If you’re interested in diving into the world of decentralized finance (DeFi), then the 1inch app is a must-have tool in your arsenal. As the name suggests, 1inch is all about finding you the best deals and navigating the complex landscape of DeFi platforms. Whether you’re a seasoned DeFi user or just starting out, this ultimate guide will provide you with everything you need to know about using the 1inch app to maximize your DeFi experience.

What is the 1inch app?

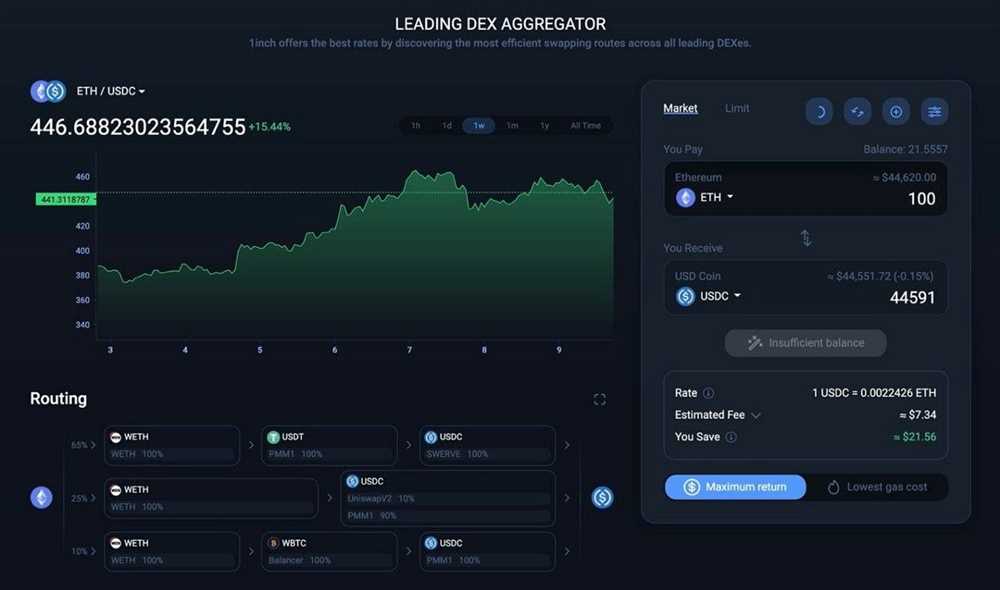

The 1inch app is a decentralized exchange aggregator that sources liquidity from various DEXs (decentralized exchanges) to provide you with the most optimal trading routes. Instead of having to manually search for the best prices and liquidity, the 1inch app does all the work for you, saving you time and effort. By routing your trades through the 1inch app, you can ensure that you’re getting the best possible deal with minimal slippage.

How does the 1inch app work?

The 1inch app works by splitting your trade across multiple DEXs to find the best possible rate. It does this by comparing prices across different platforms and executing your trade in a way that maximizes your returns. The app also takes into account factors such as gas fees and liquidity to ensure that you’re not sacrificing profits due to high transaction costs. The 1inch app is powered by an algorithm that constantly scans the market for the most optimal trading routes, so you can be confident that you’re always getting the best deal.

In conclusion, the 1inch app is a powerful tool for navigating the DeFi landscape and maximizing your returns. By leveraging its decentralized exchange aggregator, you can save time, effort, and money by finding the best deals and routes for your trades. Whether you’re a DeFi enthusiast or a beginner, the 1inch app is a must-have in your DeFi toolkit. So, download the app and start exploring the world of decentralized finance today!

Why You Need the 1inch App for Your Ultimate DeFi Navigation

Decentralized Finance, also known as DeFi, has gained immense popularity in recent years. It offers various financial services such as lending, borrowing, trading, and staking of cryptocurrencies without the need for intermediaries like banks. With the increasing number of DeFi protocols and platforms, finding the best rates and optimal routes for your trades can become a daunting task.

Efficient and Cost-Effective Trades

The 1inch app is a powerful tool that can simplify your DeFi journey. It aggregates liquidity from multiple decentralized exchanges (DEXs) to provide you with the best possible rates for your trades. By utilizing smart contract technology and advanced algorithms, the 1inch app optimizes your trades to ensure efficient and cost-effective transactions.

