Diversification is a key strategy for any successful investor, and it becomes even more crucial in the rapidly evolving world of decentralized finance (DeFi). With the rise of platforms like 1inch Exchange, investors now have the opportunity to diversify their assets and mitigate risk in a decentralized and secure manner.

1inch Exchange is a decentralized exchange aggregator that sources liquidity from various decentralized exchanges. This means that users can access multiple liquidity sources and trade on the best possible terms. By utilizing 1inch Exchange, investors can diversify their trades across different decentralized exchanges and take advantage of the various benefits offered by each platform.

One of the major benefits of diversification on 1inch Exchange is the ability to minimize the risk of price slippage. When trading large volumes of assets, price slippage can occur, resulting in unfavorable prices for the trader. By splitting trades across multiple decentralized exchanges through 1inch Exchange, investors can minimize the impact of price slippage and ensure that they are getting the best possible prices for their trades.

In addition, diversification on 1inch Exchange allows investors to take advantage of the unique features and offerings of different decentralized exchanges. Each decentralized exchange has its own set of liquidity providers, trading pairs, and fee structures. By diversifying trades across these platforms, investors can access a wider range of trading options and potentially find better opportunities for profit.

Overall, diversification on 1inch Exchange is essential for investors looking to navigate the DeFi space effectively. By spreading their trades across multiple decentralized exchanges, investors can mitigate risk, minimize price slippage, and take advantage of the various benefits and opportunities offered by different platforms. As the DeFi space continues to grow and evolve, diversification will remain a crucial strategy for investors seeking long-term success.

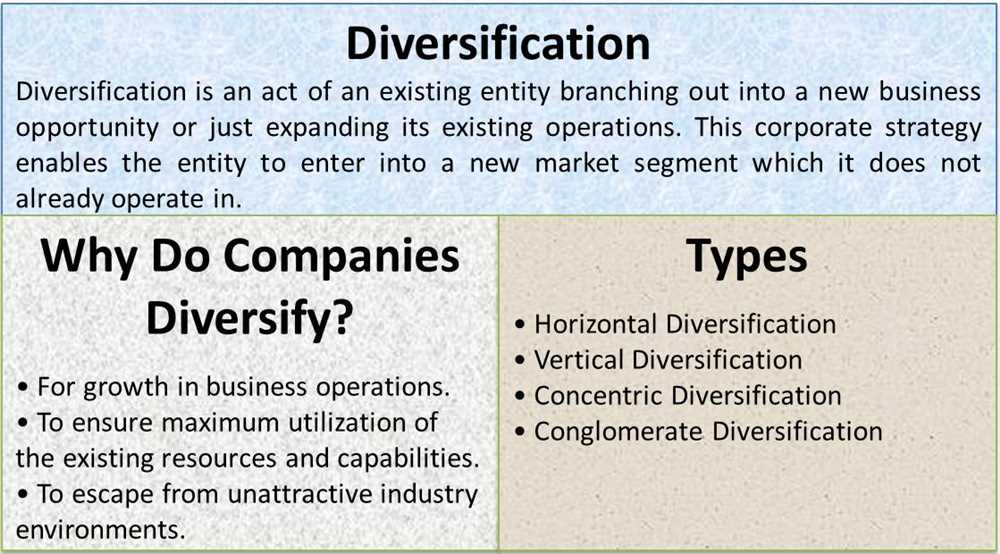

What is Diversification?

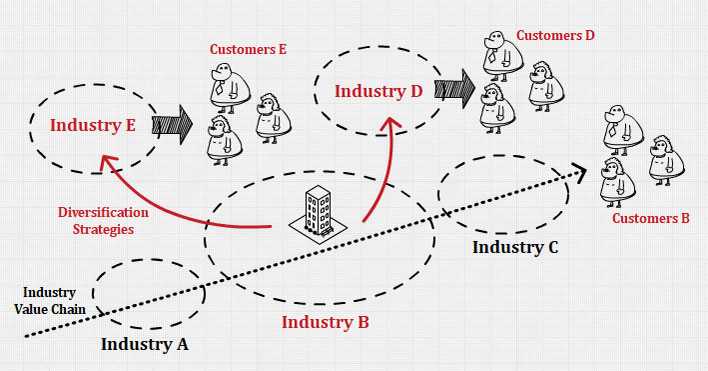

Diversification is a strategy that involves spreading your investments across different assets or securities. It is based on the idea that by diversifying, you can reduce the overall risk of your portfolio and potentially increase your chances of earning higher returns.

