Decentralized Finance (DeFi) has emerged as one of the most exciting and rapidly growing sectors in the cryptocurrency industry. One of the key players in this space is 1inch, a decentralized exchange aggregator that aims to optimize trading across multiple platforms. In this article, we will take a close look at the 1inch whitepaper and analyze the role this protocol plays in the DeFi ecosystem.

At its core, 1inch acts as a bridge between different decentralized exchanges by splitting a user’s trade across multiple platforms to ensure the best possible price execution. This innovative approach allows users to access liquidity from various sources, resulting in lower slippage and reduced trading costs. The 1inch whitepaper outlines the protocol’s unique algorithm, known as the Pathfinder, which intelligently routes trades to achieve optimal results.

One of the key advantages of 1inch is its ability to aggregate liquidity from multiple decentralized exchanges and provide users with the best possible rates. By tapping into a network of liquidity providers, 1inch ensures that users can make trades at the most competitive prices, regardless of the platform they are using. This not only benefits individual traders but also contributes to the overall liquidity of the DeFi ecosystem.

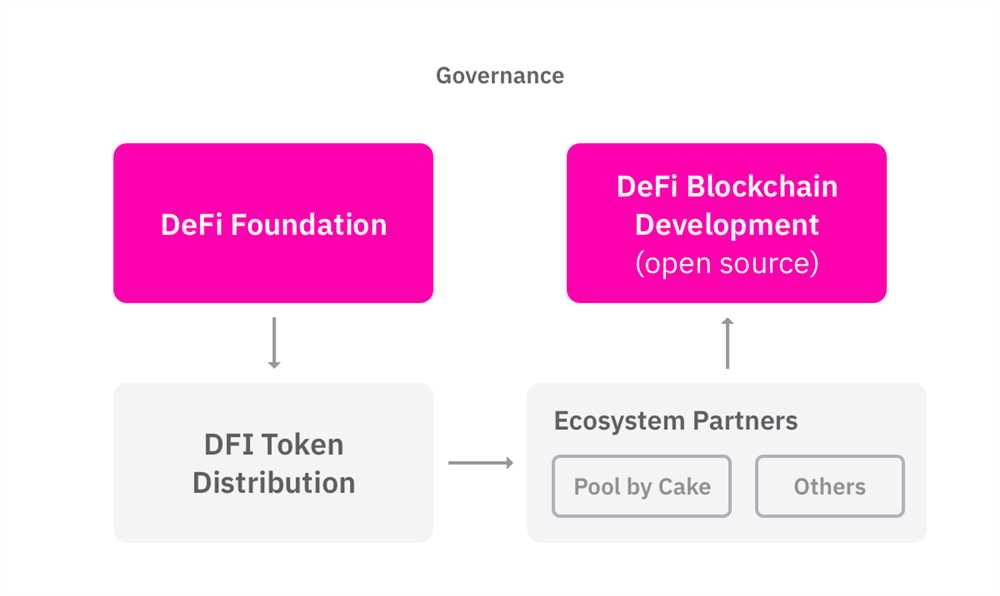

Furthermore, 1inch is powered by its native governance token, 1INCH, which plays a crucial role in the protocol’s decentralized governance model. Token holders can propose and vote on important decisions, such as protocol upgrades and changes to the fee structure. This democratic approach gives users a voice and helps ensure the protocol’s long-term sustainability.

In conclusion, the 1inch protocol plays a vital role in the DeFi ecosystem by providing users with efficient access to liquidity across decentralized exchanges. Its innovative approach to trading optimization, aggregated liquidity, and decentralized governance make it a key player in the rapidly evolving world of DeFi. By critically analyzing the 1inch whitepaper, we can gain valuable insights into the protocol’s role and potential future developments.

