Decentralized finance (DeFi) has rapidly gained popularity in the past couple of years, revolutionizing the way we interact with traditional financial systems. One of the key innovations within the DeFi space is the emergence of decentralized exchanges (DEXs), which provide users with the ability to trade cryptocurrencies without the need for intermediaries or centralized authorities.

However, despite the many advantages offered by DEXs, including improved security, increased transparency, and enhanced privacy, they still face certain limitations. One of the challenges is the fragmentation of liquidity across different DEXs, which can lead to higher slippage and lower trading volumes compared to their centralized counterparts.

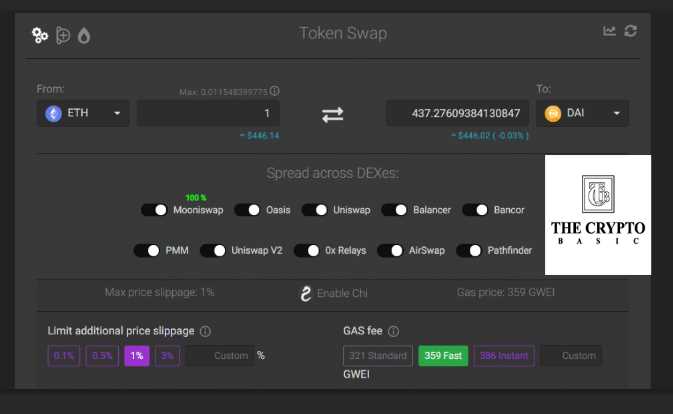

This is where 1inch comes in. 1inch is a leading decentralized exchange aggregator that optimizes trading routes across multiple DEXs, thereby ensuring the best possible trade execution for users. The 1inch whitepaper outlines the protocol’s unique architecture and sophisticated algorithms that enable users to access the most favorable liquidity pools and achieve minimal slippage.

The 1inch protocol leverages smart contract technology to split a trade across different DEXs, combining liquidity from various sources to achieve the best rates. By doing so, 1inch minimizes the impact of slippage and maximizes trading efficiency, offering an unmatched trading experience for DeFi enthusiasts.

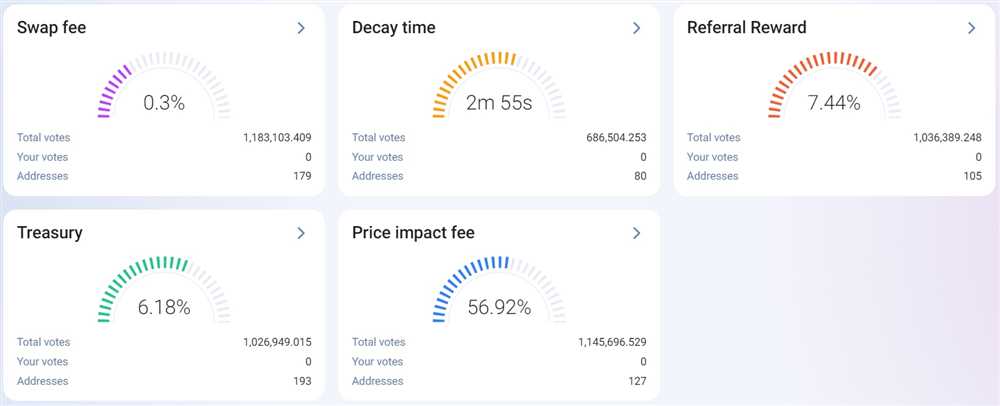

Furthermore, the 1inch whitepaper dives into detail about the protocol’s governance token, 1INCH, which plays a fundamental role in the ecosystem. Holders of 1INCH can participate in key governance decisions and earn rewards through liquidity mining and staking.

Overall, the 1inch whitepaper is a comprehensive exploration of the protocol’s capabilities and its unique value proposition in the DeFi landscape. It sheds light on the benefits of utilizing a protocol-driven approach to trading cryptocurrencies, highlighting the advantages over traditional exchanges and the potential for a more efficient and inclusive financial system.

