Exploring the Significance of Market Making Algorithms in 1inch.exchange for Facilitating Transparent and Effective Trades

In today’s fast-paced and highly competitive cryptocurrency market, traders rely on efficient platforms that can provide fair and transparent trading opportunities. One such platform is 1inch.exchange, a decentralized exchange aggregator that leverages market making algorithms to ensure smooth and efficient trades.

Market making algorithms play a crucial role in maintaining liquidity and minimizing price slippage in decentralized exchanges. These algorithms continuously monitor various markets, adjusting bid and ask prices to ensure that there is always a market for a particular asset.

By constantly updating and optimizing trading strategies, market making algorithms on 1inch.exchange help facilitate fair and efficient trades. They provide traders with access to a wide range of liquidity sources, ensuring that they can execute their trades at the best possible prices.

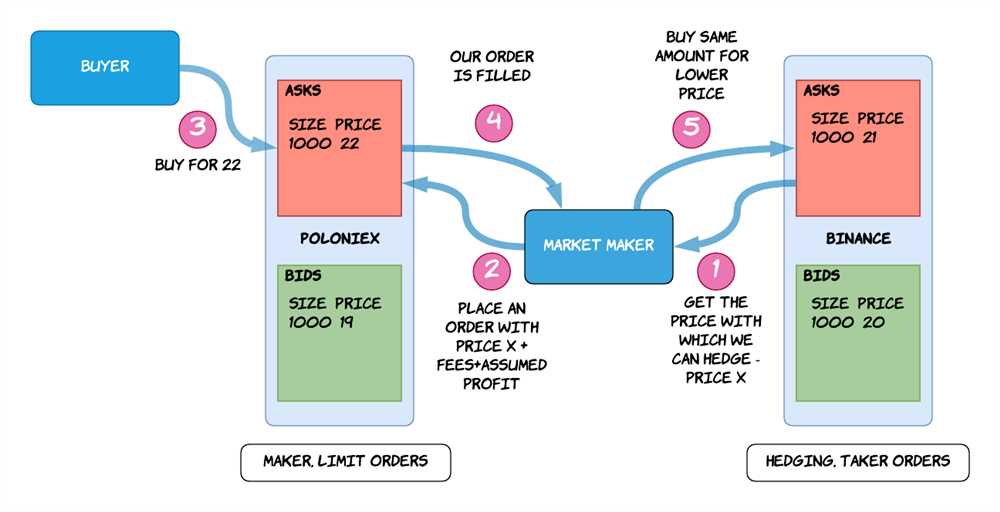

Furthermore, market making algorithms on 1inch.exchange utilize advanced techniques such as smart order routing and arbitrage opportunities to maximize trading opportunities. This allows traders to benefit from the best available prices across multiple exchanges, resulting in improved trade execution and reduced slippage.

In conclusion, market making algorithms play a pivotal role in 1inch.exchange by ensuring fair and efficient trades. By maintaining liquidity and optimizing trading strategies, these algorithms empower traders to execute their trades with confidence and transparency, ultimately contributing to the growth and stability of the cryptocurrency market.

The Importance of Market Making

Market making is a crucial component of modern financial markets. It plays a vital role in ensuring liquidity and fair trading conditions for investors. Without market makers, the smooth operation of markets would be severely hindered, and the prices of assets could become highly volatile. In this section, we will explore the importance of market making and its benefits in more detail.

Liquidity provision

One of the primary functions of market makers is to provide liquidity to the market. Liquidity refers to the ease with which an asset can be bought or sold without significantly impacting its price. Market makers achieve this by continuously quoting bid and ask prices, creating a ready market for buyers and sellers to transact.

By actively participating in the market and providing liquidity, market makers ensure that there is a smooth flow of transactions. This reduces the risk of price fluctuations caused by sudden imbalances in supply and demand. Moreover, increased liquidity enhances market efficiency, improves price discovery, and reduces trading costs for market participants.

Fair and efficient trades

Market makers also play a crucial role in ensuring fair and efficient trades. They help maintain a fair spread between bid and ask prices, which represents the profit margin for market makers. This spread provides an opportunity for investors to buy low and sell high, facilitating profit-making trades.

Additionally, market makers help narrow the bid-ask spread by continually adjusting their quotes in response to changing market conditions. This reduces the trading costs for participants and enhances market transparency. Moreover, by actively providing liquidity, market makers reduce the impact of large trades on market prices, preventing market manipulation and ensuring fair trading conditions for all participants.

