1inch Fusion’s Aggregation Algorithm is a cutting-edge technology that revolutionizes the way decentralized exchanges operate. By combining and optimizing liquidity across multiple platforms, 1inch Fusion provides users with the best possible rates for their trades. This comprehensive overview will delve into the inner workings of the algorithm and explore how it achieves such impressive results.

The algorithm behind 1inch Fusion is designed to source liquidity from multiple decentralized exchanges and aggregate it into a single pool. This allows users to access a much larger pool of liquidity, resulting in better rates and reduced slippage. By intelligently routing trades through the most favorable paths, the algorithm ensures that users get the best possible outcome for their trades.

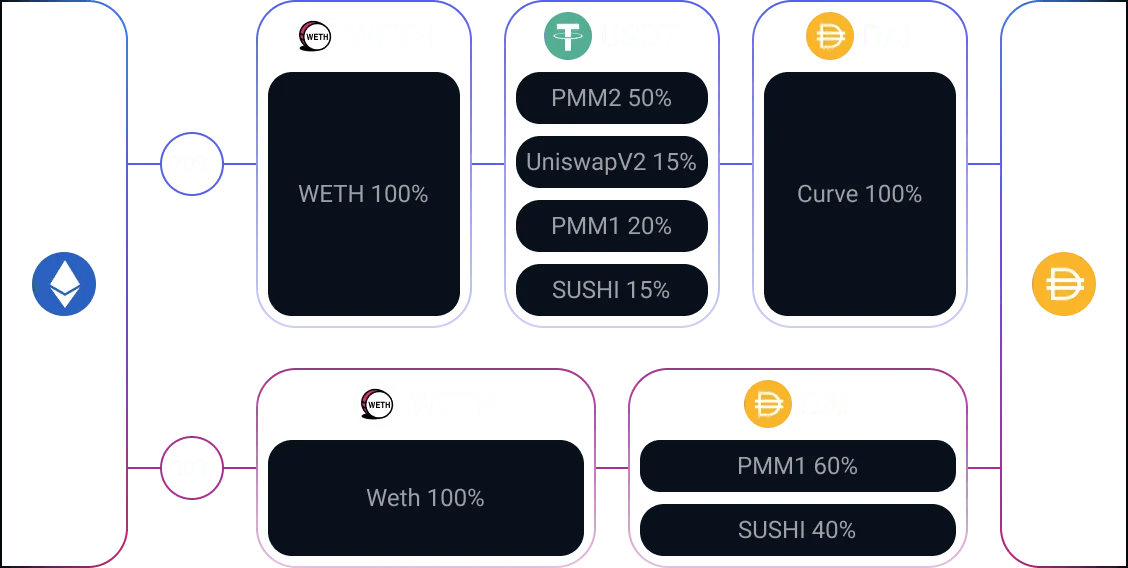

One of the key strengths of 1inch Fusion’s aggregation algorithm is its ability to split trades across multiple decentralized exchanges. By doing so, the algorithm minimizes the impact of large trades on the market and prevents significant price slippage. This approach not only benefits individual users but also helps to create a healthier and more efficient decentralized exchange ecosystem.

The 1inch Fusion algorithm leverages a variety of smart contracts and data analysis techniques to achieve optimal results. By constantly monitoring market conditions and liquidity availability, the algorithm is able to adapt and respond to changing market dynamics in real-time. This ensures that users always benefit from the best possible rates, regardless of market fluctuations.

Understanding 1inch Fusion’s Aggregation Process

1inch Fusion is a cutting-edge aggregation algorithm that is designed to provide users with the most optimal routes for executing trades across multiple decentralized exchanges (DEXs). This highly sophisticated algorithm takes into consideration various factors such as liquidity, fees, and slippage to ensure that users get the best possible prices for their trades.

