The Impact of 1inch Aggregator on Increasing Trading Volume and Market Liquidity for Decentralized Tokens

Discover the revolutionary impact of the 1inch Aggregator on trading volume and market liquidity for decentralized tokens. With its innovative technology and advanced algorithms, the 1inch Aggregator is transforming the way cryptocurrency enthusiasts trade.

By connecting multiple decentralized exchanges, the 1inch Aggregator significantly improves trading volume, allowing users to access the best available prices and liquidity across the market. With just one transaction, traders can seamlessly navigate various exchanges, maximizing their trading opportunities.

The 1inch Aggregator also enhances market liquidity, providing a deep pool of tokens for traders to buy and sell. By consolidating liquidity from multiple sources, it ensures optimal trading conditions, reducing slippage and improving overall market efficiency.

Powered by cutting-edge technology, the 1inch Aggregator ensures that traders get the most favorable rates and maximize their profits. Its intelligent algorithms analyze market trends and execute transactions with lightning speed, giving traders a competitive edge in the fast-paced world of decentralized finance.

Don’t miss out on the opportunity to experience the game-changing impact of the 1inch Aggregator. Start trading with confidence and take your decentralized token investments to new heights. Join the revolution today!

The Impact of 1inch Aggregator

Since its launch, the 1inch Aggregator has revolutionized the decentralized trading landscape, significantly impacting trading volume and market liquidity for decentralized tokens. With its innovative design and cutting-edge technology, the 1inch Aggregator has quickly become the go-to platform for traders and investors looking for the best prices and optimal liquidity in the decentralized finance (DeFi) space.

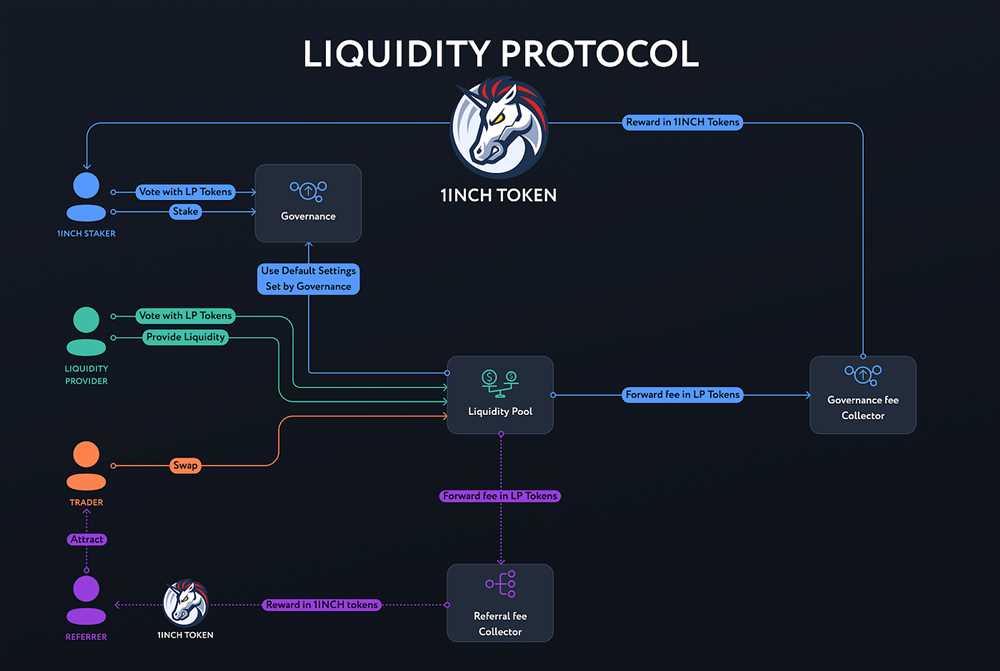

One of the key factors that sets the 1inch Aggregator apart is its ability to split orders across multiple decentralized exchanges, ensuring that users get the most favorable rates and minimal slippage when executing trades. By aggregating liquidity from various sources, such as Uniswap, Sushiswap, Balancer, and others, the 1inch Aggregator enables users to access deep liquidity pools and find the best token swaps with the lowest fees.

The impact of the 1inch Aggregator on trading volume and market liquidity cannot be understated. By providing users with a seamless and efficient trading experience, the platform has attracted a significant number of traders and investors, resulting in increased trading volume for decentralized tokens. This increased trading activity has also contributed to improved market liquidity, making it easier for users to buy and sell their tokens at fair prices.

