In the world of decentralized finance (DeFi), innovation is the name of the game. With new projects and protocols popping up every day, it can be difficult to keep up with the latest advancements. One project that has been making waves in the DeFi landscape is 1inch. With its unique aggregation protocol, 1inch is revolutionizing the way users interact with decentralized exchanges.

1inch is an Ethereum-based decentralized exchange aggregator that sources liquidity from various exchanges to provide users with the best possible swap rates. By leveraging its unique aggregation algorithm, 1inch is able to split a user’s order across multiple DEXes to ensure they get the most favorable rates. This not only saves users money but also provides them with access to a wider pool of liquidity.

What sets 1inch apart from other DEX aggregators is its commitment to transparency and decentralization. Unlike traditional exchanges, which often operate as centralized entities, 1inch is built on smart contracts and operates in a decentralized manner. This means that users have full control over their funds at all times, and there is no need to trust a centralized authority.

Furthermore, 1inch is constantly evolving and adding new features to enhance the user experience. For example, it recently introduced the 1inch Liquidity Protocol, which allows liquidity providers to earn fees by supplying liquidity to the platform. This not only benefits liquidity providers but also ensures that 1inch always has a robust pool of liquidity for users to trade against.

In conclusion, 1inch is revolutionizing the DeFi landscape with its unique aggregation protocol. By providing users with the best possible swap rates and maintaining a commitment to transparency and decentralization, 1inch is changing the way users interact with decentralized exchanges. With its continued innovation and dedication to improving the user experience, 1inch is a project to watch in the world of DeFi.

How 1inch is Disrupting the DeFi Market with its Revolutionary Aggregation Protocol

1inch, a leading decentralized finance (DeFi) platform, is revolutionizing the DeFi landscape with its unique aggregation protocol. This protocol allows users to access the best possible rates for their crypto asset trades across various decentralized exchanges (DEXs).

Traditionally, decentralized exchanges operate as silos, meaning that each DEX has its own liquidity pool and order books. This fragmentation often leads to suboptimal trading experiences for users, as they need to search multiple exchanges to find the best rates.

1inch’s aggregation protocol solves this problem by aggregating liquidity from multiple DEXs into one platform. By doing so, 1inch ensures that users can access the best possible rates for their trades without the need to switch between different exchanges.

The aggregation protocol works by splitting the user’s trade into multiple smaller trades across different DEXs, optimizing for the best rates at each step. The protocol also takes into account factors such as gas prices and slippage, ensuring that users get the most efficient and cost-effective trades.