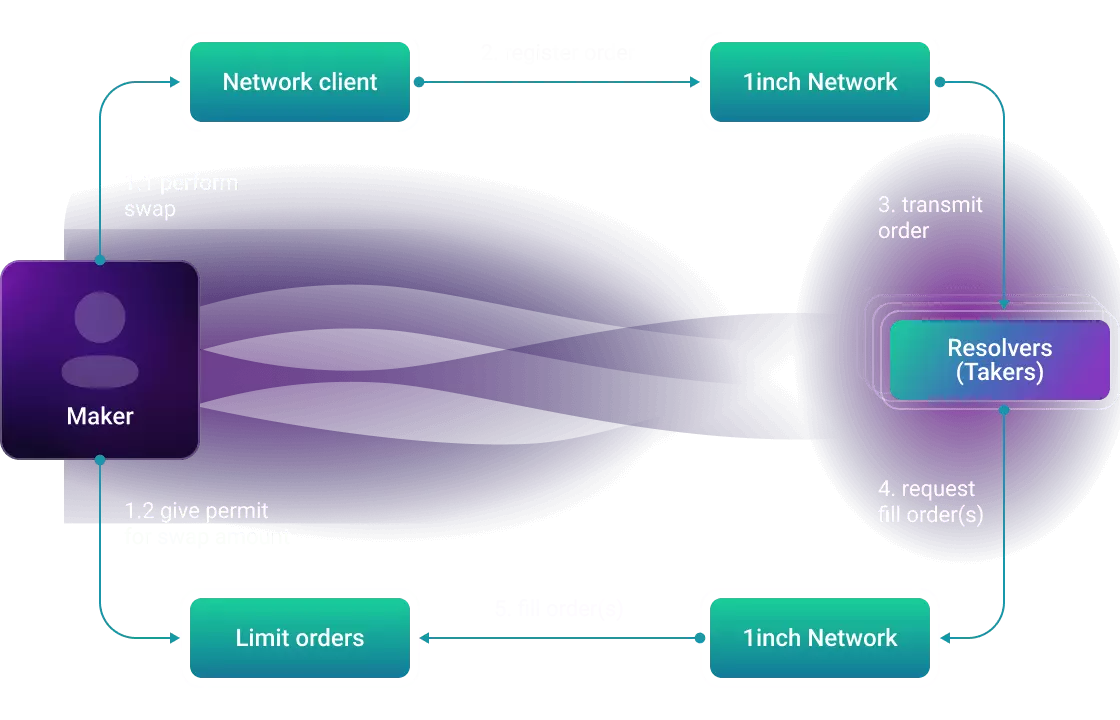

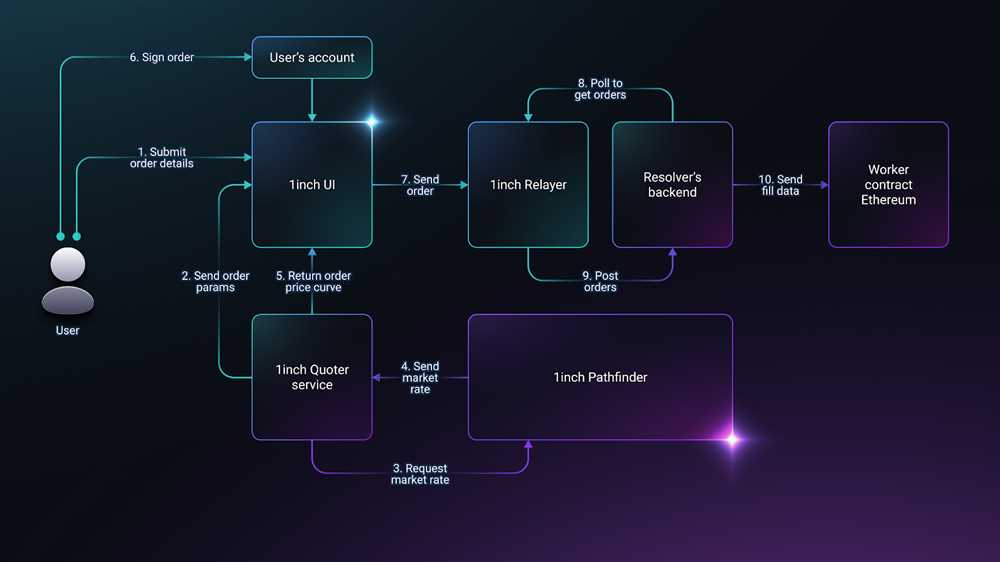

The aggregation process starts with the user inputting their desired trade parameters, such as the token they want to trade, the amount they want to trade, and the desired output token. Once the input is received, 1inch Fusion begins its search for the most favorable routes.

Smart Contract Decisions

1inch Fusion starts by identifying all the decentralized exchanges that support the desired trade pair. It then compares various parameters of these exchanges such as liquidity, trading volume, and fees to determine which exchanges offer the best conditions for executing the trade.

