Decentralized exchanges have gained significant popularity in the world of cryptocurrency, providing users with a secure and transparent way to trade digital assets. Among the wide array of decentralized exchanges available, 1inch Exchange stands out for its unique features and capabilities.

1inch Exchange is an aggregator for decentralized exchanges, allowing users to access multiple platforms and liquidity sources in a single interface. By combining the liquidity from various decentralized exchanges, 1inch ensures the best possible price execution for traders. It achieves this by splitting a single trade across multiple exchanges, optimizing gas costs, and reducing slippage.

One of the key advantages of 1inch Exchange is its superior user experience. The platform offers a simple and intuitive interface that makes it easy for both novice and experienced traders to navigate and execute trades. It provides detailed information on liquidity, pool prices, and transaction fees, empowering users to make informed decisions.

Another notable feature of 1inch Exchange is its gas optimization technology. Gas fees on the Ethereum network can be prohibitively expensive, especially during times of high demand. 1inch addresses this issue by utilizing advanced algorithms to find the most cost-efficient route for executing trades. This not only saves users money but also ensures faster transaction times.

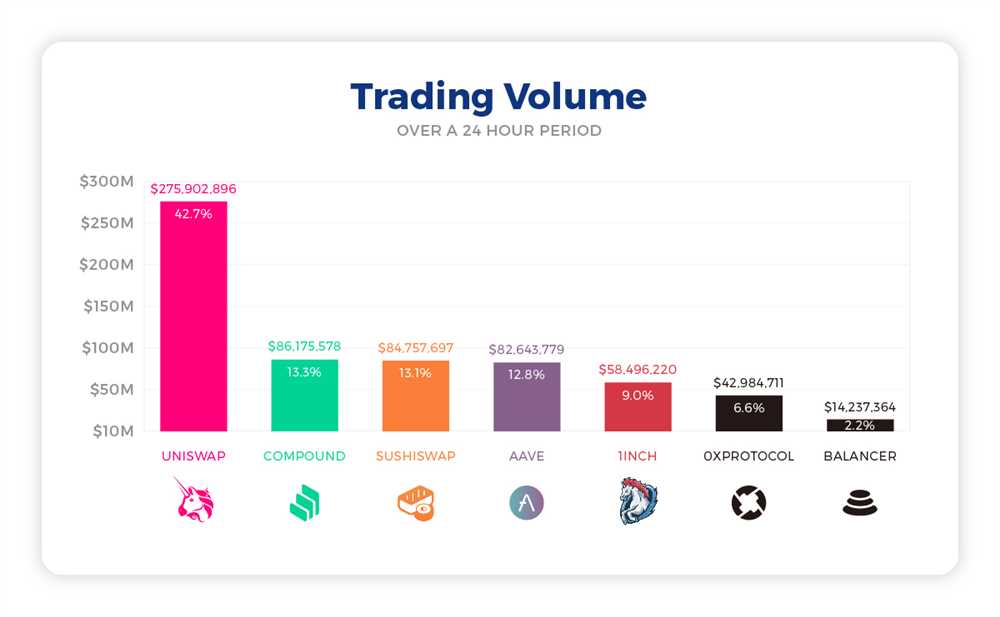

In comparison to other popular decentralized exchanges like Uniswap, SushiSwap, and PancakeSwap, 1inch Exchange offers distinct advantages. Its multi-platform aggregator approach provides users with access to a wider range of liquidity, resulting in improved price execution. Additionally, the gas optimization features of 1inch make it a more cost-effective option for traders, especially during periods of high network congestion.

In conclusion, 1inch Exchange stands out in the decentralized exchange landscape with its unique features and capabilities. With its aggregator model and gas optimization technology, it offers a seamless and cost-effective trading experience for users. As the cryptocurrency industry continues to grow, 1inch Exchange is well-positioned to become a leading player in the decentralized exchange space.

Key Features of 1inch Exchange

1. Aggregator: 1inch Exchange is an aggregator that pools liquidity from various decentralized exchanges (DEXs) to provide users with the best possible trading rates and minimal slippage. It achieves this by splitting users’ orders across multiple DEXs simultaneously. This feature ensures that users get the most competitive prices for their trades.

2. Smart Contract Protection: 1inch Exchange is built on smart contracts that are audited regularly to ensure the safety of users’ funds. The team behind 1inch has implemented several security features, such as security audits by reputable firms and bug bounty programs, to minimize the risk of hacks or vulnerabilities.