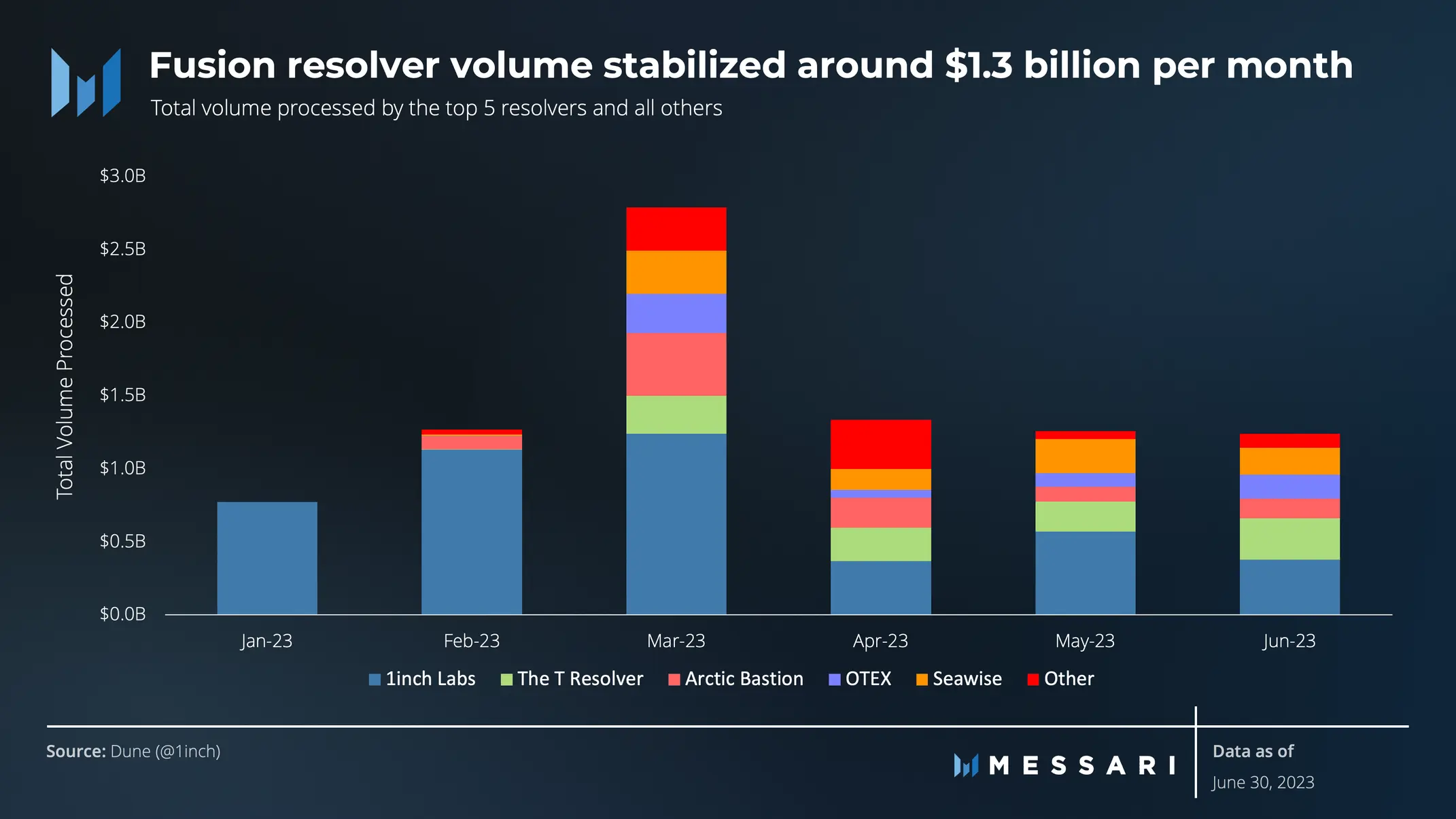

1inch has gained significant recognition and popularity within the DeFi community due to its aggregation protocol. The platform has attracted millions of users and handles billions of dollars in trading volume each month.

Furthermore, 1inch is constantly improving and expanding its aggregation protocol. The platform integrates with new DEXs and liquidity sources, ensuring that users always have access to the most comprehensive liquidity pool. Additionally, 1inch is actively exploring layer 2 solutions and cross-chain compatibility to further enhance its protocol.

In conclusion, 1inch is disrupting the DeFi market with its revolutionary aggregation protocol. By aggregating liquidity from multiple DEXs, 1inch ensures that users can access the best possible rates for their trades. With its constant innovation and expansion, 1inch is positioned to lead the DeFi landscape and revolutionize the way users trade crypto assets.

An Overview of 1inch Protocol

1inch is a revolutionary protocol that has transformed the DeFi landscape with its unique aggregation capabilities. This protocol was created to solve the problem of liquidity fragmentation on decentralized exchanges, allowing users to access the best prices across various platforms.

At the heart of the 1inch protocol is its smart contract, which is powered by an advanced algorithm that ensures optimal routing and aggregation of liquidity. This algorithm takes into account factors such as gas prices, slippage, and market depth in order to provide users with the most efficient trading experience.

How it Works

When a user wants to make a trade, the 1inch protocol scans multiple decentralized exchanges and identifies the best prices available for the desired asset. It then splits the trade into multiple smaller orders and executes them across different exchanges in order to achieve the best possible price.

One of the key features of the 1inch protocol is its ability to perform on-chain arbitrage. This means that the protocol can take advantage of price differences between different exchanges, allowing users to maximize their profits.

Furthermore, the 1inch protocol also incorporates liquidity mining, which incentivizes users to provide liquidity to the protocol in return for rewards. This helps to ensure a consistent supply of liquidity and improves the overall efficiency of the protocol.

Advantages of 1inch Protocol

The 1inch protocol offers several advantages over traditional decentralized exchanges:

- Best price execution: By aggregating liquidity from multiple exchanges, the protocol ensures that users always get the best possible price for their trades.

- Reduced slippage: Splitting trades across different exchanges helps to minimize slippage and prevent large price impacts.

- On-chain arbitrage: The protocol enables users to take advantage of price differences between exchanges, maximizing their profits.

