Are you looking for the best decentralized exchange (DEX) platform for your cryptocurrency trading needs? Look no further! In this comprehensive comparison and analysis, we dive deep into the features and advantages of two leading DEX platforms: 1inch and Uniswap.

1inch and Uniswap are both popular choices among cryptocurrency enthusiasts, but the question remains: which one is the ultimate ruler of the DEX realm?

Let’s examine their key differences and similarities to help you make an informed decision. With our thorough analysis, you’ll gain valuable insights into the performance, liquidity, fees, and user experience offered by both platforms.

Uniswap has dominated the DEX space for a while with its simple and user-friendly interface. But 1inch has emerged as a worthy competitor, offering advanced features such as multi-path routing, gas cost optimization, and a highly efficient aggregation protocol. Is it enough to dethrone Uniswap?

If you’re tired of high fees and slow transactions on centralized exchanges, join us as we explore the battle between 1inch and Uniswap. Find out which platform reigns supreme in terms of trading efficiency, security, and overall performance. Make the right choice and take your cryptocurrency trading to the next level!

Disclaimer: The opinions and analysis expressed in this article are solely those of the author and do not reflect the official stance of any company or organization.

Comparison of 1inch and Uniswap

1inch and Uniswap are both decentralized exchanges (DEX) that have gained popularity in the crypto market. While they both offer users the ability to trade cryptocurrencies, there are several key differences between the two platforms.

1. Liquidity

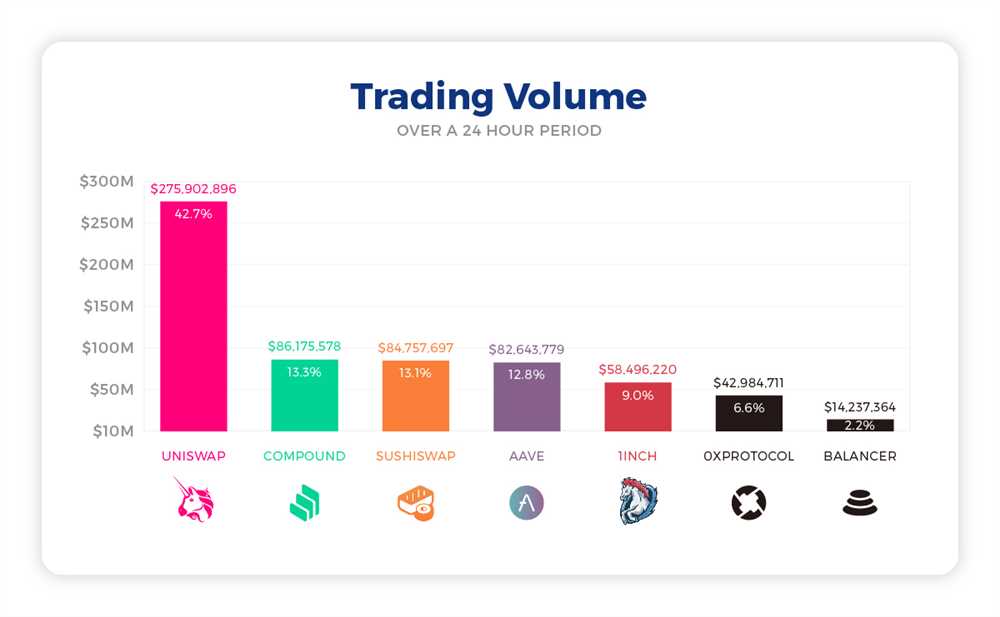

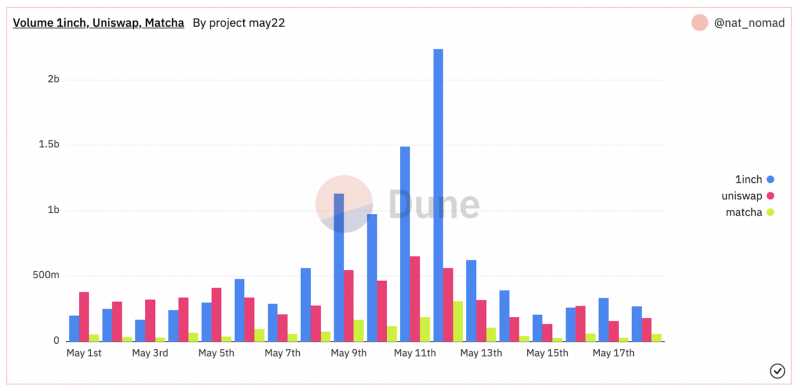

Uniswap is known for its high liquidity, as it operates on an automated market maker (AMM) model. This means that users can easily execute trades without having to wait for a counterparty. On the other hand, 1inch aggregates liquidity from various DEXs, which provides users with access to a larger pool of liquidity. This can be advantageous for traders looking for better prices and faster execution.

