1inch, a leading decentralized exchange (DEX) aggregator, has announced its expansion into Mainland China. This move marks a significant milestone for the company as it taps into one of the largest and fastest-growing cryptocurrency markets in the world. With its innovative approach to liquidity aggregation and competitive pricing, 1inch aims to revolutionize the way Chinese investors access and trade cryptocurrencies.

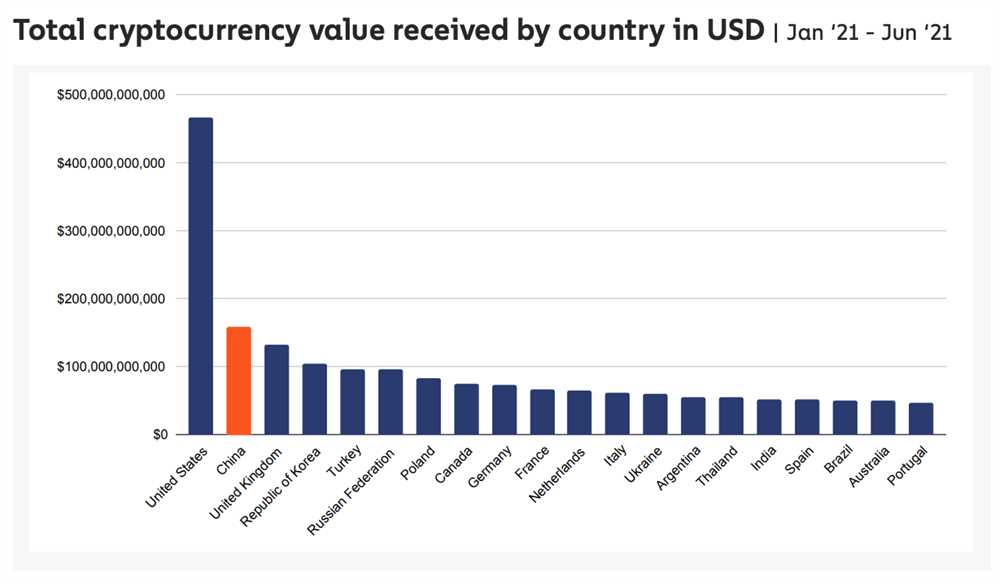

China has been a hotbed for cryptocurrency activity, but government regulations and restrictions have made it challenging for individuals to participate in the market. With 1inch’s entry into Mainland China, the barriers to entry for Chinese investors are set to diminish significantly. This move holds immense implications for the crypto market, as it opens up a vast pool of liquidity and potential trading volumes.

By leveraging its advanced algorithmic trading technology and vast network of liquidity providers, 1inch aims to provide Chinese investors with seamless access to a wide range of digital assets. This will empower individuals to diversify their investment portfolios and take advantage of the ever-evolving crypto market. Furthermore, 1inch’s expansion into Mainland China is expected to create a ripple effect, driving innovation and competition among local exchanges.

1inch’s expansion into Mainland China not only highlights the growing interest in decentralized finance (DeFi) but also reinforces the company’s commitment to democratizing access to cryptocurrencies and financial services worldwide. As the global crypto market continues to flourish, partnerships and expansions like these will play a crucial role in shaping the future of finance.

Market Potential for 1inch in Mainland China

Mainland China, with its massive population and rapidly growing economy, presents a huge market potential for 1inch. As one of the leading decentralized exchanges (DEX) in the cryptocurrency industry, 1inch has the opportunity to tap into this vast market and offer its services to millions of Chinese users.

The Chinese government has shown a relatively positive stance towards blockchain technology and cryptocurrencies in recent years. It has recognized the potential of these innovative financial instruments and has been actively exploring ways to regulate and harness their benefits. This growing acceptance and willingness to embrace cryptocurrencies create a conducive environment for 1inch to operate in Mainland China.

