The 1inch Protocol has quickly become one of the most popular and innovative automated market makers in the decentralized finance (DeFi) space. Designed to optimize trading on Decentralized Exchanges (DEXs), 1inch Protocol offers a range of features that make it a powerful tool for traders and liquidity providers alike.

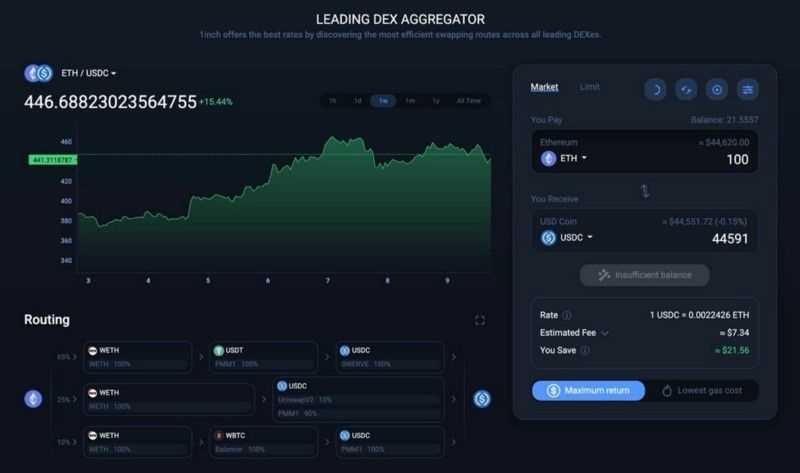

One of the key use cases of 1inch Protocol is its ability to aggregate liquidity from multiple DEXs. By routing trades through its smart contract, 1inch Protocol finds the most optimal paths across various liquidity sources, ensuring users get the best possible prices for their trades. This aggregation feature eliminates the need for traders to manually search and compare prices across different DEXs, saving time and effort.

In addition to liquidity aggregation, 1inch Protocol also offers a variety of other features that further enhance its utility. One such feature is the gas optimization, which allows users to save on transaction fees by splitting their trades across multiple DEXs. This ensures that users can execute their trades at the lowest possible cost, making 1inch Protocol an attractive option for cost-conscious traders.

Moreover, 1inch Protocol also enables users to earn passive income by providing liquidity to various liquidity pools. By becoming a liquidity provider, users can earn fees and rewards proportional to their contribution to the pool. This feature makes 1inch Protocol a compelling choice for those looking to generate additional income in the DeFi ecosystem.

Overall, the 1inch Protocol offers a range of use cases that cater to the diverse needs of traders and liquidity providers in the DeFi space. With its liquidity aggregation, gas optimization, and passive income earning features, 1inch Protocol has established itself as a leading solution for optimizing trading on DEXs and maximizing returns in the decentralized finance ecosystem.

Exploring the Many Applications of 1inch Protocol

The 1inch Protocol is a decentralized exchange aggregator that sources liquidity from various platforms to provide users with the most optimal trading routes. While its primary use case is optimizing token swaps, the 1inch Protocol has a number of other applications in the DeFi ecosystem.

Here are some of the many applications of the 1inch Protocol:

- Liquidity Aggregation: The 1inch Protocol aggregates liquidity from multiple decentralized exchanges (DEXs), including Uniswap, SushiSwap, Balancer, and more. This ensures that users get the best possible prices for their trades by sourcing liquidity from different pools. By aggregating liquidity, the 1inch Protocol mitigates issues such as low liquidity, slippage, and front-running.

- Gas Optimization: Gas fees on the Ethereum network can be quite high during periods of congestion. The 1inch Protocol optimizes gas usage by splitting larger trades into smaller ones across multiple DEXs. By doing so, it reduces the overall gas costs for users.

- Arbitrage Opportunities: The 1inch Protocol can be used to identify and exploit arbitrage opportunities in the DeFi market. By comparing prices across multiple DEXs, it can identify price discrepancies and execute trades to profit from them.

- Token Swaps: The primary use case of the 1inch Protocol is to optimize token swaps. Users can easily swap between ERC20 tokens at the best possible prices by using the 1inch Protocol. The Protocol automatically splits the trade across multiple DEXs to minimize slippage and ensure the most favorable rates.

- Lending and Borrowing: The 1inch Protocol can also be used for lending and borrowing purposes. Users can leverage the Protocol to find the best lending and borrowing rates available on various DeFi lending platforms. This enables users to optimize their interest rates and maximize their returns.

- Limit Orders: The 1inch Limit Order Protocol allows users to place limit orders on DEXs. This means that users can set specific price points at which they want to buy or sell tokens, and the Protocol will execute the trades when those conditions are met. This allows users to take advantage of market movements without constantly monitoring the market.