The Role of 1inch in the DeFi Ecosystem

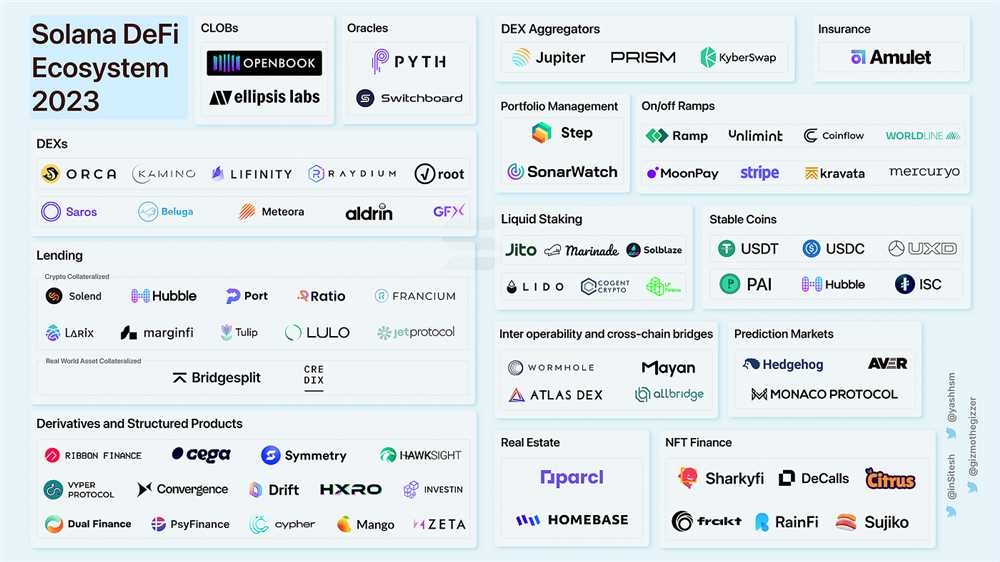

1inch plays a crucial role in the decentralized finance (DeFi) ecosystem by providing users with a decentralized exchange (DEX) aggregator. As the DeFi space continues to grow rapidly, it is becoming increasingly challenging for users to navigate and find the best rates across multiple DEXs. This is where 1inch comes in, offering a solution that allows users to access the best prices and liquidity across various decentralized exchanges.

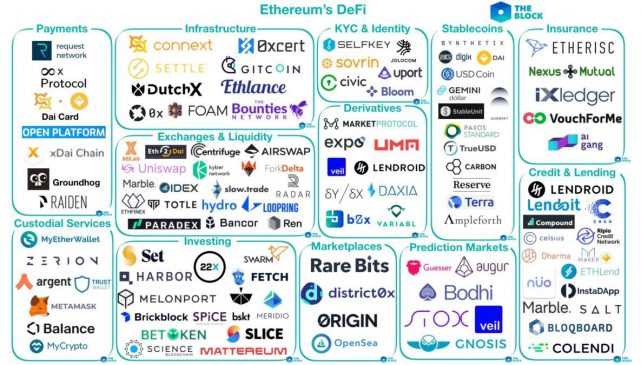

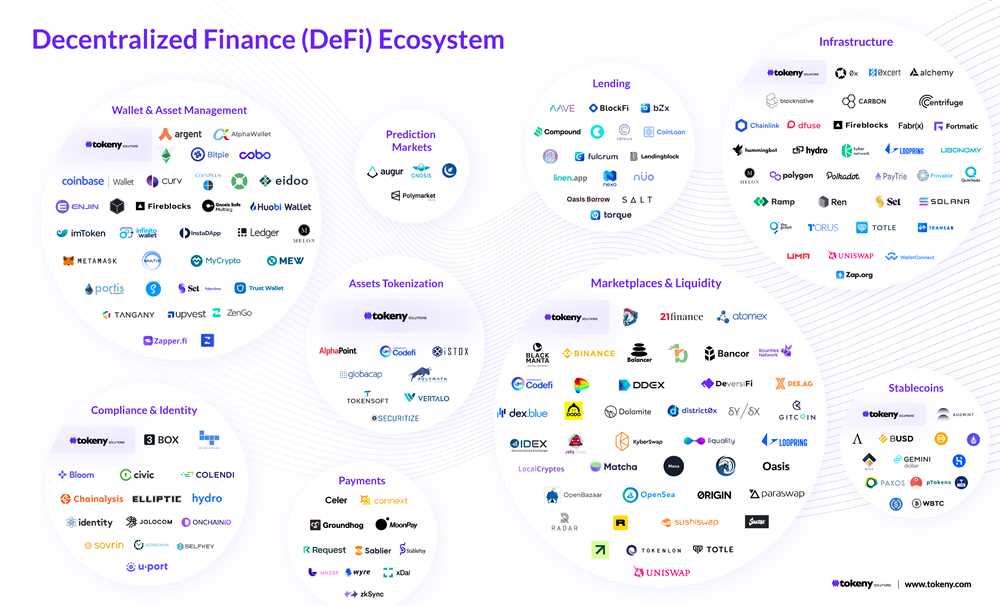

At its core, 1inch aggregates liquidity from various DEXs, including popular ones like Uniswap, SushiSwap, Curve, and Balancer, among others. By pooling liquidity from multiple sources, 1inch is able to provide users with better trading rates and reduced slippage. Through its integration with multiple DEXs, 1inch is also able to offer users access to a broader range of tokens and trading pairs.

