The Significance of 1inch Fusion in Minimizing Impermanent Loss and Enhancing Liquidity Provision.

Impermanent loss is a common challenge faced by liquidity providers in decentralized finance (DeFi) platforms. It refers to the loss that liquidity providers may incur due to price fluctuations of the assets they provide liquidity for. However, 1inch Fusion has emerged as a powerful tool to address this issue and mitigate the risks associated with impermanent loss.

1inch Fusion is an innovative protocol that allows liquidity providers to hedge against impermanent loss by diversifying their liquidity across multiple pools. By utilizing 1inch Fusion, liquidity providers can distribute their liquidity across different assets and liquidity pools, reducing their exposure to volatility and minimizing the impact of impermanent loss.

The key feature of 1inch Fusion is its ability to optimize liquidity allocation in real-time. The protocol constantly monitors the market conditions and dynamically adjusts the allocation of liquidity to different pools based on various factors such as trading volume, price volatility, and liquidity depth. This ensures that liquidity providers always have their funds allocated in the most optimal way to maximize their returns and minimize impermanent loss.

In addition to optimizing liquidity allocation, 1inch Fusion also provides liquidity providers with valuable insights and analytics. The protocol offers detailed information about the performance of different pools, historical data on impermanent loss, and recommendations on how to further improve the liquidity provision strategy. This empowers liquidity providers to make informed decisions and take proactive measures to mitigate impermanent loss.

In conclusion, 1inch Fusion plays a crucial role in avoiding impermanent loss in liquidity providing. By diversifying liquidity and optimizing allocation, this protocol offers liquidity providers a powerful tool to hedge against volatility and maximize their returns. With its real-time monitoring and analytics capabilities, 1inch Fusion stands as a game-changer in DeFi, helping liquidity providers navigate the challenges of impermanent loss and unlock the full potential of decentralized finance.

The Benefits of 1inch Fusion for Liquidity Providers

1inch Fusion offers several key benefits for liquidity providers that make it an attractive option for optimizing their yield and avoiding impermanent loss.

First and foremost, 1inch Fusion allows liquidity providers to seamlessly provide liquidity on multiple DEXs with a single token deposit. This means that instead of having to manage multiple individual LP positions across different DEXs, which can be time-consuming and inefficient, liquidity providers can simply deposit their tokens into 1inch Fusion and have their liquidity distributed across multiple pools automatically.

By doing so, liquidity providers can take advantage of the aggregated liquidity from multiple DEXs, which can result in higher trading volumes and potentially higher yields. This makes it easier for liquidity providers to access a larger pool of potential traders and maximize their returns.

