Are you looking to maximize your earning potential in the world of decentralized finance? Look no further than becoming a liquidity provider on 1inch Exchange.

What is a liquidity provider?

A liquidity provider plays a vital role in ensuring smooth transactions on decentralized exchanges. By depositing funds into a liquidity pool, you contribute to the overall liquidity of the platform, allowing users to easily swap tokens.

Why choose 1inch Exchange?

1inch Exchange is a leading decentralized exchange aggregator, offering users access to the most competitive prices across multiple liquidity sources. With its innovative smart routing system, your tokens will have the highest chances of being traded at the best rates.

How to become a liquidity provider on 1inch Exchange:

- Create an Ethereum wallet and ensure you have some tokens to provide liquidity with.

- Visit the 1inch Exchange website and click on the “Liquidity” tab.

- Connect your wallet to the platform.

- Select the tokens you would like to provide liquidity for.

- Choose the percentage of each token you would like to deposit into the liquidity pool.

- Confirm the transaction and you’re all set!

Benefits of being a liquidity provider on 1inch Exchange:

- Earn passive income through trading fees collected from swaps.

- Contribute to the growth and decentralization of the DeFi ecosystem.

- Enjoy rewards and incentives offered by 1inch Exchange.

- Experience the power of decentralized finance firsthand.

Ready to take the plunge into becoming a liquidity provider on 1inch Exchange? Start earning and making a difference today!

Overview of Liquidity

Liquidity is a crucial factor in the world of finance and trading. It refers to the ease with which an asset or security can be bought or sold without causing a significant movement in its price. In the context of cryptocurrency exchanges, liquidity plays a vital role in determining the efficiency and effectiveness of trading.

Being a liquidity provider on 1inch Exchange means that you contribute liquidity to the platform by supplying digital assets to the liquidity pool. By doing so, you enable users to trade those assets with minimal slippage, ensuring smooth and efficient transactions.

1inch Exchange is a decentralized exchange aggregator that sources liquidity from various protocols and offers the best available rates to its users. As a liquidity provider on 1inch Exchange, you become an integral part of this ecosystem, helping to facilitate seamless and cost-effective trades for users.

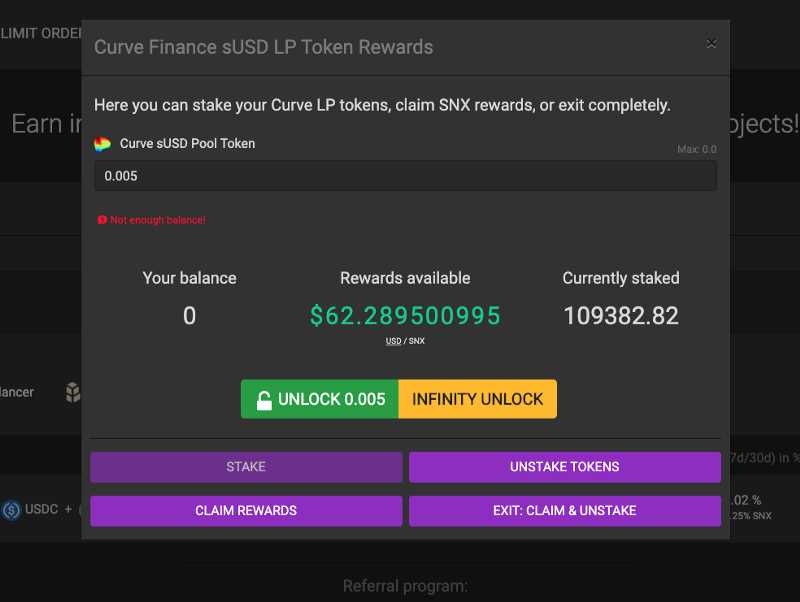

By providing liquidity on 1inch Exchange, you earn a portion of the trading fees generated by the platform. The more liquidity you provide, the higher your potential earnings. This can be an attractive opportunity for individuals and entities looking to earn passive income from their digital assets.

It is important to understand the risks and rewards associated with being a liquidity provider. While there is the potential for earning income, there are also risks involved, such as impermanent loss and the volatility of the cryptocurrency market. It is recommended to do thorough research and evaluate your risk tolerance before participating as a liquidity provider.

| Rewards | Risks |

|---|---|

| Earn trading fees | Impermanent loss |

| Contribute to the growth of the ecosystem | Market volatility |

| Passive income potential |

Becoming a liquidity provider on 1inch Exchange can be a rewarding experience, both financially and intellectually. It allows you to actively participate in the cryptocurrency market while helping to drive liquidity and efficiency. With the right understanding and risk management strategies, you can optimize your earnings and make a positive impact on the decentralized finance ecosystem.

