Decentralized finance (DeFi) has gained significant popularity in recent years, with platforms like 1inch and Uniswap emerging as leading players in the space. Both protocols offer users the ability to engage in decentralized trading, but they have distinct features and benefits that set them apart. In this comprehensive comparison, we will delve into the key differences and similarities between 1inch and Uniswap.

1inch, known for its innovative aggregation and routing technology, aims to provide users with the best possible trading rates by splitting orders across multiple DEXs. The platform’s advanced algorithm scans various liquidity sources, including Uniswap, to find the most efficient trading routes. This approach ensures that traders can enjoy competitive prices and minimal slippage.

On the other hand, Uniswap is a pioneering decentralized exchange that operates on the Ethereum blockchain. It introduced the concept of automated market makers (AMMs) and liquidity pools, revolutionizing the way users trade tokens. Uniswap’s simple and intuitive interface has made it a preferred choice for many DeFi enthusiasts.

One of the primary differences between 1inch and Uniswap is their approach to liquidity. While Uniswap focuses on providing liquidity through its pool-based model, 1inch aggregates liquidity from various sources, including Uniswap. This allows 1inch to offer users access to a wider range of liquidity, potentially resulting in better trading opportunities.

Furthermore, 1inch has its native governance token, 1INCH, which grants holders certain benefits and voting rights within the platform. In contrast, Uniswap has its governance token, UNI, which was airdropped to users who had interacted with the platform prior to a specific date. The distribution of UNI tokens has led to a vibrant community and active participation in the governance of the Uniswap protocol.

In conclusion, both 1inch and Uniswap are leading DeFi protocols that have contributed significantly to the growth and innovation of the decentralized finance ecosystem. The choice between the two depends on individual preferences and trading strategies. While 1inch offers enhanced liquidity aggregation and competitive rates, Uniswap provides a user-friendly interface and strong community governance. Ultimately, it is important for users to evaluate their specific needs and goals when selecting a DeFi platform.

inch vs Uniswap: A Comparative Analysis of Leading DeFi Protocols

Decentralized Finance (DeFi) has experienced significant growth in recent years, with protocols like 1inch and Uniswap emerging as leaders in the space. These platforms provide users with the ability to swap tokens, provide liquidity, and earn returns on their investments. In this article, we will compare 1inch and Uniswap, exploring their similarities and differences in various aspects.

1. Liquidity

Both 1inch and Uniswap offer liquidity pools that allow users to trade tokens seamlessly. However, Uniswap is known for having a larger number of liquidity providers and a more diverse range of tokens available for swapping. On the other hand, 1inch is known for its aggregation technology, which combines liquidity from multiple sources to provide users with access to the best possible rates.

2. User Experience

When it comes to user experience, Uniswap has a more straightforward and user-friendly interface. It is known for its simple and intuitive design, making it easy for both experienced and novice users to navigate the platform. On the other hand, 1inch offers a more advanced user interface with additional features and customization options, making it more suitable for experienced traders.

3. Fees

In terms of transaction fees, both 1inch and Uniswap use the Ethereum blockchain, which means that users may encounter high gas fees during times of network congestion. However, 1inch has implemented a feature called GasToken, which allows users to optimize their transaction costs by utilizing gas-efficient methods. This can potentially help users save on fees compared to using Uniswap.

4. Token Distribution

1inch and Uniswap have different token distribution models. 1inch initially conducted an airdrop to distribute its native token, which rewarded users based on their previous interactions with decentralized exchanges. Uniswap, on the other hand, has a more egalitarian token distribution model, with its UNI token being distributed to users who have interacted with the protocol in various ways.

5. Governance

Both 1inch and Uniswap have implemented governance mechanisms that allow token holders to participate in the decision-making process for protocol upgrades and other important changes. However, the governance structure and processes differ between the two platforms. 1inch has a DAO (Decentralized Autonomous Organization) that allows token holders to submit and vote on proposals. Uniswap, on the other hand, has a governance token (UNI) that can be used to vote on proposals as well as participate in the protocol’s treasury.

- Overall, both 1inch and Uniswap are leading DeFi protocols that offer unique features and benefits to users.

- While Uniswap may be more popular and user-friendly, 1inch stands out with its aggregation technology and gas efficiency.

- Ultimately, the choice between 1inch and Uniswap depends on individual preferences, trading needs, and risk tolerance.

Regardless of the platform chosen, it is important for users to conduct thorough research and understand the risks associated with DeFi protocols before engaging in any transactions or providing liquidity.

Key Features and Functionality

Both 1inch and Uniswap are decentralized finance (DeFi) protocols that provide users with the ability to swap and trade tokens. However, there are several key features and functionalities that differentiate the two platforms.

