raises concerns about anti-money laundering (AML) and know-your-customer (KYC) regulations.

Furthermore, the decentralized nature of DEXs means that there is no central authority responsible for monitoring and preventing market manipulation or insider trading. Traditional exchanges have measures in place to detect and prevent these activities, but DEXs lack these centralized controls, making it difficult to ensure fair and transparent trading.

The innovative and evolving nature of DEXs also adds to the complexities of regulation. As new features and functionalities are introduced, regulators must continually adapt their regulations to keep up with the rapidly changing landscape. This requires close collaboration between regulators, developers, and industry participants.

Overall, regulating DEXs is a complex and challenging task. Regulators must navigate the decentralized nature of these platforms, establish jurisdiction, address anonymity concerns, prevent market manipulation, and adapt to the ever-changing landscape of DEX technology. Finding the right balance between regulation and innovation will be crucial to ensure the growth and sustainability of the decentralized finance ecosystem.

Ensuring Transparency and Security

The growth of decentralized exchanges (DEXs) like 1inch has provided users with new opportunities for trading cryptocurrencies. However, as these platforms continue to gain popularity, it is essential to address the regulatory challenges that may arise.

One of the key concerns is ensuring transparency in DEX transactions. Traditional centralized exchanges are subject to strict regulations and reporting requirements, as they act as custodians of users’ funds. In contrast, DEXs operate on smart contracts and do not hold users’ assets. This lack of intermediary involvement poses a challenge in terms of tracing transactions and ensuring compliance.

To address this, DEXs need to implement innovative solutions that provide transparency without compromising users’ privacy. Technologies like zero-knowledge proofs and cryptographic commitments can be utilized to verify transaction data without exposing sensitive information.

Another crucial aspect is security. Traditional exchanges have faced numerous security breaches, resulting in the loss of user funds. DEXs need to prioritize the implementation of robust security measures to protect their users’ assets. This includes technologies like multi-signature wallets, cold storage, and rigorous auditing processes.

Furthermore, DEXs can enhance security through community-driven efforts. By encouraging bug bounties, conducting security audits, and involving users in the platform’s governance, DEXs can harness the power of decentralized collaboration to identify and mitigate potential security vulnerabilities.

Compliance with regulations is another critical factor for DEXs. As authorities around the world increase their focus on cryptocurrency transactions, it is necessary for DEXs to adopt regulatory measures. This includes implementing know-your-customer (KYC) procedures to prevent money laundering and adhering to anti-money laundering (AML) regulations.

However, it is vital to find a balance between regulation and the core principles of decentralization and privacy. DEXs should work closely with regulators to develop frameworks that ensure compliance while preserving the fundamental values of decentralized finance (DeFi).

In conclusion, while DEXs like 1inch offer numerous benefits to the crypto community, it is essential to tackle the regulatory challenges they face. Ensuring transparency and security should be at the forefront of DEX development, alongside compliance with global regulations. By adopting innovative technologies and community-driven approaches, DEXs can build a sustainable and trustworthy ecosystem for decentralized trading.

Question-answer:

What are the main challenges in regulation that 1inch and other DEXs face?

The main challenges in regulation that 1inch and other DEXs face are related to compliance with existing financial regulations, such as know-your-customer (KYC) and anti-money laundering (AML) rules. They also face challenges in ensuring the security and privacy of user data and funds, as well as dealing with potential legal and regulatory actions in different jurisdictions.

How do DEXs ensure compliance with KYC and AML regulations?

DEXs like 1inch can ensure compliance with KYC and AML regulations by implementing systems that collect and verify user identification information, such as government-issued IDs and proof of address. They can also partner with third-party providers that specialize in AML and KYC compliance to help them meet regulatory requirements. Additionally, DEXs can employ transaction monitoring technology to detect and report any suspicious or potentially illegal activity.

What are the potential legal and regulatory actions that DEXs may face?

DEXs may face legal and regulatory actions such as cease and desist orders, fines, or even criminal charges if they are found to be in violation of financial regulations. They may also face challenges in operating in certain jurisdictions where cryptocurrency regulations are unclear or strict. Additionally, DEXs may face legal battles with traditional financial institutions as they challenge the existing centralized financial system.