3. Gas Optimization: 1inch Exchange utilizes the Ethereum network’s gas optimization techniques to reduce transaction costs for users. It combines multiple trades into a single transaction, thereby saving on gas fees and making trading more cost-effective.

4. Low Slippage: With its aggregation algorithms, 1inch Exchange aims to minimize slippage, which refers to the difference between the expected price and the executed price of a trade. By splitting trades across multiple DEXs, 1inch can provide users with better prices and reduce slippage.

5. Advanced Trading Tools: 1inch Exchange offers users a range of advanced trading tools and features to enhance their trading experience. This includes limit orders, which allow users to set specific price targets for their trades, and gas fee estimation tools to help users determine the optimal gas price for their transactions.

6. Liquidity Mining: 1inch Exchange has a liquidity mining program that incentivizes users to provide liquidity to the platform. Users can earn rewards in the form of 1INCH tokens by supplying liquidity to specific trading pairs. This helps ensure that the platform has sufficient liquidity and encourages users to actively participate in the ecosystem.

7. User-Friendly Interface: The 1inch Exchange platform has a user-friendly interface that makes trading intuitive and accessible to both experienced and novice users. The platform provides clear and concise information about trading pairs, prices, and liquidity, allowing users to make informed decisions.

8. Integration with Wallets: 1inch Exchange is compatible with popular Ethereum wallets such as MetaMask, WalletConnect, and Ledger. This makes it easy for users to connect their wallets and start trading without the need for additional steps or account setups.

Advantages of 1inch Exchange over Other DEXs

1inch Exchange offers several advantages over other popular decentralized exchanges (DEXs) that make it a preferred choice for many traders and investors in the cryptocurrency market. These advantages include:

1. Efficient Price Aggregation

1inch Exchange leverages its innovative smart contract technology and liquidity aggregation protocols to offer efficient price aggregation. By searching for the best available prices across multiple DEXs, 1inch Exchange ensures that traders get the most optimal prices for their trades.

2. Low Slippage

Slippage is a common issue in decentralized exchanges where the execution price of a trade can vary significantly due to the fragmentation of liquidity. 1inch Exchange minimizes slippage by splitting larger orders into multiple smaller trades across different DEXs, ensuring better price execution and reducing the impact of market volatility.

3. Reduced Transaction Costs

1inch Exchange optimizes gas fees by intelligently routing trades through the Ethereum network. By dynamically selecting the most cost-effective route, 1inch Exchange minimizes transaction costs for traders, making it more economical compared to other DEXs.

4. Access to Deep Liquidity

Through its integration with multiple DEXs, 1inch Exchange provides users with access to deep liquidity pools. This ensures that traders can execute trades of any size without significantly impacting the market price and improves overall market efficiency.

5. User-Friendly Interface

1inch Exchange offers a user-friendly and intuitive interface that makes it easy for both experienced and novice traders to navigate and execute trades. The platform provides advanced trading tools and features, including charting tools, liquidity analysis, and customizable dashboards, to enhance the trading experience.

