Welcome to 1inch Crypto, the ultimate solution to the slippage issue in decentralized trading!

Are you tired of losing money due to high slippage? Look no further! 1inch Crypto is here to revolutionize your trading experience.

What is slippage, you ask? Slippage occurs when the price of a token changes between the time you submit a transaction and the time it is executed. This can lead to unexpected losses and frustration for traders.

But fear not! With 1inch Crypto’s innovative technology, we have eliminated slippage once and for all. Our smart algorithm splits your trade across multiple decentralized exchanges to ensure that you always get the best possible rate.

Our mission is to empower traders like you with the tools and knowledge needed to trade confidently in the decentralized world. With 1inch Crypto, you can say goodbye to slippage and hello to seamless and profitable trading!

Don’t miss out on this game-changing platform. Join thousands of satisfied users and start trading with 1inch Crypto today!

Take control of your decentralized trading and experience the power of 1inch Crypto.

Disclaimer: Trading involves risk. 1inch Crypto is not responsible for any financial losses incurred during trading activities. Please do your own research and make informed decisions.

Overview of decentralized trading

Decentralized trading, also known as peer-to-peer trading, is a type of trading that takes place directly between individuals without the involvement of intermediaries such as banks or centralized exchanges. It relies on blockchain technology and smart contracts to facilitate and secure transactions.

In a decentralized trading environment, users have full control over their funds and can trade directly with other users on the network. This eliminates the need to trust a central authority and reduces the risk of censorship, fraud, or manipulation. Decentralized trading platforms aim to provide a more transparent, secure, and open trading experience for users.

The benefits of decentralized trading

1. Privacy: Decentralized trading offers a higher level of privacy compared to traditional trading platforms. Users can trade without revealing their personal information, allowing them to maintain their privacy and protect their identity.

2. Lower fees: By eliminating intermediaries, decentralized trading platforms can significantly reduce transaction fees. This makes it more cost-effective for users to participate in trading activities, especially for high-frequency traders who execute a large number of transactions.

The challenges of decentralized trading

1. Liquidity: One of the main challenges faced by decentralized trading platforms is liquidity. As these platforms rely on individual traders, it can be harder to find counterparties for certain assets or trading pairs, potentially leading to higher slippage.

2. User experience: While decentralized trading platforms offer many advantages, they can also be more complicated to use compared to centralized exchanges. Users need to have some technical knowledge and be comfortable managing their own funds and wallets.

With its innovative approach, 1inch Crypto aims to address the slippage issue in decentralized trading by providing users with the best possible rates across multiple decentralized exchanges. By aggregating liquidity from various sources, 1inch Crypto offers users a seamless trading experience with low slippage and minimal fees.

