During periods of market instability, it is crucial to examine the performance of different cryptocurrencies to understand their resilience and potential as investment options. One such cryptocurrency that has garnered significant attention is 1inch Coin. In this article, we will analyze the performance of 1inch Coin market cap during market crashes and evaluate its potential as a safe haven asset.

Market crashes can cause substantial volatility in the cryptocurrency market, leading to sharp declines in market cap. However, some cryptocurrencies have shown remarkable resilience during these turbulent times. 1inch Coin, with its unique decentralized exchange (DEX) aggregator, has gained recognition for its ability to navigate market crashes and emerge as a potential hedge against downturns.

As market crashes create panic and uncertainty among investors, it becomes important to identify assets that can withstand the storm and potentially even thrive. 1inch Coin’s market cap performance during such periods can provide valuable insight into its stability and long-term growth prospects.

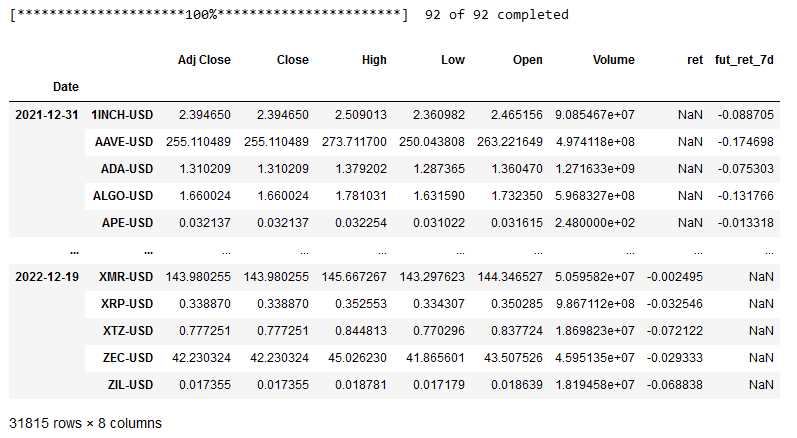

Throughout this article, we will delve into the data and examine the historical performance of 1inch Coin market cap during market crashes. By analyzing various market indicators and factors such as trading volumes, price movements, and investor sentiment, we aim to provide a comprehensive understanding of 1inch Coin’s performance and its potential as a safeguard against market turmoil.

Performance Analysis of 1inch Coin Market Cap

During market crashes, it is essential to analyze the performance of different cryptocurrencies to understand their resilience and potential as investment options. In this article, we will focus on analyzing the performance of 1inch Coin Market Cap during market crashes and evaluate its ability to withstand volatile market conditions.

Background

1inch Coin Market Cap is a decentralized exchange aggregator that enables users to swap tokens across different decentralized exchanges. It provides users with the best possible prices by splitting orders among multiple exchanges. The platform also offers liquidity pools, yield farming, and governance features, making it a comprehensive and versatile platform.

Performance during Market Crashes

Market crashes are periods of significant price declines across the cryptocurrency market. During such times, it is crucial to assess the performance of a cryptocurrency like 1inch Coin Market Cap to understand its stability and potential as a long-term investment.

When evaluating the performance of 1inch Coin Market Cap during market crashes, we can consider the following factors:

- Price Volatility: Analyzing the cryptocurrency’s price volatility during market crashes helps us determine how well it maintains its value compared to other assets. Lower price volatility suggests a more stable investment option.

- Liquidity: Assessing the liquidity of 1inch Coin Market Cap during market crashes helps us understand its ability to handle high volumes of trading activity. Higher liquidity indicates a healthier market and provides better trading opportunities.

- Market Share: Examining the market share of 1inch Coin Market Cap during market crashes gives us insights into its popularity and acceptance among traders. A larger market share can indicate a stronger position and potentially better future performance.

By analyzing these factors and comparing them to other cryptocurrencies, we can gain a better understanding of the performance of 1inch Coin Market Cap during market crashes and make informed investment decisions.

In conclusion, studying the performance of 1inch Coin Market Cap during market crashes is crucial for investors looking for resilient and potentially rewarding investment options. By considering factors such as price volatility, liquidity, and market share, we can assess its ability to withstand market downturns and potentially deliver positive returns in the long run.