Benefits of Becoming a Liquidity Provider

By becoming a liquidity provider on 1inch Exchange, you can enjoy a range of benefits that can greatly enhance your trading experience. Here are some of the key advantages:

|

1. Earn Passive Income: |

As a liquidity provider, you can earn passive income by providing liquidity to the 1inch Exchange. Whenever users trade on the platform, you receive a portion of the trading fees as a reward for your contribution. This can be a great way to generate income without actively trading. |

|

2. Reduce Slippage: |

By providing liquidity, you help to increase the liquidity pool, which can significantly reduce slippage for traders. This means that traders can execute their trades at the desired price without experiencing significant price impact. |

|

3. Improved Trading Experience: |

As a liquidity provider, you contribute to the overall liquidity of the platform, making it easier for traders to execute their trades. This can result in a smoother and more efficient trading experience for everyone involved. |

|

4. Diversification: |

By providing liquidity on 1inch Exchange, you can diversify your holdings and reduce your exposure to any single asset. This can help to mitigate risk and potentially improve your overall investment strategy. |

|

5. Access to New Projects: |

Liquidity providers often get early access to new projects and tokens that are listed on the platform. This can provide you with the opportunity to invest in promising projects before they become widely available, potentially resulting in higher returns. |

In conclusion, becoming a liquidity provider on 1inch Exchange can offer various benefits, including passive income, reduced slippage, improved trading experience, diversification, and access to new projects. If you’re looking to enhance your trading experience and generate additional income, consider becoming a liquidity provider on 1inch Exchange today!

Step 1: Understanding Liquidity Pools

Before you become a liquidity provider on 1inch Exchange, it’s important to understand what liquidity pools are and how they work.

What are Liquidity Pools?

Liquidity pools are pools of tokens that are locked in smart contracts and used to facilitate decentralized trading. In simple terms, they provide the necessary liquidity (or availability of tokens) for trades to occur.

