Discover the power of institutional investors in driving the exponential growth of the 1inch Token. With their vast financial resources and strategic investments, institutional investors play a crucial role in shaping the future of the 1inch ecosystem.

Unmatched Expertise: Institutional investors bring a wealth of knowledge and experience to the table. Their seasoned investment professionals thoroughly analyze market trends, assess risk profiles, and identify lucrative opportunities for the 1inch Token. Their guidance helps navigate the volatile cryptocurrency landscape with confidence and accuracy.

Increased Liquidity: Institutional investors inject substantial liquidity into the 1inch Token market, elevating its trading volumes and fostering a more robust and efficient ecosystem. Enhanced liquidity attracts more investors and traders, creating a virtuous cycle of growth and prosperity.

Market Credibility: When institutional investors back the 1inch Token, it lends significant credibility to the project. Their endorsement establishes trust among the wider investor community, leading to increased confidence and adoption. This trust fosters a strong foundation for the sustainable growth of the 1inch Token.

Join the revolution and seize the opportunities created by institutional investors. Invest in the future of the 1inch Token today!

The Role of Institutional Investors

Institutional investors play a pivotal role in the growth and development of the 1inch token. These investors, such as pension funds, insurance companies, and mutual funds, have significant financial resources and expertise in managing large portfolios. Their participation in the 1inch token ecosystem brings stability, credibility, and liquidity to the market.

One of the primary roles of institutional investors is to provide capital for the 1inch token project. Their investments enable the team behind the project to fund research and development, marketing efforts, and infrastructure expansion. By injecting substantial funds into the project, institutional investors help accelerate the growth and adoption of the 1inch token.

Furthermore, institutional investors bring a wealth of knowledge and experience to the table. They conduct extensive due diligence and risk assessments before making investment decisions. Their rigorous evaluation process helps identify the potential risks and opportunities associated with the 1inch token. This thorough analysis makes the token more attractive to other investors and provides reassurance to the market.

Institutional investors also provide market liquidity. Their large-scale transactions and trading activities increase the trading volume and overall liquidity of the 1inch token. This liquidity is essential for the token’s stability and ensures that investors can easily buy or sell their holdings at any time. Additionally, institutional investors often serve as market makers, contributing to price discovery and reducing volatility.

Moreover, the involvement of institutional investors instills trust and confidence in the 1inch token ecosystem. Their reputation and credibility act as a seal of approval, attracting a broader range of investors and users to the platform. This increased trust leads to enhanced market participation and ultimately drives the growth of the 1inch token.

In conclusion, institutional investors bring invaluable resources, expertise, and stability to the growth of the 1inch token. Their capital, knowledge, and market participation contribute to the development of a robust and thriving ecosystem. As the role of institutional investors continues to evolve, their impact on the 1inch token market will be instrumental in shaping its future success.

Growth of the 1inch Token

The 1inch token has experienced significant growth since its inception, becoming one of the leading cryptocurrencies in the market. This growth can be attributed to several key factors.

Firstly, the 1inch token has gained popularity due to its unique value proposition. As a utility token, it serves as the native currency of the 1inch platform, allowing users to access various features and services. This creates a strong demand for the token, driving up its value.

Additionally, the 1inch token has benefited from the increasing adoption of decentralized finance (DeFi) platforms. As more users and investors flock to DeFi protocols, the demand for 1inch tokens increases, further boosting its growth.

Furthermore, the role of institutional investors cannot be overlooked in the growth of the 1inch token. Institutional investors bring credibility and stability to the market, attracting more users and investors. Their involvement also contributes to the liquidity and trading volume of the token, creating a healthy market ecosystem.

Moreover, the team behind the 1inch token has been actively working to improve the platform and expand its reach. They have formed partnerships with key players in the crypto space, enhancing the visibility and accessibility of the token. These efforts have resulted in increased interest from both retail and institutional investors.

In conclusion, the growth of the 1inch token can be attributed to its unique value proposition, the increasing adoption of DeFi platforms, the involvement of institutional investors, and the proactive approach of its team. With these factors in play, the future looks promising for the 1inch token.

Increasing Demand

Institutional investors play a crucial role in the growth and development of the 1inch token by driving increasing demand for it in the market. The entry of institutional investors brings a new level of credibility and legitimacy to the 1inch token, attracting more retail investors and users.

One of the main reasons behind the increasing demand from institutional investors is the recognition of the potential of the 1inch token. Institutional investors are known for their extensive research and analysis capabilities, and they have identified the unique features and advantages that the 1inch token offers.