Once the most suitable exchanges are identified, 1inch Fusion analyzes their liquidity pools to determine the best splitting ratio. This means that if there are multiple routes available for executing the trade, 1inch Fusion calculates the optimal distribution of the trade volume across these routes to minimize slippage and maximize the user’s profit.

Optimizing Trade Execution

After determining the best splitting ratio, 1inch Fusion creates and executes a series of transactions across multiple exchanges to complete the trade. This process involves accessing the liquidity pools of the selected exchanges and executing the trades in the most efficient manner.

By using 1inch Fusion, users can take advantage of the aggregated liquidity from multiple DEXs, which can result in better pricing and improved trade execution. The algorithm constantly monitors the market conditions and adjusts the trade execution strategy in real-time to ensure that users get the best possible outcomes for their trades.

In conclusion, 1inch Fusion’s aggregation process combines advanced algorithms with real-time market data to provide users with the most optimal routes and prices for executing trades across decentralized exchanges. By utilizing this innovative aggregation algorithm, users can enhance their trading experiences and achieve better outcomes for their trades.

The Benefits of 1inch Fusion’s Aggregation Algorithm

1inch Fusion’s aggregation algorithm brings several key benefits that make it a powerful tool in the DeFi space. By utilizing this algorithm, users can enjoy:

1. Improved Liquidity

1inch Fusion’s aggregation algorithm combines multiple liquidity sources to provide users with the best possible rates. This helps to ensure that users can access the liquidity they need without experiencing slippage or high fees. By tapping into a wide range of liquidity pools, the algorithm maximizes the available liquidity and improves the overall trading experience.

2. Reduced Transaction Costs

With 1inch Fusion’s aggregation algorithm, users can minimize transaction costs by finding the most cost-effective routes for their trades. The algorithm intelligently analyzes different liquidity sources and suggests the optimal path to execute a trade with the lowest fees. This not only saves users money but also enables them to optimize their trading strategies and maximize their returns.

3. Price Improvement

The aggregation algorithm also offers price improvement opportunities. By splitting large orders into smaller pieces and routing them through various liquidity sources, the algorithm can potentially achieve better prices for users. This means that users can get more favorable rates compared to executing large trades directly on a single exchange. The algorithm ensures that traders can take advantage of price fluctuations and maximize their trading profits.

4. Access to Multiple Liquidity Sources

With 1inch Fusion’s aggregation algorithm, users gain access to a wide range of liquidity sources, including decentralized exchanges (DEXs) and centralized exchanges (CEXs). This allows users to tap into a diverse and extensive network of liquidity, ensuring that they can trade a wide range of assets at any time. The algorithm aggregates the liquidity from these various sources, enabling users to enjoy a seamless and integrated trading experience.

5. Efficient Trade Execution

1inch Fusion’s aggregation algorithm is designed to ensure that trades are executed quickly and efficiently. By leveraging its intelligent routing mechanism, the algorithm minimizes slippage and maximizes trade execution speed. This helps users to capitalize on market opportunities and ensures that their trades are executed within the optimal time frame. The algorithm’s efficiency is essential for traders who require fast and reliable execution to stay ahead in the rapidly evolving DeFi market.

In conclusion, 1inch Fusion’s aggregation algorithm provides a range of benefits that enhance liquidity, minimize transaction costs, improve prices, expand access to liquidity sources, and enable efficient trade execution. This algorithm empowers users to create a more seamless and profitable trading experience, making it a valuable tool in the DeFi ecosystem.

Implementing 1inch Fusion’s Aggregation Algorithm

Implementing 1inch Fusion’s aggregation algorithm involves several key steps. First, the algorithm gathers information about the available liquidity across multiple decentralized exchanges (DEXs).