Furthermore, the 1inch Aggregator has significantly reduced the fragmentation of liquidity in the DeFi space. Previously, traders had to manually search for the best prices on different decentralized exchanges, resulting in a fragmented market and potential missed opportunities. With the 1inch Aggregator, users can access a comprehensive view of the market, allowing them to make more informed trading decisions and take advantage of arbitrage opportunities.

In conclusion, the impact of the 1inch Aggregator on trading volume and market liquidity for decentralized tokens has been profound. By leveraging its advanced technology and efficient order routing system, the platform has transformed the way traders interact with decentralized exchanges, creating a more liquid and efficient trading environment for everyone involved.

Trading Volume

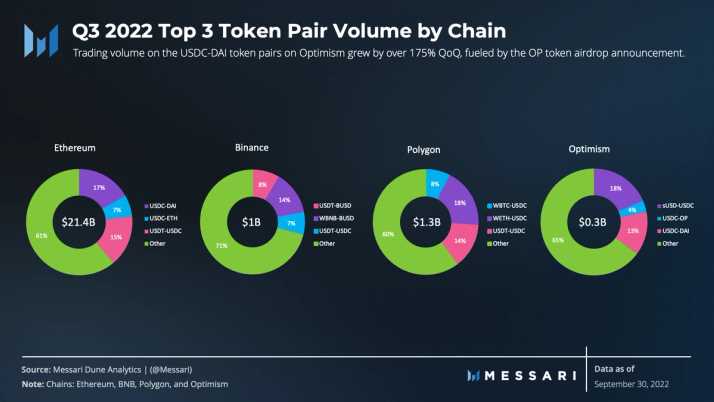

The 1inch Aggregator has had a significant impact on the trading volume of decentralized tokens. By providing users with access to numerous decentralized exchanges and aggregating liquidity from these sources, the 1inch Aggregator has greatly increased the trading volume for decentralized tokens.

Improved Access to Liquidity

One of the main reasons for the increased trading volume is the improved access to liquidity provided by the 1inch Aggregator. Instead of having to individually access multiple decentralized exchanges and navigate their interfaces, users can simply connect their wallet to the 1inch Aggregator and gain access to a wide range of liquidity sources.

This ease of access encourages more trading activity as users can quickly and easily execute trades with minimal effort. This has led to a significant increase in the overall trading volume for decentralized tokens.

Efficient Price Discovery

Another factor contributing to the increased trading volume is the efficient price discovery enabled by the 1inch Aggregator. By aggregating liquidity from multiple decentralized exchanges, the 1inch Aggregator can provide users with the best possible prices for their trades.

This efficient price discovery attracts more traders to the platform, as they can expect to get the best possible prices for their tokens. As more traders join the platform, the trading volume naturally increases, further benefiting all participants in the decentralized token market.

Overall, the 1inch Aggregator has had a significant positive impact on the trading volume for decentralized tokens. By improving access to liquidity and enabling efficient price discovery, the 1inch Aggregator has attracted more traders to the decentralized token market, resulting in increased trading volume and market liquidity.

Market Liquidity for Decentralized Tokens

Market Liquidity is a critical factor in determining the success and growth of decentralized tokens. Liquidity refers to the ease with which an asset can be bought or sold on the market without causing significant price fluctuations. In the case of decentralized tokens, liquidity plays a crucial role in ensuring a healthy and vibrant market ecosystem.

One of the main challenges faced by decentralized tokens is their relatively low liquidity compared to traditional financial markets. This is primarily due to the fragmented nature of decentralized exchanges and the lack of liquidity providers. Without sufficient market liquidity, investors may find it difficult to enter or exit positions without experiencing slippage or price manipulation.

However, the introduction of 1inch Aggregator has had a significant impact on market liquidity for decentralized tokens. 1inch Aggregator is a decentralized exchange aggregator that sources liquidity from various decentralized exchanges, allowing users to find the best prices and execute trades with minimal slippage.