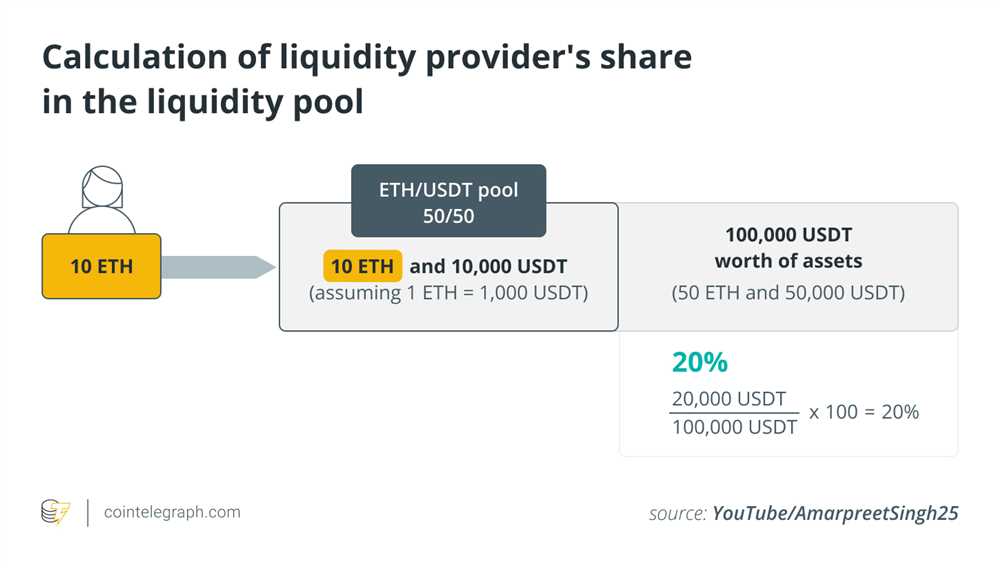

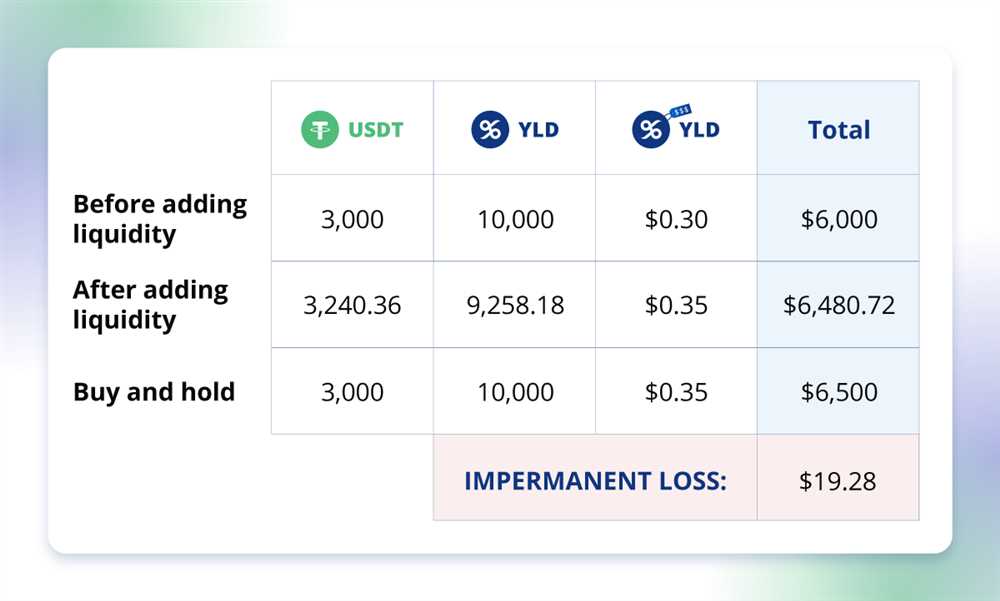

In addition, 1inch Fusion helps liquidity providers avoid impermanent loss, which is a common risk when providing liquidity on DEXs. Impermanent loss occurs when the value of the tokens held in a liquidity pool changes compared to holding them individually. This can happen when the price of one token in the pool increases or decreases significantly relative to the other token.

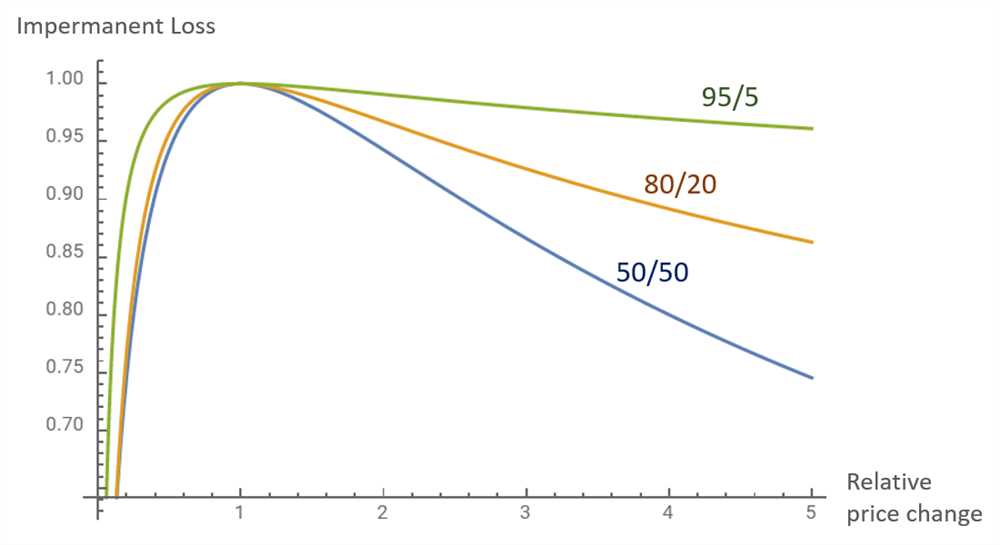

By automatically redistributing liquidity across different pools based on market conditions, 1inch Fusion helps mitigate the risk of impermanent loss. Liquidity providers can benefit from a more balanced exposure to different pools, reducing the impact of price fluctuations on their overall yield.

