The emergence of blockchain technology has paved the way for numerous innovations in the world of finance and decentralized applications. One of these groundbreaking projects is 1inch, a decentralized exchange aggregator that aims to provide users with the best possible trading experience across different decentralized exchanges (DEXs).

1inch utilizes a unique algorithm called the Pathfinder, which is designed to optimize trade execution by splitting orders across multiple DEXs. This ensures that users get the most favorable prices and minimal slippage when trading cryptocurrencies. With the Pathfinder, users can access liquidity across various DEXs without the need to manually search for the best rates.

Another key benefit of 1inch is its ability to save users on gas fees. Gas fees, or the transaction fees required to execute operations on the Ethereum network, have been a major concern for users due to their high costs. 1inch addresses this issue by implementing a gas token called Chi, which can be used to reduce gas fees by up to 42%. This gas optimization mechanism allows users to save significant amounts of money when executing trades on the platform.

inch Benefits: Highlights from the Whitepaper

The 1inch protocol offers numerous benefits that make it a valuable tool for decentralized finance (DeFi) users. Here are some key highlights:

1. Aggregation and Optimized Trading

1inch leverages smart contract technology to aggregate liquidity from multiple decentralized exchanges, allowing users to find the best prices and execute trades at the optimal time. The protocol automatically splits the trade across different exchanges to achieve the best possible rate, reducing slippage and maximizing trade efficiency.

2. On-Chain Liquidity Protocol

The 1inch liquidity protocol is designed to provide a seamless trading experience on the Ethereum blockchain. It ensures that users can trade tokens instantly without the need for manual price comparison or market analysis. By tapping into the available liquidity across multiple exchanges, 1inch offers a high level of trading efficiency and cost-effectiveness.

3. Gas Efficiency and Cost Savings

One of the major advantages of 1inch is its gas optimization feature. The protocol minimizes the number of transactions required for a trade, reducing the associated gas fees. This not only saves users money, but also makes the trading process faster and less burdensome on the network.

4. Governance and Community Ownership

1inch is a community-driven protocol with a strong emphasis on decentralization. The platform has its own governance token, 1INCH, which grants holders voting rights and allows them to participate in the decision-making process. This ensures that the community has a say in the future development of the protocol, fostering transparency and inclusivity.

5. Security and Trustlessness

By leveraging smart contracts, 1inch maintains a high level of security and trustlessness. Users can trade directly from their wallets, without the need to deposit funds into an intermediary’s custody. This reduces the risk of hacks or thefts and provides users with full control over their assets.

Overall, the 1inch protocol offers a range of benefits that enhance the DeFi trading experience. Its aggregation and optimization features, coupled with its on-chain liquidity and gas efficiency, make it a powerful tool for users seeking cost-effective and efficient trades. Additionally, its governance and security features foster trust and community participation, ensuring the protocol’s long-term sustainability.

Unleashing the Power of Decentralized Exchanges

Decentralized exchanges (DEX) have emerged as a revolutionary solution in the world of cryptocurrency trading. These exchanges operate on blockchain technology, allowing users to trade directly with each other without the need for intermediaries.

One of the key benefits of decentralized exchanges is that they provide users with full control over their funds. Unlike centralized exchanges, where users have to deposit their funds and trust the platform with their assets, DEX allow users to maintain custody of their funds at all times. This ensures increased security and eliminates the risk of hacking or theft.

Additionally, decentralized exchanges offer greater anonymity compared to centralized exchanges. Users do not need to provide personal information or complete KYC procedures to trade on DEX platforms. This appeals to individuals who value privacy and want to maintain their anonymity while participating in cryptocurrency trading.

Another advantage of decentralized exchanges is their ability to facilitate peer-to-peer trading. Traditional centralized exchanges rely on order books and matching engine algorithms to execute trades. DEX, on the other hand, enable direct trades between users, eliminating the need for a centralized order book. This results in faster transaction times and lower fees, as there is no intermediary involved in the trading process.

Decentralized exchanges also contribute to the overall decentralization of the cryptocurrency ecosystem. By removing the need for centralized authorities and intermediaries, DEX help to create a more democratic and inclusive financial system. They empower individuals to have full control over their financial activities and participate in the global economy on equal terms.

Moreover, decentralized exchanges are often built on interoperable blockchain networks, which means that users can trade various cryptocurrencies without having to rely on a single platform or token. This allows for greater flexibility and accessibility in the trading process.

In conclusion, decentralized exchanges have emerged as a powerful tool in the world of cryptocurrency trading. They provide users with greater control over their funds, enhanced privacy, faster transactions, and contribute to the overall decentralization of the financial system. As the cryptocurrency industry continues to grow and evolve, decentralized exchanges will play a pivotal role in shaping the future of finance.

Maximizing Efficiency through Aggregation and Pathfinder

1inch aims to maximize efficiency in decentralized finance (DeFi) by utilizing two core components: Aggregation and Pathfinder. These elements work together to find the best possible trading routes and ensure optimal execution for users.

Aggregation

The Aggregation mechanism of 1inch allows users to access multiple liquidity sources and obtain the best prices for their trades. By aggregating liquidity from various decentralized exchanges (DEXes), 1inch ensures that users can take advantage of the most favorable rates available.

When a user submits a trade request, 1inch’s Aggregation algorithm splits the trade into smaller parts and routes them through different liquidity sources. By doing so, it minimizes slippage and maximizes the overall trade value for the user.