Analyzing Performance During Market Crashes

Market crashes are a common occurrence in the financial world, and they can have a significant impact on the performance of cryptocurrencies such as 1inch Coin. Analyzing the performance of 1inch Coin during market crashes can provide valuable insights into how the coin behaves under extreme market conditions.

1. Price Volatility

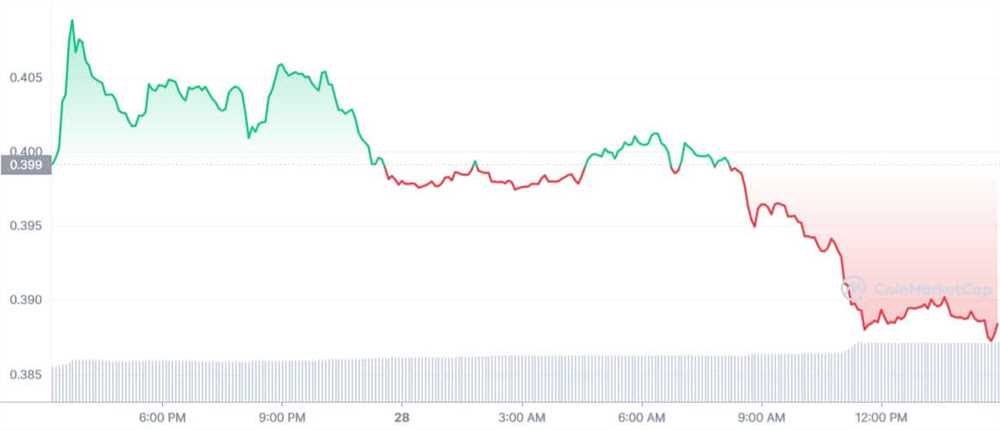

During market crashes, price volatility is usually higher as investors panic and sell off their holdings. By analyzing the price volatility of 1inch Coin during market crashes, we can determine how sensitive the coin is to market fluctuations. This information can help investors make informed decisions about whether to hold or sell their 1inch Coin during turbulent market conditions.

2. Liquidity

Liquidity is another important factor to consider when analyzing the performance of 1inch Coin during market crashes. High liquidity means that there is a large volume of buyers and sellers in the market, which can help mitigate the impact of market crashes. Low liquidity, on the other hand, can lead to sharp price declines and make it difficult for investors to sell their 1inch Coin at a favorable price.

By analyzing the liquidity of 1inch Coin during market crashes, we can determine whether the coin is able to maintain its value and liquidity during turbulent market conditions. This information can be useful for investors looking to trade or hold 1inch Coin during market crashes.

3. Market Sentiment

Market sentiment refers to the overall attitude and perception of investors towards a particular cryptocurrency. During market crashes, investor sentiment can play a crucial role in determining the performance of 1inch Coin. Negative sentiment can lead to a decline in demand and a decrease in the price of the coin.

By analyzing the market sentiment towards 1inch Coin during market crashes, we can gain insights into how investors perceive the coin and whether they are confident in its future prospects. This information can help investors make informed decisions about whether to buy, sell, or hold 1inch Coin during market crashes.

Conclusion

Analyzing the performance of 1inch Coin during market crashes is essential for understanding how the coin behaves under extreme market conditions. By considering factors such as price volatility, liquidity, and market sentiment, investors can make informed decisions about whether to hold or sell their 1inch Coin during turbulent market periods.

Factors Influencing 1inch Coin Market Cap during Crashes

During market crashes, the market cap of 1inch Coin can be influenced by several factors. These factors can play a crucial role in determining the performance of the coin and its market cap. Understanding these factors can help investors and traders make informed decisions during turbulent market conditions.

1. Market Sentiment: The overall market sentiment plays a significant role in determining the market cap of 1inch Coin during crashes. If the market sentiment is bearish, investors may sell off their holdings, leading to a decrease in market cap. Conversely, if the market sentiment is bullish, investors may hold onto their investments, preventing a significant decline in the market cap.

2. Investor Confidence: Investor confidence in 1inch Coin is another crucial factor during market crashes. If investors believe in the long-term potential of the coin, they may continue to hold onto their investments, supporting the market cap. However, if investor confidence wavers, it may lead to a significant decrease in market cap.