In conclusion, market making is an essential function in financial markets. It ensures liquidity, promotes fair and efficient trades, and contributes to the overall stability of the market. Without market makers, trading volumes would decrease, price volatility would spike, and market efficiency would suffer. Therefore, market making algorithms, such as those employed by 1inch.exchange, are vital for ensuring fair and efficient trades for all market participants.

Market Making Algorithms in 1inch.exchange

Market making algorithms play a crucial role in the operations of 1inch.exchange, ensuring fair and efficient trades for users. These algorithms are designed to provide liquidity to the decentralized exchange by constantly quoting both a buy and a sell price for selected trading pairs.

The 1inch.exchange platform combines multiple DeFi protocols, such as Uniswap, Balancer, and Kyber Network, to provide users with the best possible trading rates across various liquidity pools. Market making algorithms are used to analyze the current market conditions and dynamically adjust the buy and sell prices to provide the most competitive rates.

One of the key advantages of market making algorithms in 1inch.exchange is their ability to reduce slippage. Slippage occurs when the executed price of a trade differs from the expected price. By constantly adjusting the buy and sell prices based on the available liquidity, the algorithms ensure that traders can execute their trades at the expected price with minimal slippage.

In addition to reducing slippage, market making algorithms also promote market efficiency by ensuring that there is always sufficient liquidity available for traders. By maintaining constant bid and ask prices, the algorithms encourage other market participants to place orders, resulting in a more active and liquid market environment.

Furthermore, these algorithms use advanced mathematical models and statistical analysis to identify market trends and patterns, allowing for more accurate price predictions. This helps traders make informed decisions and take advantage of potential arbitrage opportunities.

Overall, market making algorithms are an essential component of 1inch.exchange, enabling fair and efficient trades by providing continuous liquidity and reducing slippage. Through their ability to adjust prices based on market conditions and their use of advanced analysis techniques, these algorithms ensure that users can trade assets at the best possible rates on the platform.

Benefits of Market Making Algorithms

Market making algorithms provide several key benefits in the functioning of cryptocurrency exchanges:

- Liquidity: Market making algorithms enhance the liquidity of an exchange by ensuring that there is always a ready supply of both buy and sell orders for different assets. This ensures that traders can quickly and easily buy or sell their assets without causing significant price fluctuations.

- Efficiency: By continuously adjusting bid and ask prices based on market conditions, market making algorithms optimize the execution of trades. This results in faster and more efficient trades, reducing the chances of slippage and maximizing the overall profitability of traders.

- Fairness: Market making algorithms contribute to fair trading conditions by reducing the spread (the difference between bid and ask prices). This helps to create a more balanced and equitable market where traders can transact at prices that closely reflect the true value of the asset.

- Stability: The presence of market making algorithms helps to stabilize the market by absorbing sudden and large price movements. These algorithms adjust their bid and ask prices in response to changes in market conditions, mitigating the impact of price volatility and promoting a more stable trading environment.

- Increased Market Participation: Market making algorithms encourage increased market participation by providing a continuous flow of liquidity. This attracts more traders to the exchange, increases trading volumes, and ultimately improves market depth.

In conclusion, market making algorithms play a crucial role in ensuring fair and efficient trades on cryptocurrency exchanges. By enhancing liquidity, improving efficiency, promoting fairness, maintaining stability, and attracting more participants, these algorithms contribute to the overall health and functionality of the market.

Question-answer:

What is 1inch.exchange?

1inch.exchange is a decentralized exchange (DEX) aggregator that sources liquidity from various DEXs to provide users with the best possible trading rates.

How do market making algorithms work in 1inch.exchange?

Market making algorithms in 1inch.exchange analyze the liquidity across multiple DEXs and determine the optimal routes for trades. They continuously adjust and update the prices to ensure fair and efficient trades.

Why are market making algorithms important in 1inch.exchange?

Market making algorithms play a crucial role in 1inch.exchange as they help provide users with competitive rates and ensure efficient trades by sourcing liquidity from multiple DEXs.

What are the benefits of market making algorithms in 1inch.exchange?

The benefits of market making algorithms in 1inch.exchange include improved liquidity, better trading rates, and reduced slippage for users. These algorithms also contribute to the overall efficiency and fairness of the platform.