Unlocking the Possibilities of Automated Trading on 1inchswap: A Comprehensive Exploration

The world of cryptocurrency trading is evolving rapidly, and innovative platforms like 1inchswap are at the forefront of this revolution. Automated trading has emerged as a game-changer in the crypto space, enabling traders to execute trades with speed, accuracy, and efficiency. In this article, we will delve into the potential of automated trading on 1inchswap and explore how it can revolutionize the way we trade cryptocurrencies.

1inchswap is a decentralized exchange aggregator that sources liquidity from various decentralized exchanges to provide traders with the best possible trading rates. With its advanced algorithm, 1inchswap ensures that traders can access the most competitive prices across multiple platforms. But what sets 1inchswap apart is its integration of automated trading, which opens up a whole new world of possibilities.

Automated trading, also known as algorithmic trading, involves using computer programs to execute trades based on predefined parameters. Traders can set up these programs to analyze market data, monitor price movements, and execute trades automatically. This eliminates the need for manual intervention and allows traders to take advantage of market opportunities 24/7.

On 1inchswap, automated trading provides several advantages. Firstly, it enables traders to execute trades instantly, with minimal latency and slippage. This is particularly beneficial in volatile market conditions, where every second counts. Secondly, automated trading eliminates human emotions and biases from the trading process, enabling objective and data-driven decision making. Finally, automated trading on 1inchswap allows for the seamless execution of complex trading strategies, such as arbitrage and market-making.

In conclusion, 1inchswap is taking automated trading to the next level by integrating it into its decentralized exchange aggregator platform. With its advanced algorithm and seamless execution, automated trading on 1inchswap offers traders unparalleled speed, accuracy, and efficiency. As the crypto market continues to evolve, automated trading will undoubtedly play a central role in shaping the future of cryptocurrency trading.

Understanding the Concept of Automated Trading

Automated trading, also known as algorithmic trading or black-box trading, is a method of executing trades in financial markets using pre-programmed software. With automated trading, computer algorithms analyze market conditions, identify trading opportunities, and execute trades without human intervention.

This method of trading has gained popularity due to its ability to execute trades at high speeds, eliminate human error, and take advantage of market inefficiencies. Automated trading systems can be used for various financial instruments such as stocks, futures, options, and cryptocurrencies.

There are several types of automated trading strategies that traders can implement. These strategies include trend following, mean reversion, breakouts, statistical arbitrage, and many others. Each strategy is based on specific market conditions and aims to generate profits by exploiting price movements.

Automated trading relies on complex mathematical models and large amounts of historical data. Traders use algorithms to backtest their strategies, which involves running the algorithm on historical data to see how it would have performed in the past. This helps traders assess the profitability and risk of their strategies before deploying them in live trading.

One of the key advantages of automated trading is its ability to execute trades based on predefined rules and criteria. This removes emotional biases and irrational decision-making that might occur in manual trading. Automated trading systems can also process vast amounts of data and react to market conditions in real time, enabling traders to capture trading opportunities as soon as they arise.

- Automated trading can be beneficial for both institutional and individual traders. Institutions can use automated trading to execute large orders without disrupting the market, while individual traders can leverage automated systems to trade multiple markets simultaneously.

- It is important to note that automated trading does not guarantee profits. Markets are complex and unpredictable, and there is always a risk of losses. Traders should carefully design and test their trading strategies and constantly monitor their performance to adapt to changing market conditions.

In conclusion, automated trading is a powerful tool that allows traders to execute trades based on pre-programmed rules and criteria. It offers advantages such as speed, efficiency, and the ability to process large amounts of data. However, it is important to understand the risks involved and continually evaluate and adjust trading strategies to stay profitable in dynamic markets.

The Evolution of Trading Strategies

As the world of finance has evolved, so too have the strategies used by traders. From the days of open outcry on the trading floors to today’s high-frequency algorithmic trading, the landscape of trading strategies has undergone a significant transformation.

In the early days of trading, most strategies relied heavily on fundamental analysis. Traders would evaluate the financial health and performance of companies, study market trends, and make decisions based on their analysis. However, this approach was time-consuming and relied on manual calculations, making it difficult to execute trades quickly.

With the advent of computers and the internet, technical analysis became more prevalent. Traders began using historical price data and mathematical indicators to identify patterns and trends in the market. This approach allowed for faster and more precise decision-making, as well as the ability to automate certain trading actions.

The Rise of Quantitative Trading

Quantitative trading, also known as algorithmic trading, took off in the 1990s with the increasing availability of high-speed computers and advanced mathematical models. Traders began developing algorithms that could analyze large amounts of data and execute trades automatically based on predefined criteria.

These algorithms could take into account various factors, such as price movements, volatility, and market liquidity, to make trading decisions. By eliminating human emotions and biases from the trading process, quantitative trading aimed to achieve consistent profitability and reduce market inefficiencies.

The Emergence of High-Frequency Trading

High-frequency trading (HFT) is a subset of quantitative trading that involves executing a large number of trades at extremely high speeds. HFT firms use sophisticated algorithms and co-location services to gain a competitive advantage in the market.

These algorithms are designed to exploit small price discrepancies and take advantage of market microstructure. HFT strategies often involve scalping, where trades are executed within milliseconds or even microseconds to capture small profits on each trade.

The evolution of trading strategies has been driven by advancements in technology and the increasing availability of data. Today, automated trading platforms like 1inchswap allow traders to execute trades on decentralized exchanges with minimal manual intervention.

As technology continues to advance, it is likely that trading strategies will continue to evolve. Artificial intelligence and machine learning are already being used to develop more sophisticated and adaptive trading algorithms. The future of trading strategies holds promising opportunities for both individual and institutional traders.