Furthermore, 1inch Fusion offers a user-friendly interface and intuitive dashboard that allows liquidity providers to monitor and manage their liquidity efficiently. They can easily track their performance, view detailed analytics, and make adjustments to their liquidity provision strategy as needed. This makes it easier for liquidity providers to stay informed and optimize their yield.

Overall, the benefits of 1inch Fusion for liquidity providers are significant. It provides a streamlined solution for managing liquidity across multiple DEXs, allows for increased trading volumes and potential higher yields, helps mitigate impermanent loss, and offers a user-friendly interface for efficient management. As a result, liquidity providers can enjoy improved returns and a more hassle-free experience in the decentralized finance ecosystem.

Understanding Impermanent Loss

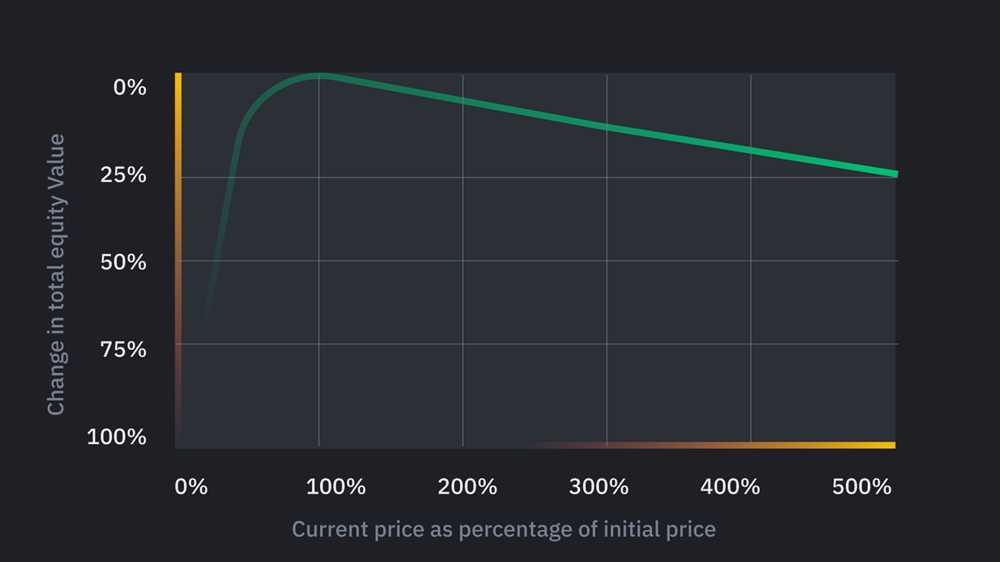

Impermanent loss refers to the temporary loss of funds experienced by liquidity providers in automated market maker (AMM) protocols like 1inch Fusion. It occurs when the value of the tokens in the liquidity pool changes compared to the value of the tokens outside the pool.

When a liquidity provider adds funds to a pool, they contribute both tokens in equal value. However, as the market price of tokens changes, the value of the tokens inside the pool can deviate from the value of the tokens outside the pool. This deviation leads to impermanent loss.

It is important to note that impermanent loss is not realized unless the liquidity provider removes their funds from the pool. If the liquidity provider stays in the pool for a longer period of time, the impermanent loss can become permanent if the market conditions continue to move against their initial deposit.

Impermanent loss can be more significant when there is high volatility in the market or when the price of one of the tokens in the pool experiences a large swing. Additionally, impermanent loss is more pronounced when the liquidity pool has a lower trading volume and a smaller size.

To mitigate impermanent loss, 1inch Fusion employs various strategies like the use of Chainlink oracles to provide accurate and up-to-date market prices. Moreover, it offers dynamic fee adjustments to incentivize liquidity providers to stay in the pool for a longer period of time, reducing the impact of impermanent loss.

By understanding impermanent loss and the factors that contribute to it, liquidity providers can make informed decisions when participating in liquidity provision on 1inch Fusion and other AMM protocols.

