Welcome to the world of decentralized finance, where the possibilities are endless and the potential for growth is immense. In this rapidly evolving landscape, 1inch crypto protocol has emerged as a game-changer, revolutionizing the way we trade and exchange digital assets.

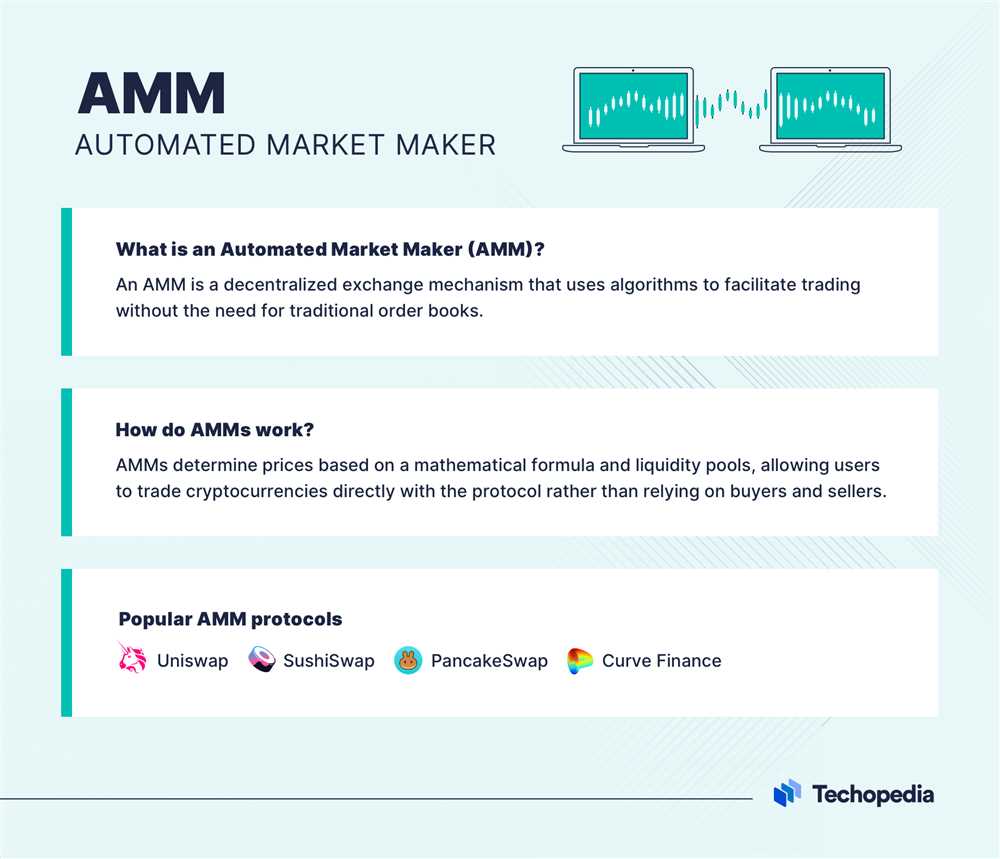

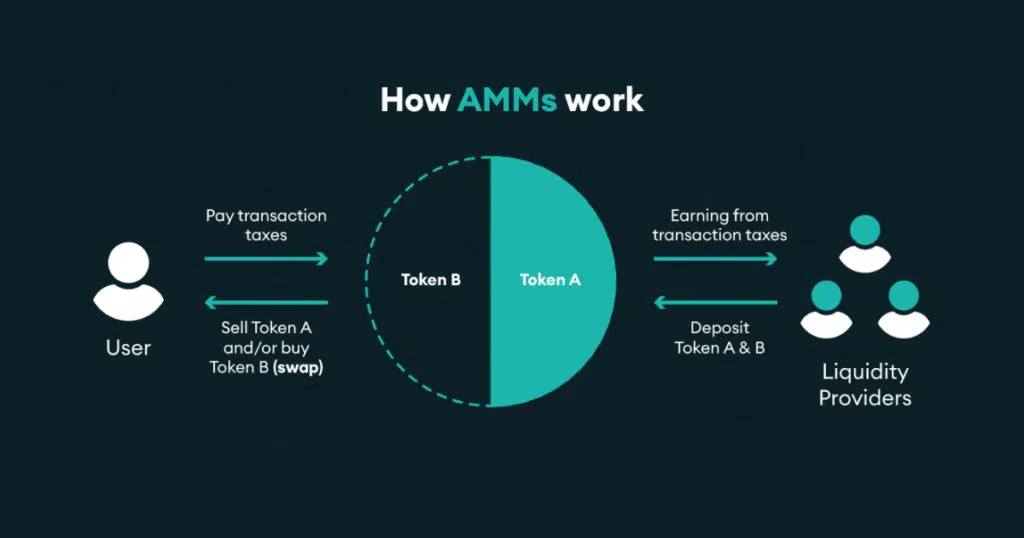

At the heart of this revolutionary protocol are automated market makers (AMMs), which play a crucial role in ensuring liquidity and efficiency in the decentralized marketplace. Unlike traditional markets, where liquidity is typically provided by centralized exchanges, AMMs operate on a decentralized network, allowing traders to swap tokens directly from their wallets.

One of the key advantages of AMMs is their ability to eliminate the need for order books and intermediaries, resulting in faster and more cost-effective transactions. By leveraging smart contracts and algorithmic pricing models, AMMs ensure that trades are executed seamlessly, while minimizing the impact of slippage.

