The decentralization revolution has brought about various innovations in the financial world, one of which is Decentralized Finance (DeFi). DeFi offers an alternative to traditional financial systems by leveraging blockchain technology to provide open and permissionless financial services. This emerging sector has gained significant attention and investment due to its potential to revolutionize traditional finance.

When it comes to DeFi, one project that deserves your attention is 1inch. 1inch is a decentralized exchange (DEX) aggregator that sources liquidity from various DEXs to offer users the best possible trading rates. By splitting a user’s transaction across multiple DEXs, 1inch ensures that traders get the most favorable rates while minimizing slippage. This innovative approach has made 1inch one of the most popular and trusted DEX aggregators in the market.

What sets 1inch apart from other DEX aggregators is its focus on reducing transaction costs and increasing profits for users. 1inch achieves this by utilizing various protocols, algorithms, and smart contract technology to optimize trades. The platform also incorporates liquidity mining, allowing users to earn additional income by providing liquidity to the platform.

In addition to its innovative features, 1inch is backed by a team of experienced professionals who are dedicated to creating a seamless and secure trading experience for users. The project has also gained recognition from the crypto community and has received funding from reputable investors, further enhancing its credibility and potential for growth.

As the DeFi space continues to evolve and attract more users and investors, 1inch should definitely be on your radar. Its innovative approach, commitment to user profitability, and strong team make it a promising investment opportunity in the decentralized finance sector. So, if you are looking to diversify your investment portfolio and tap into the potential of DeFi, keep an eye on 1inch.

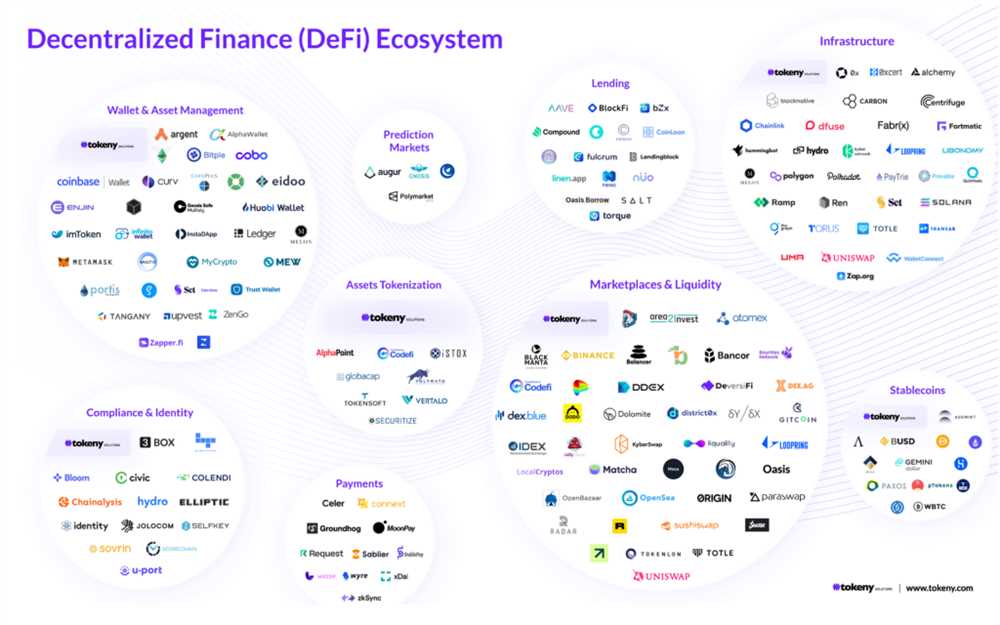

Introducing Decentralized Finance (DeFi)

Decentralized Finance, also known as DeFi, is a fast-growing sector within the cryptocurrency industry. It aims to revolutionize traditional financial systems by offering open and accessible financial services to anyone with an internet connection, without the need for intermediaries such as banks or brokers.

At the core of DeFi is the concept of decentralization, which means that control and decision-making power are distributed among participants in the network rather than being concentrated in the hands of a few. This decentralization is achieved through the use of blockchain technology, which ensures transparency, immutability, and security of transactions.

The Benefits of DeFi

DeFi offers several benefits compared to traditional financial systems:

- Accessibility: DeFi platforms can be accessed by anyone with an internet connection, regardless of their location or financial status.

- Openness: DeFi protocols are open-source, meaning that anyone can audit and verify the code, ensuring transparency and reducing the risk of fraud or manipulation.