These are just a few examples of the many applications of the 1inch Protocol. As the DeFi ecosystem continues to evolve, the Protocol is likely to find even more use cases and further enhance the user experience in decentralized finance.

Enhancing Decentralized Exchanges with 1inch Protocol

Decentralized exchanges (DEXs) have become an integral part of the blockchain ecosystem, allowing users to trade cryptocurrencies without relying on a centralized authority. However, DEXs often suffer from issues such as low liquidity and high slippage, making it less attractive for traders.

This is where the 1inch Protocol comes in. It is a decentralized exchange aggregator that connects various DEXs to provide users with the best possible trading rates. By leveraging smart contract technology, 1inch Protocol splits a user’s trade across multiple DEXs to find the most optimal trading route.

1inch Protocol enhances decentralized exchanges in several ways:

- Improved Liquidity: One of the main challenges faced by DEXs is the lack of liquidity. By aggregating liquidity from multiple DEXs, 1inch Protocol significantly increases the available liquidity, resulting in better trading opportunities for users.

- Reduced Slippage: Slippage refers to the difference between the expected price of a trade and the actual executed price. High slippage can lead to significant losses for traders. 1inch Protocol minimizes slippage by splitting larger trades across multiple DEXs, ensuring that the best individual prices are obtained.

- Optimized Trading Routes: 1inch Protocol intelligently selects the most efficient trading routes by analyzing various factors such as gas fees, trading volumes, and price differences across DEXs. This ensures that users get the best possible rates while minimizing transaction costs.

- Access to Multiple DEXs: 1inch Protocol connects users to multiple DEXs such as Uniswap, SushiSwap, and Kyber Network, giving them access to a wider range of trading options. This allows users to take advantage of different pools and liquidity sources, maximizing their trading opportunities.

The 1inch Protocol serves as a powerful tool for both experienced and novice traders in the decentralized finance (DeFi) space. It not only enhances the functionality of DEXs but also empowers users with better trading options and improved efficiency.

In conclusion, the 1inch Protocol plays a vital role in enhancing decentralized exchanges by addressing liquidity and slippage issues, optimizing trading routes, and providing access to multiple DEXs. With its innovative approach, 1inch Protocol is revolutionizing the way users trade cryptocurrencies on decentralized platforms.

Optimizing Liquidity Providers’ Profitability with 1inch Protocol

1inch Protocol is a decentralized exchange aggregator that leverages smart contract technology to optimize trades across multiple liquidity sources. While it offers benefits to both traders and liquidity providers, this article focuses on how liquidity providers can optimize their profitability by using 1inch Protocol.

One of the key advantages of 1inch Protocol for liquidity providers is its ability to source liquidity from various decentralized exchanges (DEXs) and automated market makers (AMMs). By accessing a wide range of liquidity pools, liquidity providers can increase their chances of finding the best possible trades and maximizing their profits.

Additionally, 1inch Protocol incorporates an advanced routing algorithm that selects the most cost-effective path for each trade. This means that liquidity providers can enjoy optimized trade executions, minimizing slippage and maximizing their profitability.

Another feature that enhances liquidity providers’ profitability with 1inch Protocol is the ability to earn yield on their deposited assets. By participating in liquidity pools, liquidity providers can earn trading fees and liquidity mining rewards, further increasing their overall profitability.

Furthermore, 1inch Protocol offers a user-friendly interface that makes it easy for liquidity providers to manage their positions and track their performance. The platform provides detailed analytics and real-time data, allowing liquidity providers to make informed decisions and adapt their strategies accordingly.

To ensure security and reduce the risks associated with providing liquidity, 1inch Protocol utilizes audited smart contracts and incorporates industry-leading security measures. This gives liquidity providers peace of mind knowing that their assets are protected, further enhancing their overall profitability.

In conclusion, 1inch Protocol provides liquidity providers with a powerful platform to optimize their profitability. By leveraging its decentralized exchange aggregator, advanced routing algorithm, yield opportunities, user-friendly interface, and robust security measures, liquidity providers can maximize their potential earnings and achieve higher profitability in the decentralized finance (DeFi) ecosystem.

| Benefits for Liquidity Providers: |

|---|

| Access to multiple liquidity sources |

| Optimized trade executions |

| Earn yield on deposited assets |

| User-friendly interface with detailed analytics |

| Enhanced security measures |

Empowering Blockchain Developers with 1inch Protocol

The 1inch Protocol is not only designed to provide users with efficient and secure decentralized trading solutions, but it also aims to empower blockchain developers to create innovative applications and integrations in the DeFi ecosystem.