2. User Interface

Uniswap has a simple and intuitive user interface that makes it easy for beginners to navigate and execute trades. 1inch, on the other hand, offers a more advanced interface that allows experienced traders to take advantage of additional features such as limit orders and advanced analytics. This can be appealing to users who prefer a more comprehensive trading experience.

3. Token Support

Both 1inch and Uniswap support a wide range of tokens, including popular cryptocurrencies like Ethereum and DAI. However, 1inch also supports tokens from other blockchain networks, such as Binance Smart Chain and Polygon. This gives users more options when it comes to trading different tokens.

4. Fees

Uniswap charges a flat fee of 0.30% on all trades, which is relatively high compared to other DEXs. On the other hand, 1inch has a dynamic fee structure that adjusts based on market conditions. This can result in lower fees for users, especially during times of high liquidity.

5. Governance

Uniswap has a decentralized governance model that allows token holders to participate in decision-making processes. 1inch, on the other hand, does not have its own native governance token but has implemented a snapshot voting mechanism to gather community input. This allows users to have a voice in the development of the platform.

Overall, both 1inch and Uniswap have their own unique features and advantages. The choice between the two will ultimately depend on the user’s trading preferences and needs.

Features of 1inch

1inch is a decentralized exchange aggregator that offers several unique features for users looking to trade cryptocurrencies. Here are some of the key features of 1inch:

1. Aggregation

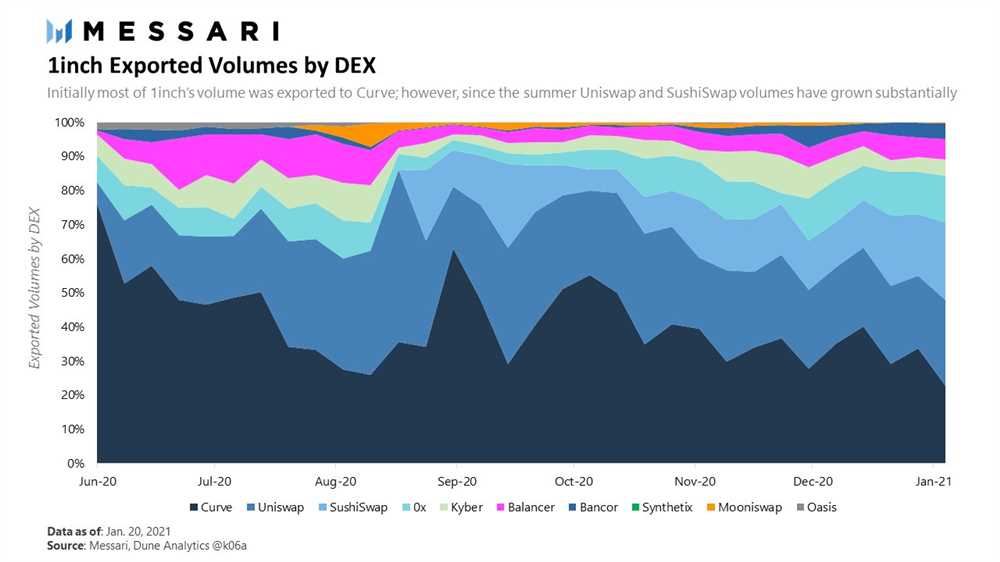

1inch is known for its aggregation algorithm, which combines multiple liquidity sources to find the best possible trading route for users. By aggregating liquidity from various decentralized exchanges, such as Uniswap and SushiSwap, 1inch ensures that users get the most favorable rates and minimal slippage.