The problem of slippage

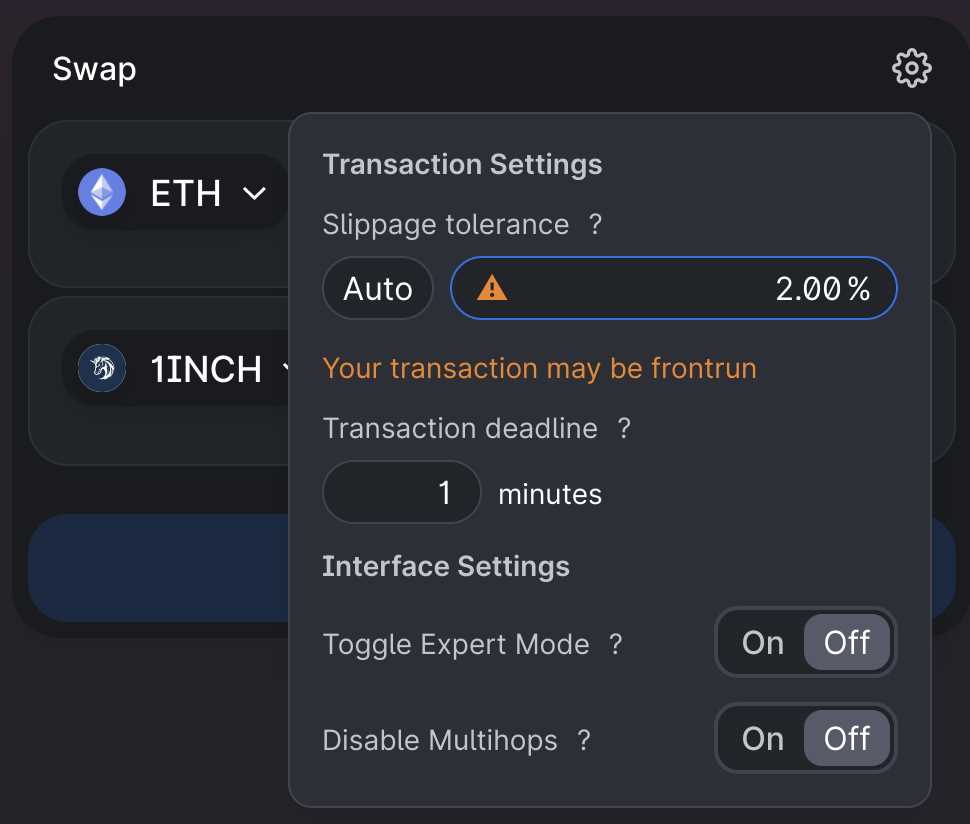

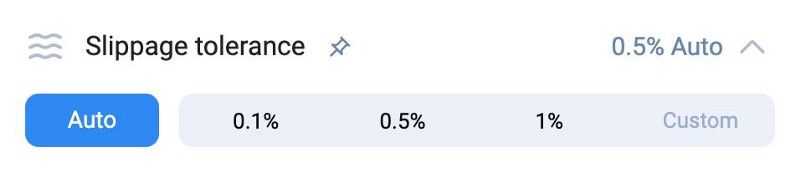

In decentralized trading, slippage refers to the difference between the expected price of a trade and the price at which the trade is actually executed. This can occur due to various factors, such as market volatility, liquidity constraints, and network congestion.

Slippage can be a significant issue for traders, as it can result in unexpected losses or reduced profits. For example, when trading large volumes or in illiquid markets, the price impact of a trade can be substantial, causing the execution price to deviate from the desired price.

Market volatility

One of the main causes of slippage is market volatility. In decentralized markets, prices can change rapidly, especially during periods of high trading activity or news events. This volatility can make it difficult for traders to execute trades at their desired price, as the market may move against them before their trade is completed.

High levels of volatility can lead to larger price spreads and increased slippage, as the gap between the bid and ask prices widens. This can make it more expensive to enter or exit a position, especially for larger trades or trades in illiquid markets.

Liquidity constraints

Liquidity is another factor that can contribute to slippage. In decentralized trading, liquidity is provided by a network of liquidity providers and market makers. If there is not enough liquidity available to fulfill a trade, the execution price may be impacted.

Low liquidity can result in wider spreads and greater price impact, as there may not be enough buyers or sellers to match the desired trade volume. This can make it more difficult for traders to execute trades at their desired price, especially for larger orders.

Furthermore, liquidity can vary across different decentralized exchanges and trading pairs. Traders may experience more slippage when trading in less liquid markets or on smaller exchanges, as there may be fewer participants and less competition among market makers.

Network congestion

Network congestion can also contribute to slippage in decentralized trading. Decentralized exchanges operate on blockchain networks, which can experience congestion during periods of high trading activity or when there is increased demand for transaction processing.

When a blockchain network is congested, transaction processing times can increase, leading to delayed trade execution. This delay can result in slippage, as the market may move against the trader while their transaction is pending.

To mitigate the problem of slippage, 1inch Crypto offers various features and technologies that help traders optimize their trading strategies and minimize their exposure to slippage. By aggregating liquidity from multiple decentralized exchanges and utilizing advanced algorithms, 1inch Crypto aims to provide traders with the best possible execution price, reducing the impact of slippage on their trades.

inch Crypto: Solving the Slippage Issue

In the world of decentralized trading, slippage has always been a major concern for traders. When executing a trade on a decentralized exchange, the price of the asset can sometimes change significantly between the moment the trade is initiated and the moment it is executed. This price difference is known as slippage, and it can result in traders paying more or receiving less for their assets than they intended.