The Advantages of the 1inch Protocol Over Traditional Exchanges

The 1inch protocol offers several distinct advantages over traditional exchanges:

1. Enhanced Liquidity

1inch uses a unique aggregation algorithm that scans various decentralized exchanges to find the best prices and liquidity. This ensures that users get the most favorable rates for their trades, resulting in enhanced liquidity compared to traditional exchanges.

2. Lower Fees

Traditional exchanges commonly charge high fees for trading, especially for large-volume transactions. In contrast, the 1inch protocol leverages the decentralized finance (DeFi) ecosystem to reduce fees significantly. By utilizing interconnected liquidity sources, the protocol can offer users lower fees, making it more cost-effective for traders.

3. Reduced Slippage

Slippage is a common issue on traditional exchanges, particularly when dealing with substantial orders or illiquid trading pairs. The 1inch protocol minimizes slippage by splitting trades across multiple decentralized exchanges, optimizing the execution to achieve optimal rates. This significantly reduces slippage and ensures that the trades are executed at the most advantageous prices available.

4. Security and Trustlessness

Traditional exchanges require users to deposit funds within their platforms, introducing counterparty risk and reliance on centralized entities. Conversely, the 1inch protocol operates in a trustless manner, taking advantage of smart contracts on public blockchains. Users retain control of their funds at all times, eliminating the need to trust a third party.

In conclusion, the 1inch protocol offers enhanced liquidity, lower fees, reduced slippage, and increased security compared to traditional exchanges. These advantages make the 1inch protocol an attractive option for traders seeking improved trading experiences in the decentralized finance ecosystem.

The Limitations of Traditional Exchanges

Traditional exchanges have long dominated the trading landscape, but they come with several limitations that hinder traders and investors. These limitations include:

Limited Access to Liquidity

Traditional exchanges often have limited liquidity, meaning that there may not be enough buyers or sellers to execute trades at desired prices. This can result in higher trading costs, as traders may have to accept less favorable prices to complete their trades.

Centralization and Control

Traditional exchanges are typically centralized entities that have control over the trading process. This centralization introduces several risks, such as the potential for fraud, market manipulation, and censorship. Traders have to rely on the trustworthiness and integrity of the exchange, which can be compromised in some cases.

Furthermore, the centralized nature of traditional exchanges also means that they can be subject to regulatory restrictions and limitations. This can impact the availability and accessibility of certain trading features and tools, limiting the opportunities for traders.

Limited asset selection

Traditional exchanges often have a limited selection of assets available for trading. This limits the diversification options for traders and investors, as they are confined to a narrow range of assets. Additionally, the listing process for new assets on traditional exchanges can be lengthy and bureaucratic, adding further barriers to entry for innovative projects.

In conclusion, traditional exchanges have several limitations that can hinder traders and investors in various ways. These limitations include limited access to liquidity, centralization and control, and limited asset selection. These limitations highlight the need for alternative solutions, such as decentralized exchanges, that can address these issues and provide a more inclusive and efficient trading environment.

Question-answer:

What is the 1inch protocol?

The 1inch protocol is a decentralized exchange aggregator that sources liquidity from various cryptocurrency exchanges. It offers users the best possible trading rates by splitting orders across multiple decentralized exchanges.

How does the 1inch protocol compare to traditional exchanges?

The 1inch protocol offers several advantages over traditional exchanges. Firstly, it provides better rates by aggregating liquidity from multiple sources. It also offers lower slippage and reduced risk of frontrunning. Additionally, it allows users to trade directly from their wallets without the need to deposit funds into an exchange.

Can you explain how the 1inch protocol reduces risks for traders?

The 1inch protocol reduces risks for traders in several ways. Firstly, it splits large orders across multiple decentralized exchanges, reducing the impact on the market and minimizing slippage. Secondly, it mitigates the risk of frontrunning by allowing users to bypass the order book and trade directly from their wallets. Finally, it offers transparent and auditable transactions, providing users with a higher level of security and trust.