1inch

1inch offers a variety of advanced features that enhance the trading experience for users. Some of its key features include:

- Aggregation: 1inch sources liquidity from multiple decentralized exchanges to provide users with the best possible trading rates.

- Optimization: The platform automatically splits orders across different decentralized exchanges to minimize slippage and ensure the most efficient trades.

- Liquidity Protocol: 1inch operates its own liquidity protocol called Mooniswap, which utilizes virtual balances and provides users with reduced slippage and better trading rates.

- Gas Cost Savings: The gas token feature enables users to save on transaction costs by using gas-efficient tokens to pay for gas fees.

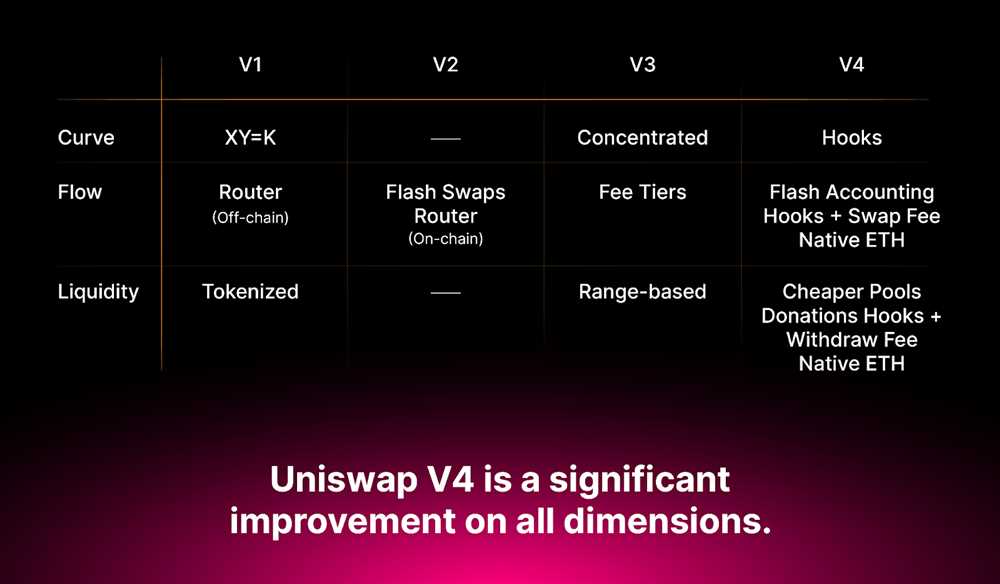

Uniswap

Uniswap is one of the most popular decentralized exchanges and offers the following key features:

- Automated Market Making: Uniswap uses an automated market making (AMM) model, allowing users to easily trade tokens without relying on traditional order books.

- Liquidity Pools: Users can contribute liquidity to Uniswap’s pools and earn trading fees in return.

- Decentralization: Uniswap is fully decentralized and operates on the Ethereum blockchain, ensuring trustless and permissionless trading.

- ERC-20 Compatibility: Uniswap supports trading of any ERC-20 token, providing users with a wide range of options for their trading needs.

Both 1inch and Uniswap are innovative DeFi protocols that offer unique features and functionalities. While 1inch focuses on optimizing trades and providing the best rates, Uniswap prioritizes the simplicity of token trading and liquidity provision. Ultimately, the choice between the two platforms depends on the specific requirements and preferences of the user.

| 1inch | Uniswap |

|---|---|

| Aggregation | Automated Market Making |

| Optimization | Liquidity Pools |

| Liquidity Protocol (Mooniswap) | Decentralization |

| Gas Cost Savings | ERC-20 Compatibility |

Trading Volume and Liquidity

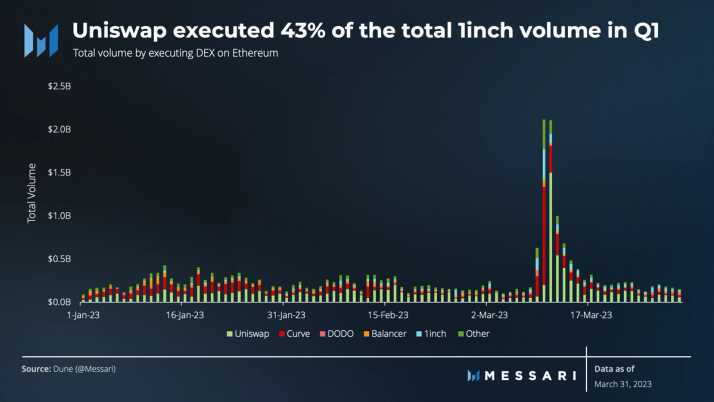

When comparing 1inch and Uniswap, one of the key factors to consider is their trading volume and liquidity. Both platforms boast significant trading volume and liquidity, but there are some differences between them.