3. Competition: The competition within the decentralized finance (DeFi) space can also impact 1inch Coin’s market cap during crashes. If rival projects gain more popularity and attract investors, it may divert investment away from 1inch Coin, resulting in a decrease in market cap.

4. Market Liquidity: Market liquidity, or the ease with which a cryptocurrency can be bought or sold, can also influence 1inch Coin’s market cap during crashes. If liquidity is low, it may be challenging to sell off large volumes of the coin, leading to a decrease in market cap. On the other hand, high liquidity can help maintain market stability.

5. Regulatory Environment: The regulatory environment surrounding cryptocurrencies, especially in regards to decentralization and security, can impact 1inch Coin’s market cap during crashes. Sudden regulatory changes or crackdowns can create uncertainty among investors and lead to a decrease in market cap.

6. Technology and Development: The technology and development behind 1inch Coin can also influence its market cap during crashes. If the project demonstrates continuous innovation, development, and improvement, it may attract more investors, preventing a significant decline in market cap.

7. Overall Market Conditions: Lastly, the overall market conditions during crashes can influence 1inch Coin’s market cap. Factors such as macroeconomic events, global economic conditions, and geopolitical tensions can have an indirect impact on the market cap of all cryptocurrencies, including 1inch Coin.

Considering these factors can provide valuable insights into the performance of 1inch Coin’s market cap during market crashes. Investors and traders should analyze these factors alongside technical and fundamental analysis to make well-informed decisions and navigate volatile market conditions.

Strategies for Managing 1inch Coin Holdings during Market Crashes

Market crashes can be a challenging time for investors, but having a solid strategy in place can help mitigate losses and potentially even profit during these turbulent times. When it comes to managing your 1inch Coin holdings during market crashes, here are some strategies to consider:

1. Diversify your portfolio: One of the key strategies for managing any crypto investment during market crashes is to diversify your portfolio. By spreading your investments across different cryptocurrencies and even other asset classes, you can reduce the impact of a single market crash on your overall holdings. This strategy can help protect against losses and potentially provide opportunities for gains in other areas.

2. Set stop-loss orders: Another useful strategy is to set stop-loss orders for your 1inch Coin holdings. A stop-loss order is an instruction to sell a certain amount of a cryptocurrency if its price falls below a specified level. This can help limit potential losses and protect your investment during a market crash. Setting stop-loss orders at a level that allows for some market volatility while still protecting your investment is essential.

3. Stay informed: It’s crucial to stay informed about the market conditions and news that may impact the price of 1inch Coin and other cryptocurrencies. Keeping an eye on market trends, industry developments, and regulatory announcements can help you make well-informed decisions during market crashes. This includes monitoring key indicators and technical analysis to identify potential market movements.

4. Consider hedging strategies: Hedging involves taking positions that offset potential losses in one investment with gains in another. This can be achieved by using financial derivative products or by investing in inverse ETFs (Exchange-Traded Funds) that aim to deliver the opposite performance of a specific cryptocurrency or market index. Hedging can help mitigate losses during market crashes and provide a level of protection for your 1inch Coin holdings.

5. Have a long-term perspective: It’s important to remember that market crashes are a normal part of any investment cycle, including cryptocurrency markets. During these downturns, it can be tempting to panic sell your 1inch Coin holdings, but taking a long-term perspective can often lead to better outcomes. Research the fundamentals of 1inch Coin, its roadmap, partnerships, and community strength to evaluate its long-term potential. By focusing on the underlying value and growth prospects of the coin, you can make more informed decisions about your holdings.

Remember, these strategies are meant to provide general guidance and should be tailored to your individual risk tolerance and investment goals. Consulting with a financial advisor or crypto expert can help you develop a personalized strategy for managing your 1inch Coin holdings during market crashes.

Question-answer:

What is 1inch Coin Market Cap?

1inch Coin Market Cap is a cryptocurrency that is based on the 1inch decentralized exchange platform. It is used to facilitate transactions and trading on the platform.

How does the 1inch Coin perform during market crashes?

The performance of 1inch Coin during market crashes can vary. In some cases, it may experience a significant decrease in price due to panic selling and a general market downturn. However, it is also possible for the coin to hold its value relatively well compared to other cryptocurrencies, depending on the factors influencing the crash.