2. Smart Contract Optimization

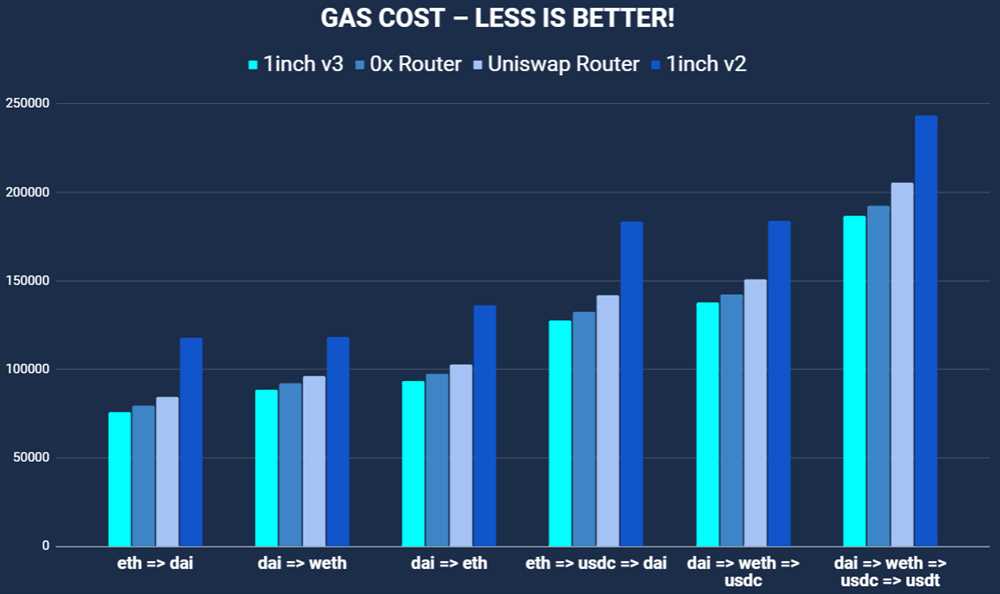

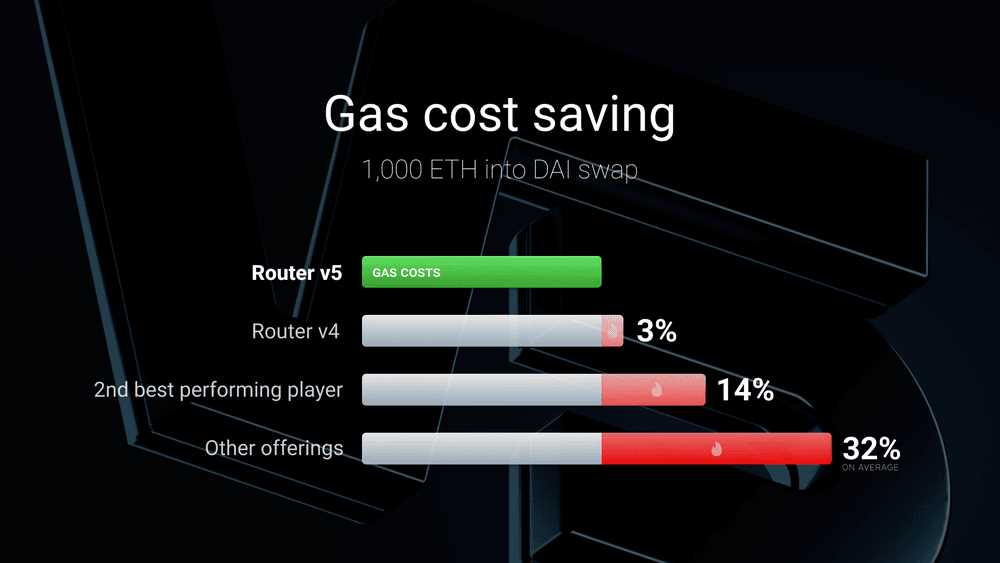

1inch utilizes smart contract technology to optimize trades and reduce gas costs for users. The platform’s intelligent routing algorithm analyzes multiple paths and splits trades across different exchanges to minimize fees and maximize returns.

3. Gas Token Savings

Gas fees can be a significant burden for traders, especially during periods of high network congestion. 1inch offers gas token savings, allowing users to pay for their transactions using Chi gas tokens. This feature can significantly reduce gas costs and make trading more affordable for users.