Furthermore, institutional investors are attracted to the transparency and security provided by the 1inch token. With a decentralized infrastructure and rigorous security measures, the 1inch token offers a level playing field for all participants, ensuring a fair and secure investment environment.

Another factor driving the increasing demand is the growing adoption of decentralized finance (DeFi). As institutional investors recognize the potential of DeFi and its ability to disrupt traditional financial systems, they are actively seeking investment opportunities in this space. The 1inch token, with its cutting-edge technology and strong community support, is well-positioned to benefit from this growing trend.

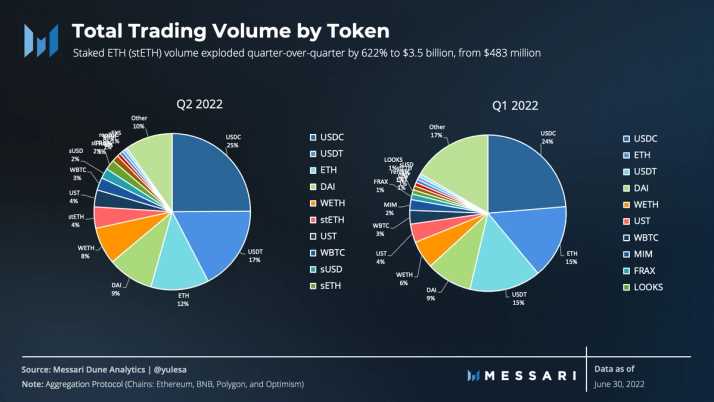

Moreover, the increasing demand for the 1inch token can also be attributed to its liquidity and trading volume. Institutional investors are drawn to assets that offer high liquidity and trading activity, as it ensures easy entry and exit from positions. The 1inch token has witnessed a significant increase in trading volume, making it an attractive investment option for institutional investors.

In conclusion, institutional investors are driving the increasing demand for the 1inch token by recognizing its potential, valuing its transparency and security, and seeking investment opportunities in the growing DeFi space. As institutional interest continues to grow, the 1inch token is poised for further growth and market expansion.

Institutional Investors

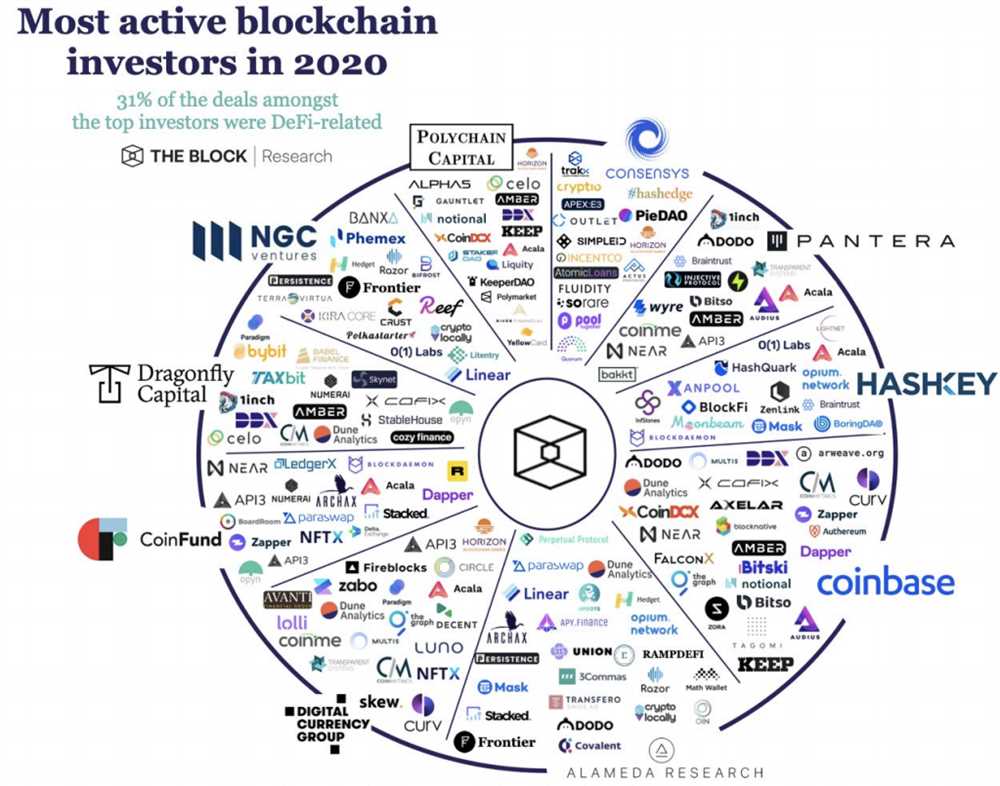

Institutional investors play a crucial role in the growth and development of the 1inch Token. These investors, such as hedge funds, pension funds, and asset management companies, have the ability to make significant investments and influence the market. Their involvement in the 1inch Token provides both financial support and credibility to the project.