When you diversify your investments, you allocate your funds to a variety of assets, such as stocks, bonds, commodities, and real estate. This strategy helps to mitigate the risk associated with any single investment by not putting all your eggs in one basket. By diversifying, you reduce the impact of any individual investment’s performance on your overall portfolio.

The main goal of diversification is to create a well-balanced portfolio that can weather market fluctuations and provide more stable, long-term returns. By spreading your investments across different asset classes, sectors, and geographical regions, you can potentially benefit from the positive performance of some investments even if others are underperforming.

Benefits of Diversification

Diversification offers several potential benefits to investors:

| Risk reduction | By diversifying your investments, you are spreading the risk across different assets. So even if one investment performs poorly, it may be offset by others performing well. |

| Potential for higher returns | While diversification can reduce risk, it also opens up opportunities for higher returns. By investing in different assets with varied growth potential, you increase your chances of capturing the upside of the market. |

| Protection against market volatility | When markets are volatile, having a diversified portfolio can help soften the impact of market swings. Investments in different asset classes may respond differently to market conditions, providing a hedge against extreme volatility. |

| Long-term stability | Diversification is particularly important for long-term investors looking to build wealth over time. By spreading investments across different assets, you can potentially benefit from various market cycles and trends. |

Diversifying on 1inch Exchange

1inch Exchange provides users with a decentralized platform to perform swaps across multiple decentralized exchanges. By utilizing 1inch, traders can access a wide range of assets and liquidity pools, which allows for easy diversification.

With 1inch, users can diversify their portfolio by swapping between different tokens and assets. This way, they can take advantage of various opportunities and potentially mitigate risk while trading. By accessing a diverse array of decentralized exchanges through 1inch, users can benefit from the liquidity and trading options provided by different platforms.

Benefits of Diversification on 1inch Exchange

Diversification is a strategy that involves spreading investments across different assets to reduce risk and potentially increase returns. When it comes to trading on the 1inch Exchange, diversification can offer several key benefits:

1. Risk Reduction

By diversifying your investments on 1inch Exchange, you can reduce the risk of potential losses. If you invest all your funds in a single asset, you are putting all your eggs in one basket. However, by diversifying across multiple assets, you can spread out the risk and protect yourself against any negative price movements.

2. Enhanced Returns

Another benefit of diversification on 1inch Exchange is the potential for enhanced returns. By investing in a variety of assets, you increase the chances of capitalizing on profitable opportunities. Different assets may perform differently under different market conditions, so by diversifying, you can potentially benefit from the success of multiple assets.

3. Exposure to a Wider Range of Assets

1inch Exchange offers a wide range of tokens and cryptocurrencies that you can trade. By diversifying, you can gain exposure to a variety of assets and tap into the potential growth of different sectors or industries. This can help you stay ahead of market trends and maximize your investment opportunities.

4. Hedging Against Volatility

The cryptocurrency market is known for its high volatility, with prices often experiencing significant fluctuations. By diversifying on 1inch Exchange, you can hedge against this volatility. While some assets may experience sharp price drops, others may see gains during the same period. By diversifying, you can potentially offset losses with gains from other assets, reducing the impact of market volatility.

Overall, diversification on 1inch Exchange can provide various benefits, including risk reduction, enhanced returns, exposure to a wider range of assets, and hedging against volatility. By spreading your investments across different assets, you can potentially optimize your trading strategy and increase the likelihood of achieving your financial goals.

How to Diversify your Portfolio on 1inch Exchange?

