Financial inequality has long been a pressing issue in the United States, with the gap between the rich and the poor continuing to widen. However, a new player in the fintech space, 1inch, is stepping up to address this problem head-on. With their innovative decentralized exchange platform, 1inch is revolutionizing the way people access and utilize financial services, particularly those who have been historically underserved.

1inch’s mission is simple yet powerful: to empower individuals by providing them with equal opportunities to participate in the financial system. Through their platform, users can trade, lend, and earn interest on their assets without the need for intermediaries. This not only eliminates the high fees and complex processes associated with traditional financial institutions but also bypasses the biases and exclusions that often prevent marginalized communities from accessing the same financial opportunities as their wealthier counterparts.

What sets 1inch apart is their commitment to decentralization and transparency. By utilizing blockchain technology, they have created an open and trustless system that ensures equal access and fair treatment for all users. This means that individuals no longer have to rely on centralized authorities to manage their finances; instead, they can take control of their assets and make decisions that align with their own best interests.

Moreover, 1inch is actively working towards bridging the gap between traditional financial systems and the rapidly evolving decentralized finance (DeFi) space. They are partnering with established financial institutions and regulators to ensure compliance and foster collaboration that benefits all parties involved. This approach not only helps to legitimize the DeFi industry but also paves the way for greater adoption and integration of decentralized financial services into the mainstream economy.

In conclusion, 1inch’s role in fighting financial inequality in the USA cannot be overstated. Through their decentralized exchange platform, they are providing individuals with the tools and opportunities they need to break free from the chains of traditional finance. By empowering marginalized communities and bridging the gap between centralized and decentralized systems, 1inch is driving towards a more inclusive and equitable financial future.

The Impact of 1inch in Promoting Financial Equality in the USA

In the United States, financial inequality remains a significant socio-economic issue that has far-reaching consequences for individuals and communities. The lack of equal access to financial opportunities prevents many people from escaping poverty or achieving financial stability. However, 1inch, an innovative decentralized finance (DeFi) platform, is playing a vital role in promoting financial equality in the USA.

1. Democratizing Access to Financial Services

One of the primary ways 1inch is promoting financial equality is by democratizing access to financial services. Traditional financial institutions often exclude marginalized communities or charge high fees, making it difficult for them to participate fully in the economy. 1inch, on the other hand, provides a decentralized platform that allows anyone to access a wide range of financial services, including borrowing, lending, and trading, without the need for intermediaries or excessive fees.

By eliminating the barriers imposed by traditional financial systems, 1inch is enabling individuals, regardless of their background or socioeconomic status, to actively engage in the financial ecosystem. This increased access empowers individuals to make better financial decisions, grow their wealth, and ultimately bridge the wealth gap.

2. Empowering the Unbanked and Underbanked

Another crucial aspect of 1inch’s impact on financial equality in the USA is its focus on empowering the unbanked and underbanked populations. According to the Federal Deposit Insurance Corporation (FDIC), approximately 7 million American households remain unbanked, while many more are underbanked, lacking access to essential financial services.

Through its decentralized platform, 1inch allows individuals to create and access their own financial accounts without the need for traditional banks. This empowers the unbanked and underbanked to participate in the economy, manage their finances, and build a credit history. By providing financial tools and services to these underserved populations, 1inch is helping to break the cycle of poverty and financial exclusion.

By promoting equal access, financial literacy, and economic empowerment, 1inch is making a significant impact in the fight against financial inequality in the USA.

In conclusion, 1inch’s decentralized finance platform is addressing the systemic barriers and inequalities in the traditional financial system. Through democratizing access to financial services and empowering the unbanked and underbanked, 1inch is promoting financial equality in the USA. This innovative approach has the potential to transform the lives of individuals and communities, creating a more inclusive and equitable financial landscape.

Reducing Wealth Disparities

Wealth disparities in the United States have reached staggering levels, with a significant portion of the population facing financial insecurity and limited access to opportunities. To address this pressing issue, 1inch has committed itself to reduce wealth disparities by providing innovative solutions for financial inclusion and empowerment.

Building Financial Access

1inch recognizes that access to financial services is a crucial factor in reducing wealth disparities. Many individuals, particularly those from lower-income backgrounds, lack access to traditional banking services and struggle to participate in the mainstream financial system. To bridge this gap, 1inch has developed a user-friendly platform that allows individuals to easily access and navigate a range of financial products and services. By providing an inclusive and accessible platform, 1inch aims to empower individuals to take control of their finances and improve their economic well-being.