How 1inch Fusion Works

1inch Fusion is a feature that allows liquidity providers to avoid impermanent loss when providing liquidity on decentralized exchanges (DEXs). Impermanent loss occurs when the value of the underlying assets in a liquidity pool fluctuates, leading to potential loss for liquidity providers. However, 1inch Fusion aims to mitigate this risk by allowing for stable and predictable returns.

1inch Fusion works by utilizing smart contract technology to fuse multiple liquidity pools into a single, optimized pool. By doing so, 1inch Fusion is able to balance and allocate liquidity across different pools in a way that minimizes impermanent loss.

When liquidity is provided to a fused pool, the 1inch Fusion algorithm dynamically distributes the funds across several underlying pools based on historical data and current market conditions. This allocation strategy helps to reduce the impact of impermanent loss, ensuring that liquidity providers are able to maximize their returns.

In addition, 1inch Fusion also takes advantage of the swapping feature of decentralized exchanges. When a user wants to make a trade on a DEX, the 1inch aggregation protocol searches for the best possible trading route across multiple pools and exchanges. By finding the most efficient route, 1inch Fusion minimizes slippage and ensures that trades are executed at the best available price.

The 1inch Fusion feature is available to liquidity providers on the 1inch exchange platform. By utilizing 1inch Fusion, liquidity providers can benefit from improved returns and reduced risks associated with impermanent loss. It provides a valuable tool for users looking to optimize their liquidity provision strategies on decentralized exchanges.

| Benefits of 1inch Fusion: |

| – Minimizes impermanent loss for liquidity providers |

| – Optimizes liquidity allocation across multiple pools |

| – Reduces slippage and ensures best price execution for trades |

| – Provides stable and predictable returns |

Advantages of Using 1inch Fusion

1inch Fusion offers several advantages that make it a valuable tool for liquidity providers looking to avoid impermanent loss:

| Advantage | Description |

|---|---|

| Reduced Impermanent Loss | By using 1inch Fusion, liquidity providers can minimize their exposure to impermanent loss compared to traditional decentralized exchanges. The algorithm ensures that swaps are executed at the best possible rates, reducing the risk of loss. |

| Larger Liquidity Pool | 1inch Fusion aggregates liquidity from multiple sources, including decentralized exchanges and liquidity protocols, creating a larger pool for liquidity providers. This results in potentially higher trading volumes, increased transaction fees, and better overall returns. |

| Lower Slippage | Slippage refers to the price difference between when a trade is requested and when it is executed. 1inch Fusion minimizes slippage by splitting large orders across multiple decentralized exchanges and liquidity pools, ensuring the best possible execution price. |

| Easier Portfolio Management | 1inch Fusion simplifies portfolio management for liquidity providers. Instead of having to manage separate positions on different decentralized exchanges, liquidity providers can manage their positions in a single interface, making it easier to track and optimize their portfolios. |

| Efficient Capital Allocation | With 1inch Fusion, liquidity providers can efficiently allocate their capital across different tokens and liquidity pools based on their risk appetite and expected returns. The platform provides insights and analytics to help liquidity providers make informed decisions. |

Overall, the advantages offered by 1inch Fusion make it a compelling option for liquidity providers looking to maximize their returns and minimize the risks associated with impermanent loss. By leveraging the power of decentralized finance and innovative algorithms, 1inch Fusion is revolutionizing liquidity provision in the cryptocurrency space.

Question-answer:

What is impermanent loss in liquidity providing?

Impermanent loss refers to the loss of value experienced by liquidity providers in decentralized exchanges due to the volatility of asset prices. When providing liquidity, the price of the assets can change, causing a difference in the value of the assets held by the liquidity provider compared to if they had simply held the assets without providing liquidity. This loss is referred to as impermanent because it only occurs when providing liquidity and can potentially be recovered if the asset prices return to their original values.

How does 1inch Fusion help in avoiding impermanent loss?

1inch Fusion is a feature that enables liquidity providers to protect themselves from impermanent loss by using stablecoins as collateral. By using stablecoins as collateral, liquidity providers can avoid the potential loss in value that comes with providing liquidity for volatile assets. The stablecoin collateral acts as a buffer, absorbing any potential losses while the liquidity provider still earns fees for their services. This helps to mitigate the risks associated with impermanent loss and provides a more stable and predictable return for liquidity providers.