With their expertise and resources, institutional investors bring a level of professionalism and stability to the market. They conduct extensive research and due diligence before making investment decisions, which helps to validate the potential of the 1inch Token. Their involvement also attracts other investors, as it signals confidence in the project’s future growth.

Financial Support

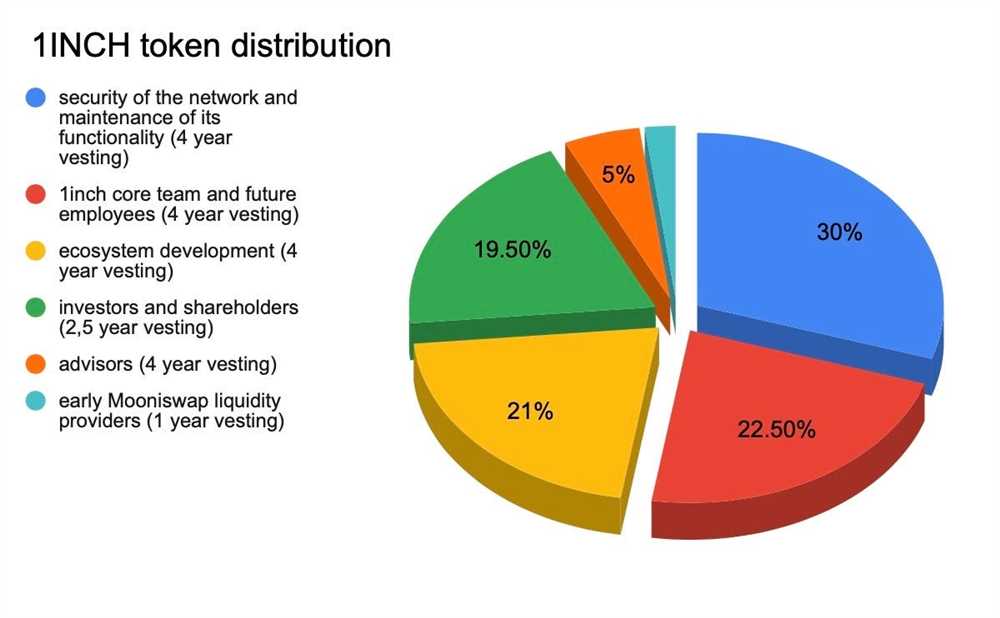

Institutional investors have the financial capacity to make large investments in the 1inch Token. This infusion of capital contributes to the liquidity and overall value of the token. Additionally, their investments can fund the development of the underlying technology, allowing for further innovation and expansion.

Moreover, institutional investors often provide guidance and strategic advice to the project team. Their experience and knowledge can help the 1inch Token navigate challenges and seize opportunities, ultimately driving its growth.

Credibility and Trust

The involvement of institutional investors also enhances the credibility and trustworthiness of the 1inch Token. These investors undergo rigorous vetting processes and adhere to stringent regulations. By investing in the 1inch Token, they signify their confidence in its potential and legitimacy.

Furthermore, institutional investors have established relationships with reputable partners and service providers. These connections can open doors for the 1inch Token to collaborate with other industry leaders, participate in strategic partnerships, and access new markets.

In conclusion, institutional investors play a vital role in the growth of the 1inch Token. Their financial support, expertise, and credibility contribute to the success of the project, attracting more investors and driving its overall development. The involvement of institutional investors further solidifies the position of the 1inch Token in the market, making it a promising investment opportunity.

Market Expansion

The 1inch Token is making its mark in the cryptocurrency market by expanding its presence and reaching new horizons.

With the increasing adoption of decentralized finance (DeFi), the demand for efficient and secure decentralized exchange platforms has been on the rise. As a result, the 1inch Token has emerged as a leading player in the market, providing users with seamless access to multiple decentralized exchanges.

The market expansion of the 1inch Token is driven by several key factors:

- Growing User Base: The 1inch Token has witnessed a steady growth in its user base as more and more crypto enthusiasts recognize the advantages of decentralized exchanges. The platform’s user-friendly interface and efficient trading experience have attracted a wide range of users, from retail traders to institutional investors.

