Welcome to the world of decentralized finance, where opportunities to maximize your earnings are endless. One of the most popular platforms in the DeFi space is 1inch Swap, a decentralized exchange aggregator that allows traders to find the best prices and routes for their token swaps. Whether you’re new to DeFi or an experienced trader, this article will provide you with valuable tips and strategies to help you make the most out of your trading experience on 1inch Swap.

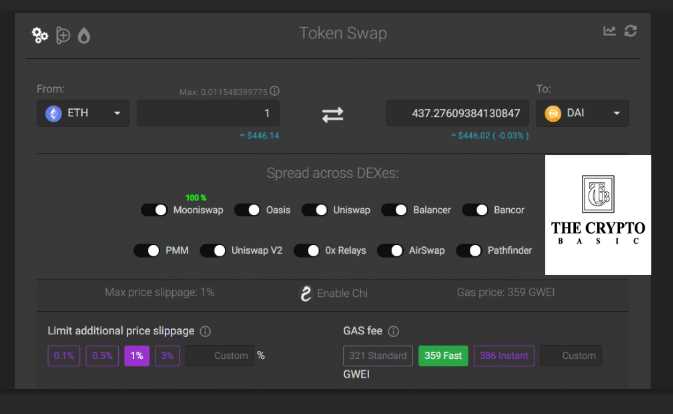

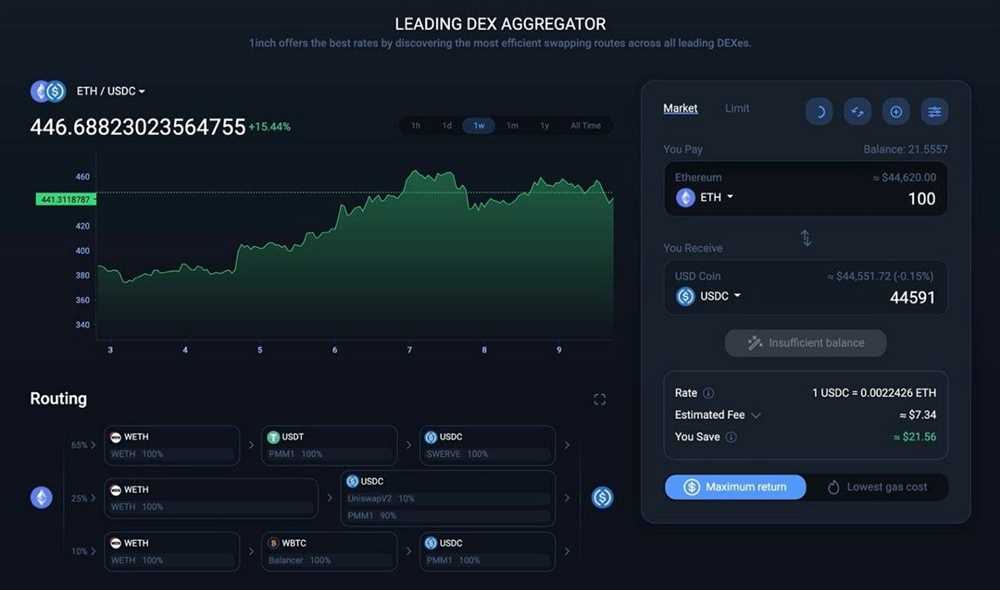

1inch Swap offers a unique feature called “smart routing,” which splits your trade across multiple liquidity sources to find the best possible price. This is especially beneficial in times of high volatility when prices can vary significantly between different decentralized exchanges. By using smart routing, you can save on gas fees and optimize your trades.

One key strategy to maximize your earnings on 1inch Swap is to take advantage of liquidity mining programs. Many tokens listed on 1inch Swap offer rewards for users who provide liquidity to their pools. By supplying tokens to these pools, you can earn additional tokens as a reward. Be sure to do your research and choose pools with high APY (Annual Percentage Yield) to maximize your earnings.

In addition to liquidity mining, another strategy to consider is arbitrage trading. As a decentralized exchange aggregator, 1inch Swap sources liquidity from multiple exchanges. This opens up opportunities for arbitrage, where you can take advantage of price differences between exchanges to make a profit. Keep an eye out for price disparities and execute quick trades to capitalize on these opportunities.

Lastly, don’t forget to stay updated with the latest market trends and news. The DeFi space is constantly evolving, and being aware of the latest developments can help you make informed trading decisions. Follow reputable sources, join relevant communities, and take advantage of social media platforms to stay informed about new token listings, partnerships, and upcoming events that may impact the prices on 1inch Swap.

With these tips and strategies in mind, you’re now equipped to maximize your earnings on 1inch Swap. Remember to always do your own research, manage your risks, and stay vigilant in the fast-paced world of decentralized finance. Happy trading!

