In the world of cryptocurrency, centralized exchanges have long been the go-to platforms for traders. These traditional exchanges have provided a reliable and secure way to buy, sell, and trade digital assets. However, with the rise of decentralized finance (DeFi), a new breed of exchange has emerged, challenging the status quo and revolutionizing the way we trade.

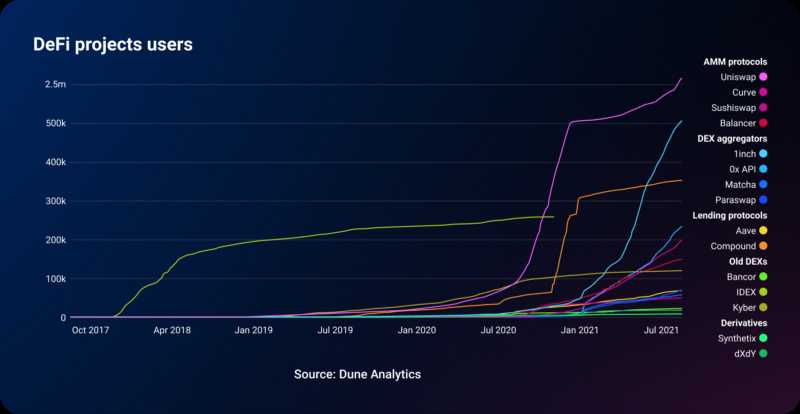

One of the most disruptive players in this space is 1inch.exchange. As an automated market maker (AMM) and decentralized exchange aggregator, 1inch.exchange offers users the ability to find the best prices across multiple decentralized exchanges, all in one place. This innovative platform has quickly gained popularity among traders and investors looking for improved liquidity and lower fees.

The impact of 1inch.exchange on centralized exchanges cannot be overstated. By leveraging the power of decentralized technology, 1inch.exchange is able to offer users a level of transparency, security, and control that simply cannot be matched by traditional exchanges. Additionally, by aggregating liquidity from various decentralized exchanges, 1inch.exchange provides users with the best possible prices for their trades, regardless of the platform they choose to execute them on.

Furthermore, 1inch.exchange’s unique governance model, which allows users to participate in decision-making through the use of the 1INCH token, gives the community a say in the future development and direction of the platform. This level of decentralization and user empowerment is a stark contrast to the centralized nature of traditional exchanges, where decisions are made by a centralized authority.

In conclusion, 1inch.exchange is disrupting the status quo of centralized exchanges by offering a decentralized, transparent, and user-centric trading experience. As the world of cryptocurrency continues to evolve, it is platforms like 1inch.exchange that are leading the charge and shaping the future of finance.

Revolutionizing the Crypto Trading Landscape

The emergence of 1inch.exchange has brought about a seismic shift in the world of cryptocurrency trading. This decentralized exchange protocol has not only disrupted the status quo but also revolutionized the entire crypto trading landscape.

With traditional centralized exchanges dominating the market for years, 1inch.exchange has emerged as a strong contender, offering unparalleled efficiency, transparency, and security to traders. By leveraging decentralized technology, 1inch.exchange has eliminated the need for intermediaries, allowing users to trade directly with their counterparts on the platform.

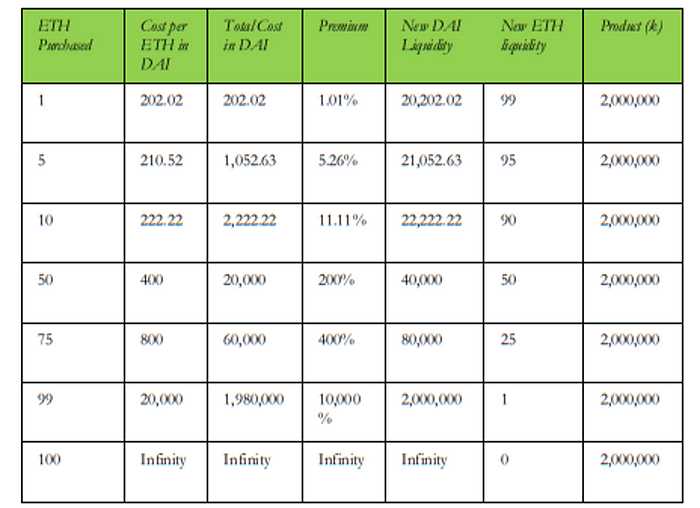

One of the key features that sets 1inch.exchange apart from centralized exchanges is its ability to aggregate liquidity from multiple platforms. This means that users can access the best prices, deep order books, and a wider range of trading pairs, all in one place. This not only enhances the trading experience but also maximizes the potential profits for traders.