- Diverse Market Offering: The 1inch Token offers a wide range of tokens and liquidity sources, enabling users to access a diverse market with competitive prices. By aggregating liquidity from various decentralized exchanges, the platform ensures users can find the best rates and execute trades with minimal slippage.

- Strategic Partnerships: The 1inch Token has formed strategic partnerships with prominent projects in the crypto space, expanding its network and enhancing its market presence. These partnerships enable the platform to tap into new markets and leverage the expertise of industry leaders, further fueling its market expansion.

- Institutional Adoption: Institutional investors and funds have recognized the potential of the 1inch Token and are actively investing in its growth. Their participation brings credibility and stability to the market, attracting more users and driving further adoption of the token.

As the market expansion of the 1inch Token continues, it solidifies its position as a key player in the decentralized finance landscape. With its user-centric approach, innovative technology, and strategic partnerships, the 1inch Token is poised for even greater growth and adoption in the future.

Token Value

The value of the 1inch token is an important factor for both institutional investors and individual holders. The token, which is built on the Ethereum blockchain, has several key features that contribute to its value.

Utility

One of the primary drivers of the 1inch token’s value is its utility within the 1inch Network ecosystem. The token serves as a governance token, giving holders the ability to participate in important decision-making processes within the platform. This gives token holders a sense of control and ownership, which can increase the perceived value of the token.

In addition to governance rights, the 1inch token also has utility within the 1inch Network for transaction fee discounts. When users pay transaction fees using 1inch tokens, they can receive discounts on these fees, providing a tangible benefit for holding and using the token. This utility can further drive demand and increase the value of the token.

Scarcity and Demand

The limited supply of the 1inch token is another factor that contributes to its value. The total supply of 1inch tokens is capped at 1.5 billion, which adds a scarcity factor to the token. As with other cryptocurrencies, this limited supply can create a sense of scarcity and exclusivity among investors, driving up demand and consequently increasing the value of the token.

The growing demand for decentralized finance (DeFi) platforms and the increasing popularity of the 1inch Network also contribute to the value of the 1inch token. As more users join the 1inch Network and utilize its services, the demand for the token to participate in governance and receive transaction fee discounts will likely increase. This increasing demand can drive up the value of the token in the market.

Overall, the value of the 1inch token is influenced by its utility within the 1inch Network ecosystem, its limited supply, and the growing demand for decentralized finance platforms. These factors contribute to the perceived value of the token, making it an attractive investment for both institutional investors and individual holders.

Question-answer:

What is the role of institutional investors in the growth of the 1inch token?

Institutional investors play a crucial role in the growth of the 1inch token. They bring both capital and expertise to the market, which helps to increase liquidity and attract more investors. Additionally, institutional investors often have a long-term investment horizon, which can contribute to the stability and sustainability of the token’s price.

How do institutional investors contribute to increasing liquidity for the 1inch token?

Institutional investors contribute to increasing liquidity for the 1inch token by providing a significant amount of capital. With their larger investment sizes, they are able to make significant transactions that help to fill buy and sell orders on the market, thereby increasing the availability of the token for other investors. This increased liquidity can lead to a more stable and efficient market for the 1inch token.

Why are institutional investors attracted to the 1inch token?

Institutional investors are attracted to the 1inch token for several reasons. Firstly, the 1inch platform offers unique features and functionality that can provide value to investors, such as its ability to aggregate liquidity from different decentralized exchanges. Secondly, the growth potential of the DeFi industry as a whole is highly attractive to many institutional investors, and the 1inch token is seen as a key player in this space. Lastly, institutional investors are often drawn to tokens that have a strong community and development team, both of which are present in the case of the 1inch token.

How does the involvement of institutional investors contribute to the stability of the 1inch token’s price?

The involvement of institutional investors contributes to the stability of the 1inch token’s price in a few ways. Firstly, institutional investors typically have a longer investment horizon compared to individual retail investors, meaning they are less likely to engage in short-term speculation and panic selling. This can help to dampen volatility and create a more stable price trajectory. Additionally, the larger capital base provided by institutional investors can help to absorb sudden price movements, preventing drastic price swings that can destabilize the token.

What are some potential risks associated with relying heavily on institutional investors for the growth of the 1inch token?

Relying heavily on institutional investors for the growth of the 1inch token can come with certain risks. One potential risk is the concentration of ownership, as a significant portion of the token’s supply may be held by a small number of institutional investors. This concentration can make the token more susceptible to price manipulation or market manipulation. Furthermore, if the sentiment or investment strategy of these institutional investors were to change, it could have a significant impact on the token’s price. Therefore, it is important for the 1inch token to maintain a diverse and robust investor base to mitigate these risks.