What is 1inch Swap?

1inch Swap is a decentralized exchange aggregator that aims to find the best trading routes across various decentralized exchanges (DEXs). It was developed in 2019 by Sergej Kunz and Anton Bukov with the goal of providing users with the most efficient and cost-effective way to swap their tokens.

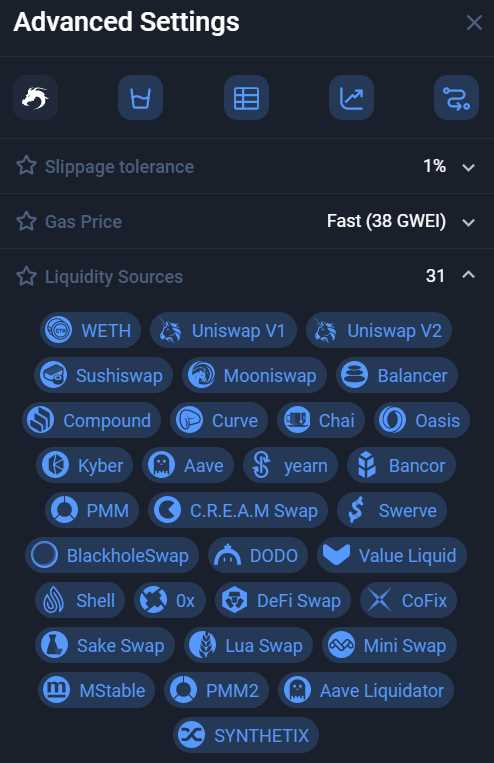

1inch Swap works by splitting a user’s swap across multiple DEXs to ensure they get the best possible price for their trade. By using various liquidity sources, such as Uniswap, Kyber Network, Balancer, and more, 1inch Swap is able to find the optimal path and execute the swap with minimum slippage and maximum returns.

The platform employs a smart contract called Pathfinder, which helps calculate the most profitable trading routes for a given swap. It takes into account factors such as liquidity depth, trading fees, and gas prices to ensure users get the best results.

1inch Swap also offers other features, such as limit orders, enabling users to set specific price conditions for their trades. This allows users to take advantage of market opportunities even when they’re not actively monitoring the market.

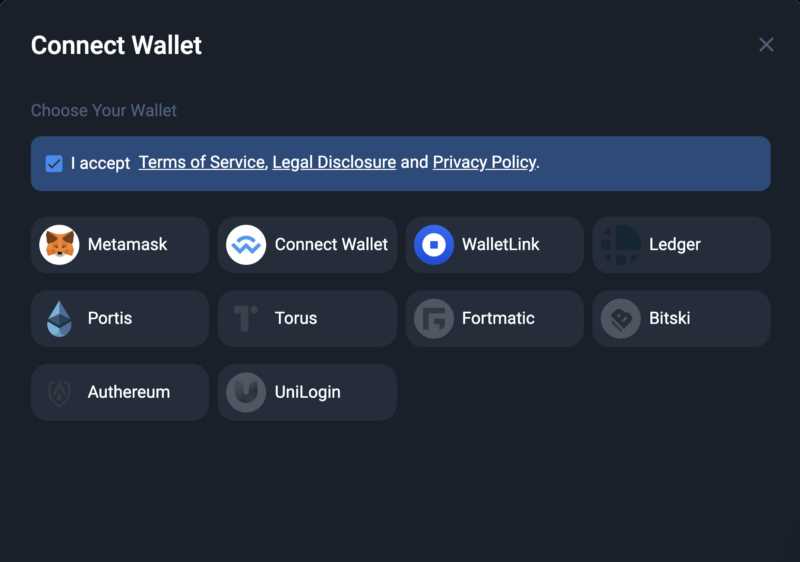

The platform is built on the Ethereum blockchain and is known for its high-speed execution and low trading fees. It also offers a seamless user experience with a user-friendly interface and integrations with popular wallets like MetaMask.

| Key Features of 1inch Swap: |

|---|

| Decentralized exchange aggregator |

| Optimal trading routes across multiple DEXs |

| Smart contract Pathfinder for route calculation |

| Limit orders for taking advantage of market conditions |

| High-speed execution and low trading fees |

In conclusion, 1inch Swap is a powerful tool for decentralized finance (DeFi) traders, providing them with an easy and efficient way to maximize their earnings by finding the best trading routes across various DEXs. With its user-friendly interface and innovative features, 1inch Swap is becoming a popular choice among DeFi enthusiasts.

Benefits of Using 1inch Swap

1inch Swap is a powerful decentralized exchange aggregator that offers several benefits to DeFi traders. Here are some of the advantages of using 1inch Swap:

- Efficiency: 1inch Swap is designed to ensure the best possible trading experience for users. It automatically splits and routes orders across multiple decentralized exchanges to ensure optimal prices and minimal slippage.

