The rise of decentralized finance (DeFi) has revolutionized the way we think about traditional financial systems. With the advent of blockchain technology, individuals can now engage in financial activities without the need for intermediaries. One of the key pillars of DeFi is liquidity, which refers to the ability to convert assets into cash quickly and without significant price impact.

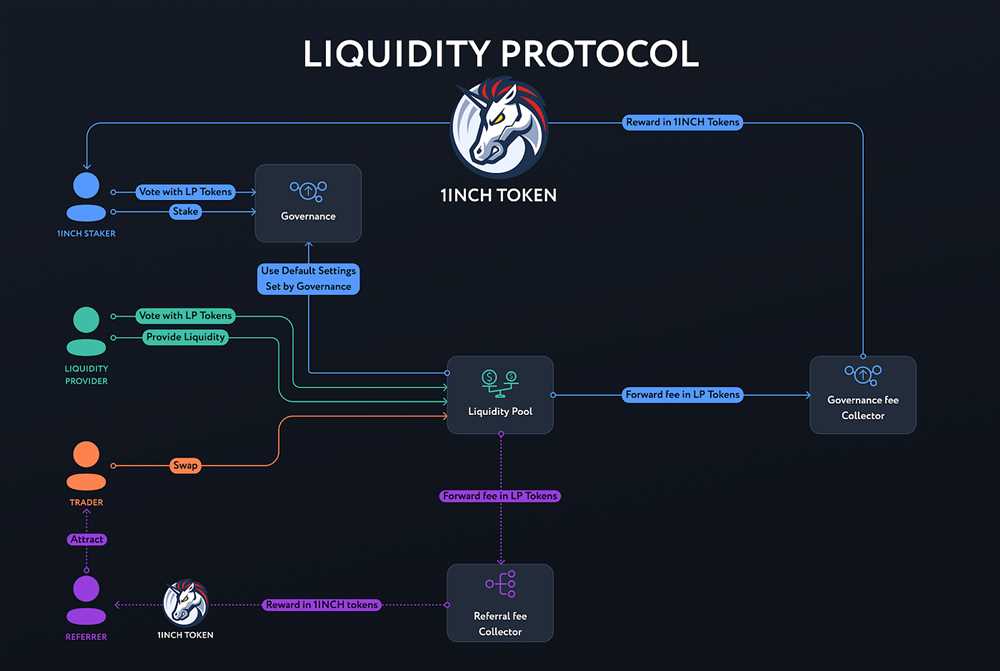

In this case study, we will explore the impact of 1inch on DeFi liquidity. 1inch is a decentralized exchange aggregator that sources liquidity from various decentralized exchanges such as Uniswap, SushiSwap, and Balancer. By aggregating liquidity from multiple sources, 1inch is able to provide users with the best possible trading prices and minimize price slippage.

The introduction of 1inch has had a profound effect on DeFi liquidity. Prior to its launch, users would have to manually navigate between different decentralized exchanges to find the best trading prices. This not only proved to be time-consuming but also resulted in significant price slippage. With 1inch, users can now access the aggregated liquidity from multiple exchanges in a single platform, eliminating the need for manual price discovery.