1inch crypto protocol has taken the concept of AMMs to the next level, combining them with intelligent routing algorithms to deliver the best possible prices for users. With 1inch, you can be confident that you are always getting the most competitive rates by accessing multiple liquidity sources simultaneously.

Whether you are a seasoned trader looking to optimize your trading strategy or a new entrant in the world of decentralized finance, 1inch crypto protocol and its automated market makers are here to level the playing field and empower you to take control of your financial future.

Join us on this exciting journey and discover the limitless possibilities of decentralized trading with 1inch crypto protocol.

The role of automated market makers

Automated market makers (AMMs) play a crucial role in the world of decentralized finance (DeFi) and are an essential component of the 1inch crypto protocol.

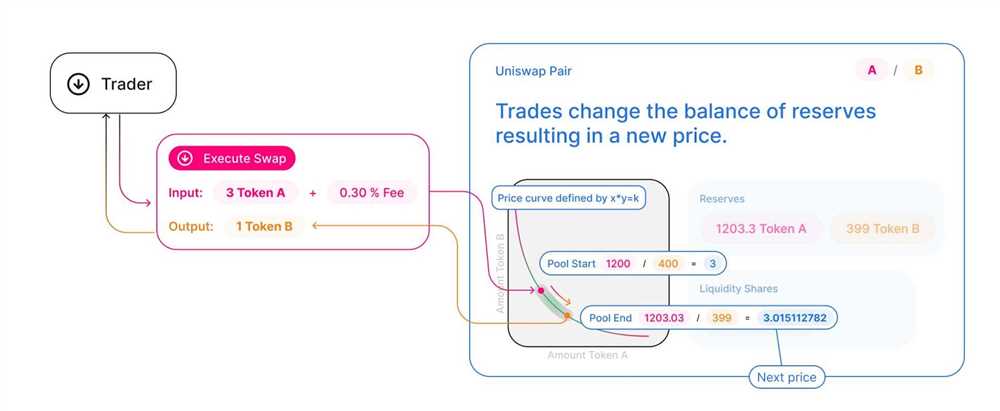

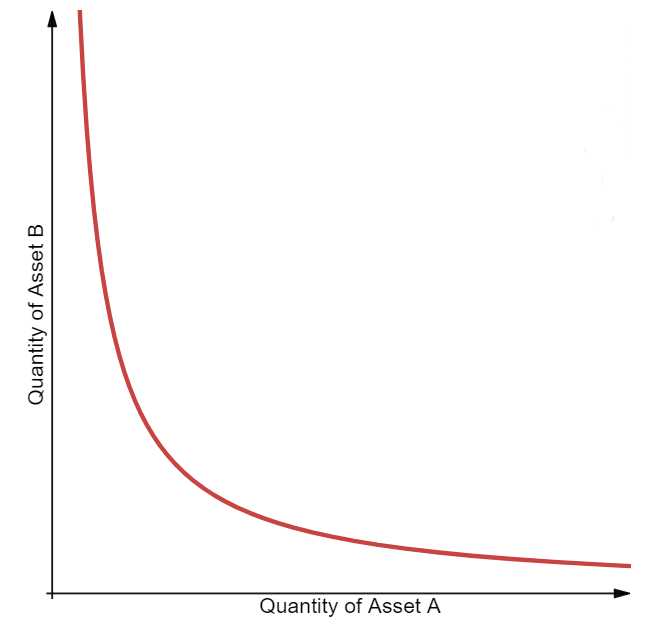

AMMs are smart contracts that enable the creation of liquidity pools, allowing users to trade assets without relying on traditional order books. These pools are filled with pairs of assets, and the prices are determined by algorithms rather than supply and demand.

