If you’re looking to earn passive income in the ever-expanding world of decentralized finance (DeFi), you may want to consider leveraging the capabilities of 1inch Aggregator and liquidity provision. These two powerful tools offer individuals an opportunity to not only participate in the burgeoning DeFi space but also generate income in a passive and sustainable manner.

1inch Aggregator is a decentralized exchange (DEX) aggregator that sources liquidity from various platforms to ensure users always get the best possible trading rates. By utilizing the 1inch Aggregator, individuals can optimize their trading strategies and maximize their returns. Additionally, this platform offers a variety of features, such as limit orders and conditional swaps, which further enhance the earning potential for users.

On the other hand, liquidity provision involves staking digital assets in a liquidity pool. By doing so, individuals contribute to the liquidity of a decentralized marketplace and are rewarded with a share of the trading fees generated by the platform. By participating in liquidity provision on 1inch, users can earn passive income by simply holding and staking their assets, without the need for active trading.

One of the key advantages of utilizing 1inch Aggregator and liquidity provision is the ability to earn income while maintaining control over your assets. Unlike traditional financial institutions, 1inch Aggregator and liquidity provision enable individuals to earn passive income without having to relinquish ownership or control of their funds. This level of financial autonomy is a fundamental principle of decentralized finance and is highly valued by participants in the DeFi ecosystem.

As the adoption and utilization of DeFi platforms continues to grow, so does the potential for earning passive income. By leveraging the power of 1inch Aggregator and liquidity provision, individuals can not only participate in the DeFi revolution but also generate income in a sustainable and autonomous manner. So whether you’re new to DeFi or a seasoned participant, consider exploring the opportunities offered by 1inch Aggregator and liquidity provision to earn passive income and take control of your financial future.

What is 1inch Aggregator?

1inch Aggregator is a decentralized exchange (DEX) aggregator that sources liquidity from different exchanges to provide users with the best possible rates for their trades.

Traditional decentralized exchanges suffer from liquidity fragmentation, which means that the liquidity is spread across multiple platforms and it becomes inefficient for traders to manually check all these platforms to find the best rates. This is where 1inch Aggregator comes in.

1inch Aggregator combines liquidity from various decentralized exchanges, such as Uniswap, SushiSwap, and Balancer, into a single interface. By doing so, it ensures that users always get the best rates for their trades without the need to check each exchange individually.

The 1inch Aggregator algorithm splits users’ orders across multiple DEXes to optimize the trade execution and minimize slippage. This means that users can benefit from improved rates and reduced trading fees.

Benefits of using 1inch Aggregator:

- Best rates: 1inch Aggregator scans multiple DEXes to find the best rates for users’ trades.

- Reduced slippage: By splitting large orders across multiple DEXes, 1inch Aggregator minimizes slippage and prevents price impact.

- Lower fees: Users can save on trading fees by using 1inch Aggregator, as it routes trades through the most cost-effective platforms.

- Single interface: Instead of visiting multiple platforms, users can access multiple liquidity sources through a single interface, making the trading process more convenient.

1inch Aggregator is also designed to be transparent and secure. It is a decentralized protocol built on the Ethereum blockchain, ensuring that all transactions are verified and recorded on a public ledger.

Overall, 1inch Aggregator simplifies the trading experience by providing users with the best rates, reduced slippage, and lower fees, all through a single interface. It is a powerful tool for traders looking to earn passive income through liquidity provision.

How does 1inch Aggregator Work?

The 1inch Aggregator is a decentralized exchange (DEX) aggregator that sources liquidity from various DEXs such as Uniswap, Sushiswap, and Balancer to provide users with the best possible trading rates. It operates by splitting users’ trades across multiple DEXs, ensuring that they get the most favorable pricing and minimized slippage.

When a user submits a trade on the 1inch Aggregator, the system finds the most efficient trading paths across different DEXs to execute the trade. It takes into account the available liquidity, trading fees, and potential price impacts on each DEX to optimize the swap. By splitting the trade, the aggregator is able to minimize slippage and provide better rates compared to trading on a single DEX.

1inch Aggregator uses a smart contract-based approach to ensure trustless and non-custodial trading. The user’s funds remain in their own wallets throughout the trading process, and the aggregator never holds or controls the assets. The smart contract interacts with the DEXs on behalf of the user, executing the trades and settling the balances.

