When it comes to investing in the cryptocurrency market, it’s crucial to make informed decisions. Whether you’re a seasoned investor or just starting out, there are several factors to consider when buying 1inch tokens.

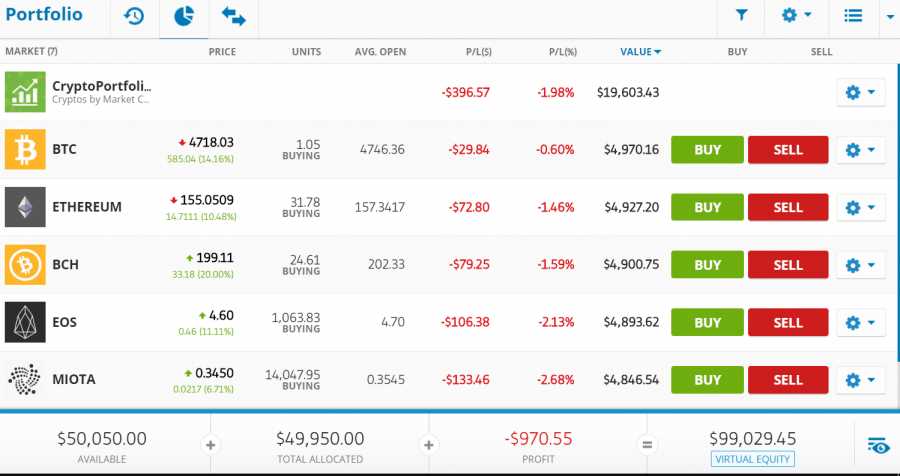

1. Market Performance: Before investing in 1inch tokens, it’s essential to analyze the market performance. Look at historical price charts, trading volume, and market capitalization to understand the token’s growth potential.

2. Technology: Assess the underlying technology of the 1inch platform. Consider factors such as scalability, security, and functionality. A robust and innovative technology can contribute to the long-term success of the token.

3. Team and Partnerships: Research the team behind 1inch and their experience in the blockchain industry. Verify their credentials and track record. Additionally, evaluate the partnerships 1inch has formed with other projects or companies, as this can indicate future collaborations and adoption.

4. Tokenomics: Examine the tokenomics of 1inch tokens, including token supply, distribution, and inflation rate. Understanding how the token operates within the ecosystem can help you assess its potential value and potential risks.

5. Community and Adoption: Take into account the size and engagement of the community surrounding 1inch. A strong and active community can drive demand and adoption of the token, increasing its value over time.

6. Regulatory Environment: Stay updated on the regulatory environment surrounding cryptocurrencies. Consider the legal and regulatory risks associated with investing in 1inch tokens, especially in your jurisdiction.

7. Risk Management: Finally, have a clear risk management strategy in place when investing in 1inch tokens. Diversify your portfolio, set realistic goals, and be prepared for market volatility.

By considering these factors, you can make a well-informed decision when buying 1inch tokens and increase your chances of a successful investment.

Key Factors for Buying 1inch Tokens

The decision to buy 1inch tokens is an important one, and there are several key factors to consider before making your investment. These factors can help guide your decision and ensure that you are making an informed choice.

1. Market Potential

Before buying 1inch tokens, it is important to assess the market potential of the token. Consider factors such as the demand for decentralized exchanges, the adoption rate of the 1inch platform, and the overall growth potential of the cryptocurrency market. By analyzing these factors, you can gauge the potential for the 1inch token to increase in value over time.

2. Project Team

The team behind a cryptocurrency project plays a crucial role in its success. When considering buying 1inch tokens, research the project team and assess their experience and expertise in the field. Look for a team with a track record of successful projects and a strong understanding of the decentralized finance (DeFi) space. This can give you confidence in the long-term viability of the project and increase the likelihood of a positive return on investment.

By considering these key factors, you can make an informed decision when buying 1inch tokens. Remember to conduct thorough research, assess the market potential, and evaluate the project team before making any investment. Investing in cryptocurrencies can be lucrative, but it is important to approach it with diligence and caution.

Token Price and Potential

One of the key factors to consider before buying 1inch tokens is their price and potential. The token price can vary greatly depending on various market factors and investor sentiment.