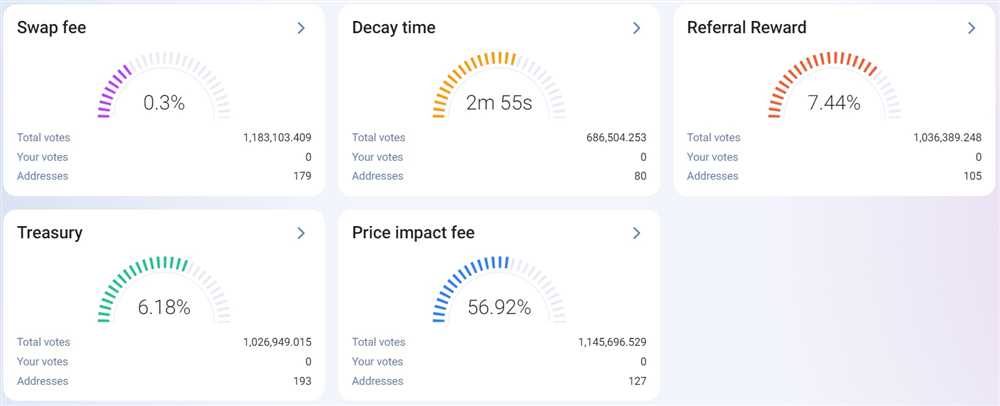

By aggregating liquidity from different decentralized exchanges, 1inch Aggregator provides a consolidated order book that ensures better liquidity for decentralized tokens. This not only improves the trading experience for users but also attracts more liquidity providers to participate in the market, further enhancing liquidity levels.

The increased market liquidity facilitated by 1inch Aggregator has several advantages for decentralized token holders. Firstly, it improves price stability by reducing the impact of large buy or sell orders on the market. This reduces the likelihood of price manipulation and enables more accurate price discovery.

Secondly, increased market liquidity enhances the efficiency of trading decentralized tokens. Users can execute larger orders with minimal slippage, resulting in lower trading costs and improved overall trading experience. This is particularly important for institutional investors and large traders who require high liquidity to execute their strategies effectively.

Furthermore, the increased liquidity provided by 1inch Aggregator attracts more market participants, including liquidity providers and market makers. This, in turn, fosters a more competitive and dynamic market environment, benefiting both traders and investors.

In conclusion, market liquidity is crucial for the success and growth of decentralized tokens. The introduction of 1inch Aggregator has significantly improved market liquidity for decentralized tokens, leading to enhanced price stability, improved trading efficiency, and a more vibrant market ecosystem. With ongoing developments and advancements in decentralized finance, we can expect further improvements in market liquidity, making decentralized tokens more accessible and attractive to a wider range of investors.

Benefits of Using 1inch Aggregator

The 1inch Aggregator provides a number of unique benefits for traders and investors in the decentralized token market. By utilizing the 1inch Aggregator, users gain access to a range of advantages that enhance their trading experience and improve their overall performance.

Increased Trading Volume

One of the main benefits of using the 1inch Aggregator is the significant increase in trading volume that it provides. By aggregating liquidity from multiple decentralized exchanges, the 1inch Aggregator ensures that traders have access to a larger pool of liquidity, resulting in higher trading volumes. This increased trading volume not only improves market efficiency but also provides more opportunities for traders to execute their orders at optimal prices.

Enhanced Market Liquidity

The 1inch Aggregator plays a crucial role in improving market liquidity for decentralized tokens. By connecting to various decentralized exchanges, the 1inch Aggregator taps into a wider range of liquidity sources, creating a more liquid market for traders. This enhanced market liquidity allows traders to buy or sell their tokens with ease, reducing slippage and minimizing the impact on token prices. As a result, traders can execute their trades more efficiently and effectively.

Moreover, the 1inch Aggregator employs advanced algorithms and smart routing techniques to optimize the execution of trades, further improving market liquidity for users. By intelligently splitting orders across multiple exchanges, the 1inch Aggregator maximizes the chances of obtaining the best possible prices for traders, ultimately benefiting their overall trading performance.

Overall, the 1inch Aggregator offers numerous benefits to traders and investors in the decentralized token market. With increased trading volume and enhanced market liquidity, users can enjoy improved trading efficiency and better execution of orders. By utilizing the 1inch Aggregator, traders can optimize their trading strategies and achieve better outcomes in the decentralized token market.

Question-answer:

What is 1inch Aggregator?

1inch Aggregator is a decentralized exchange (DEX) aggregator that sources liquidity from various DEXs to provide users with the best possible trading prices.

How does 1inch Aggregator impact trading volume?

1inch Aggregator can significantly impact trading volume by aggregating liquidity from multiple DEXs, which increases the number of trading opportunities and improves overall market liquidity.

What are the benefits of using 1inch Aggregator?

Using 1inch Aggregator can provide users with better trading prices, improved market liquidity, and access to a wide range of decentralized tokens.

Does 1inch Aggregator affect the liquidity of decentralized tokens?

Yes, 1inch Aggregator can positively impact the liquidity of decentralized tokens by aggregating liquidity from multiple DEXs, which increases the overall availability of tokens for trading.