- Lower Fees: DeFi eliminates the need for intermediaries, such as banks or brokers, which typically charge high fees for their services. This results in lower transaction costs for users.

- Financial Inclusion: DeFi allows anyone to access a wide range of financial services, such as lending, borrowing, staking, and trading, without the need for a traditional bank account.

- Global Reach: DeFi operates on a global scale, enabling cross-border transactions without the need for intermediaries or complex procedures.

The Role of 1inch in DeFi

1inch is a decentralized exchange aggregator that operates on the Ethereum blockchain. It provides users with the ability to find and execute the best trades across multiple decentralized exchanges, maximizing their profits and saving them time and effort.

By leveraging the power of smart contracts and algorithmic trading, 1inch scans multiple liquidity sources to find the most favorable rates and routes for trades. This ensures that users always get the best possible outcomes for their transactions.

Furthermore, 1inch is constantly innovating and expanding its services to meet the evolving needs of the DeFi ecosystem. It has introduced various features, such as limit orders, yield farming, and governance tokens, which allow users to earn passive income and participate in the decision-making processes of the platform.

Overall, 1inch plays a crucial role in the DeFi space by enhancing liquidity, efficiency, and accessibility, making it a platform worth considering for investors and users looking to maximize their returns in the decentralized finance ecosystem.

The Evolution of Traditional Financial Systems

In recent years, the traditional financial system has undergone significant changes due to advancements in technology and the rise of decentralized finance (DeFi). These changes have revolutionized the way financial services are provided, creating new opportunities for investors and consumers.

1. Centralized Financial Systems

For many years, traditional financial systems operated on a centralized model, with banks and other financial institutions serving as intermediaries for transactions and storing customer funds. This centralized approach provided security and stability but also came with limitations such as high transaction fees, slow processing times, and limited access for unbanked populations.

2. The Emergence of FinTech

The emergence of financial technology, or FinTech, brought about significant advancements in the traditional financial system. FinTech companies leveraged technology to provide innovative financial services such as mobile payments, peer-to-peer lending, and digital wallets. These services offered increased convenience, lower fees, and faster processing times, but still operated within the constraints of the centralized system.

3. Introduction of Blockchain Technology

Blockchain technology, the underlying technology behind cryptocurrencies like Bitcoin, introduced the concept of decentralized finance. Blockchain allows for peer-to-peer transactions without the need for intermediaries, making it possible for individuals to transact directly with each other. This technology also introduced the concept of smart contracts, which are self-executing contracts with the terms of the agreement directly written into the code.

4. Rise of Decentralized Finance (DeFi)

Decentralized finance, or DeFi, takes the concept of blockchain technology and applies it to various financial services, including lending, borrowing, and trading. DeFi platforms operate on decentralized networks, allowing users to access financial services without the need for intermediaries. This brings increased transparency, lower fees, and greater accessibility to financial services.

One notable DeFi platform that has gained significant attention is 1inch. 1inch is a decentralized exchange aggregator that leverages smart contracts to provide users with the best possible trade execution across multiple decentralized exchanges. By splitting a trade across multiple liquidity sources, 1inch can provide users with better prices and lower slippage.

Overall, the evolution of traditional financial systems has paved the way for the rise of DeFi platforms like 1inch. With the benefits of decentralization and blockchain technology, investors and consumers now have more options and opportunities to participate in the financial ecosystem.

Exploring the Benefits of DeFi Investments

Decentralized Finance (DeFi) has gained significant attention in recent years, revolutionizing the traditional financial industry. DeFi investments offer numerous benefits, making them an attractive option for investors looking to diversify their portfolio and explore new opportunities.

One of the primary benefits of DeFi investments is the elimination of intermediaries. Unlike traditional financial systems, DeFi operates on blockchain technology, which enables peer-to-peer transactions without intermediaries such as banks. This eliminates the need for third parties and reduces transaction costs, making DeFi investments more efficient and cost-effective.

Another key advantage of DeFi investments is the increased accessibility. Traditional financial systems often have strict entry barriers and require extensive verification processes, limiting access to financial services for many individuals. DeFi, on the other hand, is open to anyone with an internet connection, allowing individuals from all backgrounds to participate in the financial ecosystem.

DeFi investments also offer greater transparency and security. Blockchain technology, the foundation of DeFi, records all transactions on a public ledger, ensuring transparency and accountability. This reduces the risk of fraud and manipulation, providing investors with more confidence in the system.

Additionally, DeFi investments provide investors with the opportunity to earn passive income. Through lending and staking platforms, individuals can lock their funds and earn interest or rewards in return. This allows investors to generate a steady income stream while holding their assets, creating a new avenue for wealth creation.