Overall, 1inch’s unique features make it a powerful tool for cryptocurrency traders, providing them with better trading routes, lower fees, and enhanced efficiency in their trades.

Smart Contract Interoperability

Smart Contract Interoperability refers to the ability of different blockchain networks and protocols to communicate and interact with each other seamlessly. In the decentralized finance (DeFi) space, it has become crucial for projects to have smart contract interoperability to unlock the full potential of their platforms and provide users with efficient and seamless experiences.

1inch and Uniswap both recognize the importance of smart contract interoperability and have implemented solutions to address this challenge. Both protocols enable users to access liquidity from multiple sources and provide a seamless trading experience.

1inch’s Universal Liquidity Protocol

1inch’s Universal Liquidity Protocol (ULP) plays a significant role in promoting smart contract interoperability. ULP connects various decentralized exchanges (DEXs) and liquidity sources, allowing users to access the best liquidity available across different networks and protocols. By aggregating liquidity, ULP ensures that users can execute trades at the best possible prices.

ULP achieves smart contract interoperability by employing a combination of on-chain and off-chain mechanisms. On-chain components ensure the execution of transactions, while off-chain components gather data from various sources and calculate the best trading routes and prices.

Uniswap’s Integration with Other Platforms

Uniswap, on the other hand, has taken a different approach to achieve smart contract interoperability. The protocol has integrated with other DeFi platforms and projects, such as Aave, Compound, and Balancer, to leverage their functionalities and expand the available options for users.

This integration allows users to interact with different protocols directly from the Uniswap interface, enabling cross-protocol trades and access to additional features. Uniswap’s integration with other platforms promotes smart contract interoperability by providing users with a wide range of decentralized financial services in one place.

Conclusion

Both 1inch and Uniswap recognize the importance of smart contract interoperability and have implemented solutions to ensure seamless communication and interaction with other protocols. The Universal Liquidity Protocol of 1inch and Uniswap’s integration with other platforms demonstrate their commitment to providing users with the best possible trading experience and access to the broadest range of liquidity.

Ultimately, the choice between 1inch and Uniswap depends on individual needs and preferences. While 1inch offers a comprehensive liquidity aggregation solution, Uniswap’s integration with other platforms provides a diverse range of options. Users should consider their specific requirements and priorities when deciding which protocol to use.

Features of Uniswap

Uniswap, one of the pioneering decentralized exchanges (DEX), offers several unique features that set it apart from other platforms. Let’s take a closer look at what makes Uniswap standout:

1. Automated Market Maker (AMM) Model:

Uniswap operates on an AMM model, allowing users to trade directly from their wallets without relying on order books. This decentralized approach eliminates the need for intermediaries and provides users with continuous access to liquidity.

2. Liquidity Pools:

Uniswap utilizes liquidity pools to facilitate trading. Liquidity providers can deposit their assets into these pools, earning fees in return. By contributing to the liquidity of the platform, users also benefit from lower slippage and more efficient trades.

3. ERC-20 Token Support:

Uniswap supports ERC-20 tokens, making it compatible with a wide range of cryptocurrencies built on the Ethereum blockchain. This allows users to easily swap between different tokens and take advantage of various investment opportunities.

4. Decentralization:

Uniswap is built on decentralized smart contracts, ensuring that trading activities are transparent, secure, and censorship-resistant. It eliminates the need for intermediaries and puts control back into the hands of the users.

5. User-friendly Interface:

Uniswap provides a user-friendly interface that simplifies the trading experience for both novice and experienced users. Its intuitive design and straightforward navigation make it easy for anyone to access and participate in the decentralized finance ecosystem.

In summary, Uniswap offers an innovative and user-friendly platform that empowers individuals to trade and access liquidity in a decentralized manner. Its unique features, such as the AMM model, liquidity pools, ERC-20 token support, decentralization, and user-friendly interface, make it a top choice for users looking to engage in decentralized trading and investment.

Liquidity Pool and Automated Market Maker

In the world of decentralized exchanges (DEX), liquidity pools and automated market makers play a crucial role in ensuring efficient trading and price discovery. Both 1inch and Uniswap are popular DEX platforms that utilize liquidity pools and automated market makers to provide seamless cryptocurrency trading experiences.

Liquidity Pools

A liquidity pool is a pool of funds made available by liquidity providers (LPs) on a DEX platform. These funds are used to facilitate trading by allowing users to trade against the pool instead of relying on individual buy or sell orders. Liquidity providers add their tokens to the pool, and in return, they earn a share of the trading fees generated by the platform.

1inch and Uniswap both have liquidity pools that enable users to trade various cryptocurrencies without the need for traditional intermediaries. These pools ensure that the DEX platforms can provide ample liquidity for trading, even during periods of high volatility.

Automated Market Maker (AMM)

An automated market maker is a smart contract-based algorithm that determines the price of a token based on the ratio of its supply and demand within a liquidity pool. AMMs eliminate the need for order books and rely on mathematical formulas to determine the price. They provide continuous liquidity by automatically adjusting the prices based on the changes in supply and demand.

Both 1inch and Uniswap utilize AMMs to facilitate trading on their platforms. The AMM algorithms ensure fair and efficient price discovery, making it easier for users to trade cryptocurrencies at the best possible prices.

| 1inch | Uniswap |

|---|---|

| 1inch offers a unique aggregation feature that allows users to access the best token prices across multiple DEXs. | Uniswap is one of the first and most popular DEX platforms, known for its user-friendly interface and wide range of supported tokens. |

| 1inch also employs its own innovative AMM protocol, called Mooniswap, which aims to reduce impermanent loss for liquidity providers. | Uniswap utilizes a simple yet effective AMM algorithm that has proven to be highly reliable and secure. |

Overall, both 1inch and Uniswap rely on liquidity pools and automated market makers to provide seamless and efficient cryptocurrency trading experiences. While 1inch offers unique aggregation features and an innovative AMM protocol, Uniswap boasts popularity and a user-friendly interface. Ultimately, the choice between the two platforms depends on individual preferences and trading needs.

Analysis of 1inch vs Uniswap

1inch is known for its innovative approach to liquidity aggregation. The platform sources liquidity from various sources, including other DEXs, in order to provide users with the best possible trading rates. This means that users on 1inch can often find better prices and lower slippage compared to Uniswap.

On the other hand, Uniswap is widely regarded as one of the pioneers of the automated market maker (AMM) model. The platform uses smart contracts to facilitate token swaps, with liquidity provided by individual users who contribute to liquidity pools. This model has proven to be highly successful, as it allows for continuous liquidity and eliminates the need for order books.

One key advantage that Uniswap has over 1inch is its user interface. Uniswap’s interface is simple and user-friendly, making it easy for even novice traders to navigate and execute trades. In contrast, 1inch’s interface can be more complex and intimidating for beginners.

When it comes to fees, both platforms have their own unique fee structures. Uniswap charges a flat 0.3% fee on all trades, while 1inch employs a dynamic fee routing mechanism. This means that 1inch analyzes different liquidity sources and selects the most cost-effective route for the trade, which can result in lower fees for users.

In terms of token support, both platforms offer a wide range of tokens for trading. However, Uniswap has a longer track record and supports more tokens compared to 1inch.

Overall, the choice between 1inch and Uniswap ultimately depends on the specific needs and preferences of the user. While 1inch may offer better trading rates and lower fees, Uniswap excels in user experience and token support. It’s important for traders to consider these factors and make an informed decision based on their individual requirements.

Question-answer:

What is the difference between 1inch and Uniswap?

1inch and Uniswap are both decentralized exchanges (DEXs) but they have some differences. While Uniswap is a DEX that focuses primarily on providing liquidity for various Ethereum-based tokens, 1inch is a DEX aggregator that sources liquidity from multiple DEXs to provide users with the best possible trading rates. 1inch also offers additional features such as gas optimization and limit order functionality.

How does 1inch ensure it provides the best trading rates?

1inch aggregates liquidity from various DEXs and uses a smart algorithm to route trades in the most cost-effective way. By splitting users’ orders across multiple DEXs, 1inch can secure the best possible trading rates. It also incorporates gas price optimization, allowing users to save on transaction fees. Overall, 1inch strives to provide users with optimal trading rates and cost savings.