Front-running, a common issue in decentralized exchanges (DEXs), occurs when a trader or a bot executes a transaction ahead of others to take advantage of the information they gather about the market. This unethical and unfair practice undermines the trust and integrity of the trading ecosystem, leading to significant financial losses for innocent participants.

1inch DEX, the decentralized exchange aggregator, has taken a proactive approach to combat front-running techniques and protect its users. With the aim of creating a fair and transparent trading environment, 1inch DEX has implemented several innovative mechanisms to deter front-runners and ensure that all traders have an equal opportunity to execute their transactions.

One of the key strategies employed by 1inch DEX is the use of automated market makers (AMMs) that provide liquidity for different tokens. By utilizing multiple AMMs simultaneously, 1inch DEX disperses its trades across various liquidity pools, making it harder for front-runners to predict and exploit these trades. This approach effectively reduces the impact of front-running, as it becomes more difficult for malicious actors to front-run a specific trade.

In addition to AMMs, 1inch DEX also implements various anti-front-running techniques such as slippage control and time-locking. Slippage control allows users to define the maximum price impact they are willing to accept, thereby limiting the front-running opportunities for attackers. Similarly, time-locking ensures that trade execution occurs after a predetermined time lapse, preventing front-runners from manipulating the market during the crucial moments of a trade.

Overall, 1inch DEX’s commitment to combat front-running techniques sets an example for other DEXs in the industry. By leveraging innovative mechanisms such as AMMs, slippage control, and time-locking, 1inch DEX creates a fair and level playing field for all traders. In doing so, it establishes trust and confidence in the decentralized trading ecosystem, ultimately benefiting the entire community of crypto traders.

Understanding Front-Running Techniques

Front-running refers to the practice of unethical traders who exploit their knowledge of pending large transactions to make personal gains. These traders typically gain advance access to pending trades and use that information to execute their own trades in such a way that they maximize their profits at the expense of other market participants.

There are several front-running techniques that traders may employ:

| Technique | Description |

|---|---|

| Time Delay | In this technique, the front-runner uses a computer program to identify pending trades and execute their own trades with a slight time delay. This delay allows the front-runner to take advantage of the anticipated price movement caused by the pending trade. |

| Order Flipping | Order flipping involves the front-runner placing a large order in the opposite direction of a pending trade before the pending trade is executed. Once the pending trade is executed and causes a price movement, the front-runner quickly reverses their initial trade to capture profits. |

| Blockchain Transparency Exploitation | With the rise of decentralized exchanges (DEXs) on blockchain platforms, front-runners can exploit the transparency of blockchain transactions. By monitoring pending transactions on the blockchain, front-runners can anticipate and execute trades before others, taking advantage of the time delay between the submission and confirmation of transactions. |

| Collusion | In some cases, front-runners may collude with insiders or exchange operators to gain information about pending trades. This allows them to strategically plan their trades to maximize profits based on the upcoming transactions. |

| Machine Learning Algorithms | Front-runners may also use machine learning algorithms to analyze market data and predict pending trades. By using advanced algorithms, front-runners can identify patterns and execute trades just before the pending trades are executed, thereby profiting from the anticipated price movement. |

Understanding these front-running techniques is crucial for DEXs like 1inch to develop effective mechanisms to detect and prevent front-running. By implementing innovative solutions and constantly evolving their strategies, DEXs can help level the playing field for all market participants and maintain the integrity of the decentralized finance ecosystem.

The Concept of Front-Running in the DeFi Space

Front-running is a manipulative practice that occurs in the DeFi space, where an individual or entity takes advantage of a transaction they have prior knowledge of, in order to gain an unfair advantage. This is typically done by submitting a transaction before a known pending transaction, in the hopes of executing it first and profiting from the price movement.

In simple terms, front-running involves an actor observing a pending transaction on the blockchain that is likely to have an impact on the price of a particular asset. The front-runner then quickly submits their own transaction to buy or sell the same asset, taking advantage of the subsequent price movement caused by the pending transaction.

This practice can be highly profitable for the front-runner, but it comes at the expense of other market participants who are unaware of the pending transaction and are therefore unable to react in time. Front-running undermines the principles of fairness and transparency that are fundamental to decentralized finance.

Front-running can occur in various decentralized finance platforms, including decentralized exchanges (DEXs) like 1inch. Since DEXs operate on public blockchains, all pending transactions are visible to anyone. This makes it possible for front-runners to monitor transactions and exploit opportunities for personal gain.

To combat front-running, 1inch DEX implements various techniques and protocols to make it more difficult for front-runners to profit from their actions. These include techniques such as the use of advanced algorithms to detect potential front-running transactions, and the implementation of decentralized order book mechanisms to reduce front-running opportunities.

By actively fighting against front-running techniques, 1inch DEX aims to create a fair and transparent marketplace that benefits all participants and promotes a more sustainable and equitable DeFi ecosystem.