The price of 1inch tokens is subject to market dynamics, including supply and demand. As more people buy and hold 1inch tokens, the price is likely to increase. Conversely, if there is a large sell-off or lack of interest, the token price may decline.

When evaluating the potential of 1inch tokens, it is important to consider their utility and adoption in the cryptocurrency ecosystem. 1inch tokens are primarily used within the 1inch Network, a decentralized exchange aggregator. As the usage of the 1inch Network expands and more users adopt it, the demand for 1inch tokens may increase, potentially driving up their price.

Additionally, the potential growth of the broader decentralized finance (DeFi) space may also impact the price and potential of 1inch tokens. As more projects and users participate in DeFi, the demand for 1inch tokens as a means of accessing various decentralized exchanges may increase.

It is worth noting that the cryptocurrency market can be highly volatile and speculative. The price of 1inch tokens may experience significant fluctuations in a short period of time. Therefore, it is important to carefully assess the potential risks and rewards before making any investment decisions.

| Key Points | Explanation |

|---|---|

| Token Price | Depends on supply, demand, and market dynamics. |

| Potential | Depends on adoption of 1inch Network and DeFi market growth. |

| Market Volatility | Price can be highly volatile, requiring careful consideration. |

Overall, when considering buying 1inch tokens, it is important to carefully assess the token price and potential, taking into account market dynamics, adoption of the 1inch Network, and the broader growth of the DeFi market.

Liquidity and Trading Volume

One of the most important factors to consider when buying 1inch tokens is the liquidity and trading volume of the token. Liquidity refers to how easily a token can be bought or sold without causing a significant change in its price. A token with high liquidity will have a large number of buyers and sellers, making it easier for you to enter and exit positions without impacting the market price.

Having high liquidity is crucial because it ensures that there will always be a buyer when you want to sell your 1inch tokens and a seller when you want to buy more. It also helps prevent significant price slippages, which can occur if there is not enough liquidity in the market.

Why is liquidity important?

Liquidity is important for several reasons:

- It allows you to quickly buy or sell 1inch tokens without causing the price to move significantly.

- It reduces the risk of not being able to find a buyer or seller when you want to trade.

- It helps prevent slippages and ensures that you get a fair price when trading.

How to assess liquidity and trading volume?

There are a few key metrics you can use to assess the liquidity and trading volume of a 1inch token:

- 24-hour trading volume: This metric shows the total trading volume of a token over the last 24 hours. Higher trading volume indicates more active trading and higher liquidity.

- Order book depth: The order book depth shows the number of buy and sell orders at various price levels. A token with a deep order book will have a higher level of liquidity.

- Exchange listing: The number and quality of exchanges that list a token can also indicate its liquidity. Tokens listed on reputable exchanges are more likely to have higher trading volume and liquidity.

When buying 1inch tokens, it’s important to consider the token’s liquidity and trading volume to ensure that you can easily enter and exit positions and get a fair price for your trades.

Tokenomics and Supply

Tokenomics refers to the economics of a token and how it functions within a particular cryptocurrency ecosystem. When considering buying 1inch tokens, it is essential to understand the tokenomics and supply factors that can impact the value and potential growth of the tokens.

Token Distribution

The total supply of 1inch tokens is capped at 1.5 billion tokens. The initial token distribution included a combination of airdrops, liquidity mining rewards, and team allocations. It is important to consider how the tokens were initially distributed and whether there is a fair distribution across different stakeholders.

Token Utility

The 1inch token serves as a utility token within the 1inch Network. Holders of the tokens can use them for various purposes, such as governance voting, fee discounts, and liquidity provision rewards. Understanding the utility and potential future use cases of the 1inch tokens is crucial in evaluating their long-term value.

Additionally, it is important to consider any potential changes or updates to the token utility in the future. Will there be any token burns or buybacks, and how will they impact the token supply and value? These factors should be considered when making a decision to buy 1inch tokens.

In conclusion, when buying 1inch tokens, it is important to consider the tokenomics and supply factors that can affect their value and potential growth. Understanding the token distribution and utility, as well as any potential changes in the future, can help make an informed decision.