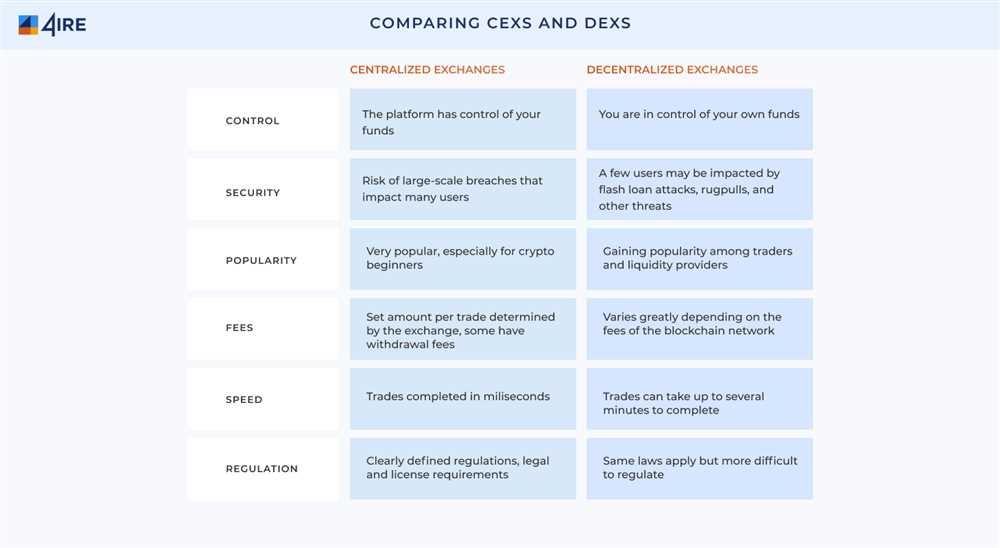

6. Secure and Non-Custodial

1inch Exchange is built on decentralized infrastructure, ensuring that users have full control over their funds. The platform operates as a non-custodial exchange, meaning that users retain ownership of their assets throughout the trading process and are not exposed to the risk of exchange hacks or theft.

- Efficient price aggregation

- Low slippage

- Reduced transaction costs

- Access to deep liquidity

- User-friendly interface

- Secure and non-custodial

In conclusion, 1inch Exchange offers a range of advantages over other DEXs, including efficient price aggregation, low slippage, reduced transaction costs, access to deep liquidity, a user-friendly interface, and security. These features make 1inch Exchange a compelling choice for traders and investors looking for optimal trading conditions and a seamless user experience.

Drawbacks of 1inch Exchange Compared to Other DEXs

While 1inch Exchange offers a range of innovative features and benefits, it also has its drawbacks when compared to other decentralized exchanges (DEXs). Some of the main drawbacks include:

| Limited Supported Cryptocurrencies | 1inch Exchange supports a decent number of cryptocurrencies; however, it has a limited range compared to some other popular DEXs. Users may find it frustrating if their preferred cryptocurrency is not available on the platform. |

| User Interface Complexity | While 1inch Exchange offers a powerful and customizable user interface, it can also be overwhelming for beginners. The interface includes various advanced options and features that may confuse users who are new to decentralized exchanges. |

| High Gas Fees | As with many Ethereum-based decentralized exchanges, 1inch Exchange can be subject to high gas fees during periods of network congestion. Users may have to pay significant transaction fees, especially when trading smaller amounts, which can be a deterrent for those seeking low-cost trading options. |

| Limited Liquidity for Lesser-known Tokens | While 1inch Exchange has a strong liquidity pool for popular tokens, it may have limited liquidity for lesser-known tokens. This can result in wider spreads and slippage, making it less attractive for users looking to trade smaller or more niche cryptocurrencies. |

| No Fiat On-Ramp | Unlike some other decentralized exchanges, 1inch Exchange does not offer a direct fiat on-ramp. Users cannot easily convert fiat currency into cryptocurrencies on the platform, which may be an inconvenience for those who prefer to use traditional banking channels. |

Despite these drawbacks, 1inch Exchange remains a popular and reputable decentralized exchange, offering unique features such as its aggregation protocol and intuitive user interface. Users should carefully consider their trading preferences and requirements when choosing a DEX.

Question-answer:

What is 1inch Exchange?

1inch Exchange is a decentralized exchange aggregator that sources liquidity from various decentralized exchanges to provide users with the best possible trading rates. It aims to minimize the slippage and fees by splitting the trade across multiple liquidity sources.

How does 1inch Exchange compare to other decentralized exchanges?

Compared to other decentralized exchanges, 1inch Exchange offers several advantages. It sources liquidity from multiple exchanges to provide the best rates, which can result in lower slippage and fees for users. 1inch Exchange also offers a user-friendly interface and supports a wide range of tokens.

What are some popular decentralized exchanges similar to 1inch Exchange?

Some popular decentralized exchanges similar to 1inch Exchange include Uniswap, SushiSwap, and Curve Finance. These exchanges also provide liquidity sourcing and offer competitive rates for trading various tokens.

What are the benefits of using 1inch Exchange over other decentralized exchanges?

There are several benefits of using 1inch Exchange over other decentralized exchanges. Firstly, 1inch Exchange sources liquidity from multiple exchanges, allowing users to get the best rates and minimize slippage. Secondly, 1inch Exchange has a user-friendly interface that makes it easy for users to navigate and execute trades. Lastly, 1inch Exchange supports a wide range of tokens, providing users with a greater choice of assets for trading.