Liquidity mining has emerged as a popular trend in the decentralized finance (DeFi) space, allowing users to earn passive income by providing liquidity to decentralized exchanges (DEXs). One of the prominent DEXs that offers liquidity mining programs is 1inch, a decentralized exchange aggregator that provides the best available prices across various DEXs.

There are several benefits to participating in liquidity mining on 1inch DEX. First and foremost, liquidity providers (LPs) can earn lucrative rewards in the form of tokens. These rewards are often distributed based on the proportion of liquidity provided by an LP, incentivizing users to contribute more to the liquidity pool. By participating in liquidity mining, LPs can passively earn additional income on their existing crypto holdings.

Additionally, liquidity mining on 1inch DEX can also provide users with access to newly launched tokens. Many projects choose to distribute their tokens through liquidity mining programs, giving early adopters an opportunity to acquire tokens with high growth potential. This can be especially advantageous for those who believe in the long-term prospects of a particular project and want to get involved in its ecosystem from the early stages.

However, it’s important to note that there are also risks associated with liquidity mining. One of the main risks is impermanent loss, which occurs when the value of the tokens in the liquidity pool fluctuates significantly. As the price of tokens in the pool changes, LPs may end up with fewer tokens compared to simply holding them in a wallet. This risk is inherent to providing liquidity on DEXs and should be carefully considered before participating in liquidity mining programs.

In conclusion, liquidity mining on 1inch DEX offers the potential for passive income and early access to promising projects, but it also carries risks such as impermanent loss. Users should carefully assess the potential rewards and risks before deciding to participate in liquidity mining programs. It is important to stay informed and make well-informed decisions to optimize the benefits and mitigate the risks of liquidity mining on 1inch DEX.

Benefits of Liquidity Mining

Liquidity mining on the 1inch DEX offers several benefits for liquidity providers and users alike:

| 1. Increased Earnings | Liquidity mining allows providers to earn additional income through token rewards. By staking their assets in a liquidity pool, users can receive tokens as an incentive for contributing to the platform’s liquidity. |

| 2. Improved Market Efficiency | By supplying liquidity to decentralized exchanges, liquidity providers play a crucial role in improving the overall market efficiency. As more liquidity is added to the platform, it becomes easier for traders to execute their orders without experiencing significant slippage. |

| 3. Access to New Tokens | Liquidity mining often involves providing liquidity for newly launched tokens or projects. This gives liquidity providers the opportunity to get early access to these tokens and potentially benefit from their future growth. |

| 4. Diversification | By participating in liquidity mining, users can diversify their cryptocurrency holdings and reduce their overall risk. By allocating their assets to different liquidity pools, they can spread out their investments and potentially mitigate losses in case one pool experiences a decline in value. |

| 5. Contribution to DeFi Ecosystem | Liquidity mining helps in further developing and expanding the decentralized finance (DeFi) ecosystem. By providing liquidity, users support the functioning of decentralized exchanges, incentivize users to transact on these platforms, and contribute to the overall growth of the DeFi space. |

Overall, liquidity mining can be a rewarding experience for liquidity providers, offering them increased earnings, access to new tokens, diversification, and the chance to contribute to the growth of the DeFi ecosystem.

Risks of Liquidity Mining

Liquidity mining on 1inch DEX comes with a number of risks that participants should be aware of before getting involved. These risks include:

1. Impermanent Loss

When participating in liquidity mining, there is a risk of experiencing impermanent loss. Impermanent loss occurs when the price of the tokens in a liquidity pool changes relative to each other, resulting in a temporary loss of value. This can happen when the price of one token in the pool significantly outperforms the other token, causing the pool to become imbalanced and resulting in the loss of potential gains. It’s important for liquidity mining participants to understand the potential for impermanent loss and assess their risk tolerance before providing liquidity.

2. Smart Contract Risk

While 1inch DEX is built on Ethereum, which is a secure blockchain, there is always a risk associated with smart contracts. Smart contracts can be subject to vulnerabilities or exploits that can result in loss of funds. It’s crucial for liquidity mining participants to conduct thorough due diligence on the smart contracts being used and ensure they are audited and secure.

3. Market Volatility

The cryptocurrency market is known for its volatility, and liquidity mining participants are exposed to this volatility. Fluctuations in the prices of tokens can result in significant gains or losses for liquidity providers. It’s important for participants to consider their risk tolerance and be prepared for market volatility when participating in liquidity mining.

4. Impermanent Loss vs. Fees

When providing liquidity to a pool, participants earn fees from the trading activity on that pool. However, these fees may not always offset the potential impermanent loss. It’s important to carefully analyze the potential returns from fees and compare them to the potential impermanent loss before deciding to participate in liquidity mining.

In conclusion, liquidity mining on 1inch DEX offers attractive rewards to participants, but it also comes with certain risks. By understanding these risks and conducting proper due diligence, participants can make informed decisions about whether liquidity mining is suitable for them.

Question-answer:

What is liquidity mining?

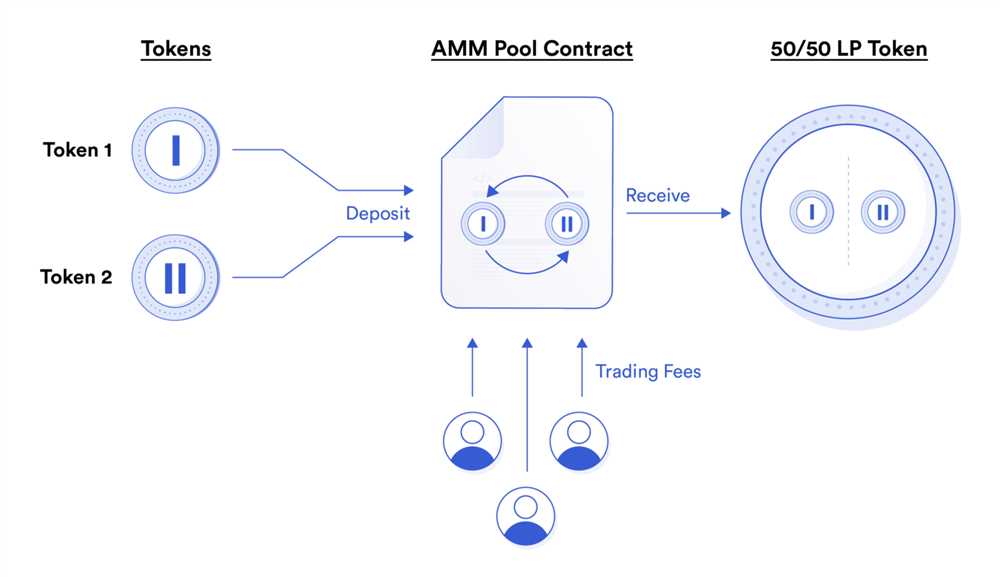

Liquidity mining is a process where users provide liquidity to a decentralized exchange (DEX) platform by depositing their digital assets into a liquidity pool. In return, they receive rewards in the form of additional tokens or fees.

What are the benefits of liquidity mining on 1inch DEX?

The benefits of liquidity mining on 1inch DEX include earning additional tokens as rewards for providing liquidity, receiving a share of the trading fees generated on the platform, and helping to improve the overall liquidity and trading experience for other users.