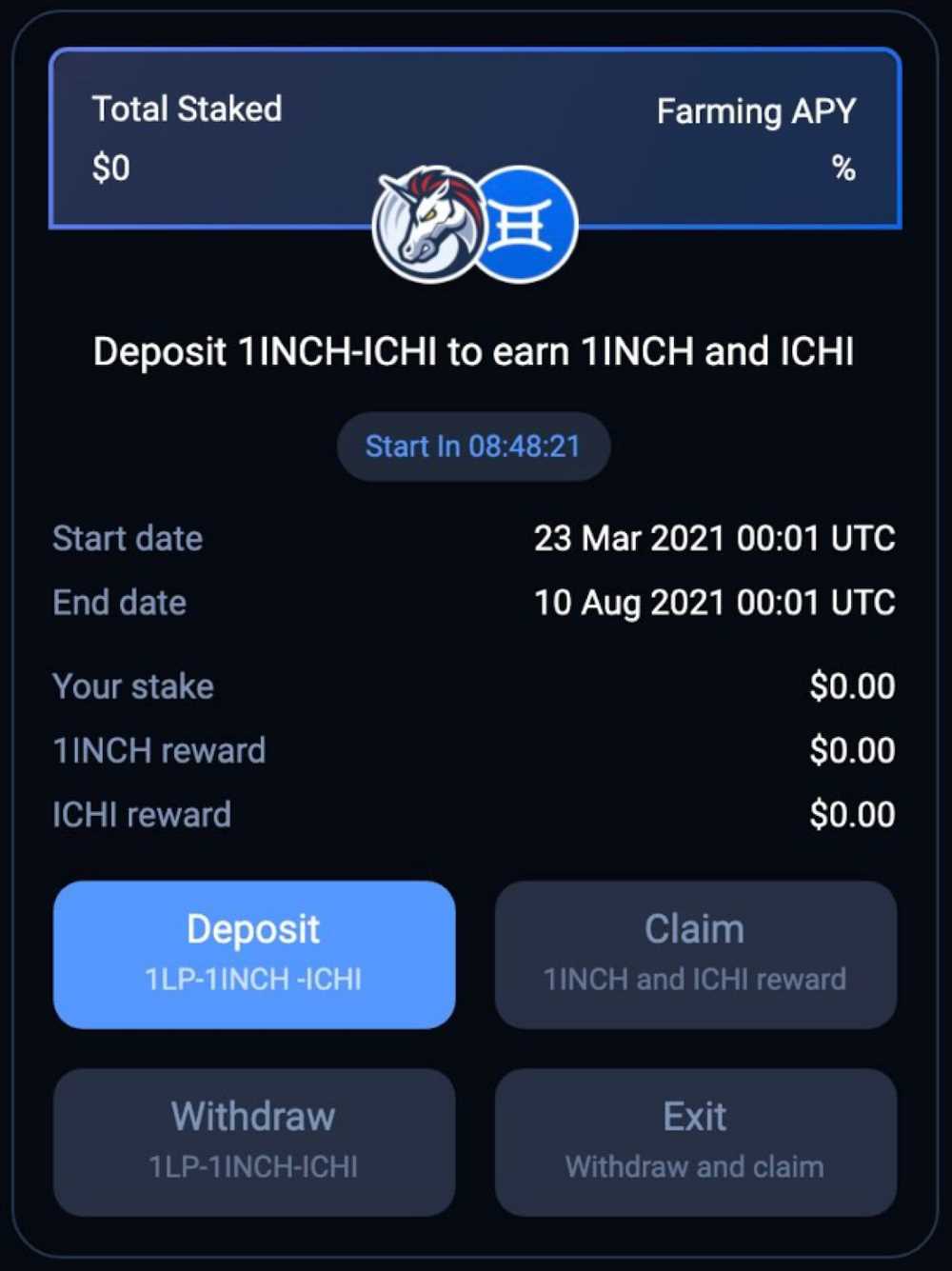

When you become a liquidity provider, you add your tokens to a liquidity pool. These tokens are then used to facilitate trades on the 1inch Exchange platform. In return for providing liquidity, you earn fees from trades that occur in the pool.

It’s important to note that when you add your tokens to a liquidity pool, they are no longer in your possession. They become a part of the pool and are used by traders for their transactions.

How do Liquidity Pools Work?

Liquidity pools work using an automated market maker (AMM) mechanism. This means that trades are not matched with specific buyers and sellers, but instead, they are executed based on a mathematical formula.

The price of tokens in a liquidity pool is determined by a constant equation. When there is more demand for a token, the price increases, and vice versa. This mechanism ensures that trades can be executed quickly and efficiently, even if there are no buyers or sellers available.

When you provide liquidity to a pool, you will receive liquidity provider (LP) tokens. These tokens represent your share of the pool. Whenever you decide to withdraw your tokens from the pool, you can redeem your LP tokens, and the corresponding amount of tokens will be given back to you.

Now that you have a basic understanding of liquidity pools, you can proceed to the next steps and learn how to become a liquidity provider on 1inch Exchange.

Step 2: Choosing the Right Tokens for Liquidity Provision

When it comes to becoming a liquidity provider on 1inch Exchange, choosing the right tokens is crucial. The tokens you select will determine the trading pairs available for users, the potential fees you can earn, and the overall success of your liquidity provision strategy.

Research the Market

Before selecting tokens, it’s important to research the market and understand the current trends and demands. Look for tokens that have a high trading volume and are in demand among traders. You want to choose tokens that have a strong following and are likely to be traded frequently.

It’s also essential to consider the overall liquidity of the tokens you are interested in. Higher liquidity means that there are more buyers and sellers in the market, making it easier to enter and exit positions. Look for tokens that have a history of maintaining liquidity and are traded on multiple exchanges.

Diversify Your Portfolio

It’s generally recommended to diversify your portfolio and provide liquidity for multiple tokens and trading pairs. This helps to spread out your risk and increase the potential rewards. By offering liquidity for different tokens, you can cater to a broader range of traders and attract more users to the platform.

When selecting tokens, consider their correlation with each other. It’s useful to choose tokens that have low or negative correlation, as this helps to reduce risk and protect your investment. Diversifying your portfolio with uncorrelated tokens can also help to smooth out potential losses.

Remember:

Choosing the right tokens for liquidity provision requires careful research and consideration. Take the time to understand the market, analyze trading volumes, and diversify your portfolio. By selecting the right tokens, you can maximize your earning potential and contribute to the liquidity of 1inch Exchange.

