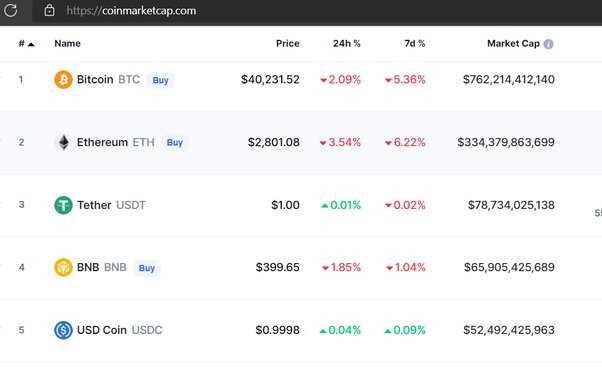

Investors looking to capitalize on the potential of cryptocurrencies need to pay attention to a digital asset’s market capitalization. When it comes to the 1inch Coin (1INCH), the market cap plays a crucial role in determining its long-term success.

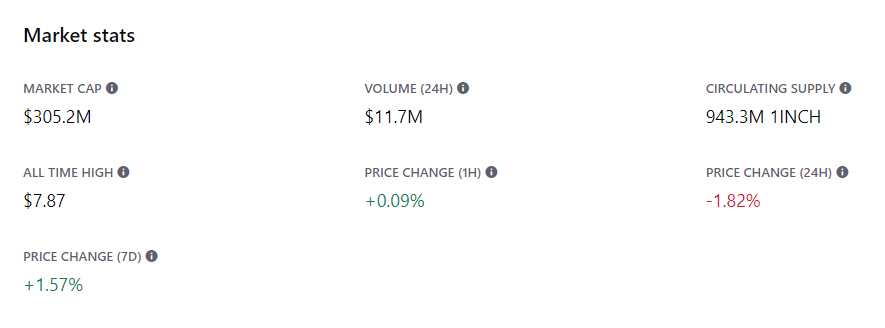

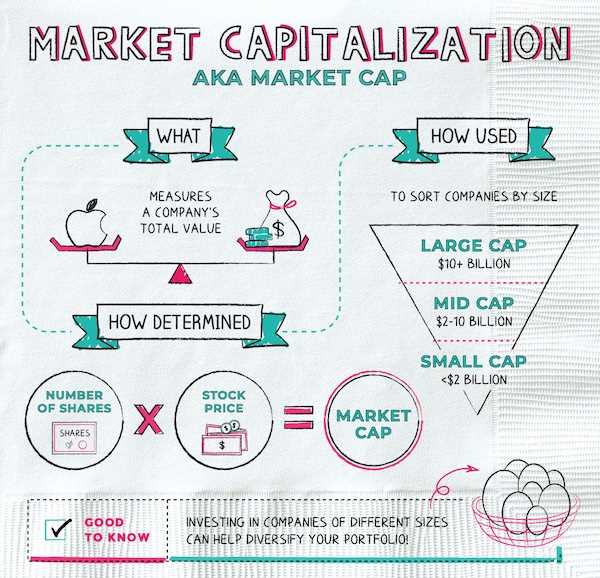

Market cap, also known as market capitalization, is a measure of a cryptocurrency’s total value. It is calculated by multiplying the current price of the coin by its total circulating supply. As the market cap increases, it indicates a higher level of investor confidence and interest in the cryptocurrency.

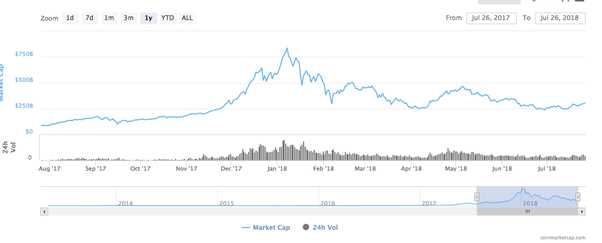

1inch Coin has been gaining momentum in the cryptocurrency market, and its market cap has been steadily growing. This growth is a reflection of the increasing adoption of the 1inch decentralized exchange and the value it brings to users.

But why is market cap important for the long-term success of a cryptocurrency like 1inch Coin? A higher market cap not only attracts more investors but also enhances the liquidity of the coin. With greater liquidity, users can easily buy and sell 1INCH without significantly impacting its price.

Moreover, a larger market cap increases the visibility and reputation of the cryptocurrency. It becomes more recognized and trusted by investors, which further fuels its growth. This, in turn, leads to a positive feedback loop, with increased adoption, market cap, and value.

As investors consider the potential of 1inch Coin, they should evaluate its market cap to determine its long-term viability and growth potential. With a rapidly expanding ecosystem and a growing user base, the market cap of 1INCH holds promise for those who see the value in this decentralized exchange platform.