Furthermore, DeFi investments offer flexibility and innovation. The DeFi ecosystem is constantly evolving, with new protocols, projects, and investment opportunities emerging regularly. This dynamic nature allows investors to explore innovative financial instruments and invest in emerging trends, potentially generating high returns.

Lastly, DeFi investments provide investors with greater control over their funds. Unlike traditional financial systems where banks or other third parties control and manage assets, DeFi allows individuals to maintain custody of their assets through digital wallets. This empowers investors with more control over their investments and eliminates the risk of asset freeze or seizure by intermediaries.

Overall, DeFi investments present a range of benefits, including lower costs, increased accessibility, transparency, passive income opportunities, flexibility, and greater control over funds. As the DeFi ecosystem continues to grow and innovate, it is becoming an increasingly compelling option for investors seeking to diversify their portfolios and tap into the future of finance.

Why 1inch Deserves Your Attention

1inch is a decentralized finance (DeFi) platform that has gained significant attention in the crypto community. Its innovative approach to liquidity aggregation and efficient trading has made it a top contender in the DeFi space.

One of the main reasons why 1inch deserves your attention is its unique feature of sourcing liquidity from various decentralized exchanges (DEXs). By utilizing smart contracts, 1inch is able to split a single trade across multiple DEXs to ensure the best possible price and minimize slippage. This not only saves users money but also provides them with access to a wider range of liquidity.

In addition to its liquidity aggregation, 1inch also offers other useful features that make it a valuable investment option. One of these features is its automated market maker (AMM), which allows users to easily provide liquidity and earn rewards. By participating in the 1inch liquidity pools, users can earn fees generated from trading activities, providing them with passive income.

Furthermore, 1inch has a user-friendly interface that simplifies the trading process and makes it accessible to both experienced traders and newcomers. Its intuitive design and comprehensive trading tools provide users with the necessary information to make informed investment decisions.

Another factor that makes 1inch stand out is its commitment to security. The platform has implemented various measures to ensure the safety of user funds, including audits and bug bounty programs. This gives users peace of mind when using the platform and helps to build trust in the 1inch ecosystem.

In conclusion, 1inch is a DeFi platform that deserves your attention due to its innovative approach to liquidity aggregation, its useful features such as AMMs and user-friendly interface, and its commitment to security. Whether you are an experienced trader or new to the world of DeFi, 1inch offers a range of benefits that make it worth considering as an investment option.

| Key Features of 1inch: |

|---|

| – Liquidity aggregation from multiple DEXs |

| – Automated market maker (AMM) for providing liquidity |

| – User-friendly interface and comprehensive trading tools |

| – Commitment to security with audits and bug bounty programs |

The Revolutionary Aggregator for Decentralized Exchanges

1inch is a revolutionary aggregator for decentralized exchanges (DEXs) that is changing the way investors and traders interact with the DeFi ecosystem. In the past, trading on DEXs was fragmented, time-consuming, and often resulted in high fees. However, 1inch has solved these issues by providing a seamless and cost-effective solution.

1inch works by connecting to multiple DEXs and routing trades through the most efficient path to ensure users get the best possible prices. It achieves this by utilizing the best prices from various liquidity sources, including DEXs, decentralized finance (DeFi) protocols, and centralized exchanges.

By aggregating liquidity and optimizing trading routes, 1inch minimizes slippage and maximizes returns for traders. This not only benefits individual users but also improves liquidity across the entire DeFi ecosystem.

With its intuitive and user-friendly interface, 1inch makes it easy for anyone to access DeFi and capitalize on opportunities in the market. Whether you are a seasoned trader or new to cryptocurrencies, 1inch provides the tools and resources you need to make informed investment decisions.

Furthermore, 1inch is constantly evolving and integrating with new DeFi protocols and liquidity sources to ensure users have access to the best possible trading experience. Its commitment to innovation and customer satisfaction sets it apart from other aggregators in the market.

If you are looking to invest in DeFi or simply want to optimize your trading on decentralized exchanges, 1inch should be on your radar. Its revolutionary aggregator technology and commitment to providing the best trading experience make it a top choice for investors and traders in the decentralized finance space.

Unleashing the Power of Efficient Crypto Trading

When it comes to navigating the world of decentralized finance (DeFi), efficiency in crypto trading is key. And 1inch is the platform that can help you unleash this power. With its innovative features and user-friendly interface, 1inch is revolutionizing the way traders buy and sell cryptocurrencies.