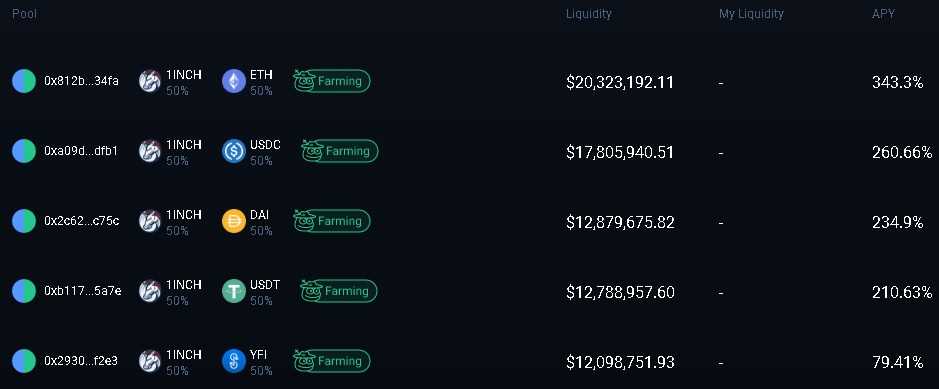

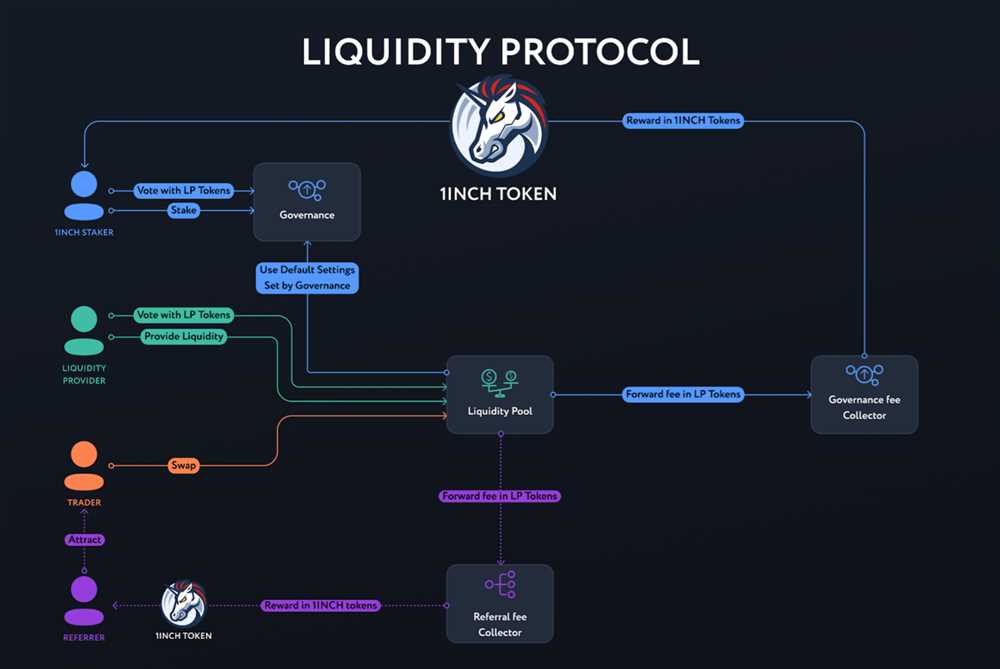

Furthermore, 1inch has also introduced the concept of “liquidity mining,” where users can earn rewards for providing liquidity to the platform. This incentivizes users to deposit their assets into the liquidity pool, increasing the overall liquidity available on the platform. As a result, 1inch has become one of the leading platforms in terms of DeFi liquidity.

In conclusion, the introduction of 1inch has greatly enhanced DeFi liquidity by providing users with a seamless trading experience and incentivizing liquidity provision. Its innovative approach to aggregating liquidity from multiple decentralized exchanges has made it a key player in the DeFi ecosystem. As the DeFi space continues to evolve, it will be interesting to see how 1inch further shapes the future of liquidity in decentralized finance.

The Role of 1inch in DeFi Liquidity

1inch is a leading decentralized exchange aggregator in the decentralized finance (DeFi) ecosystem. With its innovative and advanced technology, 1inch plays a crucial role in enhancing liquidity in the DeFi space.

Aggregating Liquidity

1inch operates by aggregating liquidity from various decentralized exchanges (DEXs) such as Uniswap, SushiSwap, and many others. By doing so, 1inch provides users with access to a wide range of trading options and ensures the best prices for their trades.

By pooling liquidity from different DEXs, 1inch significantly improves the efficiency of trades in the DeFi market. Traders no longer need to manually search for the best prices across multiple exchanges, as 1inch automatically routes their trades to the most favorable exchanges at any given moment.

Optimizing Trades with Advanced Technology

1inch utilizes sophisticated algorithms and smart contract technology to optimize trades and minimize slippage. The platform intelligently splits orders across multiple DEXs and liquidity pools to ensure the best execution for users.

Through its Pathfinder algorithm, 1inch finds the most cost-effective trading routes, taking into account factors such as liquidity depth, gas fees, and trader preferences. This approach allows traders to achieve better prices and reduce the negative impact of slippage on their trades.

