Getting Started with 1inch Finance: A Comprehensive Guide to Utilizing DeFi Applications

Welcome to the exciting world of decentralized finance (DeFi)! If you’re new to the concept, don’t worry – we’re here to help you get started. In this guide, we’ll walk you through the basics of using 1inch Finance, a popular DeFi aggregator, in various DeFi applications.

DeFi applications allow users to access financial services in a decentralized manner, meaning there is no need for intermediaries like banks or traditional financial institutions. Instead, users can directly interact with smart contracts on the blockchain. 1inch Finance is an aggregator that helps users find the most efficient paths for executing trades across various decentralized exchanges (DEXs).

When using 1inch Finance, you’ll be able to take advantage of its powerful algorithm that splits your trade across multiple DEXs to optimize for the best prices. This can potentially save you money and improve your overall trading experience. Whether you’re a beginner or an experienced trader, 1inch Finance offers a user-friendly interface that makes it easy to navigate and execute trades with confidence.

Throughout this guide, we’ll cover the steps to connect your wallet to 1inch Finance, explore the various features and options available, and walk you through an example trade. By the end, you’ll have a solid understanding of how to use 1inch Finance in your DeFi applications and take advantage of its benefits. Let’s get started!

Understanding 1inch Finance in DeFi Applications

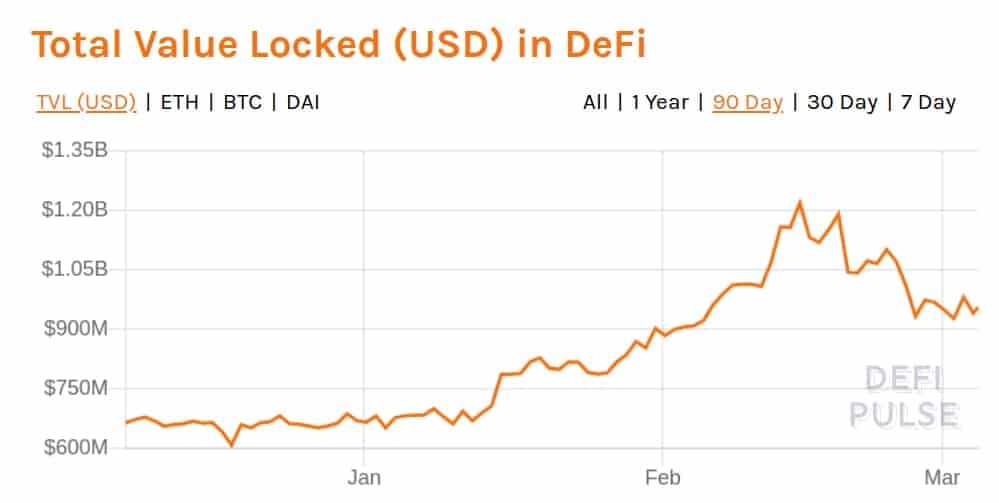

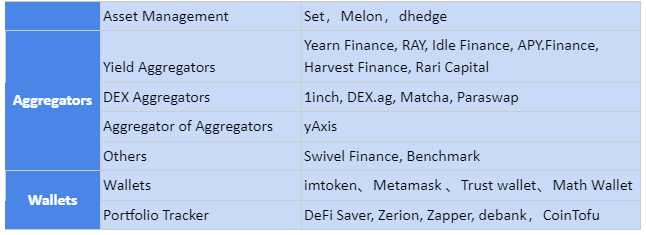

DeFi, or decentralized finance, has gained significant popularity in recent years as a way to bring traditional financial services onto the blockchain. One of the key players in the DeFi space is 1inch Finance, which offers a decentralized exchange (DEX) aggregator and other innovative DeFi solutions.

1inch Finance is designed to solve one of the biggest challenges in DeFi – liquidity fragmentation. In DeFi, liquidity is spread across multiple DEXs, and it can be difficult for traders to find the best prices and execute trades efficiently. 1inch Finance addresses this issue by aggregating liquidity from various DEXs and routing trades through the most optimal path.

Through its smart contract technology, 1inch Finance searches for the best prices across multiple liquidity sources, including popular DEXs like Uniswap, SushiSwap, and Curve. By splitting the order into smaller parts and executing them on different DEXs, 1inch Finance ensures that traders always get the best possible prices.

1inch Finance also provides additional benefits to traders, such as low slippage and reduced fees. By tapping into multiple liquidity pools, 1inch Finance minimizes slippage, which is the difference between the expected price and the actual executed price. In addition, 1inch Finance offers its own token, 1INCH, which can be used to reduce trading fees on the platform.

Another innovative feature of 1inch Finance is its Pathfinder algorithm. This algorithm dynamically selects the most cost-effective route for each trade, taking into account parameters like gas prices and liquidity pools’ depths. By optimizing the trading path in real-time, 1inch Finance ensures that traders are always getting the best possible outcomes.