- Access to Multiple Liquidity Sources: 1inch Swap aggregates liquidity from various decentralized exchanges, providing users with access to a wide range of trading pairs and liquidity pools. This allows traders to find the best liquidity and prices for their trades.

- Lower Fees: By routing trades through different decentralized exchanges, 1inch Swap can often find paths with lower fees compared to trading directly on a single exchange. This can result in significant cost savings for traders.

- Gas Optimization: Gas fees on the Ethereum network can be high during periods of high demand. 1inch Swap employs gas optimization techniques to minimize the gas fees required for transactions, making it more cost-effective for traders.

- Advanced Trading Features: 1inch Swap offers advanced trading features such as limit orders and stop-loss orders, allowing traders to execute more complex trading strategies. These features can help traders maximize their earnings and manage risks effectively.

- Security and Transparency: 1inch Swap is built on a secure and audited smart contract, ensuring the safety of users’ funds. Additionally, the platform provides clear and transparent information about trading fees, slippage, and other relevant metrics, allowing users to make informed decisions.

Overall, 1inch Swap provides traders with a powerful tool for maximizing their earnings in the DeFi space. Its efficient routing, access to multiple liquidity sources, lower fees, gas optimization, advanced trading features, security, and transparency make it a popular choice among DeFi traders.

Minimal Slippage and Better Prices

When using the 1inch Swap platform for your DeFi trading, one of the key advantages is the ability to minimize slippage and obtain better prices for your trades.

Slippage refers to the difference between the expected price of a trade and the price at which the trade is actually executed. In decentralized exchanges, slippage is particularly relevant due to the constant fluctuations in token prices.

With 1inch Swap, you can take advantage of innovative algorithms that source liquidity from different decentralized exchanges, known as DEX aggregators. This allows you to find the best possible prices for your trades, resulting in minimal slippage.

By splitting your trade across multiple liquidity sources, 1inch Swap can ensure that you get the most favorable price for your tokens. The platform uses efficient routing to identify and execute trades at lower prices, ultimately maximizing your earnings as a DeFi trader.

The Importance of Liquidity

In order to achieve minimal slippage and better prices, a key factor to consider is liquidity. Liquidity refers to the availability of tokens to be traded on a given platform.

1inch Swap is able to source liquidity from a wide range of exchanges, including both centralized and decentralized platforms. This allows for a higher level of liquidity, ensuring that your trades can be executed smoothly and at the best possible prices.

Due to the decentralized nature of the platform, 1inch Swap also benefits from the presence of liquidity providers who deposit their tokens into liquidity pools. These providers are incentivized with rewards in return for supplying liquidity, creating a sustainable ecosystem for traders.

Maximizing Your Earnings

By utilizing 1inch Swap’s advanced algorithms and liquidity sourcing capabilities, you can effectively maximize your earnings as a DeFi trader.

Here are a few tips to help you make the most of your trading experience:

| 1. Compare prices: | Before executing a trade, use 1inch Swap to compare prices across different platforms to find the best possible deal. |

| 2. Consider gas fees: | Gas fees can significantly impact your earnings. Use 1inch Swap to find the most cost-effective options while considering gas fees. |

| 3. Set appropriate slippage limits: | When executing trades, it’s important to set appropriate slippage limits to ensure that your trades are executed at the desired prices. |

| 4. Utilize limit orders: | Consider using limit orders to specify the maximum price at which you are willing to buy or sell tokens, allowing for better control over your trades. |

By following these strategies and utilizing the features offered by 1inch Swap, you can optimize your trading activities and maximize your earnings in the DeFi space.

Access to Multiple Liquidity Sources

One of the main advantages of using 1inch Swap for your DeFi trading is the access to multiple liquidity sources. This means that you can get the best possible price for your trades by tapping into a wide range of decentralized exchanges (DEXs).

When you use 1inch Swap, your trade is split across multiple DEXs to ensure that you get the most favorable rates. This is done through a process called “splitting”, where your order is divided into smaller parts and executed on different DEXs.

By accessing multiple liquidity sources, you can take advantage of the depth and diversity of the DeFi market. Each DEX may have different pools of liquidity, meaning that by tapping into multiple sources, you can find the best available prices for your trades.

| Benefits of accessing multiple liquidity sources: |

|---|

| 1. Better prices: By splitting your trade across multiple DEXs, you can get the best possible price for your tokens. |

| 2. Increased liquidity: With access to multiple sources, you have a higher chance of finding the liquidity you need, even for illiquid tokens. |

| 3. Reduced slippage: By accessing multiple liquidity sources, you can minimize slippage and ensure that your trade is executed at the expected price. |

| 4. More trading opportunities: With access to a wide range of DEXs, you can take advantage of different pools, trading pairs, and opportunities that may not be available on a single exchange. |

Overall, having access to multiple liquidity sources through 1inch Swap gives you more control and flexibility in your DeFi trading. You can optimize your trades to get the best possible prices, reduce slippage, and take advantage of various opportunities in the market.