How Front-Running Can Manipulate the Market

Front-running is a manipulative trading practice that can have serious consequences for the market. This unethical technique involves traders taking advantage of their privileged access to information about impending transactions, allowing them to execute their own trades before the original transaction occurs. By front-running, traders can profit from the anticipated price movement resulting from the original transaction, leaving other market participants at a disadvantage.

1. Unfair Advantage

Front-running gives a select group of traders an unfair advantage over the rest of the market participants. These privileged traders have access to non-public information, allowing them to predict the future price movements and execute their trades accordingly. This practice undermines the fairness and integrity of the market, as it creates an uneven playing field for participants.

2. Market Manipulation

When front-running occurs, the market can become manipulated as a result of the actions of a few individuals or entities. By executing trades based on advance knowledge of pending transactions, front-runners can artificially influence the market prices to their advantage. This creates a distorted market where prices do not reflect the true supply and demand dynamics, which can harm investors and create instability.

Furthermore, front-running can also discourage genuine market participants from participating, as they may feel that their trades are not being executed on a level playing field. This can lead to reduced liquidity and a lack of trust in the market, impacting its overall efficiency and functionality.

3. Negative Impact on Investors

Front-running can have a negative impact on investors who are not aware of this practice. These investors may unknowingly enter trades that are already disadvantageous due to the anticipated price movements caused by front-running. As a result, they may experience higher prices when buying or lower prices when selling, leading to financial losses.

Additionally, front-running can erode investor confidence in the market, as it exposes the existence of unfair practices. Investors may become wary and hesitant to engage in trading activities, fearing that their trades might be negatively impacted by front-running. This lack of trust can hinder the growth and development of the market as a whole.

In conclusion, front-running is a manipulative trading technique that can significantly impact the market. It creates an unfair advantage for a select group of traders, leads to market manipulation, and negatively impacts investors. Regulators and market participants need to work together to detect and prevent front-running activities to ensure a fair and transparent market environment.

inch DEX: Empowering Users Against Front-Running

Front-running, a manipulative practice in decentralized exchanges, involves a trader gaining an unfair advantage by placing trades ahead of other users’ orders. This can result in higher prices and lower profits for the affected users. To combat this issue, inch DEX has implemented several mechanisms to empower its users and protect them against front-running techniques.

Firstly, inch DEX employs a unique aggregation algorithm that splits orders into multiple fragments and routes them through different liquidity providers. By doing so, it prevents any single entity from gaining access to complete information about an order. This fragmentation technique ensures that front-runners cannot accurately predict the intentions of other traders, making their manipulative tactics ineffective.

In addition, inch DEX incorporates on-chain order execution, which adds an extra layer of security against front-running. By executing orders directly on the Ethereum blockchain, inch DEX eliminates the possibility of intermediaries front-running trades. This decentralized approach ensures that transactions occur in a transparent and fair manner.

Furthermore, inch DEX provides users with the ability to customize their transaction settings. Users can choose between different transaction speeds, such as fast or slow, depending on their preferences and risk tolerance. This feature empowers users to choose the optimal transaction settings for their specific needs, reducing the likelihood of front-running incidents.

To enhance user experience and minimize the risks associated with front-running, inch DEX also offers advanced features such as slippage protection and transaction monitoring tools. Slippage protection helps users avoid excessive price impacts by setting maximum price tolerances, while transaction monitoring tools enable users to track the status of their transactions and detect any unusual activity.

In conclusion, inch DEX is committed to creating a fair and transparent trading environment by empowering its users against front-running techniques. Through innovative algorithms, on-chain execution, customizable transaction settings, and advanced features, inch DEX ensures that users can trade with confidence and minimize the risks of front-running.

inch DEX: Key Features and Benefits

1inch DEX, also known as 1inch Exchange, is a decentralized exchange that operates on the Ethereum blockchain. It is designed to provide users with several key features and benefits that sets it apart from traditional centralized exchanges. Below are some of the key features and benefits of inch DEX:

| Access to Multiple Liquidity Sources | inch DEX aggregates liquidity from various decentralized exchanges, allowing users to access a wide range of liquidity sources in a single platform. This helps to ensure competitive prices and reduce slippage. |

| No Front-Running | inch DEX has implemented advanced anti-front-running techniques to prevent frontrunning, a practice where traders exploit their knowledge of pending transactions to gain an unfair advantage. This helps to protect users’ trades and ensures a fair trading environment. |

| Low Fees | inch DEX charges minimal fees for trades, making it cost-effective for users to exchange their cryptocurrencies. The fees are transparent and competitive, allowing users to keep more of their funds. |

| Gas Optimization | inch DEX leverages smart contract technology to optimize gas usage and reduce transaction costs. This helps to improve the efficiency of trades and minimize overhead expenses. |

| Security and User Control | inch DEX prioritizes the security and privacy of its users. It operates on a non-custodial model, meaning users have full control over their funds and are not exposed to the risks associated with centralized exchanges. Users’ funds are stored in their own wallets, reducing the likelihood of hacks or theft. |

These key features and benefits make inch DEX a popular choice for traders looking for a decentralized and user-friendly platform to trade cryptocurrencies. By combining access to multiple liquidity sources, advanced security measures, and cost-effective fees, inch DEX offers a compelling alternative to traditional exchanges.