Investors looking to stay ahead in the cryptocurrency market should keep a close eye on the market cap of 1inch Coin. By understanding its role in the long-term success of this digital asset, they can make informed investment decisions and potentially reap the rewards.

The Importance of Market Cap

Market cap, short for market capitalization, is a crucial metric in assessing the success and potential of a cryptocurrency like 1inch Coin. Market cap refers to the total value of a cryptocurrency, calculated by multiplying its circulating supply by its current price. It is a measure of the market’s confidence and interest in a particular coin.

Understanding the importance of market cap can provide valuable insights for investors and traders. A high market cap indicates that a cryptocurrency has a large and established user base, as well as strong demand in the market. This can be indicative of a coin’s long-term success, as it demonstrates widespread adoption and potential for further growth.

Market cap also plays a significant role in determining a cryptocurrency’s position and influence within the overall cryptocurrency market. Coins with larger market caps tend to have more liquidity and are more likely to be listed on major exchanges. This provides greater accessibility and visibility for investors, which can contribute to increased trading volume and price stability.

Furthermore, market cap can be used as a comparative tool when evaluating different cryptocurrencies. By comparing the market caps of different coins, investors can gain insights into the relative size and potential of various projects. This information can help in making informed investment decisions and identifying opportunities in the market.

However, it is essential to note that market cap alone should not be the sole factor in making investment decisions. Other factors such as technology, team, community, and market trends should also be considered. Nonetheless, market cap remains a critical metric that provides valuable information about the market’s perception and confidence in a cryptocurrency like 1inch Coin.

In conclusion, market cap is an important metric in assessing the success and potential of a cryptocurrency. It indicates the market’s confidence and interest in a particular coin, as well as its position and influence within the overall cryptocurrency market. While market cap should not be the sole factor in investment decisions, it can provide valuable insights for investors and traders when combined with other relevant factors.

Understanding Market Cap

Market cap, short for market capitalization, is a key concept in the world of finance. It is used as an indicator to measure the size and value of a company or a cryptocurrency, such as 1inch Coin. Understanding market cap is crucial for investors and traders alike, as it provides insights into the potential growth and stability of an asset.

Definition

Market cap represents the total value of all outstanding shares of a publicly traded company or the total value of a cryptocurrency in circulation. It is calculated by multiplying the current price of a single share or coin by the total number of shares or coins in existence. Market cap is often expressed in billions or trillions of dollars for large companies, and in millions or billions of dollars for smaller companies or cryptocurrencies.

Importance

Market cap is a useful metric for evaluating the size and significance of a company or cryptocurrency. It can help investors assess the potential risks and returns associated with an investment. Companies or cryptocurrencies with larger market caps are generally considered more established and stable, while those with smaller market caps may offer higher growth potential but also higher volatility.

Market cap can also be used to compare companies or cryptocurrencies within the same industry or sector. It allows investors to gauge the relative size and competitiveness of different assets. Additionally, market cap can influence the liquidity of a stock or cryptocurrency, as larger market caps often attract more buyers and sellers, resulting in higher trading volumes.

Limitations

While market cap is a widely used indicator, it has its limitations. It does not provide a complete picture of a company or cryptocurrency’s financial health or profitability. Market cap solely considers the market price and number of shares or coins outstanding, without taking into account factors such as debt, earnings, or growth potential.

Furthermore, market cap can be influenced by factors such as investor sentiment, market trends, and speculative trading. It can fluctuate greatly in the short term, making it important to consider other fundamental and technical analysis tools when making investment decisions.

Overall, understanding market cap is essential for investors and traders to make informed decisions. It provides insights into the size, value, and potential of a company or cryptocurrency, helping individuals navigate the complex world of finance.

Market Cap and Financial Stability

The market capitalization, or market cap, of a cryptocurrency plays a crucial role in its long-term success and financial stability. Market cap is a measure of the total value of a cryptocurrency, calculated by multiplying the price of each coin by its total supply.

One of the key benefits of a high market cap is the increased financial stability it provides. A cryptocurrency with a larger market cap generally has a higher level of liquidity, which means there is a larger volume of coins available for buying and selling. This makes it easier for investors to enter or exit positions without significant price impact.

Furthermore, a high market cap often indicates a higher level of trust and confidence in the cryptocurrency. Investors are more likely to trust a cryptocurrency with a significant market cap, as it suggests that there is a larger and more active user base. This can lead to increased adoption and usage of the cryptocurrency, further enhancing its long-term success.

Market Cap and Price Stability

Market cap also plays a role in price stability. Cryptocurrencies with a larger market cap are generally less volatile, as the larger number of coins in circulation provides a buffer against sudden price fluctuations. This stability can make the cryptocurrency more attractive to investors and businesses looking for a reliable store of value or means of exchange.