1inch Finance has become a popular choice for traders and liquidity providers in the DeFi space due to its user-friendly interface and advanced features. Its easy-to-use platform allows traders to access multiple DEXs and execute trades with just a few clicks. Furthermore, 1inch Finance offers various DeFi tools, such as yield farming and staking, allowing users to maximize their returns on their assets.

In conclusion, 1inch Finance is a powerful tool for traders and liquidity providers in the DeFi space. By aggregating liquidity, reducing slippage, and optimizing trading paths, 1inch Finance enhances the trading experience and provides users with the best possible outcomes. As DeFi continues to evolve, 1inch Finance will likely play a significant role in shaping the future of decentralized finance.

What is 1inch Finance?

1inch Finance is a decentralized finance (DeFi) platform that is designed to optimize trading on decentralized exchanges (DEXs). It is best known for its automated market maker (AMM) aggregator, which helps users find the most efficient routes for token swaps across multiple DEXs.

With 1inch Finance, users can access liquidity from various DEXs, including popular platforms such as Uniswap, SushiSwap, and Balancer, all from a single interface. This allows users to save on gas fees and slippage, as well as obtain the best possible prices for their trades.

The 1inch aggregation protocol splits orders across different DEXs to minimize price impact and optimize trading opportunities. It achieves this by taking into account factors such as exchange rates, gas fees, and liquidity pools. By offering a streamlined trading experience, 1inch Finance aims to make DeFi more accessible and user-friendly.

In addition to its AMM aggregator, 1inch Finance also offers other innovative features, such as yield farming, staking, and governance. These features allow users to earn passive income by providing liquidity to DEXs and participating in the platform’s governance decisions.

Overall, 1inch Finance is a powerful tool for traders and liquidity providers in the DeFi ecosystem. It enables users to make the most of their assets by leveraging the benefits of multiple DEXs, all while optimizing their trading strategies and maximizing their potential returns.

Getting Started with 1inch Finance

1inch Finance is a decentralized exchange aggregator that sources liquidity from various exchanges to provide users with the best possible trading rates. By using 1inch Finance, you can access multiple decentralized exchanges in one platform, saving you time and effort.

Step 1: Set up a Wallet

To get started with 1inch Finance, you’ll need a wallet that supports decentralized applications (DApps). Popular options include MetaMask, Trust Wallet, and Coinbase Wallet. Set up your preferred wallet and make sure you have some cryptocurrency funds in it.

Step 2: Connect Your Wallet

Once you have a wallet set up, visit the 1inch Finance website and connect your wallet to the platform. This will allow you to access your funds and perform transactions on the platform. Follow the instructions provided by your wallet provider to connect your wallet securely.

Step 3: Explore Trading Options

Now that your wallet is connected, you can start exploring the trading options available on 1inch Finance. The platform will display a list of supported tokens and their current rates. You can search for specific tokens or browse the available options.

Step 4: Compare and Swap Tokens

When you find a token you want to trade, 1inch Finance will compare the rates across different decentralized exchanges and recommend the best option for you. You can then choose to swap your tokens at the suggested exchange and receive the best possible rate.

Step 5: Review and Confirm

Before finalizing the transaction, review the details provided by 1inch Finance and ensure that everything is correct. Check the token amounts, fees, and destination address. Once you’re satisfied, confirm the transaction and wait for it to be processed on the blockchain.

With these simple steps, you can get started with 1inch Finance and take advantage of its decentralized exchange aggregation capabilities. Remember to do your own research and assess the risks involved in trading cryptocurrencies before making any transactions.

How to Set Up 1inch Finance?

If you’re new to 1inch Finance and want to take advantage of its features in DeFi applications, here’s a step-by-step guide on how to set it up:

Step 1: Connect Your Wallet

The first step to setting up 1inch Finance is to connect your wallet to the platform. 1inch Finance supports various wallets, including MetaMask, WalletConnect, and Coinbase Wallet. Simply click on the wallet icon, select your preferred wallet, and follow the instructions to connect it.

Step 2: Explore Available Services

Once you’ve connected your wallet, you’ll have access to a wide range of services offered by 1inch Finance. These services include swapping tokens, providing liquidity, earning interest, and more. Take some time to explore the platform and familiarize yourself with the different options available to you.

Step 3: Swap Tokens

If you want to swap tokens, 1inch Finance makes it easy. Click on the “Swap” button and enter the token you want to swap from and the token you want to swap to. You’ll be shown various liquidity sources and exchange rates to choose from. Once you’ve selected the desired options, click “Swap” to initiate the transaction.

Step 4: Provide Liquidity

If you’re interested in providing liquidity to decentralized exchanges, 1inch Finance offers a range of options. Click on the “Liquidity” tab and select the token pair you want to provide liquidity for. You’ll be shown the available pools and their respective APRs (Annual Percentage Rates). Choose the pool with the best rates and click “Add Liquidity” to provide your tokens.

Step 5: Earn Interest

Another feature of 1inch Finance is the ability to earn interest on your funds. Click on the “Earn” tab and choose the token you want to earn interest on. You’ll be shown various lending platforms and their respective interest rates. Select the platform with the desired rates and click “Deposit” to start earning interest.