In addition to liquidity aggregation, 1inch.exchange also utilizes an advanced algorithm that automatically splits users’ orders across different decentralized exchanges to ensure the best possible execution. This not only saves traders time and effort but also minimizes slippage and maximizes the overall trading experience.

Furthermore, 1inch.exchange is built on the Ethereum blockchain, which ensures that all transactions are transparent and immutable. This eliminates the possibility of manipulation or fraud, providing traders with a higher level of security and trust in the platform.

Another revolutionary aspect of 1inch.exchange is its native governance token, 1INCH. Holding this token allows users to participate in the decision-making process of the platform, giving them a voice in shaping the future of 1inch.exchange. This decentralized governance model promotes community engagement and ensures that the platform remains aligned with the needs and aspirations of its users.

Overall, 1inch.exchange has completely revolutionized the crypto trading landscape by introducing a decentralized, efficient, and transparent platform. With its unique features and benefits, it has disrupted the status quo of centralized exchanges and empowered traders with more control over their assets and trading strategies. As the popularity of decentralized finance continues to grow, 1inch.exchange is poised to play a significant role in shaping the future of crypto trading.

Decentralized Finance Takes the Lead

Decentralized finance has emerged as a powerful force in the financial industry, challenging the traditional centralized model. With the rise of platforms like 1inch.exchange, decentralized finance is taking the lead in disrupting the status quo.

Decentralized finance, also known as DeFi, refers to the use of blockchain technology and smart contracts to provide financial services in a decentralized manner. Unlike centralized exchanges, which rely on intermediaries and face significant regulatory scrutiny, decentralized finance platforms are built on trustless protocols that allow users to transact directly with one another.

One of the key advantages of decentralized finance is the ability to provide greater financial inclusivity. Traditional financial systems often exclude individuals who lack access to banking services or who are in regions with limited financial infrastructure. With decentralized finance, anyone with an internet connection can participate in various financial activities, such as lending, borrowing, and trading.

Decentralized finance also offers increased transparency and security. Transactions on decentralized platforms are recorded on the blockchain, providing an immutable and transparent ledger. This reduces the risk of fraud and manipulation, as all transactions can be audited and verified by anyone on the network.

Furthermore, decentralized finance platforms like 1inch.exchange often offer lower fees compared to traditional financial institutions. Without intermediaries and overhead costs, decentralized finance platforms can provide more competitive rates for users. This can help individuals save money and access better financial services.

As decentralized finance continues to gain traction, it poses a significant challenge to centralized exchanges. While centralized exchanges have dominated the financial industry for years, the advent of decentralized finance is disrupting their control. With its benefits of inclusivity, transparency, and lower fees, decentralized finance is poised to take the lead in shaping the future of the financial industry.

Overcoming the Limitations of Centralized Exchanges

Centralized exchanges have long been the dominant players in the cryptocurrency trading space. However, they come with certain limitations that can restrict users’ trading experience and put their funds at risk.

Lack of Privacy

One of the major concerns with centralized exchanges is the lack of privacy. When users trade on these platforms, they often have to provide personal information and complete KYC (Know Your Customer) procedures. This compromises their privacy and exposes them to the risk of identity theft or data breaches. The decentralized nature of 1inch.exchange offers a solution to this problem, as it allows users to trade without sharing their personal information, ensuring greater privacy.

Single Point of Failure

Centralized exchanges are susceptible to hacking and other security breaches since they store users’ funds in a centralized manner. In the event of a security breach, users can lose their funds, and the exchange may struggle to compensate for the losses adequately. With 1inch.exchange operating on a decentralized network, there is no single point of failure, reducing the risk of hacks or breaches and ensuring the security of users’ funds.

High Trading Fees

Traditional centralized exchanges charge high trading fees, which can significantly eat into traders’ profits. These fees can hinder smaller traders from participating in the market or limit their trading activity. 1inch.exchange, being an exchange aggregator, aims to provide users with the best available prices across multiple decentralized exchanges, reducing trading fees and improving the overall trading experience for users.