Community and Development Support

At 1inch, we strongly believe in the power of community and the importance of sustainable development. We are committed to supporting and fostering a thriving ecosystem of users, developers, and contributors.

Our vibrant community is at the heart of everything we do. We actively engage with our users, listening to their feedback, and prioritizing their needs. Through open dialogues and collaborations, we aim to cultivate a strong bond with our community, ensuring their voices are heard and their concerns are addressed.

When you buy 1inch tokens, you’re not just investing in a promising digital asset – you’re becoming part of a dynamic and supportive community. Our community members actively participate in discussions, contribute innovative ideas, and share valuable resources. Together, we drive the growth and development of the 1inch ecosystem.

Furthermore, we are dedicated to supporting the development of cutting-edge technologies in the DeFi space. Through strategic partnerships and collaborations, we provide resources and guidance to developers who are building on the 1inch platform. We actively invest in research and development, pushing the boundaries of what is possible in decentralized finance.

By buying 1inch tokens, you are not only benefiting from the potential growth of a revolutionary protocol but also contributing to the advancement of the DeFi industry as a whole. Your support directly fuels innovation and helps shape the future of decentralized finance.

Join us in empowering the community, supporting development, and shaping the future of DeFi. Together, we can create a more inclusive and sustainable financial ecosystem.

Question-answer:

What is the purpose of 1inch tokens?

The purpose of 1inch tokens is to provide governance and utility within the 1inch ecosystem. Token holders can participate in voting on protocol upgrades, earn staking rewards, and access various features and benefits within the platform.