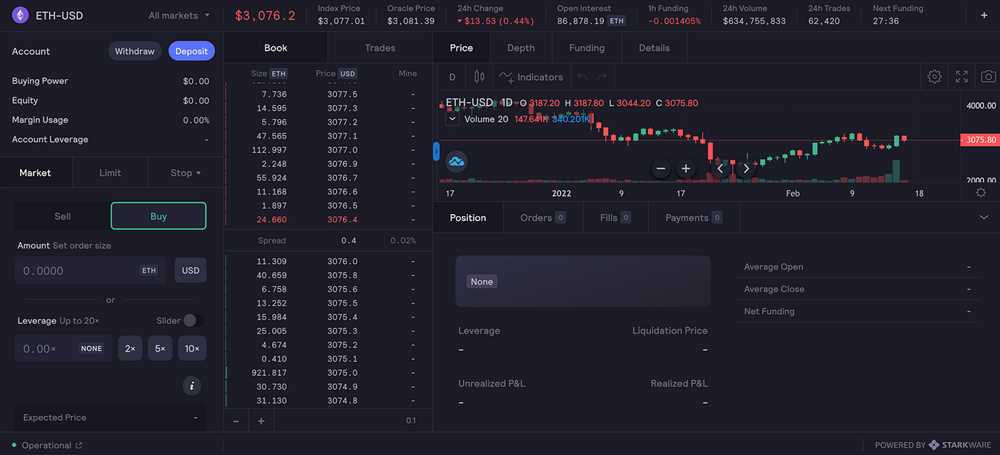

Smart Contract Technology for Optimal Trades

1inch utilizes smart contract technology to ensure that traders get the best price for their trades. By aggregating liquidity from various decentralized exchanges (DEXs), 1inch analyzes the market in real-time and executes trades at the most optimal prices. This not only saves traders money but also maximizes their profits.

High-Speed Execution and Low Slippage

One of the main benefits of using 1inch is its high-speed execution. By using multiple DEXs simultaneously, 1inch can execute trades faster than traditional centralized exchanges. This minimizes slippage and reduces the risk of price fluctuations. Traders can take advantage of this high-speed execution to capitalize on market opportunities and maximize their trading profits.

In addition to its fast execution, 1inch also offers low slippage. Slippage refers to the difference between the expected price of a trade and the executed price. With 1inch, traders can enjoy minimal slippage, which means they get to keep more of their profits.

Unrivaled Liquidity with Access to Multiple DEXs

1inch connects traders to a wide range of decentralized exchanges, giving them access to unrivaled liquidity. Instead of being limited to a single exchange, 1inch pools liquidity from different sources, ensuring that traders get the best possible prices for their trades. This increased liquidity also reduces the risk of price manipulation, providing traders with a safer trading experience.

| Benefits of 1inch’s Efficient Crypto Trading |

|---|

| 1. Smart contract technology for optimal trades. |

| 2. High-speed execution and low slippage. |

| 3. Unrivaled liquidity with access to multiple DEXs. |

| 4. Enhanced trading profits and reduced risk. |

Overall, 1inch is empowering traders to unlock the full potential of efficient crypto trading. With its smart contract technology, high-speed execution, low slippage, and access to multiple DEXs, 1inch is revolutionizing the way traders buy and sell cryptocurrencies. If you’re looking to maximize your trading profits and minimize risk, 1inch should definitely be on your radar.

Question-answer:

What is 1inch and why should I invest in it?

1inch is a decentralized exchange aggregator that connects several decentralized exchanges to provide users with the best possible trading rates. Investing in 1inch can be a wise decision because it offers a unique value proposition in the growing DeFi space. By using 1inch, investors can access liquidity across multiple decentralized exchanges, reducing slippage and maximizing their trading profits.

How does 1inch achieve the best trading rates?

1inch achieves the best trading rates by splitting trades across multiple decentralized exchanges to find the most favorable prices and liquidity. It utilizes a smart routing algorithm that takes into account factors such as exchange fees, gas costs, and available liquidity. This ensures that users get the best possible rates and minimizes the impact of slippage.

What are the risks associated with investing in 1inch?

Like any investment in the DeFi space, investing in 1inch comes with certain risks. The main risks include smart contract vulnerabilities, regulatory uncertainty, market volatility, and potential hacks or exploits. It’s important for investors to conduct their own research, understand the risks involved, and only invest what they can afford to lose. It’s also advisable to use reputable wallets and platforms when interacting with 1inch to minimize risks.