Gas Optimization

Gas optimization is an essential aspect of maximizing your earnings with 1inch Swap. Gas refers to the computational effort required to execute a transaction on the Ethereum network, and it is paid in Ether (ETH).

To optimize gas usage, there are a few strategies you can follow:

1. Choose the Right Time to Trade

Gas prices on the Ethereum network fluctuate depending on demand. By monitoring gas prices, you can identify periods when gas fees are lower and make your trades during those times.

2. Use Limit Orders

Instead of making market orders, consider using limit orders. By setting a target price for your trade, you can wait for the market to reach that price, which can save on unnecessary transactions and reduce gas costs.

Tip: Be sure to set sensible expiration dates for your limit orders to avoid any potential losses if the market doesn’t move in your favor.

3. Batch Transactions

Batching multiple transactions into a single transaction can help reduce gas costs. For example, instead of making separate trades for each token you want to swap, you can combine them into one transaction using the 1inch Swap interface. This reduces the overall gas fees you need to pay.

4. Choose the Right Gas Price

When making a transaction, you can choose the gas price you are willing to pay. Higher gas prices generally result in faster transaction confirmation, but they also come with higher costs. By selecting the right gas price based on network congestion and your urgency, you can optimize your gas expenses.

Tip: Use the Gas Price in Gwei slider in the 1inch Swap interface to select an appropriate gas price for your transaction.

By implementing these gas optimization strategies, you can maximize your earnings and minimize your gas fees when using 1inch Swap.

Tips for Maximizing Earnings with 1inch Swap

1. Utilize the best liquidity pools: When using 1inch Swap, it is important to choose the liquidity pool that offers the best rates. This can significantly increase your earnings. Take advantage of the available data and make informed decisions about which pool to use.

2. Consider the slippage: Slippage refers to the difference between the expected price and the executed price of a trade. It is important to consider the slippage when trading on 1inch Swap, as high slippage can reduce your earnings. Choose pools with lower slippage to maximize your earnings.

3. Use limit orders: 1inch Swap allows users to set limit orders, which allow you to specify the maximum price you are willing to pay for a specific token. By using limit orders, you can ensure that you get the best possible rate and maximize your earnings.

4. Monitor gas fees: Gas fees can significantly impact your earnings, especially when trading on Ethereum. Keep an eye on the gas fees and try to trade during periods of low congestion to minimize costs and maximize your earnings.

5. Diversify your investments: Instead of putting all your funds into a single liquidity pool, consider diversifying your investments across multiple pools. This can help spread the risk and increase your chances of earning higher returns.

6. Stay informed: Continuously monitor the market and keep yourself updated with the latest news and trends in the DeFi space. This will help you make more informed decisions and maximize your earnings with 1inch Swap.

7. Consider impermanent loss: Impermanent loss occurs when you provide liquidity to a pool and the value of the assets changes. It is important to consider the potential impermanent loss when deciding which pools to provide liquidity to. Minimizing impermanent loss can help maximize your earnings.

8. Do your own research: While these tips can help you maximize your earnings with 1inch Swap, it is important to do your own research and make informed decisions based on your individual risk tolerance and investment goals.

By following these tips and strategies, you can maximize your earnings with 1inch Swap and make the most of your DeFi trading experience.

Question-answer:

What is 1inch Swap?

1inch Swap is a decentralized exchange aggregator that sources liquidity from various platforms to offer users the best possible trading rates. It is designed to provide users with the most cost-effective and efficient way to make trades in the DeFi space.

How can I maximize my earnings with 1inch Swap?

To maximize your earnings with 1inch Swap, you can take advantage of various strategies such as finding the best rates, using limit orders, and exploring different liquidity pools. Additionally, staying updated with the latest market trends and conducting thorough research can help you make informed trading decisions to maximize your earnings.

What are some tips for using 1inch Swap as a DeFi trader?

As a DeFi trader using 1inch Swap, some tips to consider are: always compare rates across different platforms to find the best deal, be aware of transaction fees and gas costs, stay updated with the latest market trends and news, consider using limit orders for better control over your trades, and diversify your portfolio by exploring different liquidity pools.

Can you explain how the liquidity pools work on 1inch Swap?

Liquidity pools on 1inch Swap are formed by users who provide their funds to the platform in exchange for fees generated by trades. These pools are used to provide liquidity for different tokens, allowing users to easily swap between them. By providing liquidity to these pools, users can earn a share of the fees generated by trades, which can become a source of passive income.