With its intuitive API and developer-focused tools, the 1inch Protocol offers an array of features and functionalities that enable developers to build decentralized applications on top of its infrastructure.

One of the key aspects of the 1inch Protocol is its aggregation algorithm, which sources liquidity from various decentralized exchanges to provide users with the best trading rates and lowest slippage possible. Developers can leverage this algorithm by integrating it into their applications, allowing their users to access the benefits of optimized trading routes.

Additionally, the 1inch Protocol provides an easy-to-use API that developers can utilize to access and utilize various features of the protocol. This includes querying trading pairs, getting token prices, executing trades, and monitoring transactions. The API documentation is well-documented and provides comprehensive information and examples, making it easier for developers to integrate the protocol into their applications.

Furthermore, the 1inch Protocol offers a software development kit (SDK) that simplifies the integration process even further. The SDK includes a set of pre-built functions and tools that enable developers to quickly and efficiently integrate the protocol into their applications. This saves developers valuable time and effort, allowing them to focus on building the core features of their dApps.

By empowering blockchain developers with these tools and resources, the 1inch Protocol aims to foster innovation and drive the adoption of decentralized finance. It provides developers with the capability to create decentralized exchanges, liquidity pools, yield farming platforms, and other DeFi applications with ease.

- Integrating the 1inch Protocol into a decentralized exchange allows users to access liquidity from multiple sources and ensures optimal trading routes.

- Building a yield farming platform on top of the 1inch Protocol enables users to maximize their returns by automatically optimizing yields across various protocols.

- Creating a decentralized lending platform with the 1inch Protocol allows users to borrow and lend assets with competitive interest rates across different lending protocols.

In conclusion, the 1inch Protocol is not just a powerful trading tool for users, but it also empowers developers to build innovative decentralized applications. With its aggregation algorithm, API, and SDK, developers have the necessary tools and resources to create new and exciting DeFi solutions, driving the growth and adoption of the decentralized finance ecosystem.

Unlocking New Possibilities for DeFi Users with 1inch Protocol

DeFi, or decentralized finance, has emerged as one of the most promising use cases for blockchain technology. It allows users to access financial services in a decentralized manner, without the need for intermediaries.

1inch Protocol is a decentralized exchange (DEX) aggregator that is making waves in the DeFi space. It allows users to access multiple decentralized exchanges through a single interface, providing them with the best possible prices and saving them time and gas fees.

Improved Liquidity

One of the key ways that 1inch Protocol unlocks new possibilities for DeFi users is by improving liquidity. Liquidity is a measure of how easily an asset can be exchanged for another without affecting its price. High liquidity is crucial for efficient trading and ensures that users can easily enter and exit positions.

1inch Protocol achieves improved liquidity by aggregating liquidity pools from various decentralized exchanges. This means that users can access a larger pool of liquidity, resulting in better prices and reduced slippage. It also allows users to trade assets that may not be available on a single exchange.

Reduced Costs and Complexity

Another way that 1inch Protocol benefits DeFi users is by reducing costs and complexity. When using traditional decentralized exchanges, users often need to manually search for the best prices and execute trades on different platforms. This process can be time-consuming and result in higher gas fees.

1inch Protocol simplifies this process by automatically executing trades on the most favorable exchanges. By aggregating liquidity and routing trades efficiently, users can save time and reduce costs. This is especially beneficial for traders who frequently engage in arbitrage opportunities or need to execute trades quickly.

| Benefits of 1inch Protocol for DeFi Users |

|---|

| Improved liquidity by aggregating liquidity from various decentralized exchanges. |

| Reduced costs and complexity by automatically executing trades on the most favorable exchanges. |

| Access to a wide range of assets, including those not available on a single exchange. |

| Enhanced security through the use of smart contracts and decentralized technology. |

Overall, 1inch Protocol is unlocking new possibilities for DeFi users by providing them with improved liquidity, reduced costs and complexity, and access to a wide range of assets. This innovative protocol is revolutionizing the DeFi space and empowering users to take full advantage of the opportunities offered by decentralized finance.

Question-answer:

What is 1inch Protocol?

1inch Protocol is a decentralized exchange aggregator that sources liquidity from various decentralized exchanges and chooses the best available rates for users. It aims to provide users with the most cost-effective and seamless trading experience.

How does 1inch Protocol work?

1inch Protocol uses an algorithm called Pathfinder that scans multiple decentralized exchanges to find the most optimal routes for trading. It splits orders across various decentralized exchanges to ensure users get the best prices and minimize slippage. It also takes into account gas fees and network congestion to provide the most cost-effective trades.

What are the use cases of 1inch Protocol?

1inch Protocol can be used for various purposes, including but not limited to: