The 1inch token has rapidly gained popularity in the decentralized finance (DeFi) space, offering users the ability to find and trade the best prices across various decentralized exchanges (DEXs). As the demand for decentralized trading solutions continues to grow, scaling the 1inch token presents both challenges and opportunities for the project and its community.

One of the main challenges of scaling the 1inch token is ensuring the efficiency and speed of transactions as the user base continues to expand. With more users utilizing the 1inch platform, the network must be able to handle the increased volume of transactions without sacrificing security or usability. This requires a robust infrastructure and technical solutions that can support the scalability needs of the project.

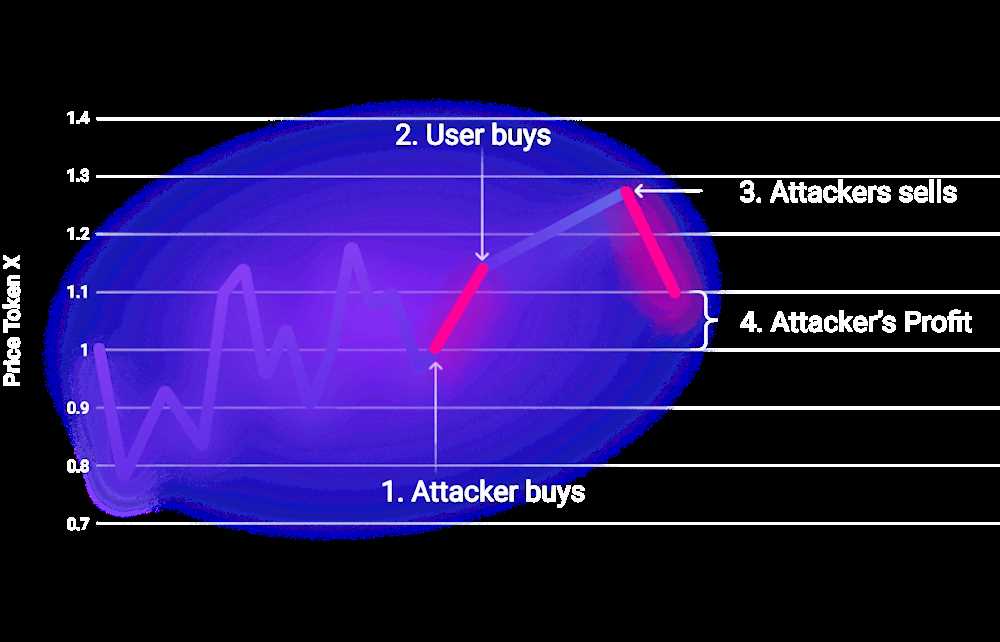

Another challenge is maintaining decentralization and security while scaling the 1inch token. As the project grows, it becomes more susceptible to attacks and vulnerabilities. Ensuring the security of user funds and protecting against potential threats is crucial for maintaining user trust and confidence in the platform. Additionally, maintaining a decentralized governance model is essential to prevent centralization of power and decision-making.

However, scaling the 1inch token also brings significant opportunities. By expanding the user base and increasing liquidity, the 1inch token can become more widely adopted and integrated into the decentralized finance ecosystem. This would provide users with greater access to liquidity and more trading options, ultimately benefiting the entire DeFi community.

Furthermore, scaling the 1inch token opens doors to partnerships and collaborations with other projects and platforms in the DeFi space. By leveraging the growing network effects and exploring interoperability solutions, the 1inch token can further enhance its capabilities and provide users with even more innovative and efficient trading experiences.

In conclusion, scaling the 1inch token presents both challenges and opportunities for the project. By addressing the challenges of scalability, security, and decentralization, while capitalizing on the opportunities for expansion and collaboration, the 1inch token can continue to position itself as a leading player in the decentralized finance landscape.

Challenges in scaling the 1inch token

Scaling the 1inch token presents various challenges that need to be addressed in order to ensure its successful growth and adoption. These challenges include:

1. Network congestion

As the popularity of the 1inch token increases, it may result in network congestion on the blockchain where it operates. This congestion can lead to higher transaction fees and longer confirmation times, making it less efficient for users to trade or transfer the token. Finding solutions to mitigate network congestion will be essential in scaling the 1inch token.

2. Security and performance

Scaling the 1inch token will require ensuring its security and maintaining optimal performance throughout the scaling process. As the token grows, it becomes a more attractive target for hackers and malicious actors seeking to exploit vulnerabilities. Therefore, implementing robust security measures and regularly auditing the token’s smart contracts will be crucial to protect it and maintain user confidence.

Additionally, scaling the token’s infrastructure to handle increased demand while providing fast and seamless transactions will be essential. This may involve upgrading the network’s computational capabilities, improving the token’s consensus algorithm, or exploring layer-two solutions for increased scalability.

3. User adoption and liquidity

Another challenge in scaling the 1inch token is ensuring widespread adoption among users and sufficient liquidity in the market. Without a vibrant and active user base, the token’s value and utility may be limited. This requires implementing effective marketing strategies, partnerships, and incentive programs to attract and retain users.

Furthermore, establishing liquidity pools and developing strategic partnerships with other decentralized exchanges (DEXs) and liquidity providers will be critical in ensuring that users have access to liquid markets for trading the 1inch token. Lack of liquidity can hinder the token’s growth and its ability to scale effectively.

4. Regulatory compliance

Complying with regulatory requirements is another challenge in scaling the 1inch token. As the token attracts more attention and gains wider adoption, it may come under increased scrutiny from regulatory authorities. Ensuring compliance with applicable laws and regulations will be crucial to avoid legal and regulatory issues that could hinder its growth and adoption.

| Challenges | Solutions |

|---|---|

| Network congestion | Implementing scalability solutions, such as layer-two protocols or sharding, to improve transaction throughput and reduce congestion. |

| Security and performance | Regularly auditing smart contracts, implementing robust security measures, and enhancing the token’s infrastructure to handle increased demand. |

| User adoption and liquidity | Implementing effective marketing strategies, partnerships, incentive programs, and establishing liquidity pools to attract and retain users. |

| Regulatory compliance | Ensuring compliance with relevant laws and regulations to avoid legal and regulatory issues that could hinder growth and adoption. |

Opportunities in scaling the 1inch token

The 1inch token has gained significant popularity and adoption in the decentralized finance (DeFi) space. As its user base continues to grow, there are several opportunities that can arise from scaling the 1inch token.

1. Enhanced liquidity: Scaling the 1inch token can lead to increased liquidity across various decentralized exchanges (DEXs). This would allow users to seamlessly trade the token across different platforms, resulting in lower slippage and improved trading experiences.

2. Expanded use cases: By scaling the 1inch token, the range of use cases can be expanded. With increased scalability, the token can be utilized in a wider range of DeFi applications, such as lending, yield farming, and decentralized governance. This would create more opportunities for token holders to engage and participate in the 1inch ecosystem.

3. Global accessibility: Scaling the 1inch token can enable global accessibility, allowing users from different parts of the world to easily access and use the token. This can lead to increased adoption and participation from a diverse range of users, contributing to the overall growth and success of the 1inch ecosystem.

4. Lower transaction costs: As the 1inch token scales, transaction costs can potentially be reduced. With increased scalability, the network can handle a higher volume of transactions, resulting in lower fees for users. This would make it more cost-effective for users to interact with the 1inch token and participate in the decentralized finance space.

5. Partnerships and collaborations: Scaling the 1inch token can open up opportunities for partnerships and collaborations with other projects and platforms in the DeFi space. This can result in synergistic collaborations, where the strengths of different platforms can be combined to create innovative solutions and services for users.

Overall, scaling the 1inch token presents numerous opportunities for improved liquidity, expanded use cases, global accessibility, lower transaction costs, and partnerships. By harnessing these opportunities, the 1inch token can continue to grow and play a significant role in the evolving DeFi landscape.

The future of scaling the 1inch token

The 1inch token has gained significant traction and popularity since its inception. As the decentralized finance (DeFi) space continues to grow, the challenges and opportunities of scaling the 1inch token become increasingly important. In this article, we will explore the future of scaling the 1inch token and how it can continue to thrive in the ever-changing landscape of DeFi.

The Importance of Scaling

Scaling is crucial for the long-term success and sustainability of the 1inch token. As more users and transactions join the network, scalability becomes a pressing issue. The ability to handle large volumes of transactions quickly and efficiently is essential for providing a smooth user experience and keeping transaction fees low.

1inch recognizes the significance of scaling and has been actively exploring various solutions to address this challenge. One of the most promising approaches is layer 2 scaling.

Layer 2 Scaling Solutions

Layer 2 scaling solutions aim to alleviate the scalability issues faced by decentralized networks like Ethereum. These solutions involve taking some of the transaction processing off the main Ethereum chain, thus reducing congestion and improving transaction speeds.

1inch has been partnering with leading layer 2 solutions such as Optimism and Arbitrum to explore the potential of integrating their technology. These layer 2 solutions can significantly enhance the scalability of the 1inch token, allowing it to handle a larger volume of transactions without sacrificing speed or security.

By leveraging layer 2 solutions, 1inch can unlock new opportunities for its users. Lower transaction fees and faster transaction speeds will make the 1inch token even more attractive to DeFi users, fostering greater adoption and usage.

The Future of Scaling

The future of scaling the 1inch token looks promising. With continued developments in layer 2 solutions and collaborations with industry leaders, 1inch is well-positioned to overcome the scalability challenges and seize the opportunities presented in the DeFi space.

Moreover, the 1inch team remains committed to ongoing research and development to ensure that the token can adapt and evolve with the growing demands of the DeFi ecosystem. By staying at the forefront of technological advancements and collaborating with innovative projects, 1inch can continue to scale effectively and provide a seamless experience for its users.

In conclusion, scaling the 1inch token is vital for its long-term success. By embracing layer 2 solutions and remaining proactive in addressing scalability challenges, 1inch can cement its position as a leading player in the DeFi space. The future looks promising for the 1inch token as it continues to scale and unlock new possibilities for users.

Question-answer:

What is the current price of the 1inch token and how has it changed recently?

The current price of the 1inch token is $4.20. Over the past month, it has experienced significant volatility, reaching a high of $6.50 and a low of $3.60.

How does scaling the 1inch token present both challenges and opportunities?

Scaling the 1inch token presents challenges in terms of maintaining network stability and preventing congestion. However, it also presents opportunities for increased liquidity and improved user experience.

What steps is the 1inch team taking to address the challenges of scaling the token?

The 1inch team is actively working on implementing layer 2 scaling solutions, such as Ethereum’s Optimistic Rollups and other sidechains. They are also exploring collaborations with other protocols to enhance scalability.

How does the scalability of the 1inch token affect its potential for adoption and growth?

The scalability of the 1inch token directly impacts its potential for adoption and growth. If the token can handle a larger number of transactions with lower fees, it will attract more users and contribute to its overall success.

Are there any other factors besides scalability that could impact the growth of the 1inch token?

Yes, besides scalability, factors such as market demand, competition, regulatory clarity, and technological advancements in the decentralized finance (DeFi) space can also significantly impact the growth of the 1inch token.