One of the primary benefits of AMMs is their ability to provide liquidity for otherwise illiquid assets. By incentivizing liquidity providers to deposit their assets into the pools, AMMs ensure that traders can always execute trades at a fair price without worrying about low trading volumes.

AMMs also play a vital role in reducing slippage, which refers to the difference between the expected price and the executed price of a trade. With traditional order book exchanges, large trades can lead to significant price slippage, but AMMs use algorithms to ensure that the price impact is minimal.

Furthermore, AMMs are accessible to anyone with an internet connection, allowing for broader participation in the financial markets. Traditional financial institutions often have high barriers to entry, making it difficult for individuals with limited resources to participate. AMMs democratize finance by enabling anyone to become a liquidity provider or trader.

The 1inch crypto protocol utilizes AMMs to provide users with the best possible trading experience. By aggregating liquidity from multiple sources, 1inch ensures that users can find the most favorable prices for their trades. The platform intelligently routes trades across different pools to minimize slippage and optimize trading outcomes.

In conclusion, automated market makers have revolutionized the DeFi space by providing liquidity, reducing slippage, and enabling broader participation in the financial markets. The 1inch crypto protocol leverages the power of AMMs to optimize trading and create a seamless experience for its users.

in 1inch crypto protocol

The 1inch crypto protocol is a revolutionary decentralized exchange aggregator that allows users to swap tokens across multiple liquidity pools with optimal efficiency and low slippage. One of the key components of the 1inch protocol are automated market makers (AMMs).

What are automated market makers?

Automated market makers are smart contracts that provide liquidity for decentralized exchanges. They are designed to replace traditional order books with algorithmically determined prices, eliminating the need for buyers and sellers to interact directly.

In the 1inch crypto protocol, automated market makers play a crucial role in ensuring liquidity and seamless token swaps. They achieve this by maintaining a pool of tokens that can be exchanged using predefined formulas based on the ratio of the tokens in the pool.

The benefits of automated market makers

Automated market makers offer several advantages compared to traditional order book-based exchanges:

1. Continuous liquidity: Unlike order book exchanges that require matching buyers and sellers, automated market makers always provide liquidity, ensuring that trades can be executed at any time.

2. Low slippage: Automated market makers minimize slippage by adjusting token prices based on the demand and supply in the liquidity pool. This ensures that users get the best possible exchange rates for their tokens.

3. No reliance on intermediaries: Automated market makers operate on a decentralized network, removing the need for intermediaries and ensuring that trades are executed peer-to-peer without any third-party involvement.

Overall, automated market makers are an essential component of the 1inch crypto protocol, enabling fast, seamless, and cost-effective token swapping across various liquidity pools.

Benefits for liquidity providers

Automated market makers (AMMs) play a crucial role in the 1inch crypto protocol and provide several benefits for liquidity providers. By participating in liquidity provision, individuals can enjoy the following advantages:

- High returns: Liquidity providers on the 1inch crypto protocol have the opportunity to earn high returns on their investment. As AMMs automatically adjust token prices based on supply and demand, liquidity providers can benefit from arbitrage opportunities and receive trading fees.

- Constant passive income: By supplying liquidity to the protocol, individuals can generate a constant passive income stream. As long as their funds remain in the liquidity pool, they will continue to earn a share of trading fees.

- Reduced impermanent loss: Unlike traditional exchanges, AMMs can help mitigate impermanent loss for liquidity providers. Impermanent loss occurs when the value of tokens within a liquidity pool fluctuates compared to holding the same tokens individually. With 1inch’s automated market makers, the risk of impermanent loss is reduced.

- Diversification: Liquidity providers can diversify their portfolios by supplying liquidity to different token pairs on the 1inch crypto protocol. This allows them to have exposure to multiple assets and potentially reduce risks associated with holding a single token.

- Efficient capital allocation: 1inch’s automated market makers provide liquidity providers with the ability to efficiently allocate their capital. By supplying liquidity to the protocol, individuals can ensure that their funds are being put to work and generating returns, rather than sitting idle.

In summary, participating as a liquidity provider in the 1inch crypto protocol offers various benefits ranging from high returns and constant passive income to reduced impermanent loss and efficient capital allocation. With its automated market makers, 1inch provides a platform that empowers individuals to maximize their earnings and optimize their capital utilization.