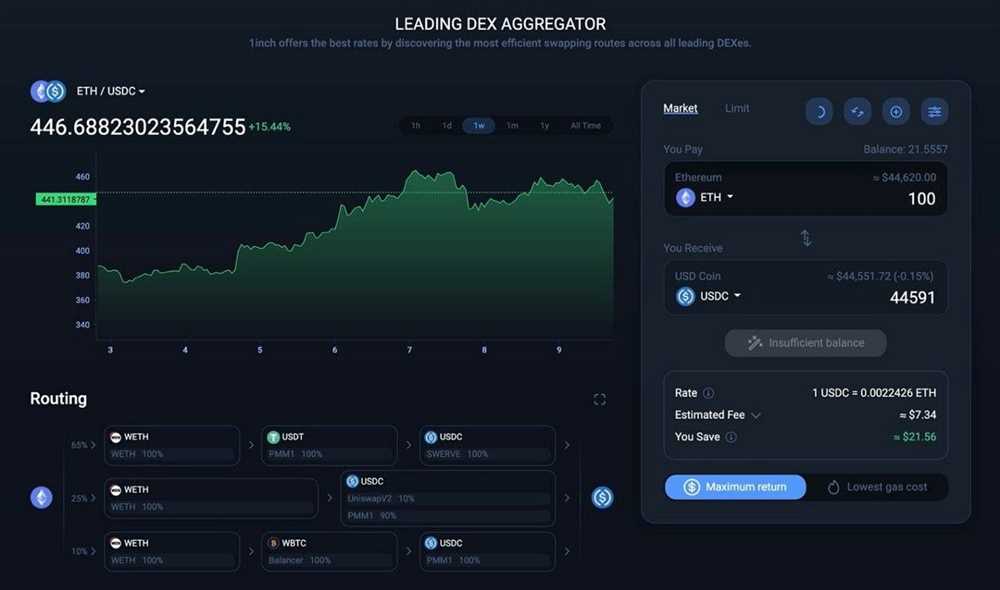

1inch Crypto is a revolutionary platform that aims to solve the slippage issue in decentralized trading. By leveraging advanced algorithms and smart contract technology, 1inch Crypto analyzes multiple decentralized exchanges in real-time to find the best prices and liquidity pools for any given trade.

With 1inch Crypto, traders no longer have to worry about slippage impacting their trades. The platform automatically splits orders across multiple exchanges and liquidity sources to ensure that traders get the best price possible. This not only saves traders money but also provides them with a seamless trading experience.

Furthermore, 1inch Crypto is built on the Ethereum blockchain, providing users with a secure and transparent trading environment. The platform is non-custodial, meaning that users retain full control over their funds at all times. Additionally, 1inch Crypto is compatible with popular wallets such as MetaMask, ensuring a user-friendly and accessible experience.

Whether you’re a seasoned trader or new to the world of decentralized finance, 1inch Crypto is the solution to the slippage issue. Say goodbye to unexpected price changes and start trading with confidence. Join 1inch Crypto today and experience the future of decentralized trading.

| Key Features: |

| ✓ Advanced algorithms for finding the best prices and liquidity pools |

| ✓ Automatic order splitting across multiple exchanges |

| ✓ Secure and transparent trading on the Ethereum blockchain |

| ✓ Non-custodial platform with full user control |

| ✓ Compatible with popular wallets like MetaMask |

How 1inch Crypto addresses slippage

1inch Crypto is a revolutionary platform that aims to solve the slippage issue in decentralized trading. Slippage refers to the discrepancy between the expected price of a trade and the actual executed price of the trade.

Here’s how 1inch Crypto addresses slippage:

- Aggregation of liquidity: 1inch Crypto leverages multiple decentralized exchanges to aggregate liquidity from various sources. By pooling together liquidity from different platforms, 1inch Crypto is able to provide users with the best possible execution price, reducing slippage.

- Smart order routing: 1inch Crypto’s smart order routing algorithm analyzes the available liquidity across different exchanges in real-time. It automatically splits the trade into multiple smaller orders and routes them to the most liquid exchanges, optimizing for price execution and reducing slippage.

- Gas optimization: 1inch Crypto employs gas optimization techniques to minimize transaction costs while maximizing trade execution efficiency. By utilizing sophisticated algorithms, 1inch Crypto ensures that trades are executed at the lowest possible gas fees, saving users money.

