Enhancing Liquidity Provision through 1inch Swap: An In-Depth Manual for Liquidity Providers

Are you a liquidity provider looking to maximize your returns? Look no further than 1inch Swap – the ultimate tool for improving liquidity provision in the decentralized finance (DeFi) space. With 1inch Swap, you can enhance your trading efficiency and boost your profitability, all while enjoying a seamless user experience.

What is 1inch Swap?

1inch Swap is a decentralized exchange aggregator that sources liquidity from various protocols, including Uniswap, Kyber Network, and Balancer. By utilizing cutting-edge technology, 1inch Swap finds the most optimal paths to swap your assets and ensures that you always get the best prices.

Why Choose 1inch Swap for Liquidity Provision?

1. Efficiency: With 1inch Swap, you can execute trades with minimal slippage and reduced costs, boosting your overall profitability as a liquidity provider.

2. Aggregated Liquidity: By tapping into multiple liquidity sources, 1inch Swap ensures that you always have access to the deepest pools, increasing your chances of securing higher returns.

3. Optimal Routing: 1inch Swap employs advanced algorithms to find the most cost-effective paths for swapping your assets, maximizing your profits and minimizing trading fees.

4. User-friendly Interface: 1inch Swap is designed with the user in mind, providing a seamless and intuitive experience for liquidity providers of all levels of expertise.

How to Get Started with 1inch Swap?

1. Connect your wallet: Simply connect your preferred Ethereum wallet to the 1inch Swap interface.

2. Select your assets: Choose the tokens you wish to provide liquidity for and specify their desired ratios.

3. Review and confirm: Double-check your settings, review the estimated returns, and confirm the transaction.

4. Earn rewards: Once your liquidity is provided, you will start earning rewards proportional to your contribution.

Don’t miss out on the opportunity to improve your liquidity provision! Join the growing community of liquidity providers who are already utilizing 1inch Swap to optimize their returns. Get started today and take your liquidity provision to the next level with 1inch Swap!

Understanding Liquidity Provision

To understand liquidity provision, it is important to grasp the concept of liquidity and its significance in financial markets. Liquidity refers to the ability of an asset to be converted into cash quickly, without causing a significant impact on its price. In the context of decentralized finance (DeFi), liquidity provision refers to the act of supplying funds to a liquidity pool, which enables users to trade and swap assets seamlessly.

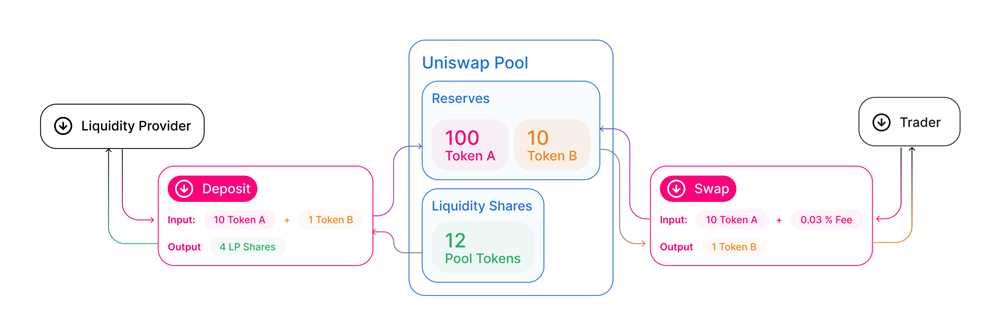

What is a Liquidity Pool?

A liquidity pool is a smart contract-based pool of funds that provides liquidity for trading and swapping assets. These pools are an essential component of decentralized exchanges, as they facilitate efficient and fast trading by ensuring that there is enough liquidity available for various trading pairs. Liquidity providers contribute to these pools by depositing their assets, which are then used to facilitate trades.

Benefits of Liquidity Provision

Liquidity provision offers several benefits to both liquidity providers and traders. For liquidity providers, it presents an opportunity to earn passive income by supplying their assets to a liquidity pool. They earn a share of the trading fees generated by the pool, proportional to their contribution. Additionally, liquidity provision can also act as a hedge against volatility, as it allows diversification across multiple assets.