Smart Contract Routing

One of the key features of 1inch is its smart contract routing algorithm, which ensures that users always get the most optimal route for their trades. The algorithm takes into account various factors such as liquidity, gas fees, and trading volume to determine the best route for a trade. By analyzing these factors, 1inch is able to minimize slippage and improve overall trading efficiency.

The smart contract routing algorithm is designed to split a user’s trade across different DEXs to achieve the best possible outcome. For example, if a trade involves swapping ETH for DAI, the algorithm may split the trade between Uniswap and SushiSwap to take advantage of the best rates available on both platforms. This dynamic and automated routing system ensures that users always get the most favorable trading rates and avoid unnecessary fees.

Governance and the 1INCH Token

1inch has its native utility token called 1INCH, which plays a vital role in the governance and sustainability of the platform. Holders of the 1INCH token have the power to participate in the decision-making process of the platform through voting on various proposals and protocol upgrades. This decentralized governance model ensures that the community has an active role in shaping the future of 1inch.

In addition to governance, the 1INCH token also serves as a reward mechanism within the ecosystem. Users who provide liquidity to 1inch’s liquidity pools are rewarded with 1INCH tokens, incentivizing them to contribute to the platform’s liquidity and growth.

Overall, 1inch plays a critical role in the DeFi ecosystem by offering users a seamless and efficient way to access liquidity across multiple DEXs. With its smart contract routing algorithm and governance model, 1inch is well-positioned to continue growing and providing value to the DeFi community.

An Overview of the 1inch Protocol

The 1inch Protocol is a decentralized exchange aggregator that allows users to optimize their trades across multiple liquidity sources. It was created with the goal of solving the common problems faced by traders in decentralized finance (DeFi) platforms.

At its core, the 1inch Protocol aims to provide users with the best possible trading experience by reducing slippage and maximizing the efficiency of their trades. It achieves this by automatically splitting a user’s trade across multiple decentralized exchanges, taking into account factors such as prices, fees, and available liquidity.

By leveraging its smart contract technology, the 1inch Protocol is able to scan various decentralized exchanges and liquidity pools in real-time to find the most favorable rates for users. This allows users to avoid the hassle of manually searching for the best rates and executing multiple trades themselves.

One of the key features of the 1inch Protocol is its Pathfinder algorithm, which determines the optimal route for a trade based on factors such as liquidity and gas costs. This algorithm ensures that users are able to get the best possible rates while also minimizing their transaction costs.

In addition to its trading optimization features, the 1inch Protocol also offers other useful tools and services. For example, it provides users with detailed analytics and insights on their trades, allowing them to make more informed decisions. It also offers advanced trading options, such as limit orders and stop-loss orders.

Overall, the 1inch Protocol plays a crucial role in the DeFi ecosystem by providing users with a seamless and efficient trading experience. Its ability to aggregate liquidity from multiple sources and optimize trades makes it a valuable tool for both experienced traders and newcomers to the DeFi space.

A Detailed Analysis of the 1inch Whitepaper

1inch is a decentralized exchange aggregator that aims to provide users with the best possible rates for their trades. The 1inch whitepaper outlines the protocol’s design and functionality, and in this analysis, we will delve deeper into its key aspects and evaluate its potential impact on the DeFi ecosystem.

Protocol Overview

The 1inch protocol operates by splitting users’ trades across multiple decentralized exchanges to achieve lower slippage and better prices. It aggregates liquidity from various sources and routes trades based on smart contract algorithms, aiming to minimize user fees and maximize returns. By utilizing the power of decentralized technology, 1inch aims to provide a seamless trading experience for users.

Security and Trustlessness

The whitepaper emphasizes the importance of security and trustlessness in the design of the 1inch protocol. By utilizing smart contracts and audited code, the protocol ensures that user funds are secure and transactions are executed as intended. Additionally, the protocol doesn’t require users to trust any single exchange or entity, as it operates in a decentralized manner and distributes trades across multiple platforms.