- Intelligent algorithms: 1inch Crypto utilizes intelligent algorithms that continuously monitor market conditions and adjust trading strategies accordingly. These algorithms analyze historical data, liquidity, and price volatility to make informed decisions, ultimately reducing slippage for users.

By addressing the slippage issue, 1inch Crypto offers traders a reliable and efficient decentralized trading experience. With its innovative approach and advanced technology, 1inch Crypto is transforming the world of decentralized finance.

Benefits of using 1inch Crypto

1. Improved liquidity: By using 1inch Crypto, traders can access multiple decentralized exchanges (DEXs) simultaneously, which increases liquidity and significantly reduces slippage. This means that traders can execute their trades at a more favorable price without affecting the market.

2. Aggregation of DEXs: 1inch Crypto aggregates liquidity from various DEXs, allowing users to find the best possible price for their trades. This not only saves time but also maximizes potential profits for traders.

3. Optimized gas fees: Gas fees can be a significant concern when trading on Ethereum-based DEXs. 1inch Crypto provides users with the option to select the most cost-effective transaction route, taking into account gas prices and transaction speed. This ensures that users can save on gas fees and complete their trades quickly.

4. Security: 1inch Crypto leverages smart contract technology, ensuring that users’ funds remain secure throughout the trading process. The platform has undergone extensive security audits and is built on robust protocols, providing users with peace of mind when executing trades.

5. User-friendly interface: 1inch Crypto offers an intuitive and user-friendly interface, making it easy for both beginners and experienced traders to navigate the platform. The platform provides a seamless trading experience, allowing users to focus on executing profitable trades rather than dealing with complex interfaces.

6. Access to a wide range of tokens: With 1inch Crypto, users can trade a vast array of tokens, including those that are not available on centralized exchanges. This opens up opportunities for investors and traders to access unique and potentially lucrative markets.

7. Integration with popular wallets: 1inch Crypto seamlessly integrates with popular crypto wallets, such as MetaMask, enabling users to connect their wallets and execute trades directly from the wallet interface. This simplifies the trading process and provides users with an added layer of convenience.

By utilizing 1inch Crypto, traders can enjoy these benefits and more, allowing them to make the most out of their decentralized trading experience.

The future of decentralized trading with 1inch Crypto

Decentralized trading has emerged as a groundbreaking concept in the world of cryptocurrencies. With its promise of transparent, secure, and permissionless transactions, it has quickly gained popularity among traders and investors.

However, decentralized trading platforms have faced numerous challenges, including the issue of slippage. Slippage occurs when a trade is executed at a different price than expected due to the lack of liquidity or market volatility. This can result in substantial losses for traders.

1inch Crypto is revolutionizing decentralized trading by solving the slippage issue. Using advanced algorithms and protocols, 1inch Crypto ensures that trades are executed at the best available prices across multiple liquidity sources. This eliminates the risk of slippage and maximizes the potential profits for traders.

But the benefits of 1inch Crypto go beyond just solving the slippage issue. As the decentralized trading landscape continues to evolve, 1inch Crypto is at the forefront of innovation.

- Aggregation: 1inch Crypto aggregates liquidity from various decentralized exchanges, providing users with access to a wider range of trading opportunities.

- Optimization: The advanced algorithms of 1inch Crypto optimize trades to minimize gas fees and maximize transaction efficiency.

- Governance: 1inch Crypto is a community-driven platform that empowers users to participate in the decision-making process through governance tokens.

- Interoperability: 1inch Crypto is built on Ethereum but is also compatible with other blockchains, enabling seamless cross-chain trading in the future.

The future of decentralized trading is bright, and 1inch Crypto is leading the way. With its innovative solutions, 1inch Crypto is transforming the decentralized trading experience, making it more efficient, secure, and accessible for all.

Question-answer:

What is 1inch Crypto?

1inch Crypto is a decentralized exchange aggregator that sources liquidity from various exchanges to provide users with the best rates for their trades.

How does 1inch Crypto solve the slippage issue in decentralized trading?

1inch Crypto solves the slippage issue by splitting larger trades across multiple DEXs and using a complex routing algorithm to minimize the impact on the price. This ensures that users get the most favorable rates even when trading large volumes.