For traders, liquidity provision ensures that there is sufficient liquidity available for trading various assets. This translates to better execution prices and reduced slippage, resulting in cost savings and improved trading experiences. Liquidity provision also enhances market depth, making it easier to enter and exit trades without significantly impacting the market price.

In conclusion, understanding liquidity provision is crucial for those looking to participate in decentralized finance. By contributing funds to a liquidity pool, users can benefit from passive income and improved trading experiences. Liquidity provision plays a vital role in ensuring the efficiency and effectiveness of decentralized exchanges, ultimately contributing to the growth and adoption of DeFi.

The Power of 1inch Swap

1inch Swap is a powerful tool that revolutionizes the way liquidity is provided in the DeFi space. With its advanced algorithm, 1inch Swap allows liquidity providers to access the best possible prices across multiple decentralized exchanges (DEXs).

By utilizing the power of 1inch Swap, liquidity providers can significantly enhance their trading and profit opportunities. The platform aggregates liquidity from various DEXs, including Uniswap, SushiSwap, and more, to offer the most competitive rates and minimize slippage.

Additionally, 1inch Swap employs intelligent routing algorithms to optimize the execution of trades. This ensures that liquidity providers can quickly and efficiently exchange their assets without facing high gas fees or delays.

Furthermore, 1inch Swap offers a range of advanced features and tools to enhance liquidity provision. The platform supports limit orders, allowing liquidity providers to set specific price targets and automate their trading strategies.

With 1inch Swap, liquidity providers can also take advantage of flash swaps. This innovative feature enables users to borrow assets from the liquidity pool without requiring upfront collateral. This opens up new possibilities for arbitrage and speculative trading strategies.

Moreover, 1inch Swap provides comprehensive analytics and tracking tools, giving liquidity providers insight into their performance and portfolio. This allows them to make informed decisions and optimize their liquidity provision strategies.

In conclusion, the power of 1inch Swap lies in its ability to offer liquidity providers the best possible prices, optimize trade execution, and provide advanced tools and features. By using 1inch Swap, liquidity providers can maximize their profit potential and navigate the rapidly evolving DeFi landscape with ease.

Benefits of Liquidity Provision with 1inch Swap

When it comes to liquidity provision in the decentralized finance (DeFi) space, 1inch Swap stands out as a reliable and efficient solution. Here are some key benefits of liquidity provision with 1inch Swap:

1. Access to Multiple Liquidity Sources

By providing liquidity through 1inch Swap, you gain access to a wide range of liquidity sources. This means that your funds can be utilized across multiple decentralized exchanges (DEXs), allowing for efficient and convenient trading for users.

2. Reduced Slippage and Improved Pricing

1inch Swap is designed to optimize trading routes and provide the best possible prices for users. As a liquidity provider, you benefit from this optimization as well. By providing liquidity with 1inch Swap, you can minimize slippage and ensure that your trades are executed at optimal prices.

3. Competitive Fee Sharing

1inch Swap offers a competitive fee sharing mechanism for liquidity providers. By contributing to the liquidity pool, you earn a portion of the trading fees generated on the platform. This allows you to passively earn income while providing liquidity to the decentralized ecosystem.

4. Automated Rebalancing and Risk Management

Managing liquidity can be challenging, but 1inch Swap simplifies the process with its automated rebalancing and risk management features. The platform constantly monitors liquidity sources and adjusts your allocations accordingly, ensuring that your funds are always optimized for trading.

5. Exposure to a Growing DeFi Ecosystem

By participating as a liquidity provider on 1inch Swap, you become an integral part of the expanding DeFi ecosystem. As the popularity of decentralized finance continues to rise, your exposure and potential rewards also increase.

Overall, liquidity provision with 1inch Swap offers numerous benefits, including access to multiple liquidity sources, improved pricing, competitive fee sharing, automated risk management, and exposure to a growing DeFi ecosystem. Start providing liquidity with 1inch Swap today and experience the advantages for yourself.

Maximizing Profits and Returns

As a liquidity provider on 1inch Swap, there are several strategies you can employ to maximize your profits and returns. By understanding these strategies and implementing them effectively, you can ensure that you are making the most out of your liquidity provision on the platform.