Limited Liquidity

Centralized exchanges often face issues with liquidity, especially for less popular or newly listed assets. This can result in lower trading volumes and wider bid-ask spreads, making it difficult for users to execute trades at their desired prices. By leveraging decentralized liquidity pools and accessing various exchanges, 1inch.exchange is able to provide users with better liquidity for a wide range of assets, ensuring competitive prices and efficient trades.

Geographical Restrictions

Centralized exchanges may impose geographical restrictions on certain regions or countries, limiting access to their services for users in those areas. This can hinder the participation of potential traders and investors who are looking to enter the cryptocurrency market. As a decentralized exchange, 1inch.exchange is not subject to these restrictions and allows users from around the world to access its services, breaking down barriers to entry and fostering a more inclusive trading ecosystem.

In conclusion, while centralized exchanges have played a vital role in the cryptocurrency trading industry, they come with significant limitations. 1inch.exchange, with its decentralized approach, aims to address these limitations and provide users with a more private, secure, cost-effective, liquid, and accessible trading experience.

The Road to Mass Adoption

In order for decentralized exchanges like 1inch.exchange to disrupt the status quo and truly make an impact on centralized exchanges, mass adoption is key. While decentralized exchanges offer numerous advantages such as increased security, lower fees, and greater transparency, they have yet to gain widespread usage among the general public.

Challenges to Mass Adoption

One of the main challenges to mass adoption is the complexity of decentralized exchanges. The average user may find the process of swapping tokens, providing liquidity, or participating in yield farming on decentralized exchanges confusing and overwhelming. Additionally, the lack of user-friendly interfaces and intuitive design can deter potential users.

Another challenge is the lack of liquidity on decentralized exchanges compared to centralized exchanges. Many users rely on centralized exchanges due to their larger trading volumes and access to a wider range of trading pairs. Decentralized exchanges need to tackle this issue by attracting more liquidity providers and implementing efficient mechanisms for trading large volumes.

Strategies for Mass Adoption

Improving the user experience and interface of decentralized exchanges is crucial for mass adoption. This can be achieved through user-friendly interfaces, clear instructions, and simplified processes. Additionally, educational resources and tutorials can help users understand and navigate decentralized exchanges more easily.

Collaborations and partnerships with established players in the crypto industry can also contribute to mass adoption. By forging alliances with wallet providers, blockchain projects, and other decentralized finance platforms, decentralized exchanges can expand their user base and gain credibility among a wider audience.

Regulatory Considerations

Regulatory clarity and compliance are essential for mass adoption. Decentralized exchanges need to navigate the evolving regulatory landscape to ensure they operate within the boundaries set by governments and financial authorities. By working closely with regulators, decentralized exchanges can build trust and ensure their users feel secure while using their platforms.

In conclusion, the journey to mass adoption for decentralized exchanges like 1inch.exchange is not without its challenges. However, by addressing the complexities, improving user experience, attracting liquidity, and ensuring regulatory compliance, decentralized exchanges can pave the way for a new era of financial inclusivity and disruption of the centralized exchange model.

| Advantages of Decentralized Exchanges | Challenges for Mass Adoption |

|---|---|

| Increased security | Complexity of decentralized exchanges |

| Lower fees | Lack of liquidity compared to centralized exchanges |

| Greater transparency |

Question-answer:

What is 1inch.exchange and how does it disrupt centralized exchanges?

1inch.exchange is a decentralized exchange aggregator that allows users to find the best prices and liquidity across multiple decentralized exchanges. It disrupts centralized exchanges by providing a more efficient and cost-effective way of trading cryptocurrencies. Instead of relying on a single centralized exchange, which may have limited liquidity and high fees, users can access a wide range of decentralized exchanges through 1inch.exchange, ensuring that they get the best possible prices for their trades.

Why is the impact of 1inch.exchange significant for the cryptocurrency industry?

The impact of 1inch.exchange is significant for the cryptocurrency industry because it challenges the dominance of centralized exchanges. Centralized exchanges have traditionally been the go-to platforms for trading cryptocurrencies, but they often have issues with high fees, limited liquidity, and lack of transparency. 1inch.exchange offers a decentralized alternative that provides users with better prices, higher liquidity, and increased transparency. By disrupting the status quo, 1inch.exchange promotes a more fair and efficient trading environment for cryptocurrency users.