Additionally, the 1inch Aggregator offers advanced features such as limit orders, enabling users to set their desired price for a trade and automatically executing it when the market reaches that price. This feature allows users to take advantage of favorable market conditions without the need for constant monitoring.

Overall, the 1inch Aggregator provides a convenient and efficient way for users to access liquidity and trade across various DEXs, optimizing their trades and potentially earning better returns.

What is Liquidity Provision?

Liquidity provision refers to the process of providing liquidity to a financial market by depositing funds into a liquidity pool. In the context of decentralized finance (DeFi), liquidity provision is an essential component for enabling the efficient and seamless operation of decentralized exchanges (DEXs).

Decentralized exchanges rely on liquidity pools, which are smart contracts that hold funds from liquidity providers. These funds serve as the base for trade executions on the exchange. Liquidity providers essentially deposit their tokens into these pools and in return, receive pool tokens that represent their share of the liquidity pool.

When someone wants to trade on a decentralized exchange, they can do so by swapping tokens directly from the liquidity pool. By providing liquidity to these pools, users enable others to execute trades and earn fees in the process. The fees earned are usually distributed proportionally to the liquidity providers based on their share in the pool.

It is important for liquidity providers to consider the potential risks associated with providing liquidity. Market volatility, impermanent loss, and smart contract vulnerabilities can all impact the overall profitability of liquidity provision. However, with careful planning and risk management strategies, liquidity provision can be a lucrative way to earn passive income in the DeFi space.

| Pros of Liquidity Provision | Cons of Liquidity Provision |

| Passive income from trading fees | Potential for impermanent loss |

| Opportunity to earn additional rewards and incentives | Smart contract vulnerabilities |

| Diversification of investment by providing liquidity to multiple pools | Market volatility |

| Contribution to the liquidity and efficiency of decentralized exchanges | Potential for slippage during large trades |

Overall, liquidity provision can be a profitable way to earn passive income in the DeFi space. However, it is essential for liquidity providers to carefully consider and understand the risks involved before committing funds to liquidity pools.

Benefits of Providing Liquidity

When you provide liquidity on the 1inch Aggregator, you can enjoy various benefits:

1. Earning Passive Income: By providing liquidity, you can earn a share of the trading fees generated on the platform. As users trade through the 1inch Aggregator, a portion of the fees is distributed to liquidity providers based on their contribution. This allows you to earn a passive income stream without actively trading yourself.

2. Price Impact Minimization: By supplying liquidity to the pools, you help reduce the price impact of trades. When there is sufficient liquidity available, larger trades can be executed without significantly affecting the asset’s price. This benefits both traders and liquidity providers by providing a more efficient trading experience.

3. Access to Various Tokens: As a liquidity provider, you have the opportunity to support different token pairs on the 1inch Aggregator. This allows you to diversify your portfolio and potentially earn fees from multiple trading pairs. The platform offers a wide range of tokens and pools, giving you the flexibility to choose the assets you want to provide liquidity for.

4. Exposure to DeFi Opportunities: By participating in liquidity provision, you gain exposure to the decentralized finance (DeFi) ecosystem. DeFi has gained popularity due to its innovative financial applications and potential for high returns. Through liquidity provision, you can tap into this growing market and leverage the opportunities it offers.

5. Participation in Governance: Some decentralized exchanges and protocols provide liquidity providers with governance tokens. These tokens give you voting rights and the ability to influence the platform’s decisions. By staking LP tokens on such platforms, you can actively participate in shaping the future of the protocols you support.

In conclusion, providing liquidity on the 1inch Aggregator offers several benefits, including passive income, price impact minimization, access to various tokens, exposure to DeFi opportunities, and participation in governance. It is a rewarding way to engage with the crypto ecosystem and contribute to its growth.

How to Get Started with Liquidity Provision on 1inch Aggregator?

To get started with liquidity provision on 1inch Aggregator, follow the steps below:

- Create an account on a supported decentralized exchange (DEX) platform such as Uniswap, Sushiswap, or Balancer.

- Transfer your desired tokens to your wallet address on the DEX platform.

- Connect your wallet to the 1inch Aggregator platform by selecting the provider and wallet option.