This Aggregation mechanism is particularly beneficial in situations where a single DEX may not have sufficient liquidity to fulfill a large trade. By accessing multiple sources, 1inch provides better liquidity and price discovery options, resulting in improved trading outcomes.

Pathfinder

1inch’s Pathfinder algorithm complements the Aggregation mechanism by optimizing the trade execution path. It scans and evaluates multiple pathways to identify the most efficient trading route for users.

This is achieved by considering factors such as gas costs, price impact, and trade volume across different DEXes. By evaluating these parameters, Pathfinder selects the pathway that offers the best trade execution with minimal costs and slippage.

By leveraging both Aggregation and Pathfinder, 1inch ensures that users can achieve the most efficient and cost-effective trades in the DeFi space. It combines liquidity aggregation with a sophisticated routing algorithm to provide optimal trading solutions.

Enhancing User Experience with Gas Optimization and Limit Orders

The 1inch platform provides users with enhanced user experience through its gas optimization and limit order features. Gas optimization is a crucial aspect of using decentralized exchanges, as it allows users to minimize the gas fees they pay for transactions.

By leveraging its intelligent algorithm, 1inch analyzes the gas prices across multiple decentralized exchanges to identify the most cost-effective route for executing trades. This ensures that users can save on gas fees while still enjoying the benefits of decentralized trading.

In addition to gas optimization, 1inch also offers a limit order feature. This feature enables users to set specific parameters for their trades, such as the desired price at which to buy or sell a particular asset. Once these parameters are met, the platform automatically executes the trade on behalf of the user.

This ability to set limit orders gives users more control over their trading activities and eliminates the need for constant monitoring of the market. Users can simply set their desired parameters and let the platform do the work for them. This simplifies the trading process and enhances the overall user experience on 1inch.

In conclusion, 1inch understands the importance of gas optimization and limit orders in providing a seamless and efficient decentralized trading experience. By prioritizing these features, the platform ensures that users can optimize their gas fees and have more control over their trades, ultimately enhancing their overall user experience.

Question-answer:

What is 1inch?

1inch is a decentralized exchange aggregator that sources liquidity from various exchanges and provides users with the best possible rates for their trades.

How does 1inch work?

1inch works by using an algorithm that splits a large trade into multiple smaller trades across different decentralized exchanges to get the best rates. It also takes into account gas fees and other factors to optimize the trade execution.

What are the benefits of using 1inch?

There are several benefits of using 1inch. Firstly, it provides users with the best possible rates by sourcing liquidity from multiple exchanges. Secondly, it saves users time and effort by automatically splitting trades across exchanges. Lastly, it provides users with access to a wide range of decentralized exchanges and liquidity pools.

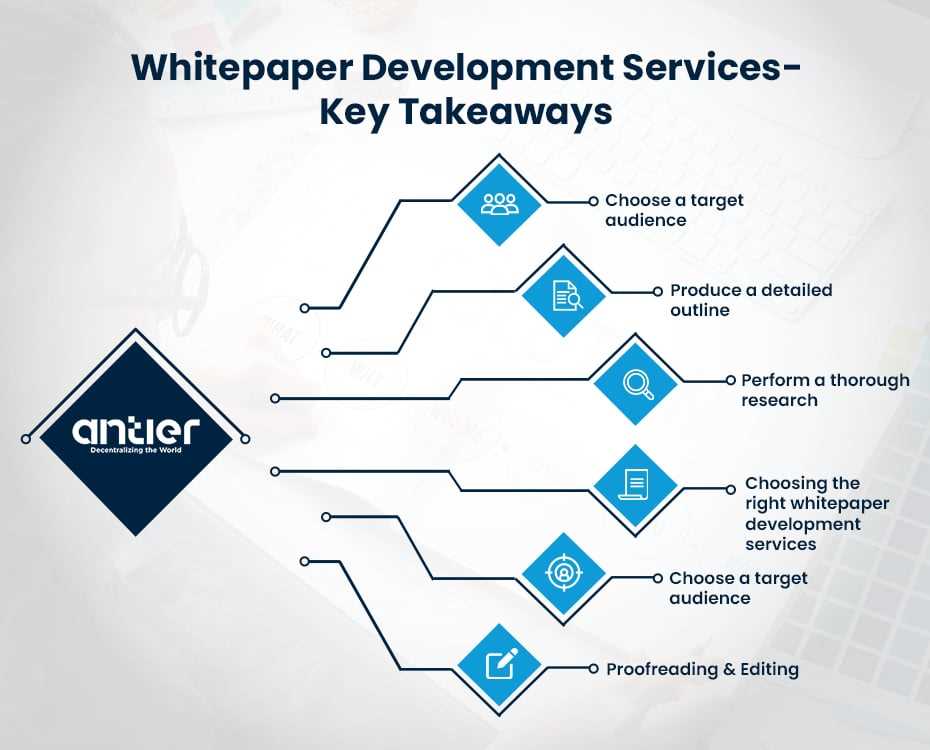

What are the key takeaways from the 1inch whitepaper?

The key takeaways from the 1inch whitepaper include the explanation of the algorithm used by 1inch to optimize trades, the benefits of using 1inch compared to trading on individual exchanges, and the roadmap for future development and improvements of the protocol.