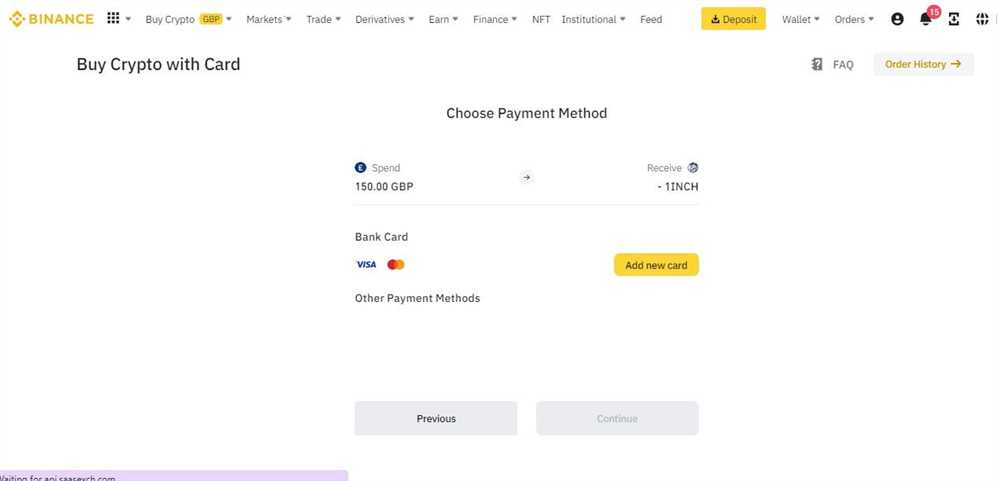

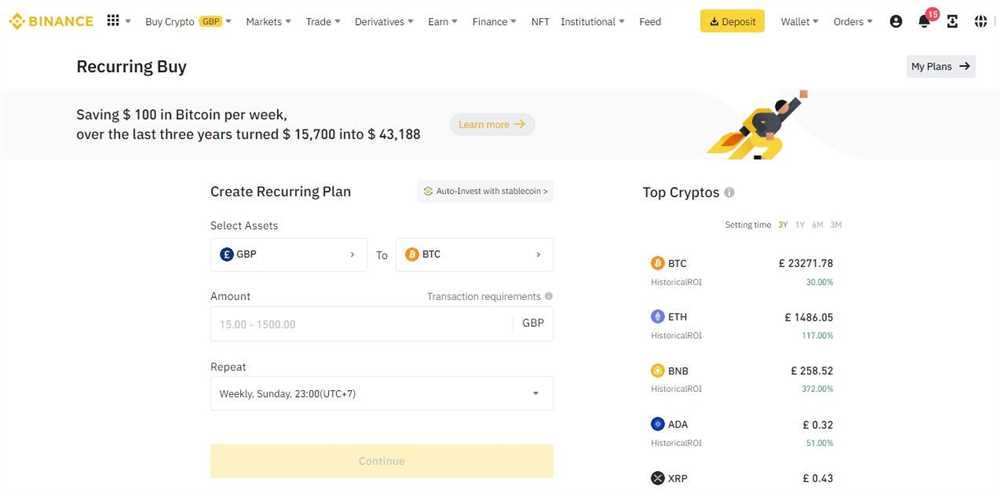

How can I buy 1inch tokens?