Real-Time Price Comparison

One of the key features of the 1inch app is its real-time price comparison. It enables you to compare the prices and liquidity across various DEXs, allowing you to identify the most favorable trading opportunities. With this information at your fingertips, you can make informed decisions and maximize your profits.

The 1inch app also provides you with detailed information about each trade, including the estimated gas fees and slippage. This transparency allows you to plan your trades effectively and avoid unexpected costs.

Moreover, the 1inch app supports multiple blockchains, such as Ethereum, Binance Smart Chain, and Polygon. This broad compatibility ensures that you can access a wide range of DeFi protocols and platforms, giving you more options for your trades.

Conclusion

Whether you are new to the world of DeFi or an experienced trader, the 1inch app is an essential tool for your ultimate DeFi navigation. Its efficient trade routing, real-time price comparison, and support for multiple blockchains make it a must-have for anyone looking to navigate the DeFi landscape with ease.

With the 1inch app, you can trade with confidence, knowing that you are getting the best rates and optimizing your profits. Download the 1inch app today and unlock the full potential of DeFi.

Seamless DeFi Trading Experience

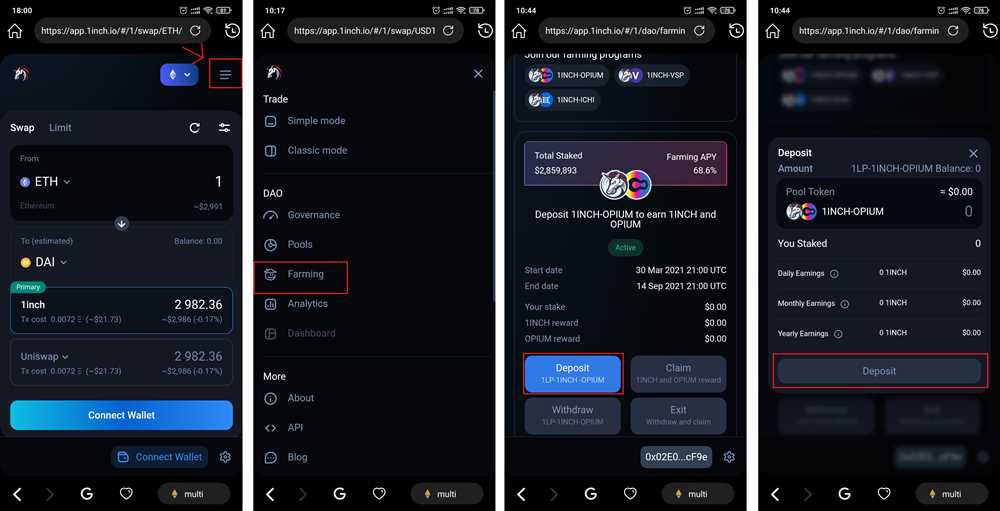

The 1inch app offers a seamless DeFi trading experience, making it easy for users to navigate through the vast world of decentralized finance. With its user-friendly interface and intuitive design, even beginners can quickly understand and utilize the platform.

By aggregating liquidity from various decentralized exchanges, 1inch ensures that users get the best possible rates for their trades. The app scans multiple DEXs in real-time and splits the user’s order across different protocols to achieve optimal price execution.

One of the key features of the 1inch app is the ability to perform multi-path and multi-route swaps. This means that users can choose between different routing options to find the most efficient and cost-effective path for their trades. The app also offers advanced features such as limit orders and the ability to set slippage tolerance to ensure the best possible outcomes.

Security is a top priority for 1inch, and the app incorporates various measures to protect user funds. The platform does not hold user assets, and all transactions are executed directly on the blockchain, ensuring that users have complete control over their funds at all times. Additionally, the app undergoes regular security audits to detect and fix any potential vulnerabilities.

With its seamless trading experience, advanced features, and commitment to security, the 1inch app is the ultimate tool for navigating the world of decentralized finance.

Advanced DeFi Tips and Strategies

When diving deeper into the world of decentralized finance (DeFi), it is important to understand some advanced tips and strategies that can help you navigate through the various protocols and maximize your returns. Here are some useful pointers:

1. Do Your Research

Before investing in any DeFi project, it is crucial to conduct thorough research. Learn about the team behind the project, their past experiences, and the technology they are using. Look for reviews, audits, and community discussions to get a better understanding of the project’s credibility.

2. Diversify Your Portfolio

As with any investment, diversification is key in DeFi. Spread your assets across different protocols and projects, as this can help mitigate risks and maximize potential returns. Avoid putting all your eggs in one basket.

3. Keep Updated with the Latest News

DeFi is a fast-paced industry, with new projects and updates constantly emerging. Stay updated with the latest news and developments by following influencers, joining communities, and reading trustworthy sources. Being aware of market trends and changes can give you an edge in making informed investment decisions.

4. Understand the Risks

While DeFi presents numerous opportunities, it is important to be aware of the risks involved. Smart contract vulnerabilities, market volatility, and potential exploits are some of the risks associated with DeFi. Only invest what you can afford to lose and consider using risk management strategies, such as stop-loss orders.

5. Use Decentralized Exchanges (DEX)

Decentralized exchanges have gained popularity in the DeFi space due to their added security and privacy features. Utilize DEX platforms to trade your assets, as they often provide better liquidity and lower fees compared to centralized exchanges. Just make sure to double-check the addresses and contract details before making any transactions.

6. Take Advantage of Yield Farming

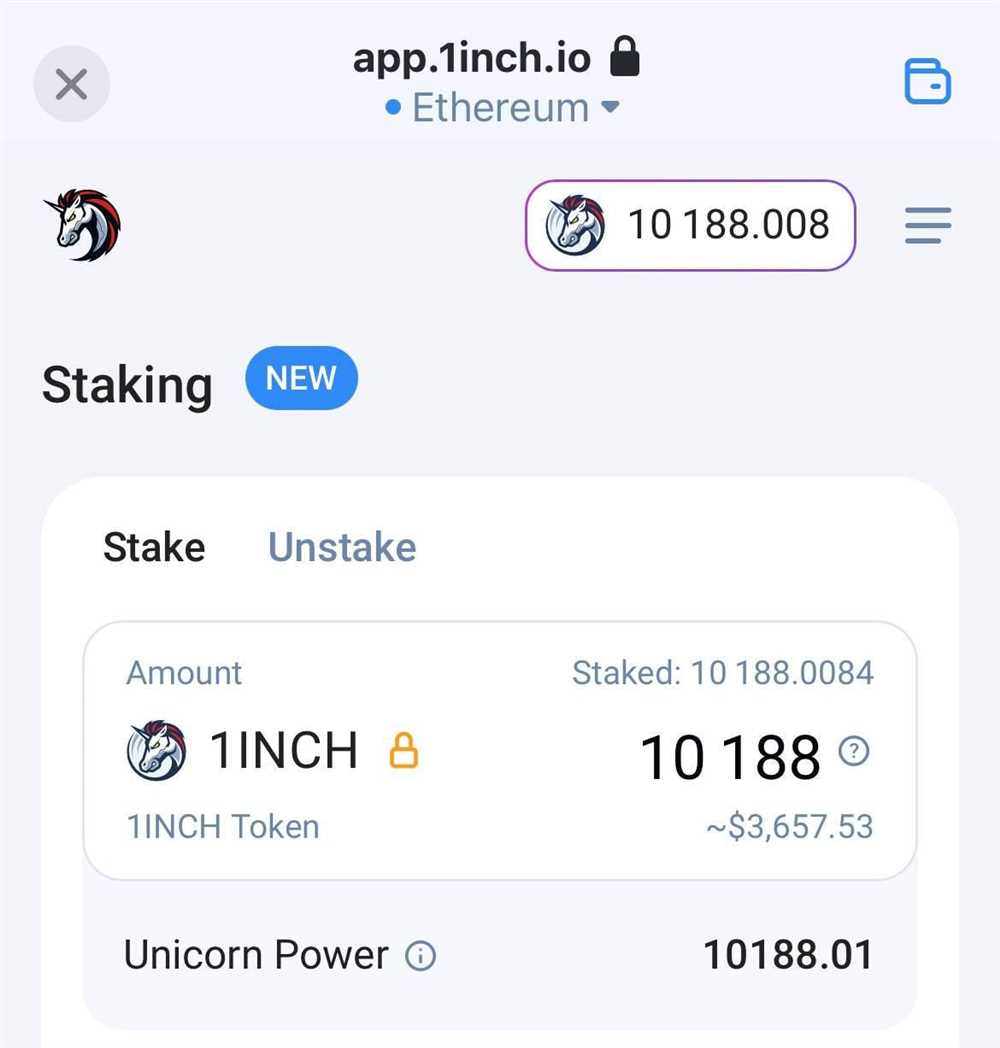

Yield farming is a strategy where users provide liquidity to DeFi protocols in exchange for rewards. By lending or staking your assets, you can earn additional tokens or interest rates. However, be cautious and do thorough research on the risks and potential returns of different yield farming opportunities.

7. Consider Impermanent Loss

Impermanent loss is a concept that refers to the potential loss in value experienced when providing liquidity to an automated market maker (AMM) pool. Understand the concept and calculate the potential losses and gains before providing liquidity to avoid unexpected outcomes.

8. Utilize Limit Orders and DCA

When trading on decentralized exchanges, consider using limit orders to set the desired price for buying or selling assets. This strategy can help you avoid FOMO (fear of missing out) or panic selling. Additionally, consider dollar-cost averaging (DCA), where you invest a fixed amount at regular intervals, to mitigate the impact of short-term price fluctuations.

By implementing these advanced tips and strategies, you can enhance your DeFi journey and increase your chances of success. Remember to always stay informed, diversify your portfolio, and assess the risks involved before making any investment decisions.

Stay Updated on the Latest DeFi Trends

Keeping up with the latest trends in the rapidly evolving world of decentralized finance (DeFi) is crucial to stay ahead and make informed decisions. Here are some tips to help you stay updated on the latest DeFi trends:

1. Follow Reputable News Sources

Stay informed by following reputable news sources that cover DeFi extensively. Websites like CoinDesk, Cointelegraph, and Decrypt regularly publish news articles, analysis, and insights on DeFi trends, projects, and developments. Set up Google Alerts or subscribe to their newsletters to get updates directly to your inbox.

2. Join DeFi Communities

Engage in DeFi communities like forums, subreddits, and Discord channels. These platforms provide opportunities to interact with experienced community members and industry experts who often share valuable insights, tips, and the latest news about emerging DeFi projects and trends.

3. Explore DeFi Analytics Platforms

Take advantage of DeFi analytics platforms like Dune Analytics, DeBank, and DeFi Pulse. These platforms provide comprehensive data, charts, and statistics on various DeFi protocols, including their TVL (Total Value Locked), user activity, tokens, and more. Monitoring these metrics can give you a better understanding of the performance and trends in the DeFi ecosystem.

4. Follow DeFi Influencers on Social Media

Follow influential figures in the DeFi industry on social media platforms like Twitter and LinkedIn. Many DeFi influencers regularly share their thoughts, analysis, and updates on the latest DeFi trends and projects. You can also join industry-specific Telegram groups or Discord communities to stay in the loop.

5. Attend DeFi Conferences and Webinars

Participate in DeFi conferences, webinars, and online events organized by industry leaders and associations. These gatherings often feature panel discussions, presentations, and workshops on the latest DeFi trends, insights, and case studies. Attending such events can provide you with a deeper understanding of the evolving DeFi landscape.

6. Keep an Eye on Social Media Chatter

Monitor social media platforms, especially Twitter and Reddit, for discussions and hot topics related to DeFi. Many important updates, news, and trends often get shared and discussed on these platforms. By actively participating in conversations and following relevant hashtags, you can stay updated and gain insights from the community.

By implementing these tips, you can stay up to date with the latest DeFi trends and developments, enabling you to make informed decisions and navigate the ever-changing DeFi landscape more effectively.

Question-answer:

What is 1inch app?

1inch app is a decentralized finance (DeFi) platform that provides users with an easy-to-use interface to access various DeFi protocols and optimize their trading. It aggregates liquidity from different decentralized exchanges (DEXs) and allows users to swap tokens at the best available rates across different DEXs.

How does the 1inch app work?

The 1inch app works by splitting a user’s trade across multiple decentralized exchanges to get the best rates. It compares prices and liquidity across various DEXs and selects the most optimal routes for the trade. It also takes into account potential gas fees and slippage to provide users with the best trading experience.

What are the advantages of using the 1inch app?

The 1inch app offers several advantages for DeFi users. Firstly, it provides users with the best available rates for their token swaps by aggregating liquidity from various DEXs. Secondly, it helps users save on gas fees by splitting their trades across different exchanges. Additionally, it offers a user-friendly interface and advanced features like limit orders and liquidity mining.