Growing Market Cap

A growing market cap is often seen as a positive sign for the long-term success of a cryptocurrency. As the market cap increases, it demonstrates that more investors and users are buying and holding the cryptocurrency. This increased demand can drive up the price and attract even more investors, creating a positive feedback loop.

In conclusion, market cap plays a vital role in the financial stability and success of a cryptocurrency. A high market cap brings increased liquidity, trust, and price stability, all of which contribute to the long-term growth and adoption of the cryptocurrency.

Market Cap and Long Term Growth

When it comes to assessing the long-term growth potential of a cryptocurrency like 1inch Coin, market capitalization (market cap) plays a crucial role. Market cap is a key indicator of the overall value and significance of a cryptocurrency within the market.

Market cap is calculated by multiplying the current price of a cryptocurrency by the total number of coins in circulation. It provides investors and market participants with an estimate of the total investment in a particular cryptocurrency.

A large market cap indicates that a cryptocurrency is well-established and has a significant number of investors and users. This can contribute to the stability and growth potential of the coin in the long term.

Market Cap as a Measure of Success

Having a high market cap is often seen as a measure of success and reliability. It demonstrates that a cryptocurrency has captured a large portion of the market and has gained the trust and confidence of investors.

1inch Coin’s market cap reflects its popularity and traction within the cryptocurrency market. As more investors and users recognize its value, the market cap is likely to increase, indicating that the coin is gaining momentum and attracting more attention.

A high market cap can also lead to increased liquidity, making it easier for investors to buy and sell the cryptocurrency. This can contribute to the overall growth and adoption of 1inch Coin as it becomes more widely accessible.

The Role of Market Cap in Long Term Growth

Market cap plays a crucial role in the long-term growth of 1inch Coin. It serves as a measure of the coin’s value and potential, attracting new investors and users who see its market cap as an indicator of stability and reliability.

With a large market cap, 1inch Coin can have a competitive edge in the market, allowing it to attract partnerships, collaborations, and support from major players in the industry. This can further enhance its growth trajectory and contribute to its long-term success.

Additionally, a high market cap can also bring about increased media attention and visibility for 1inch Coin. This can help create a positive perception of the cryptocurrency, leading to greater awareness and adoption in the market.

Overall, market cap serves as a significant factor in assessing the long-term growth potential of 1inch Coin. As the market cap continues to grow, the coin’s value and significance within the market are likely to increase, providing investors with greater confidence in its long-term success.

Market Cap and Investor Confidence

Market capitalization (market cap) is an important metric that investors use to evaluate the potential of a cryptocurrency. It represents the total value of all the coins or tokens in circulation multiplied by their current market price. The market cap of a cryptocurrency reflects the overall trust and confidence that investors have in the project.

When the market cap of a cryptocurrency is high, it indicates that there is significant investor interest in the project. This can be seen as a vote of confidence in the long-term success and sustainability of the cryptocurrency. A high market cap also suggests that there is a large amount of capital invested in the project, which can provide stability and liquidity to the market.

Investors pay close attention to market cap when making investment decisions. A low market cap may indicate that the cryptocurrency is still in its early stages and has potential for growth. On the other hand, a high market cap may signal that the cryptocurrency has already gained substantial popularity and may be less likely to experience rapid growth in the future.

Market cap can also influence investor sentiment and perception of a cryptocurrency. A high market cap can create a positive feedback loop, attracting more investors and increasing demand for the cryptocurrency, which in turn can drive up the market price. Conversely, a low market cap can lead to negative sentiment and discourage potential investors from getting involved.

| Advantages of a High Market Cap | Disadvantages of a Low Market Cap |

|---|---|

|

|

Investors should carefully consider the market cap of a cryptocurrency when assessing its potential for long-term success. While a high market cap can provide stability and confidence, it is important to also consider other factors such as the project’s team, technology, and market demand. By taking a holistic approach to evaluating cryptocurrencies, investors can make more informed decisions and increase their chances of achieving long-term success.

Question-answer:

What is the market cap of 1inch Coin?

The market cap of 1inch Coin is currently around $1.5 billion.

How does the market cap affect the long term success of 1inch Coin?

The market cap is an important metric for evaluating the overall value and market perception of a cryptocurrency like 1inch Coin. A higher market cap generally indicates a larger and more established user base, greater liquidity, and increased investor confidence. These factors can contribute to the long term success of the coin.

What factors can contribute to a higher market cap for 1inch Coin?

Several factors can contribute to a higher market cap for 1inch Coin. These include increased adoption and usage of the platform, positive news and partnerships that enhance its reputation, strong fundamental characteristics such as security and functionality, and positive sentiment and demand from investors and traders.