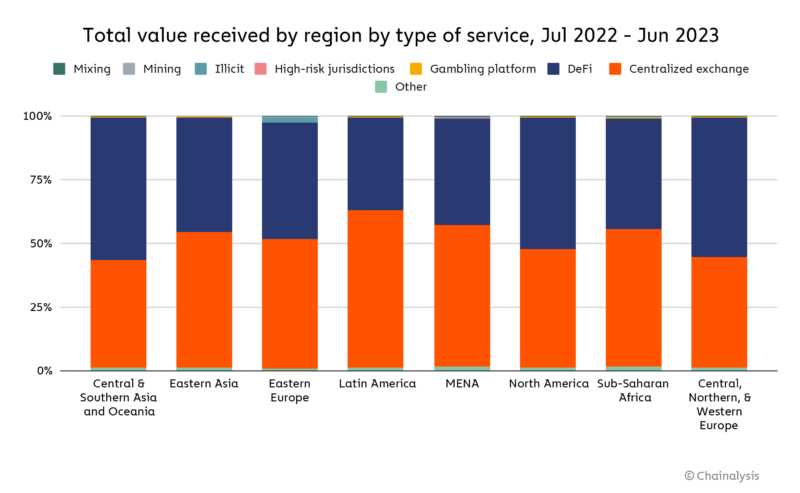

One of the key drivers of 1inch’s market potential in China is the increasing demand for decentralized finance (DeFi) solutions. DeFi has gained significant traction globally, and China is no exception. Chinese users are becoming increasingly interested in DeFi applications, seeking opportunities to earn passive income and access innovative financial products.

1inch’s advanced technology and user-friendly interface can attract and cater to this growing demand. Its efficient and cost-effective trading mechanism allows users to access a wide range of digital assets and swap between them seamlessly. This convenience is particularly appealing to Chinese users who value efficiency and convenience in their everyday transactions.

Beyond the existing demand for DeFi, Mainland China offers immense growth potential for 1inch by virtue of its large population. The country has over a billion people, many of whom are eager to explore new investment opportunities and diversify their portfolios. 1inch provides these users with a secure and transparent platform to participate in the global cryptocurrency market.

In addition to its market potential, expanding into Mainland China also brings strategic advantages for 1inch. By establishing a presence in this market, 1inch can enhance its global reach and strengthen its position as a leading DEX. It can also forge partnerships with local companies and blockchain projects, leveraging their expertise and knowledge of the Chinese market.

While entering the Chinese market poses its own challenges, such as regulatory compliance and competition from established players, the market potential outweighs the risks for 1inch. With its innovative technology, strategic partnerships, and growing demand for DeFi solutions, 1inch is well-positioned to thrive in Mainland China and revolutionize the crypto market in the region.

Increased Access to DeFi for Chinese Investors

The expansion of 1inch into mainland China has the potential to significantly increase access to decentralized finance (DeFi) for Chinese investors. DeFi, which refers to financial applications built on blockchain technology, allows users to engage in various financial activities such as borrowing, lending, and trading without the need for intermediaries like banks.

Chinese investors have shown a strong interest in cryptocurrencies and blockchain technology, but they have faced certain challenges when it comes to accessing DeFi protocols. One major challenge is the restrictive regulations imposed by the Chinese government on cryptocurrencies and digital assets. The entry of 1inch into mainland China could provide Chinese investors with a more convenient and secure way to access DeFi platforms.

By using 1inch’s platform, Chinese investors can benefit from its aggregation service, which combines multiple decentralized exchanges to provide the best possible prices for trading cryptocurrencies. This allows investors to access a wider range of liquidity and increase their chances of getting the best possible deals.

In addition, 1inch’s expansion into mainland China could also help Chinese investors mitigate some of the risks associated with DeFi. The platform is known for its sophisticated smart contract technology and security measures, which aim to protect users’ funds from potential hacks or vulnerabilities.

Furthermore, 1inch’s expansion could encourage the growth of the DeFi ecosystem in China. As more Chinese investors gain access to DeFi protocols, the demand for decentralized applications and services is likely to increase. This could lead to greater innovation and development within the Chinese DeFi space, benefiting both investors and the overall crypto market.

In summary, the expansion of 1inch into mainland China has the potential to provide Chinese investors with increased access to DeFi platforms. This could help them overcome regulatory hurdles and benefit from the convenience, security, and potential profitability of decentralized finance. Additionally, it could contribute to the growth and development of the Chinese DeFi ecosystem, making it an exciting development for the crypto market as a whole.

Competition in the Chinese Crypto Market

When it comes to the Chinese crypto market, competition is fierce. With a population of over 1.4 billion people and a growing interest in digital assets, China presents a huge opportunity for crypto companies looking to expand their presence.

One of the main competitors in the Chinese crypto market is Binance, a global cryptocurrency exchange. Binance has managed to capture a significant market share in China by offering a wide range of cryptocurrency trading pairs and a user-friendly interface. They also have a strong presence in the Chinese community, with many Chinese traders using their platform for crypto trading.

Another major player in the Chinese crypto market is Huobi, another cryptocurrency exchange. Huobi is known for its extensive selection of trading pairs and its focus on security and compliance. They have built a strong reputation in China for their reliable platform and have attracted a large user base.