- Liquidity mining: Users can earn rewards by providing liquidity to the protocol, ensuring a consistent supply of liquidity.

- Improved user experience: The 1inch protocol simplifies the trading process by automatically finding the best prices and executing trades across multiple exchanges.

In conclusion, the 1inch protocol has revolutionized the DeFi landscape by introducing an innovative approach to liquidity aggregation. With its advanced algorithm and range of features, it provides users with the best possible trading experience while also incentivizing liquidity provision. This protocol marks a significant step forward in the evolution of decentralized finance.

Advantages of 1inch Protocol

The 1inch aggregation protocol provides several key advantages that make it a standout in the DeFi landscape. Here are some of the main benefits:

1. Improved Liquidity

One of the main advantages of using the 1inch protocol is the improved liquidity it offers. By aggregating liquidity from various decentralized exchanges (DEXs), 1inch is able to provide users with access to a larger pool of liquidity. This ensures that users can always find the best prices for their trades.

2. Smart Routing

The 1inch protocol uses advanced algorithms to determine the optimal route for each trade. By taking into account factors such as gas costs and slippage, 1inch is able to route trades through the most efficient path, resulting in cost savings for users.

3. Reduced Fees

Using the 1inch protocol can help users save on fees. By splitting trades across multiple DEXs and aggregating liquidity, 1inch is able to minimize slippage and reduce fees. Additionally, 1inch has its own native token, 1INCH, which can be used to pay for protocol fees, further reducing costs for users.

Overall, the 1inch protocol offers a more efficient and cost-effective way for users to trade cryptocurrencies on decentralized exchanges. With its focus on liquidity aggregation, smart routing, and reduced fees, 1inch is revolutionizing the DeFi landscape and providing a valuable service to the crypto community.

Question-answer:

What is 1inch?

1inch is a decentralized exchange aggregator that sources liquidity from various DEXs and provides users with the best possible trade routes. It launched in 2019 with the aim of making DeFi trading more efficient and cost-effective.

How does 1inch revolutionize the DeFi landscape?

1inch revolutionizes the DeFi landscape by using its unique aggregation protocol. It sources liquidity from multiple decentralized exchanges (DEXs) and automatically splits user trades across these platforms to provide the best possible prices. This saves users time and money by ensuring they always get the most favorable rates and reduces their reliance on a single exchange.

What are the benefits of using 1inch?

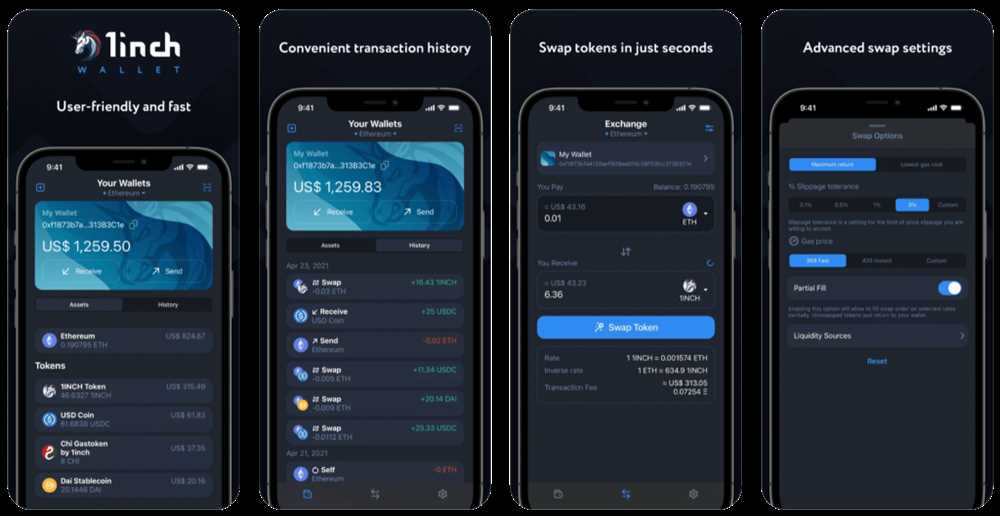

Using 1inch brings several benefits to DeFi traders. Firstly, it offers the best possible prices by aggregating liquidity from multiple DEXs. Secondly, it saves users time by automatically splitting trades across different exchanges. Additionally, 1inch provides users with a user-friendly interface and advanced features like limit orders and gas optimization. Overall, it offers a more efficient and cost-effective trading experience in the DeFi landscape.