Diversification is key when it comes to managing your portfolio on 1inch Exchange. By spreading your investments across multiple assets, you can reduce risk and increase the potential for returns. Here are some steps to help you diversify your portfolio:

1. Research different assets: Start by researching and understanding different tokens and their performance in the market. Look for projects with solid fundamentals and promising growth potential.

2. Choose a variety of assets: Once you have done your research, select a variety of assets from different sectors or industries. This could include cryptocurrencies, stablecoins, or even tokens from emerging sectors like decentralized finance (DeFi) or non-fungible tokens (NFTs).

3. Consider different risk levels: Assess the risk associated with each asset and balance your portfolio accordingly. Higher risk assets may have the potential for higher returns, but also come with increased volatility. On the other hand, lower risk assets may offer more stability but lower returns.

4. Set allocation limits: Determine the percentage of your portfolio that you want to allocate to each asset. This will depend on your risk tolerance and investment goals. It is important to maintain a balanced allocation to ensure diversification.

5. Regularly review and rebalance: The market is constantly changing, so it is important to regularly review your portfolio and make adjustments as needed. Rebalancing involves buying or selling assets to maintain your desired allocation.

6. Utilize 1inch Exchange features: Take advantage of the features available on 1inch Exchange to diversify your portfolio. Use the swap and liquidity protocols to easily trade and invest in different assets. Additionally, you can explore yield farming or liquidity mining opportunities to earn passive income.

7. Seek professional advice: If you are new to investing or want expert guidance, consider seeking advice from a financial professional. They can help you create a diversified portfolio and provide insights based on your individual financial situation and goals.

Remember, diversification is not a guarantee against losses, but it can help mitigate risk and improve overall portfolio performance. Always do your own research and invest within your means.

Risk Management through Diversification on 1inch Exchange

Risk management is a crucial aspect of any investment strategy, and it becomes even more important when dealing with decentralized exchanges like 1inch. While the decentralized nature of these platforms offers many benefits, such as lower fees and increased privacy, it also presents unique risks that traders must consider.

One of the most effective ways to mitigate these risks is through diversification. Diversification involves spreading your investments across a range of different assets or tokens, rather than focusing on just one. By diversifying your portfolio, you can reduce the impact of negative market events on your overall investment.

On 1inch Exchange, diversification can be achieved in several ways. Firstly, you can choose to trade a variety of tokens on the platform, rather than concentrating solely on one. This spreads your risk across multiple assets and reduces your exposure to any one token’s price movements.

Additionally, 1inch Exchange offers the option to utilize liquidity protocols such as Uniswap, SushiSwap, and Curve Finance. These protocols enable the swapping of tokens from different liquidity providers, further enhancing diversification. By spreading your trades across multiple liquidity sources, you reduce the risk of encountering low liquidity or price slippage.

Furthermore, 1inch Exchange provides access to a wide range of decentralized finance (DeFi) products, including lending and borrowing platforms. By diversifying your investments across different DeFi protocols, you can hedge against the risk of any one platform failing or suffering a security breach.

In conclusion, risk management through diversification on 1inch Exchange is essential for any trader looking to protect their investments. By spreading your investments across various tokens, liquidity sources, and DeFi protocols, you can minimize the impact of adverse market events and increase the overall stability of your portfolio.

Question-answer:

Why is diversification important on 1inch Exchange?

Diversification is important on 1inch Exchange because it helps reduce the risk associated with holding a single asset. By diversifying your holdings across different assets, you can mitigate the potential losses from a single asset’s price fluctuations and increase the chance of earning profits from other assets.

How does diversification on 1inch Exchange help reduce risk?

Diversification on 1inch Exchange helps reduce risk by spreading your investments across different assets. If one asset loses value, the potential losses can be offset by the gains from other assets. This reduces the overall volatility of your portfolio and helps protect your investment capital from significant losses.

What are the benefits of diversifying on 1inch Exchange?

Diversifying on 1inch Exchange offers several benefits. Firstly, it helps reduce the risk associated with holding a single asset, as losses from one asset can be offset by gains from others. Secondly, diversification can increase the potential for earning profits, as you are exposed to different assets with varying growth potential. Finally, diversification can also provide liquidity and improve your ability to participate in different markets.