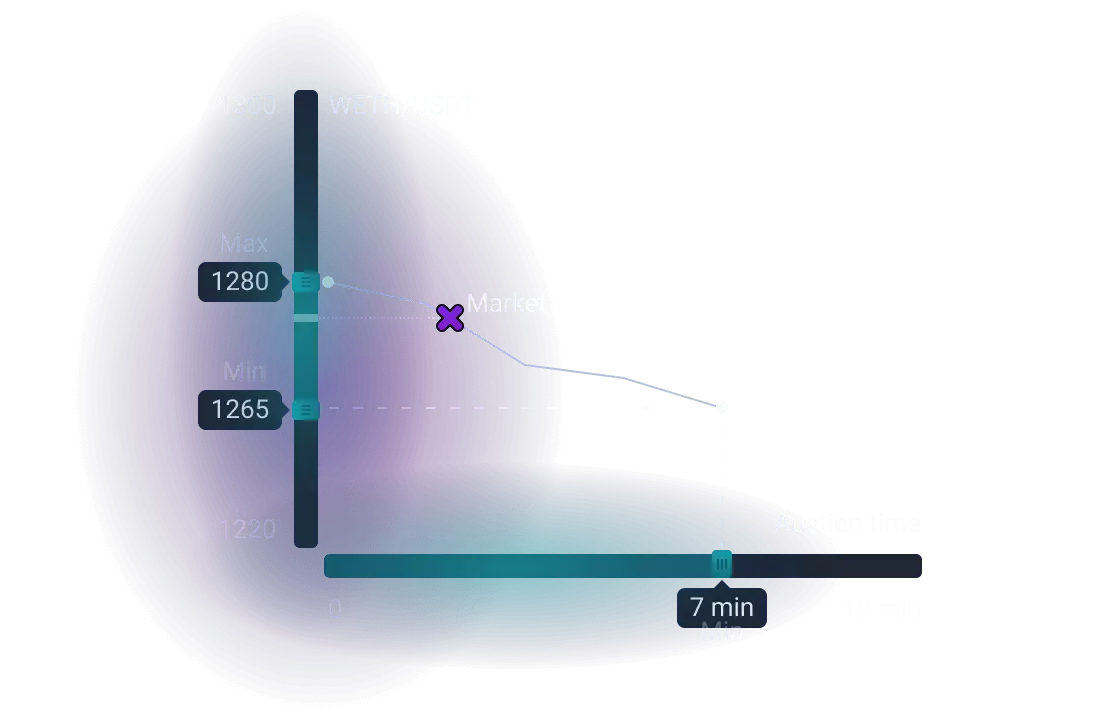

Next, it analyzes the liquidity data to identify the most optimal route for executing the user’s trade. This involves considering factors such as the asset pair being traded, the available liquidity for each pair, and the associated costs and slippage.

The algorithm then splits the trade across multiple DEXs to maximize the chances of getting the best possible price. This is done by dividing the user’s trade into smaller orders that can be executed across different DEXs simultaneously.

Furthermore, the algorithm considers gas fees and transaction costs associated with executing trades on different DEXs. It calculates the most cost-efficient way to execute the trade while taking into account these additional expenses.

1inch Fusion’s aggregation algorithm also incorporates user-defined preferences and settings. Users have the ability to set parameters such as the maximum allowable slippage or the preferred DEXs to be considered for executing the trade.

The algorithm continuously monitors market conditions and adjusts the execution strategy in real-time. This ensures that the trade is executed at the most advantageous prices available at any given moment.

Finally, the algorithm tracks and records the results of each trade executed using the aggregation algorithm. This allows users to review and analyze their trading history and assess the effectiveness of the aggregation algorithm in achieving their desired outcomes.

In conclusion, implementing 1inch Fusion’s aggregation algorithm involves gathering liquidity data, analyzing market conditions, splitting trades across multiple DEXs, considering gas fees and transaction costs, incorporating user-defined preferences, and continuously monitoring and adjusting the execution strategy. This comprehensive approach aims to provide users with the best possible trade execution experience in the decentralized finance (DeFi) ecosystem.

Question-answer:

What is 1inch Fusion?

1inch Fusion is an algorithm that combines the liquidity of multiple decentralized exchanges (DEXs) into one platform, giving users access to the best prices and lowest slippages.

How does 1inch Fusion work?

1inch Fusion works by splitting a user’s swap transaction into multiple parts and executing them on different DEXs to get the best possible price. It uses intelligent routing algorithms to determine the optimal distribution of the swap across different liquidity sources.

Why is aggregation important in decentralized trading?

Aggregation is important in decentralized trading because it allows users to access liquidity from multiple DEXs, which helps to increase the depth of the order book and minimize price slippage. It also helps users to find the best available price across different platforms.

What are the benefits of using 1inch Fusion?

Using 1inch Fusion has several benefits. It allows users to get the best possible price for their trades by aggregating liquidity from multiple DEXs. It also helps users to save on gas fees by splitting transactions and executing them on the most cost-effective DEXs. Additionally, it reduces the time and effort required for manually searching and executing trades on different platforms.