Stay tuned for Step 3: Setting up Liquidity Provision Parameters

Step 3: Setting Up an Account on 1inch Exchange

Setting up an account on 1inch Exchange is a simple process that allows you to access a wide range of liquidity pools and trade cryptocurrencies with ease. Follow the steps below to create your account:

- Visit the official 1inch Exchange website at https://1inch.exchange.

- Click on the “Connect Wallet” button located at the top right corner of the website.

- Choose your preferred wallet provider from the list of supported options. 1inch Exchange supports popular wallets such as MetaMask and WalletConnect.

- Follow the instructions provided by your selected wallet provider to connect your wallet to 1inch Exchange.

- Once your wallet is connected, you will be able to access your wallet balance and manage your funds.

- Ensure that you have sufficient funds in your connected wallet to be able to provide liquidity on 1inch Exchange.

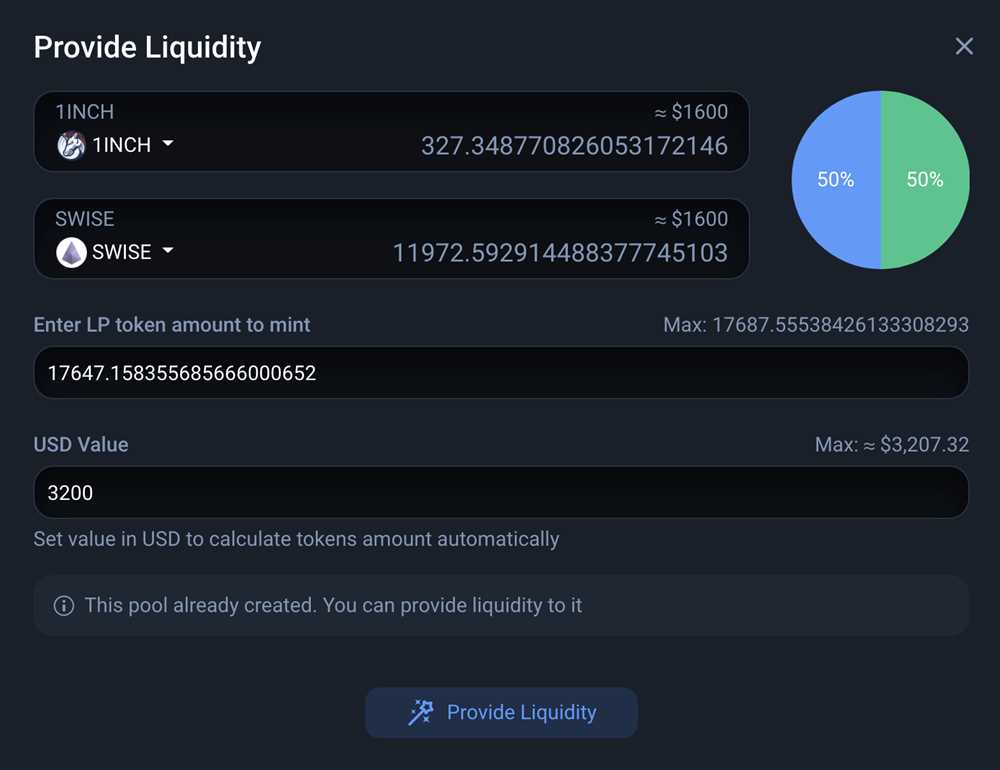

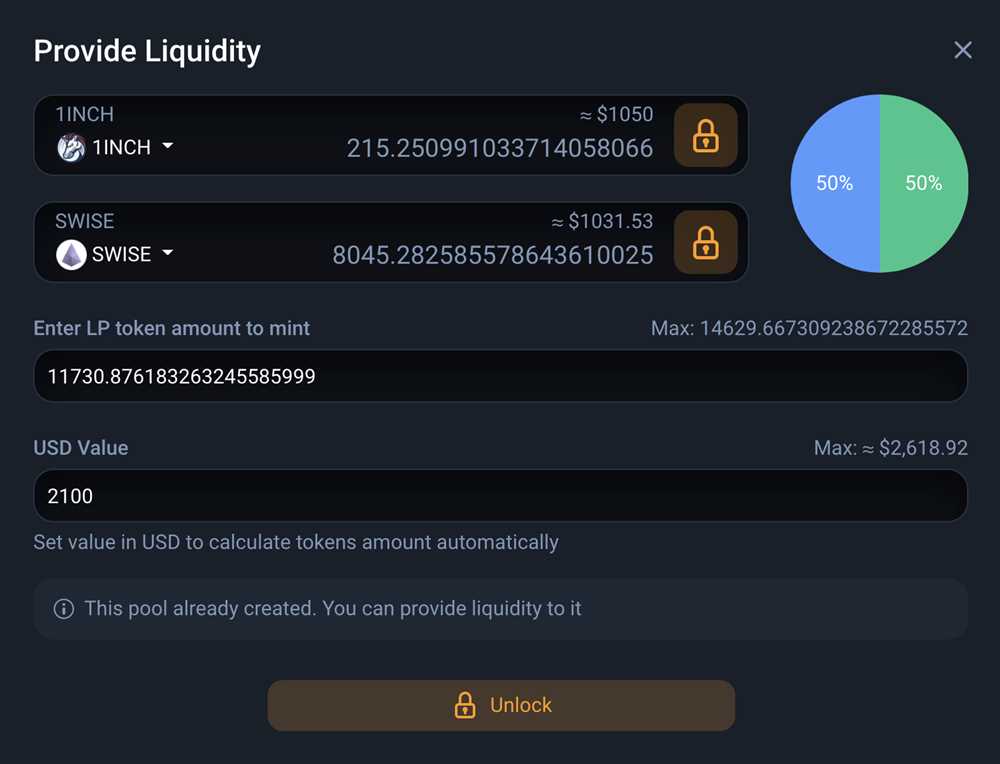

- Click on the “Pool” tab on the 1inch Exchange website to access the available liquidity pools.

- Select the liquidity pool you want to contribute to and click on the “Add liquidity” button.

- Specify the amount of tokens you wish to provide and confirm the transaction.

- Wait for the transaction to be processed and for your liquidity to be added to the pool.

- Your liquidity will now be available for trading on 1inch Exchange, and you will start earning fees based on the trading activity in the pool.

Setting up an account on 1inch Exchange is a crucial step towards becoming a liquidity provider and participating in the decentralized finance ecosystem. Follow the above steps to get started and unlock the various benefits and opportunities offered by 1inch Exchange.

Question-answer:

What is a liquidity provider?

A liquidity provider is an individual or entity that contributes funds to a liquidity pool on a decentralized exchange, such as 1inch Exchange. By providing liquidity, they enable users to make trades by matching their orders with the available funds in the liquidity pool.

How does one become a liquidity provider on 1inch Exchange?