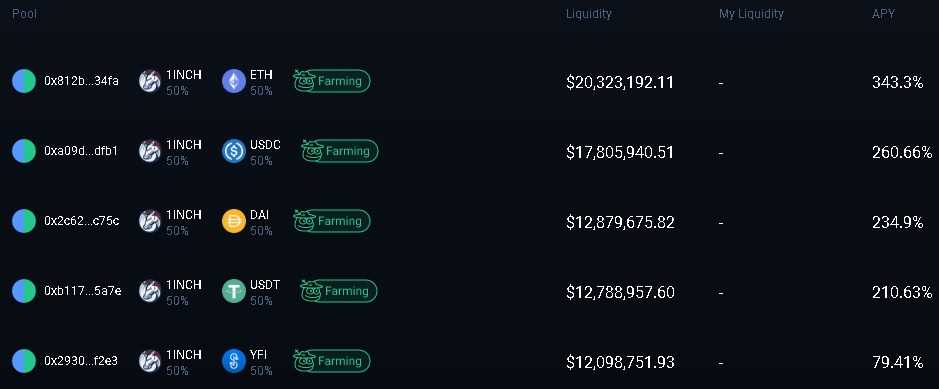

1. Diversify Your Liquidity

One of the key ways to maximize your profits is by diversifying your liquidity across multiple pools. By spreading your liquidity across different tokens and pools, you can reduce the risk associated with a single asset and increase your chances of earning higher returns.

To diversify your liquidity effectively, it is important to analyze the market trends, check the historical performance of different pools, and identify the assets that have the potential for growth. By selecting pools that have a high trading volume and demand, you can maximize your chances of generating profits.

2. Take Advantage of Impermanent Loss Mitigation

Impermanent loss is a common risk associated with providing liquidity on decentralized exchanges. However, on 1inch Swap, you can take advantage of the innovative tools and features to mitigate this loss and maximize your returns.

One such feature is the ability to stake your liquidity provider tokens (LP tokens) in farming pools. By staking your LP tokens, you can earn additional rewards in the form of governance tokens or other incentives. These rewards can help offset any potential impermanent loss and increase your overall profitability.

Pro Tip: Regularly monitor the performance of your liquidity provision and adjust your strategies accordingly. Stay updated with the latest developments and features on 1inch Swap to make the most of your liquidity.

Remember, maximizing profits and returns requires careful analysis, monitoring, and implementation of effective strategies. By diversifying your liquidity and taking advantage of impermanent loss mitigation tools, you can increase your chances of earning higher returns on your liquidity provision with 1inch Swap.

Reducing Risk and Slippage

When providing liquidity on 1inch Swap, it is important to consider strategies that can help reduce risk and slippage. By implementing these strategies, liquidity providers can optimize their profits and minimize potential losses.

1. Diversify Your Pool: One way to reduce risk is by diversifying your liquidity across different pools. By spreading your liquidity across multiple pools, you can reduce the impact of a single pool experiencing a sudden decline in liquidity.

2. Monitor Pool Health: It is crucial to regularly monitor the health of the pools you are providing liquidity to. By staying informed about the trading volume, fees, and liquidity of each pool, you can make informed decisions about when to enter or exit a pool. This can help you avoid pools that are experiencing low liquidity or high slippage.

3. Adjust Fee Settings: 1inch Swap allows liquidity providers to set their own fees for each pool. By adjusting the fee settings, you can attract more traders to your pool or incentivize them to choose pools with lower slippage. It is important to find the right balance between attracting traders and maximizing your own profitability.

4. Rebalance Your Portfolio: As market conditions change, it is important to periodically rebalance your portfolio. This involves adjusting the amount of liquidity you provide to each pool based on their performance and market demand. By regularly rebalancing, you can optimize your profits and minimize potential losses.

5. Use Advanced Features: 1inch Swap offers a range of advanced features that can help reduce risk and slippage. These include options like enabling slippage protection and using limit orders. By leveraging these features, liquidity providers can have greater control over their trades and minimize the impact of sudden price movements.

By implementing these strategies, liquidity providers can enhance their trading experience on 1inch Swap and achieve better results in terms of reducing risk and slippage. Remember to always stay informed, adapt to market conditions, and make data-driven decisions to maximize your profitability.

Getting Started with Liquidity Provision on 1inch Swap

Are you interested in improving liquidity provision for your assets? Look no further than 1inch Swap, a decentralized exchange aggregator that offers enhanced liquidity provision for a wide range of tokens. In this guide, we will walk you through the process of getting started with liquidity provision on 1inch Swap.

Step 1: Setting up Your Wallet

The first step in getting started with liquidity provision on 1inch Swap is to set up a compatible wallet. Currently, 1inch Swap supports wallets such as MetaMask, WalletConnect, and Coinbase Wallet. Ensure that you have a functioning wallet that is compatible with 1inch Swap before moving on to the next step.

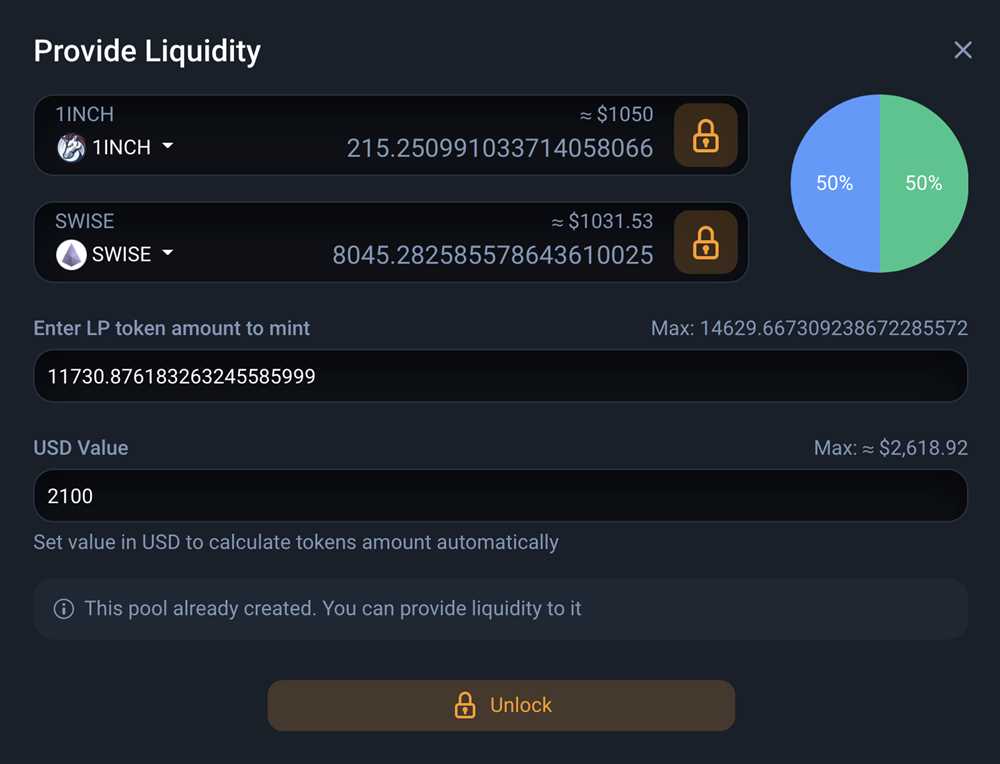

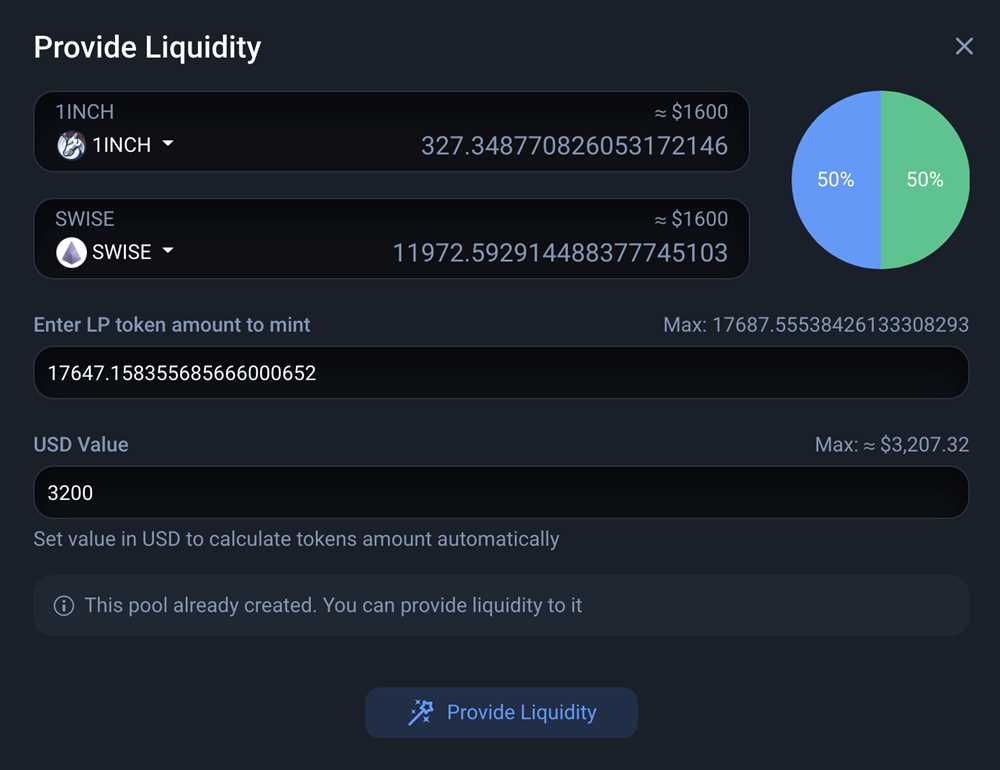

Step 2: Selecting the Tokens

Once you have set up your wallet, you need to select the tokens that you would like to provide liquidity for. 1inch Swap allows you to provide liquidity for a wide range of tokens, so choose the tokens that you believe will yield the best returns. Consider factors such as token liquidity and market demand when making your selection.

Step 3: Adding Liquidity

After selecting the tokens, it is time to add liquidity to the pool. Using 1inch Swap, you can easily add liquidity by following these steps:

| Step | Action |

|---|---|

| 1 | Navigate to the 1inch Swap website. |

| 2 | Connect your wallet to the platform. |

| 3 | Select “Add Liquidity” from the menu. |

| 4 | Choose the tokens you want to provide liquidity for. |

| 5 | Enter the amount of tokens you would like to add to the liquidity pool. |

| 6 | Click “Add Liquidity” to finalize the transaction. |

By following these steps, you will successfully add liquidity to the 1inch Swap pool and start earning fees from trades.

Step 4: Managing Your Liquidity

Once you have added liquidity to the pool, it is important to continuously manage your liquidity to optimize your returns. Monitor the performance of your liquidity and make adjustments as necessary. Additionally, keep an eye on market trends and adjust your liquidity provision strategy accordingly to maximize your earnings.

With these steps, you are now ready to get started with liquidity provision on 1inch Swap. Take advantage of the enhanced liquidity provision and start earning fees from trades. Happy providing!

Question-answer:

What is “Improving Liquidity Provision with 1inch Swap: A Guide for Liquidity Providers” about?

“Improving Liquidity Provision with 1inch Swap: A Guide for Liquidity Providers” is a guide that explains how liquidity providers can improve their liquidity provision using 1inch Swap. It provides step-by-step instructions and tips to help liquidity providers increase their profitability and efficiency.

How can liquidity providers benefit from using 1inch Swap?

Liquidity providers can benefit from using 1inch Swap in several ways. Firstly, it allows them to access multiple liquidity sources, which can result in better prices. Secondly, 1inch Swap optimizes the routing of trades, ensuring liquidity providers capture the most profitable opportunities. Additionally, 1inch Swap offers gas optimization, reducing transaction costs for liquidity providers.

Is “Improving Liquidity Provision with 1inch Swap: A Guide for Liquidity Providers” suitable for beginners?

Yes, “Improving Liquidity Provision with 1inch Swap: A Guide for Liquidity Providers” is suitable for beginners. It provides a detailed explanation of liquidity provision and outlines the step-by-step process of using 1inch Swap. It also includes helpful tips and considerations for beginners to ensure they can optimize their liquidity provision effectively.

Can experienced liquidity providers benefit from “Improving Liquidity Provision with 1inch Swap: A Guide for Liquidity Providers”?

Yes, experienced liquidity providers can also benefit from “Improving Liquidity Provision with 1inch Swap: A Guide for Liquidity Providers.” While it covers the basics, it also delves into advanced topics such as gas optimization and optimizing liquidity distribution. The guide provides insights and strategies that can help experienced liquidity providers improve their profitability and efficiency.