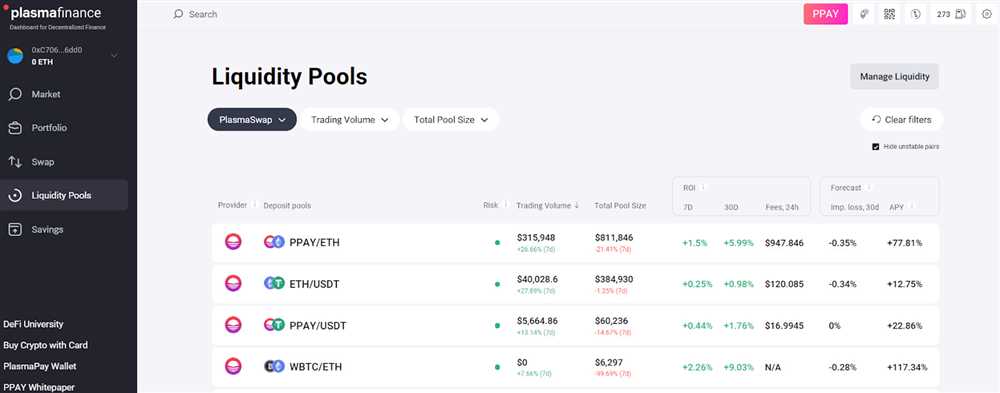

- Select the “Liquidity” tab on the 1inch Aggregator platform.

- Choose the token pair you want to provide liquidity for.

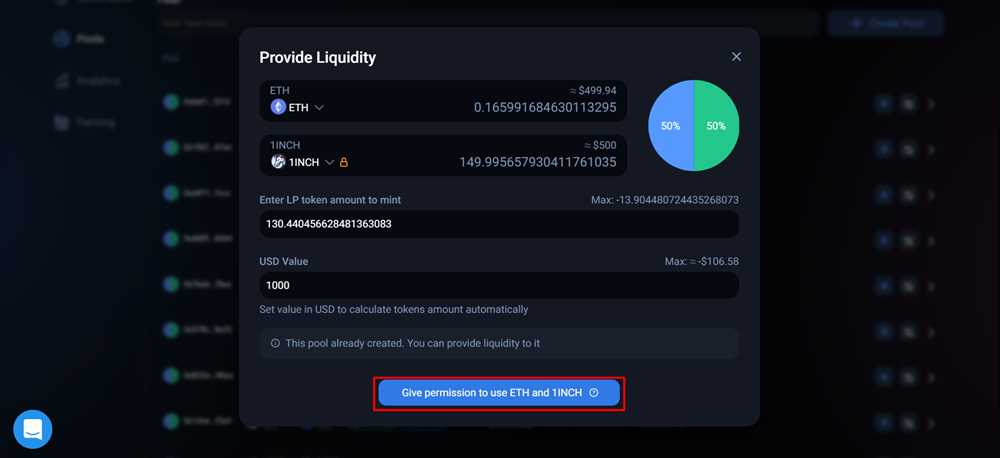

- Specify the amount of tokens you wish to provide as liquidity.

- Review the transaction details and confirm the transaction.

- Wait for the transaction to be confirmed on the blockchain.

- Once confirmed, your tokens will be added to the liquidity pool, and you will start earning passive income through trading fees.

It’s important to note that providing liquidity involves risks, such as impermanent loss. Therefore, it’s advisable to do thorough research and understand the potential risks before participating in liquidity provision.

Question-answer:

What is 1inch Aggregator?

1inch Aggregator is a decentralized exchange aggregator that sources liquidity from various decentralized exchanges to provide users with the most competitive rates and low slippage.

How can I earn passive income with 1inch Aggregator?

There are two main ways to earn passive income with 1inch Aggregator. The first is by providing liquidity to the platform as a liquidity provider and earning fees from trades. The second is by staking 1inch tokens and participating in the governance of the protocol.

What is liquidity provision?

Liquidity provision refers to the act of supplying funds to a decentralized exchange or aggregator, enabling users to trade assets. Liquidity providers earn fees from trades made using their supplied funds.

How does the 1inch Aggregator source liquidity?

The 1inch Aggregator sources liquidity from various decentralized exchanges by splitting orders across different platforms to find the best possible rates and lowest slippage for users. It uses smart contract technology to optimize trades and provide the most competitive prices.