Sustainability and Governance

1inch is designed to be a sustainable and community-driven protocol. The whitepaper describes the 1inch token (1INCH) and its role in the network’s governance and incentivization mechanisms. Token holders have the ability to vote on protocol upgrades and parameter changes, ensuring that the protocol adapts to the changing market conditions and remains in line with the community’s interests.

Advantages and Challenges

One of the key advantages of 1inch is its ability to provide users with the best possible rates, thanks to its aggregation and routing algorithms. However, the protocol also faces challenges such as the complexity of integration with various decentralized exchanges and the need to continuously adapt to the evolving DeFi landscape. The whitepaper acknowledges these challenges and emphasizes the importance of community engagement and collaboration to overcome them.

In conclusion, the 1inch whitepaper provides a detailed analysis of the protocol’s design, security features, governance mechanisms, and challenges. It showcases the potential of 1inch to revolutionize decentralized trading and highlights the importance of community involvement in shaping the protocol’s future. As the DeFi ecosystem continues to evolve, it will be interesting to see how 1inch and similar exchange aggregators contribute to the growth and adoption of decentralized finance.

The Implications of 1inch for the DeFi Industry

As the decentralized finance (DeFi) industry continues to expand and evolve, new projects and platforms emerge to meet the growing demands of users. One such platform that has gained considerable attention is 1inch. With its unique approach to decentralized exchanges (DEXs), 1inch has the potential to revolutionize the DeFi space and have significant implications for the industry as a whole.

At its core, 1inch is a decentralized exchange aggregator that sources liquidity from various DEXs to provide users with the best possible exchange rate for their trades. By splitting a user’s order across multiple DEXs, 1inch can minimize slippage and maximize the value of the trade. This approach not only ensures the best price but also provides users with access to a wider range of tokens and liquidity pools.

One of the key implications of 1inch for the DeFi industry is its ability to improve overall liquidity. By aggregating liquidity from multiple sources, 1inch can increase the depth and breadth of liquidity available to users. This, in turn, reduces the impact of large trades on the market and helps to stabilize prices. Additionally, by accessing liquidity from different DEXs, 1inch can mitigate the risks associated with low liquidity or market manipulation on a single platform.

Furthermore, 1inch’s approach to decentralized exchanges promotes competition and innovation within the industry. By sourcing liquidity from multiple DEXs, 1inch encourages these platforms to offer better rates and services to attract users. This competitive environment fosters innovation and drives the development of new features and functionalities that can enhance the overall DeFi experience.

Another implication of 1inch for the DeFi industry is its potential to enhance accessibility and inclusivity. By aggregating liquidity from different DEXs, 1inch enables users to access a wider range of tokens and liquidity pools that may not be available on a single platform. This opens up new investment opportunities and allows users to diversify their portfolios. Additionally, 1inch’s user-friendly interface and integration with popular wallets make it easier for individuals to participate in DeFi regardless of their technical expertise.

Overall, 1inch’s unique approach to decentralized exchanges has significant implications for the DeFi industry. By improving liquidity, promoting competition and innovation, and enhancing accessibility, 1inch has the potential to reshape the landscape of DeFi and drive its further growth and adoption.

Question-answer:

What is 1inch and what role does it play in the DeFi ecosystem?

1inch is a decentralized exchange aggregator that allows users to find and swap tokens across multiple liquidity sources. It plays an important role in the DeFi ecosystem by providing users with the best possible prices and minimizing slippage.

How does 1inch achieve the best possible prices for users?

1inch achieves the best possible prices for users by splitting a user’s trade across multiple decentralized exchanges to find the most optimal route for trading. This helps minimize slippage and ensures users get the best prices for their trades.

What is the significance of 1inch’s governance and liquidity mining programs?

1inch’s governance and liquidity mining programs are significant as they incentivize users to provide liquidity to the platform and participate in decision-making processes. This helps create a decentralized and community-driven ecosystem, where users can actively contribute to the platform’s development and growth.

How does the Chi Gas Token work and what benefits does it provide?

The Chi Gas Token is a unique feature of 1inch that allows users to save on gas fees by optimizing the gas usage for their transactions. By using the Chi Gas Token, users can effectively reduce their gas costs and save money when interacting with the 1inch platform.

What are some potential risks and challenges that 1inch may face in the DeFi ecosystem?

Some potential risks and challenges that 1inch may face in the DeFi ecosystem include competition from other decentralized exchange aggregators, regulatory challenges, and the overall volatility and uncertainty of the DeFi market. Additionally, security and smart contract risks are also important factors to consider in the DeFi space.