How 1inch DEX Implements Anti-Front-Running Measures

Front-running, a predatory practice in DeFi, involves a trader or an entity using insider information to exploit a pending transaction of another user for personal gain. This unethical behavior can significantly impact the fairness and trustworthiness of decentralized exchanges.

1inch DEX takes a proactive approach to combat front-running and employs various measures to ensure a level playing field for all users:

Smart Contract Design

1inch DEX smart contracts are designed with careful consideration for front-running prevention. The team utilizes techniques such as token swaps in a single atomic transaction, minimizing the time window for potential frontrunners to interfere. This design choice reduces the chances of front-running attempts and enhances the overall security of the platform.

Advanced Monitoring

The 1inch DEX team constantly monitors the network for any suspicious activities and potential front-running attempts. They leverage advanced monitoring tools and algorithms to detect and mitigate any unfair practices. By keeping a close eye on the network, the team ensures that any front-running attempts are promptly addressed and the integrity of the platform is maintained.

Slippage Management

To further protect users from front-running, 1inch DEX employs a unique feature called slippage management. This feature adjusts the transaction price by adding a small amount of slippage to counteract potential front-runners. This way, users are less likely to fall victim to unfair price manipulation and can execute their trades at the intended price without worrying about front-running.

In conclusion, 1inch DEX recognizes the importance of fighting front-running techniques in the DeFi space. By implementing smart contract design strategies, utilizing advanced monitoring tools, and incorporating slippage management features, the platform aims to provide a fair and secure trading environment for all its users.

Question-answer:

What is 1inch DEX?

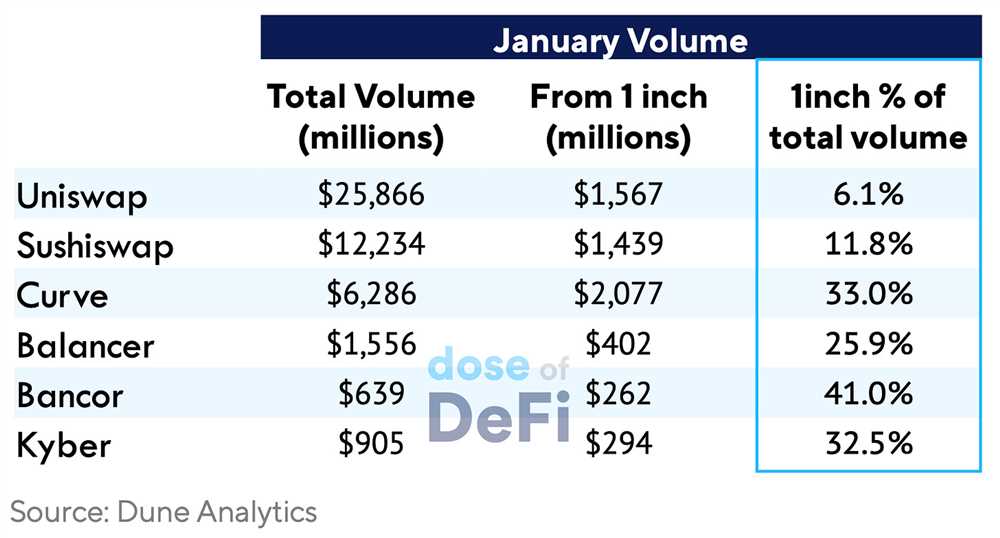

1inch DEX is a decentralized exchange aggregator that sources liquidity from various decentralized exchanges (DEXs) such as Uniswap, Balancer, SushiSwap, and others. It allows users to optimize their trades by splitting them across different DEXs to ensure the best possible price.

What are front-running techniques?

Front-running techniques, in the context of decentralized exchanges, involve a malicious actor placing a transaction in the mempool before a legitimate user’s transaction, and then executing a trade based on the knowledge of the pending transaction. This allows the attacker to exploit the price movement caused by the legitimate user’s transaction and make a profit at the expense of the user.

How does 1inch DEX fight front-running techniques?

1inch DEX implements a variety of techniques to minimize the impact of front-running. One of the key approaches is known as “CHI Gas Token.” This token encapsulates the cost of transaction execution and allows users to perform multiple transactions within a single transaction. By using this approach, 1inch DEX reduces the predictability of a user’s transaction and makes it harder for attackers to front-run.