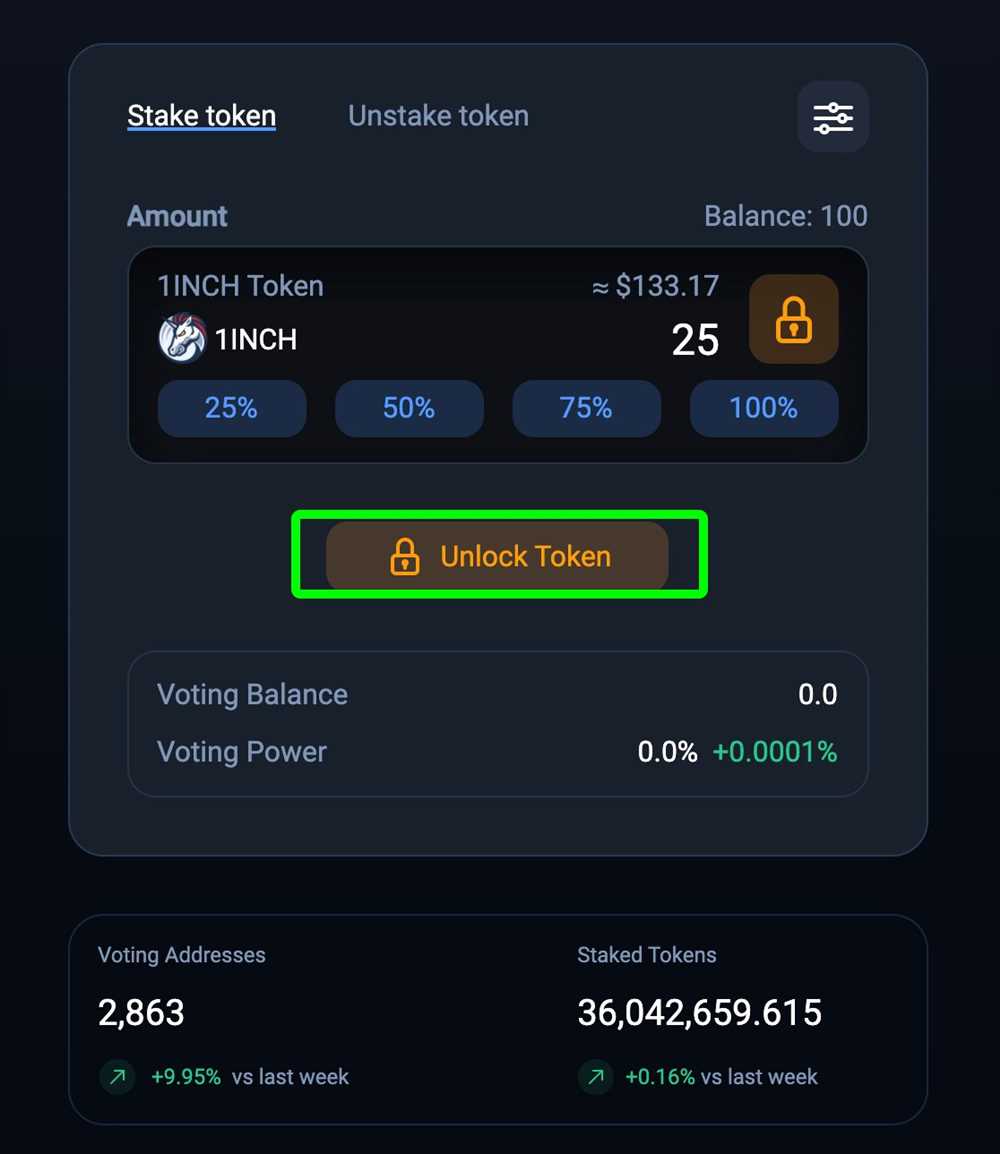

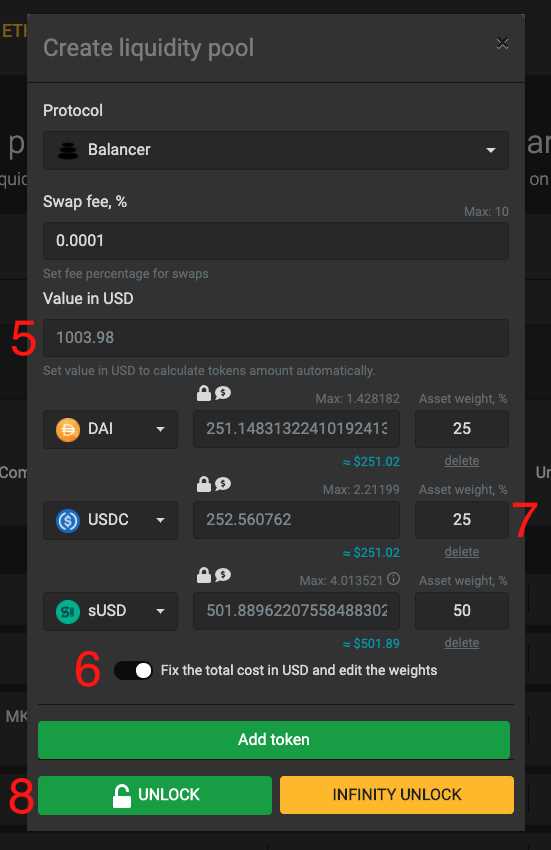

To become a liquidity provider on 1inch Exchange, you need to connect your wallet to the platform and navigate to the “Liquidity” section. From there, you can choose the tokens you want to provide liquidity for and specify the amount. Once you confirm the transaction, your funds will be added to the liquidity pool and you will start earning fees.

What are the risks of being a liquidity provider?

Being a liquidity provider involves certain risks. One of the main risks is impermanent loss, which occurs when the value of the tokens in the liquidity pool significantly changes relative to each other. This can result in a loss of funds compared to simply holding the tokens. Additionally, there is always the risk of smart contract vulnerabilities or hacks, which can lead to the loss of funds.

What fees do liquidity providers earn on 1inch Exchange?

Liquidity providers on 1inch Exchange earn fees from trades made on the platform. These fees are proportionate to the share of the liquidity pool they provide. The exact fee percentages may vary depending on the specific pool, but typically range from 0.05% to 0.3%.