Maximizing Returns with Yield Aggregation

In addition to its role in improving liquidity for trading, 1inch also offers yield aggregation services. Users can deposit their assets into 1inch’s yield farming protocols, which automatically allocate the funds to the most profitable opportunities in the DeFi market.

By actively managing and reallocating users’ funds, 1inch maximizes their returns on investment and saves them the time and effort required to research and participate in various yield farming strategies. This feature further contributes to enhancing liquidity in the DeFi ecosystem.

Conclusion

The role of 1inch in DeFi liquidity cannot be understated. By aggregating liquidity, optimizing trades, and offering yield aggregation services, 1inch plays a vital role in increasing liquidity, efficiency, and profitability for users in the DeFi market.

The Effects of 1inch on the DeFi Ecosystem

The emergence of 1inch has had a profound impact on the decentralized finance (DeFi) ecosystem. This cutting-edge platform has revolutionized the way liquidity is accessed and provided in the DeFi space, leading to a number of transformative effects.

Increase in Liquidity

One of the most significant effects of 1inch on the DeFi ecosystem is the substantial increase in liquidity. By aggregating various decentralized exchanges (DEXs) into a single interface, 1inch has made it easier for users to find the best available liquidity across multiple platforms. This has resulted in a higher level of liquidity in the DeFi market, enabling users to execute trades with minimal slippage and obtain better prices.

Improvement in Price Efficiency

Another notable effect of 1inch is the improvement in price efficiency within the DeFi ecosystem. Through its smart routing algorithms, 1inch is able to analyze and identify the most optimal trading paths across different DEXs, taking into account various factors such as fees and liquidity depth. This has led to a reduction in price disparities between exchanges and improved price stability, ultimately benefiting DeFi users by offering better trading opportunities.

| Effects | Description |

|---|---|

| Enhanced User Experience | 1inch’s user-friendly interface and intuitive design have significantly enhanced the overall user experience in DeFi. With its seamless integration with multiple DEXs, users are able to access a wide range of liquidity and execute trades more efficiently. |

| Increased Adoption | The introduction of 1inch has attracted a large number of users to the DeFi ecosystem, resulting in increased adoption of decentralized exchanges and other DeFi protocols. The platform’s ability to provide better liquidity and improved trading opportunities has made it an attractive option for both retail and institutional investors. |

| Competition and Innovation | The emergence of 1inch has fuelled competition among DeFi platforms, leading to increased innovation in the space. Other DEXs have begun to improve their offerings and develop new features in order to stay competitive, ultimately benefiting the overall DeFi ecosystem. |

In conclusion, the effects of 1inch on the DeFi ecosystem have been significant and far-reaching. From increasing liquidity and improving price efficiency to enhancing user experience and driving adoption, 1inch has played a pivotal role in shaping the future of decentralized finance.

Question-answer:

What is 1inch and how does it affect DeFi liquidity?

1inch is a decentralized exchange aggregator that sources liquidity from various DEX platforms. It combines different liquidity pools to find the best possible prices for users. This helps to increase the overall liquidity in the DeFi ecosystem by providing users with access to better trading opportunities.

How does 1inch achieve better prices for its users?

1inch uses a smart routing algorithm that splits orders across multiple liquidity sources, such as DEX platforms and liquidity pools. By doing so, it finds the most efficient routes for trading and ensures users get the best prices available in the market.

Can you explain how 1inch impacts the liquidity of the DeFi ecosystem?

1inch has a significant impact on the liquidity of the DeFi ecosystem. By aggregating liquidity from different sources, it creates a larger pool of available funds for users to trade with. This increased liquidity ensures that there is always enough supply and demand to facilitate smooth trading activities in the DeFi space.

What are the main benefits of using 1inch for DeFi liquidity?

There are several benefits to using 1inch for DeFi liquidity. Firstly, it offers better prices by sourcing liquidity from multiple platforms. Secondly, it provides users with access to a wide range of tokens and trading pairs. Lastly, 1inch ensures that trades are executed quickly and efficiently, thanks to its smart routing algorithm.