In addition to these established players, there are also many smaller local exchanges in China that compete for market share. These exchanges often focus on specific regional markets and offer unique features tailored to the needs of Chinese traders.

Competition in the Chinese crypto market is not limited to exchanges. There are also a number of blockchain projects and decentralized finance (DeFi) platforms that are vying for attention in China. These projects offer innovative solutions and aim to disrupt traditional financial systems.

Overall, the Chinese crypto market is highly competitive, with a wide range of players offering diverse services. As 1inch expands into mainland China, they will likely face stiff competition from both established exchanges and emerging blockchain projects. However, their unique aggregation and liquidity protocol may give them an edge in attracting Chinese users who are looking for efficient and cost-effective ways to trade cryptocurrencies.

Impact on the Global Crypto Market

The expansion of 1inch into Mainland China can have significant implications for the global crypto market. Here are several areas where this development could have an impact:

- Liquidity: As 1inch provides access to decentralized exchanges, the platform’s expansion in Mainland China could increase liquidity in the global crypto market. This would enable more efficient and seamless trading for users around the world, leading to reduced slippage and better prices.

- Market Competition: With its expansion into Mainland China, 1inch could introduce more competition to the global crypto market. This can drive innovation and improvements in existing decentralized exchange platforms, as well as encourage new players to enter the market. Ultimately, this increased competition could benefit users by offering a wider range of options and better services.

- Global Adoption: The entry of 1inch into Mainland China could contribute to the global adoption of cryptocurrencies and decentralized finance (DeFi). By offering convenient access to decentralized exchanges and DeFi protocols, 1inch can help drive awareness and usage of these technologies on a global scale. This could lead to increased adoption of cryptocurrencies and DeFi applications beyond Mainland China, as more users learn about and explore the benefits of these decentralized systems.

- Regulatory Influence: The expansion of 1inch into Mainland China may also have implications for regulatory frameworks surrounding cryptocurrencies and DeFi. As China is known for its strict regulatory approach to these technologies, the way in which 1inch operates within the country could influence how regulators in other jurisdictions perceive and regulate decentralized exchanges and related services. This could lead to a more standardized and globally accepted regulatory environment for the crypto market.

In summary, the expansion of 1inch into Mainland China has the potential to impact the global crypto market by increasing liquidity, encouraging competition, driving global adoption, and influencing regulatory frameworks. These developments could shape the future of the crypto industry and further solidify the importance of decentralized finance in the global financial landscape.

Question-answer:

What is 1inch’s expansion into mainland China?

1inch’s expansion into mainland China refers to the cryptocurrency platform’s entry into the Chinese market. It means that 1inch will now be available for users in mainland China to trade and access decentralized finance (DeFi) services.

What are the implications of 1inch’s expansion into mainland China for the crypto market?

The expansion of 1inch into mainland China has several implications for the crypto market. Firstly, it opens up a new market of cryptocurrency users and potential investors in China, which has a large population and a growing interest in digital assets. This can potentially increase the overall trading volume and liquidity in the crypto market. Secondly, the entrance of 1inch into China could also lead to greater adoption and awareness of decentralized finance (DeFi) services in the country. This could further boost the development and innovation in the DeFi sector. Overall, it signifies the global expansion and reach of 1inch, which could have positive effects on the crypto market as a whole.

How will 1inch’s expansion into mainland China benefit users in the country?

1inch’s expansion into mainland China will benefit users in the country in several ways. Firstly, it will provide them with access to a wider range of cryptocurrency trading options and DeFi services. This can be particularly advantageous for users who are looking for alternative investment opportunities and ways to grow their wealth. Additionally, 1inch’s presence in China can also contribute to the overall development of the cryptocurrency ecosystem in the country, leading to a more vibrant and robust market. Lastly, by offering competitive rates and efficient trading services, 1inch can potentially help users in China to save on transaction costs and maximize their returns.

Are there any challenges that 1inch may face in expanding into mainland China?

While 1inch’s expansion into mainland China presents promising opportunities, there may also be some challenges that the platform could face. One of the primary challenges is navigating the regulatory landscape in China, which has imposed various restrictions on cryptocurrency activities in the past. Compliance with local regulations and ensuring the platform operates within legal boundaries will be crucial for 1inch’s success in China. Additionally, competition from existing local cryptocurrency platforms and established players in the market may also pose a challenge for 1inch. Building trust and establishing a strong user base will be key in overcoming these challenges.