Uniswap is known for its high trading volume and liquidity. As one of the pioneers in the decentralized exchange space, it has attracted a large number of users and has become one of the go-to platforms for DeFi trading. Its liquidity is generated through a unique automated market maker (AMM) model, which allows users to provide liquidity to various trading pairs.

On the other hand, 1inch is a relatively newer platform but has rapidly gained popularity due to its innovative features and user-friendly interface. It also boasts a substantial trading volume and liquidity, although it may not be on the same level as Uniswap.

Both platforms have their own strengths and weaknesses when it comes to trading volume and liquidity. Uniswap’s long-standing presence and large user base give it an advantage in terms of trading volume and liquidity for popular tokens. On the other hand, 1inch’s unique aggregator feature allows it to tap into liquidity from multiple decentralized exchanges, potentially offering better prices for traders.

In conclusion, both 1inch and Uniswap offer significant trading volume and liquidity, but each platform has its own strengths and weaknesses in this regard. Traders should carefully consider their specific trading needs and preferences when choosing which platform to use.

Fees and Revenue Models

When it comes to fees and revenue models, both 1inch and Uniswap have their own approach.

1inch

1inch charges a fee for each transaction made on its platform. The fee is calculated based on the size of the trade and the liquidity available. The higher the trade volume, the higher the fee. However, 1inch also offers a unique feature called the “Chi Gas Token”. This token can be purchased and used to pay for transaction fees at a discounted rate, allowing traders to save on fees.

In addition to transaction fees, 1inch also has a revenue sharing program called “1inch Liquidity Protocol”. This program allows liquidity providers to earn a share of the fees generated on the platform. The share is based on the amount of liquidity provided and the length of time it is provided for.

Uniswap

Uniswap, on the other hand, follows a different fee model. Each trade made on Uniswap incurs a 0.30% fee, which is distributed to liquidity providers. The fee is automatically added to the liquidity pool and can be claimed by liquidity providers based on their share of the pool. Uniswap does not have a fee discount or token like 1inch’s Chi Gas Token.

Uniswap also does not have a revenue sharing program like 1inch. Instead, liquidity providers earn a portion of the trading fees based on their share of the liquidity pool. This allows them to earn a passive income on their provided liquidity.

Overall, both 1inch and Uniswap have their own fee and revenue models. While 1inch offers a fee discount token and a revenue sharing program, Uniswap follows a simple fee distribution model. The choice between the two platforms may depend on individual preferences and trading strategies.

User Experience and Security Measures

When it comes to user experience, both 1inch and Uniswap have their own unique features that set them apart.

1inch offers a user-friendly interface that is designed to simplify the process of trading. Its intuitive design allows users to easily navigate through the platform and execute trades with just a few clicks. Additionally, 1inch offers a mobile app, making it even more convenient for users to access the platform on the go.

On the other hand, Uniswap is known for its simple and straightforward interface. It provides users with a seamless trading experience, allowing them to easily swap tokens without any hassle. Uniswap’s interface is designed to be beginner-friendly, making it accessible to users with varying levels of experience in DeFi.

When it comes to security measures, both protocols prioritize user safety. 1inch implements various security measures to protect users’ funds, including audited smart contracts and partnerships with reputable security firms. Additionally, 1inch allows users to connect their hardware wallets for an extra layer of security.

Uniswap also places a strong emphasis on security. The platform has undergone extensive security audits and is constantly monitored to ensure the safety of users’ funds. Uniswap has taken steps to enhance security by implementing measures such as the use of non-upgradable smart contracts and limiting the amount of control that the platform has over user funds.

Comparison of User Experience

| 1inch | Uniswap |

|---|---|

| Intuitive interface | Simple and straightforward interface |

| Mobile app available | N/A |

| Designed for user-friendly trading | Accessible to users with varying levels of experience |

In summary, both 1inch and Uniswap offer a user-friendly experience with their intuitive interfaces. However, 1inch stands out with its mobile app availability, while Uniswap is known for its simplicity and accessibility. In terms of security measures, both protocols prioritize user safety and have implemented various measures to protect users’ funds.

Question-answer:

What is the difference between 1inch and Uniswap?

One of the main differences between 1inch and Uniswap is that 1inch is a decentralized exchange aggregator, while Uniswap is a decentralized exchange protocol.

Which one has lower fees, 1inch or Uniswap?

The fees on 1inch can be lower compared to Uniswap, as 1inch sources liquidity from multiple exchanges, allowing users to find the best prices and lowest fees.

Can I use 1inch on mobile devices?

Yes, you can use 1inch on mobile devices. 1inch has a mobile app available for both iOS and Android, providing users with access to decentralized trading and swapping on the go.