Providing Equal Opportunities

Another key aspect of reducing wealth disparities is providing equal opportunities for wealth creation. 1inch has taken this goal to heart by offering a decentralized exchange that enables users to access a wide range of assets and liquidity pools. This allows individuals, regardless of their socioeconomic status, to participate in the growing world of decentralized finance and potentially generate wealth. By democratizing access to financial opportunities, 1inch is working towards leveling the playing field and creating a more equitable financial landscape.

In summary, 1inch is committed to reducing wealth disparities in the United States through its efforts to build financial access and provide equal opportunities. By offering an inclusive platform and enabling individuals to participate in decentralized finance, 1inch aims to empower individuals and improve economic outcomes for all.

Increasing Access to Financial Opportunities

Financial inequality is a major issue in the United States, with many individuals and communities lacking access to basic financial services and opportunities. 1inch is committed to addressing this problem by providing innovative solutions to increase access to financial opportunities for all.

1. Building a Decentralized Financial Ecosystem

1inch is actively working to build a decentralized financial ecosystem that empowers individuals and communities to participate in various financial activities. Through its platform, users can access a wide range of decentralized finance (DeFi) protocols, such as lending, borrowing, trading, and more. This allows individuals to take control of their finances and explore different investment options without relying on traditional financial institutions.

2. Ensuring Low Transaction Costs

1inch aims to reduce financial barriers by offering low transaction costs. Traditional financial services often come with high fees and hidden charges, making it difficult for low-income individuals to access and benefit from them. However, by leveraging its decentralized protocols and smart contract technology, 1inch is able to significantly reduce transaction costs, making financial opportunities more affordable and accessible to everyone.

| Benefits of Increased Access to Financial Opportunities through 1inch |

|---|

| 1. Economic Empowerment: By providing access to financial opportunities, 1inch helps individuals and communities to build wealth, improve their financial situations, and achieve economic empowerment. |

| 2. Financial Inclusion: 1inch’s efforts contribute to greater financial inclusion, ensuring that no individual or community is left behind in the financial system. This helps to reduce inequality and foster a more equitable society. |

| 3. Diversification of Investments: Increased access to financial opportunities allows individuals to diversify their investments, reducing their dependency on a single asset or financial instrument. This can enhance financial security and resilience. |

| 4. Financial Education: 1inch also promotes financial education and literacy, helping individuals to better understand and navigate the financial landscape. This empowers them to make informed decisions and take control of their financial futures. |

By increasing access to financial opportunities, 1inch is playing a critical role in fighting financial inequality in the USA. Through its decentralized financial ecosystem and focus on low transaction costs, 1inch is breaking down barriers and empowering individuals and communities to participate in the financial system and create a more inclusive and equitable society.

Empowering Unbanked Communities

The issue of financial inequality in the USA is not only limited to those who are underbanked or have limited access to financial services. There is also a significant population of unbanked individuals who do not have any access to traditional banking services. These individuals often rely on alternative financial services that come with high fees and limited financial security.

1inch is playing a crucial role in empowering unbanked communities by providing them with access to decentralized finance (DeFi) platforms. Through its user-friendly interface and seamless integration with various DeFi protocols, 1inch allows unbanked individuals to participate in DeFi activities without the need for traditional banking services.

By using 1inch, unbanked individuals can easily convert their crypto assets into stablecoins or other cryptocurrencies, providing them with the flexibility to transact and store value without the need for a traditional bank account. This empowers them to have control over their finances and participate in the global financial system, irrespective of their banking status.

Additionally, 1inch’s decentralized nature provides unbanked individuals with increased financial security. Unlike traditional banking systems, which are vulnerable to hacking and centralized control, 1inch operates on a decentralized network, making it more resistant to potential threats and ensuring the safety of users’ funds.

Furthermore, 1inch’s low transaction fees make it an affordable option for unbanked individuals who often face high fees when using alternative financial services. By reducing these fees, 1inch helps unbanked individuals keep more of their hard-earned money and break free from the cycle of financial inequality.

In conclusion, 1inch is playing a pivotal role in empowering unbanked communities by providing them with access to decentralized finance, increasing their financial security, and reducing their transaction costs. Through its innovative solution, 1inch is helping bridge the gap between traditional banking services and unbanked individuals, ultimately fighting financial inequality in the USA.

Pioneering Decentralized Finance

1inch has played a significant role in pioneering decentralized finance (DeFi) in the United States. DeFi is a term used to describe the use of blockchain technology and cryptocurrencies to recreate and innovate traditional financial systems. It aims to provide greater accessibility, transparency, and efficiency in financial services, ultimately empowering individuals and fostering financial inclusion.