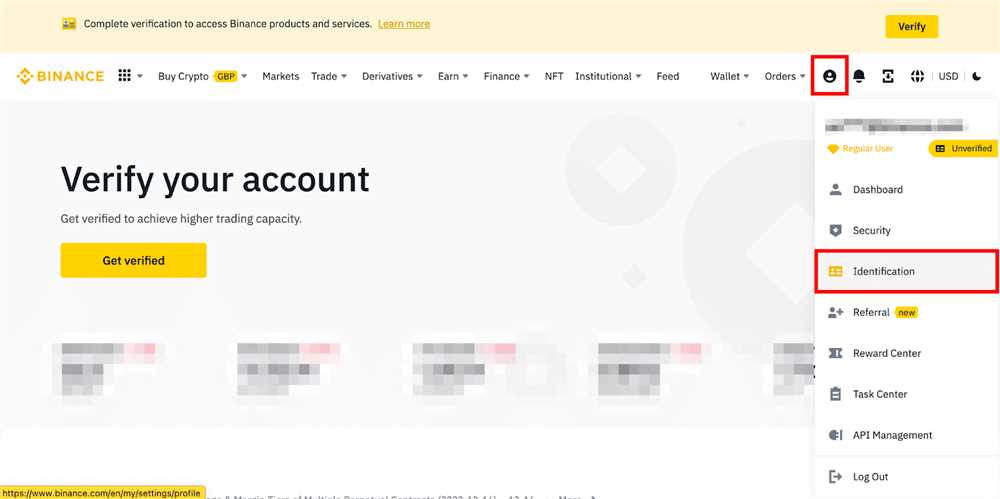

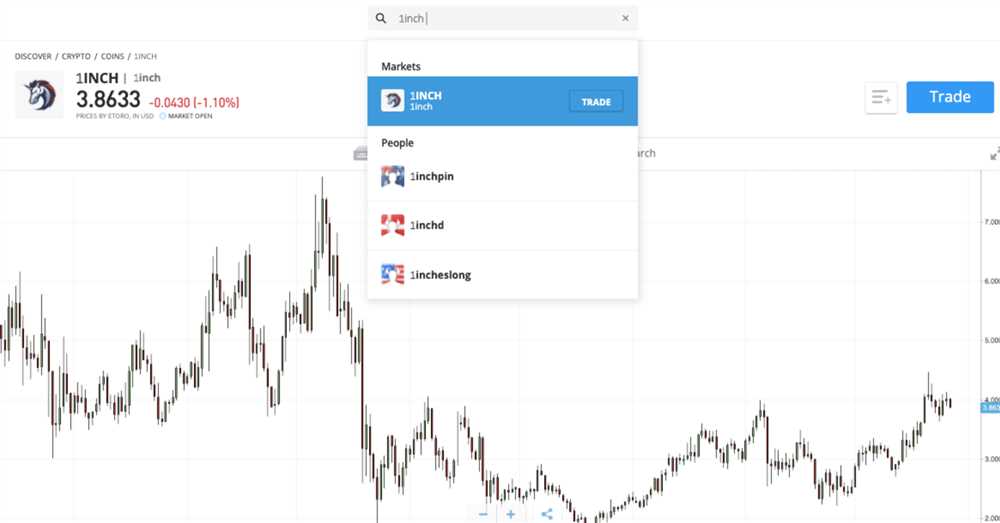

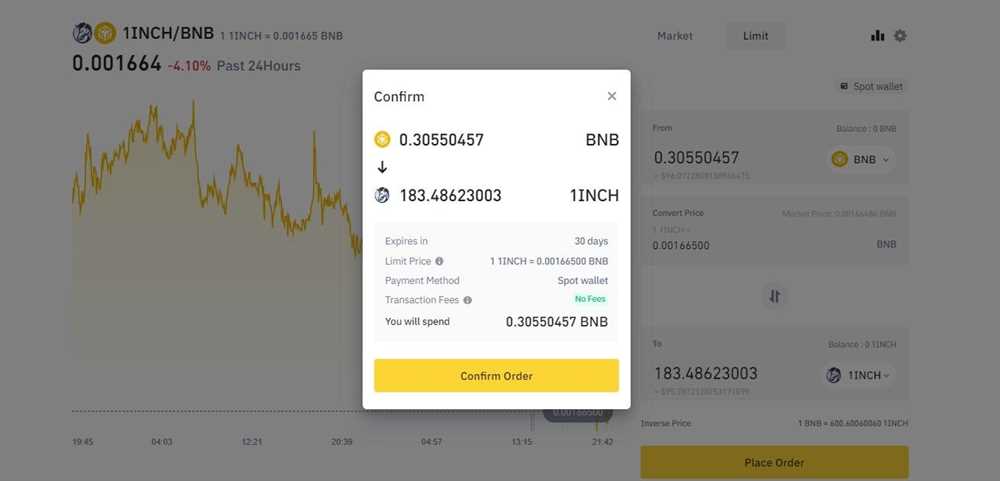

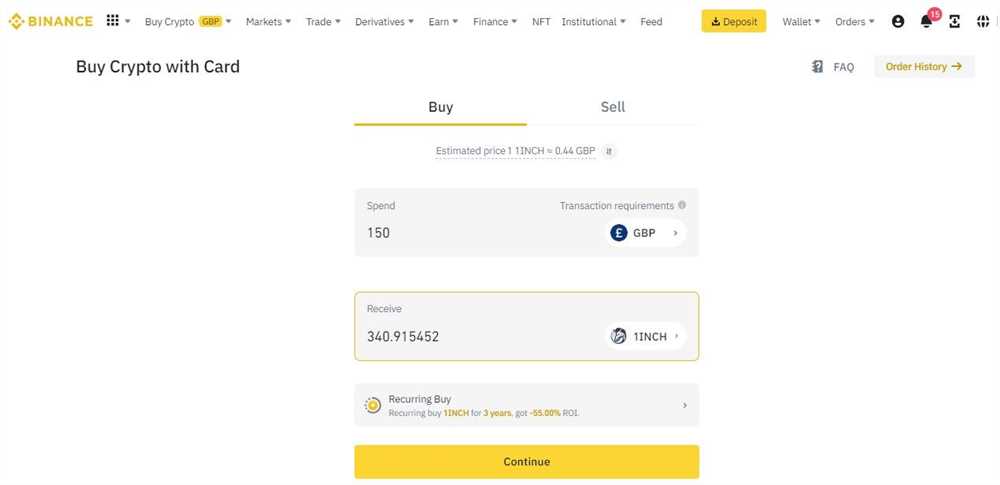

You can buy 1inch tokens on various cryptocurrency exchanges such as Binance, Coinbase, or Kraken. Simply create an account on the exchange, deposit funds, and search for the 1inch token to place your buy order.

What factors should I consider before buying 1inch tokens?

Before buying 1inch tokens, consider factors such as the current market price, the project’s roadmap and development progress, the team behind the project, the tokenomics and supply of the tokens, as well as the overall market conditions and trends.

Are 1inch tokens a good investment?

Investing in 1inch tokens can be a good idea, but it depends on your personal investment goals and risk tolerance. It’s important to do thorough research on the project, its fundamentals, and the market conditions before making any investment decisions.

What are the risks of buying 1inch tokens?

Some of the risks associated with buying 1inch tokens include market volatility, regulatory uncertainty, competition from other decentralized exchanges, potential security vulnerabilities, and the overall performance and adoption of the 1inch platform. It’s important to assess these risks and make informed decisions.