Setting up 1inch Finance is a straightforward process that allows you to access a wide range of DeFi services. Whether you want to swap tokens, provide liquidity, or earn interest, 1inch Finance has you covered.

Using 1inch Finance in DeFi Applications

In the realm of decentralized finance (DeFi) applications, 1inch Finance has emerged as a leading platform for optimizing and executing trades across multiple decentralized exchanges (DEXs). With its innovative automated market maker (AMM) algorithm, 1inch Finance offers users the ability to access the best possible pricing and liquidity across various DEXs, saving both time and money.

To begin using 1inch Finance in your DeFi applications, you first need to integrate the protocol’s smart contract and API. The smart contract handles the execution of trades on behalf of users, while the API allows your application to interact with the 1inch Finance platform.

Integrating the Smart Contract

To integrate the 1inch Finance smart contract, you will need to deploy it on the Ethereum blockchain. The smart contract code is open source and available on GitHub, making it easily accessible for developers. Once deployed, you can interact with the smart contract by calling its functions to execute trades and perform other operations.

When integrating the 1inch Finance smart contract, it’s important to ensure that you handle the necessary security measures, such as input validation and protection against reentrancy attacks. These measures help to safeguard user funds and maintain the integrity of your application.

Using the API

The 1inch Finance API allows your application to query the platform for trade data, such as the best possible trades for a given token pair and the estimated gas costs. By leveraging the API, you can provide users with real-time trade insights and optimize their trading experience.

To use the 1inch Finance API, you will need to sign up for an API key on the 1inch Finance website. Once you have obtained your API key, you can make HTTP requests to the API endpoints to retrieve the desired trade data. The API documentation provides detailed information on the available endpoints and the required parameters.

| Endpoint | Description |

|---|---|

| /v1.5/quote | Retrieve the estimated quote for a trade |

| /v1.5/spender | Retrieve the address of the spender contract |

| /v1.5/tokens | Retrieve the list of supported tokens |

By integrating the 1inch Finance smart contract and utilizing the API, you can empower your DeFi applications with advanced trading capabilities. Whether you’re building a decentralized exchange, portfolio tracker, or other DeFi tool, incorporating 1inch Finance can enhance the user experience and provide access to the best possible liquidity in the DeFi ecosystem.

What Are the Benefits of Using 1inch Finance?

1inch Finance is a popular decentralized finance (DeFi) protocol that has gained a lot of attention in the crypto community. Here are some of the benefits of using 1inch Finance:

|

1. Enhanced Liquidity 1inch Finance uses an automated market-making (AMM) algorithm to aggregate liquidity from various decentralized exchanges. This helps in providing users with the best possible trading prices and improved liquidity. |

|

2. Cost-saving By leveraging the technology behind 1inch Finance, users can save on transaction fees by finding the most cost-efficient routes for executing their trades. The protocol automatically splits orders across different exchanges to minimize fees. |

|

3. Best Trade Execution 1inch Finance uses smart contract technology to execute trades. This ensures that trades are executed quickly and efficiently, providing users with the best possible results. |

|

4. Gas Optimization Gas fees can be a significant concern in the world of DeFi. 1inch Finance leverages advanced gas optimization techniques to minimize transaction costs and improve the overall user experience. |

|

5. Diverse Range of Supported Assets 1inch Finance supports a wide range of assets, including popular cryptocurrencies such as Ethereum (ETH) and Binance Coin (BNB), as well as various stablecoins. This allows users to access a diverse range of trading options. |

|

6. Non-Custodial Service 1inch Finance is a non-custodial platform, which means that users have complete control over their funds. Users’ assets remain in their own wallets, reducing the risk of hacks or thefts commonly associated with centralized exchanges. |

These are just some of the benefits of using 1inch Finance in DeFi applications. The protocol provides users with enhanced liquidity, cost-saving opportunities, efficient trade execution, gas optimization, a diverse range of supported assets, and the security of a non-custodial service.

Question-answer:

How does 1inch Finance work in DeFi applications?

1inch Finance is a decentralized exchange aggregator that sources liquidity from various decentralized exchanges and provides users with the best rates for their trades. It uses an algorithm that splits the transaction across different exchanges to ensure the best prices and minimize slippage. Users can connect their wallets to 1inch Finance and trade directly from their wallets.

What are the benefits of using 1inch Finance?

Using 1inch Finance has several benefits. First, it provides users with access to the best prices and liquidity across multiple decentralized exchanges, saving them money on their trades. Second, it allows users to make trades directly from their wallets, providing a seamless and secure user experience. Finally, 1inch Finance has low fees compared to traditional centralized exchanges, making it an attractive option for those looking to save on trading costs.

Can I use 1inch Finance to swap between different cryptocurrencies?

Yes, 1inch Finance allows users to swap between different cryptocurrencies. Users can select the input and output tokens they want to trade, and 1inch Finance will source the best rates from various decentralized exchanges to execute the trade. This makes it easy for users to quickly and efficiently trade between different cryptocurrencies without the need for multiple accounts on different exchanges.