Advantages of 1inch over traditional exchanges

When it comes to trading cryptocurrencies, 1inch offers a number of advantages over traditional exchanges. Here are some of the key benefits that set 1inch apart:

1. Enhanced liquidity

1inch leverages the power of automated market makers (AMMs) to provide users with enhanced liquidity. Unlike traditional exchanges that rely on order books, 1inch utilizes AMMs to pool liquidity from various decentralized exchanges. This allows traders on 1inch to enjoy better liquidity, reduced slippage, and improved pricing.

2. Lower fees

Compared to traditional exchanges, 1inch offers lower fees for trading. By aggregating liquidity from multiple decentralized exchanges, 1inch is able to provide users with access to the best available prices and lower trading fees. This can result in significant cost savings for traders.

3. Improved privacy

1inch prioritizes user privacy and security. Unlike traditional exchanges that require users to create accounts and provide personal information, 1inch allows users to trade cryptocurrencies without the need for registration. This helps to protect user privacy and eliminates the risk of personal data being compromised.

4. Faster execution

1inch’s decentralized infrastructure enables faster order execution compared to traditional exchanges. Utilizing smart contracts and AMMs, 1inch eliminates the need for intermediaries and allows for direct peer-to-peer trading. This results in faster trade settlements and reduces the risk of order delays or failures.

In conclusion, 1inch offers a range of advantages over traditional exchanges, including enhanced liquidity, lower fees, improved privacy, and faster execution. These benefits make 1inch a compelling choice for cryptocurrency traders looking for a more efficient and user-friendly trading experience.

The future of decentralized finance

The rise of decentralized finance (DeFi) has unleashed a new era of financial innovation, revolutionizing the way we interact with money and traditional systems. As decentralized technologies continue to evolve, the future of finance is set to be fully decentralized.

Decentralized finance offers a range of advantages over traditional systems. With no intermediaries, transactions can be executed peer-to-peer, eliminating the need for middlemen and reducing costs. Smart contracts enable automation and transparency, ensuring that all transactions are executed as agreed upon.

One of the key elements driving the future of decentralized finance is the rise of automated market makers (AMMs). AMMs are smart contracts that act as liquidity pools, enabling users to trade directly from their wallets. These market makers are designed to provide liquidity and facilitate trading without the need for a traditional order book.

The role of automated market makers in the 1inch crypto protocol is a prime example of the future of DeFi. The 1inch protocol utilizes AMMs to split trades across multiple decentralized exchanges, ensuring the best possible prices and minimizing slippage. With the ability to automatically swap tokens at the best rates, users can optimize their trading strategies and maximize their returns.

Looking ahead, the future of decentralized finance holds immense potential. Improved scalability and interoperability will enable seamless integration with existing financial systems, allowing for greater adoption and participation. The use of blockchain technology and decentralized protocols will also pave the way for new financial products and services.

Furthermore, decentralized finance has the power to empower individuals, particularly those who have limited access to traditional financial services. By eliminating third parties and enabling direct ownership, DeFi can bridge the global financial gap and empower individuals to take control of their own financial future.

| Benefits of decentralized finance: | Rise of automated market makers |

|---|---|

| – Lower costs | – Optimize trading strategies |

| – Peer-to-peer transactions | – Minimize slippage |

| – Automation and transparency | – Split trades across decentralized exchanges |

| – Empowerment and accessibility | – Ensure best possible prices |

Question-answer:

What is an automated market maker?

An automated market maker (AMM) is a type of decentralized exchange protocol that uses smart contracts to create liquidity and facilitate trades without the need for traditional order books.

How does the 1inch crypto protocol use automated market makers?

The 1inch crypto protocol uses automated market makers to aggregate liquidity from various decentralized exchanges and provide users with the best possible trading rates for their transactions.

What are the benefits of using automated market makers in the 1inch crypto protocol?

Using automated market makers in the 1inch crypto protocol allows for increased liquidity, lower slippage rates, and the ability to find the best trading rates across multiple decentralized exchanges.

Can I provide liquidity to the automated market makers in the 1inch crypto protocol?

Yes, you can provide liquidity to the automated market makers in the 1inch crypto protocol by depositing your tokens into the liquidity pools associated with the protocol. In return, you will earn a share of the trading fees generated by the protocol.

Are there any risks involved in using the automated market makers in the 1inch crypto protocol?

While the automated market makers in the 1inch crypto protocol are designed to provide efficient and secure trading experiences, there are still risks inherent in the volatile nature of cryptocurrency markets. It is important to understand these risks and exercise caution when using the protocol.