Through its platform, 1inch has introduced numerous decentralized finance solutions that have revolutionized the way individuals can access and engage with financial products and services. By leveraging smart contracts and decentralized exchanges, 1inch enables users to trade, lend, borrow, and earn interest without relying on intermediaries such as banks or traditional financial institutions.

1inch’s decentralized finance solutions have also helped to address financial inequality in the United States. Traditional financial systems often exclude individuals who lack access to banking services, have limited income or credit history, or live in underserved communities.

By leveraging blockchain technology and cryptocurrencies, 1inch has created a more inclusive financial ecosystem that allows individuals from all walks of life to participate and benefit. 1inch’s decentralized finance solutions are accessible to anyone with an internet connection, empowering individuals who have been historically underserved by traditional financial institutions.

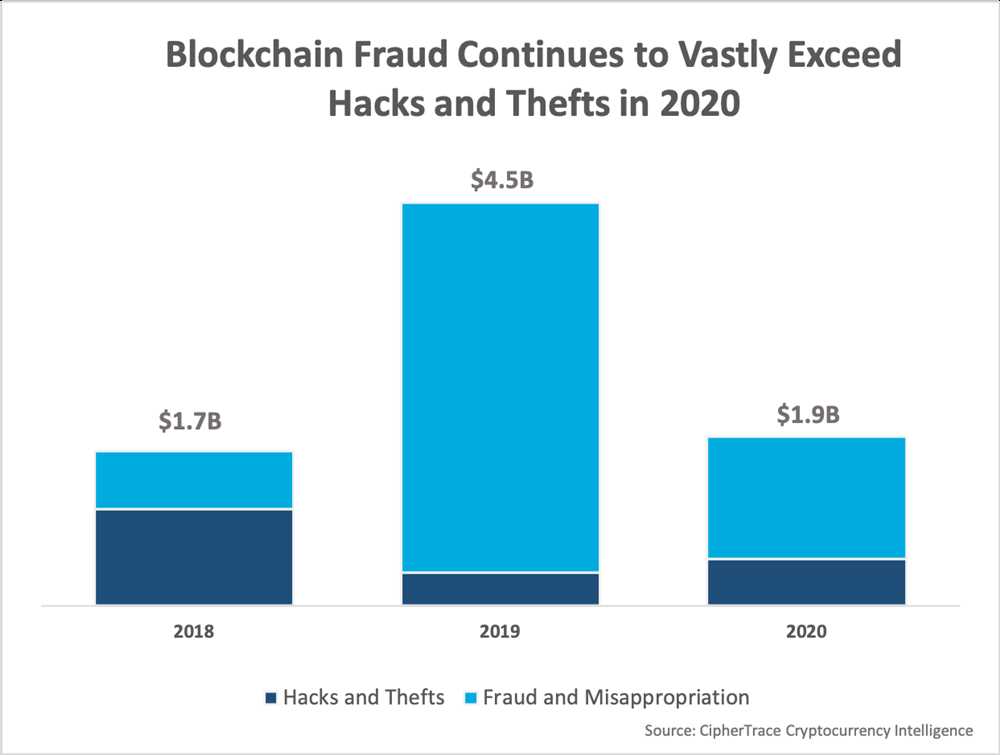

Furthermore, 1inch’s decentralized finance solutions offer greater transparency and security compared to traditional financial systems. Transactions conducted through 1inch are recorded on the blockchain, ensuring immutability and reducing the risk of fraud or manipulation. This increased transparency provides users with peace of mind and trust in the financial system.

In conclusion, 1inch has been at the forefront of pioneering decentralized finance in the United States. By leveraging blockchain technology and cryptocurrencies, 1inch has created a more accessible, transparent, and inclusive financial ecosystem. Through its innovative solutions, 1inch is helping to fight financial inequality and empower individuals to take control of their financial destinies.

Question-answer:

What is 1inch and how does it fight financial inequality?

1inch is a decentralized exchange aggregator that sources liquidity from various other exchanges to provide users the best possible trading rates. It fights financial inequality by allowing people to access and trade different digital assets easily, regardless of their location or financial status.

Can you give an example of how 1inch helps fight financial inequality?

Sure! Let’s say there are two individuals, one living in a developed country and the other in a developing country. The person from the developed country has easy access to traditional financial services, but the person from the developing country may not have access to the same level of services. With 1inch, both individuals can easily trade digital assets and have access to a global financial market, helping to bridge the gap in financial inequality.