In conclusion, the evolution of trading strategies has been shaped by the changing landscape of technology and data availability. From fundamental analysis to quantitative trading and high-frequency trading, traders have embraced new tools and techniques to gain a competitive edge in the market.

The Role of Automation in Modern Trading

In the fast-paced world of trading, automation has proven to be a powerful tool for traders. With the advancement of technology, automated trading systems have become increasingly popular among both retail and institutional traders.

One of the main advantages of automation in trading is the ability to execute trades quickly and efficiently. With automated systems, traders can take advantage of any market opportunity that arises, regardless of the time or their physical presence. This saves valuable time and allows for a more flexible trading strategy.

Automation also helps to remove the emotional aspect from trading. Emotions, such as fear and greed, can often cloud judgment and lead to poor trading decisions. Automated trading systems follow predefined rules and algorithms, eliminating the influence of emotions. This can lead to more disciplined and consistent trading, reducing the impact of human error.

Furthermore, automation allows for backtesting and optimization of trading strategies. Traders can simulate their strategies using historical market data to see how they would have performed in the past. This helps to identify strengths and weaknesses in the strategy and make necessary adjustments for better performance. It also allows traders to test and compare multiple strategies simultaneously, saving time and effort.

Another benefit of automation is the ability to monitor and react to multiple markets and instruments simultaneously. Manual trading can be time-consuming and challenging to keep up with the constantly changing market conditions. Automated trading systems can scan the markets, identify trading opportunities, and execute trades across multiple platforms in real-time, providing traders with the ability to take advantage of diverse market conditions.

However, it is important to note that automation is not a magic solution. It still requires careful planning, proper risk management, and continuous monitoring. Traders need to understand the underlying principles and mechanisms of the automated trading system they are using.

In conclusion, automation plays a crucial role in modern trading. It offers benefits such as faster execution, emotion-free decision-making, strategy optimization, and the ability to monitor multiple markets simultaneously. Traders who embrace automation are likely to stay competitive in the ever-evolving financial markets.

Exploring the Benefits of Automated Trading on 1inchswap

Automated trading has revolutionized the way people trade in the financial markets, offering numerous benefits such as increased efficiency, reduced emotions, and improved accuracy. These benefits also extend to decentralized exchanges like 1inchswap, where automated trading can enhance the trading experience even further.

Increased Efficiency

One of the primary benefits of automated trading on 1inchswap is increased efficiency. With automated trading algorithms, traders can execute trades quickly and efficiently, taking advantage of market opportunities without the need for manual intervention. This eliminates the time-consuming process of manually monitoring the market and entering trades, allowing traders to focus on other aspects of their trading strategy or even have more free time.

Reduced Emotions

Emotions can often cloud judgment and lead to poor trading decisions. Automated trading removes human emotions from the equation, as trades are executed based on pre-set rules and algorithms. Traders no longer need to worry about making impulsive decisions or letting fear or greed dictate their actions. This can lead to more disciplined and rational trading, ultimately improving overall performance.

Furthermore, automated trading on 1inchswap can provide peace of mind, as the algorithms can continue executing trades even when the trader is away or offline. This level of automation allows traders to take advantage of opportunities in the market 24/7 without the need to constantly monitor their positions.

Improved Accuracy

Automated trading algorithms are designed to execute trades based on precise rules and parameters. This eliminates the potential for human error, such as entering incorrect trade details or missing out on profitable trades due to oversight. With automated trading on 1inchswap, traders can rely on the accuracy of their algorithms to execute trades consistently and without mistakes, leading to potentially better trading results over time.

| Benefits of Automated Trading on 1inchswap |

|---|

| Increased Efficiency |

| Reduced Emotions |

| Improved Accuracy |

Enhanced Speed and Efficiency

Automated trading on 1inchswap offers enhanced speed and efficiency compared to manual trading. With automation, trades can be executed instantaneously, taking advantage of market opportunities in real time. Manual trading requires constant monitoring of the market and executing trades manually, which can be time-consuming and prone to human error.

By utilizing automated trading strategies, traders can overcome the limitations of manual trading and leverage the speed of computer algorithms to execute trades more efficiently. Automated trading systems can quickly analyze market data, identify trading signals, and execute trades with minimal latency, ensuring that traders can capitalize on market movements without delay.

Real-time Data Analysis

Automated trading systems on 1inchswap continuously monitor market data in real time. They can instantly analyze various indicators, such as price movements, trading volume, and liquidity, to identify trading opportunities. By utilizing algorithms that are designed to detect patterns and trends in the market, automated trading systems can make informed trading decisions based on data-driven analysis.

This real-time data analysis enables traders to react swiftly to changing market conditions and capture profits from short-term price movements. It also reduces the reliance on human intuition and emotions, ensuring that trading decisions are based on objective criteria rather than subjective factors.

Minimized Latency

Automated trading eliminates the latency associated with manual trading. Trades can be executed instantaneously without the need for human intervention. This minimizes the risk of delays caused by slow internet connections or manual errors. Traders can take advantage of even the smallest market inefficiencies with high-frequency trading strategies that execute trades at lightning-fast speeds.

Furthermore, automated trading systems can be set to automatically adjust trading parameters based on market conditions. This dynamic adaptation helps optimize trading strategies and ensures efficient execution regardless of market fluctuations. Traders can also set stop-loss and take-profit orders to manage risk more effectively and secure profits when specific price levels are reached.

In summary, automated trading on 1inchswap offers enhanced speed and efficiency compared to manual trading. By leveraging the power of computer algorithms, traders can analyze real-time market data, make informed trading decisions, and execute trades instantaneously. This enables traders to capitalize on market opportunities efficiently and minimize the risks associated with manual trading.

Question-answer:

What is 1inchswap?

1inchswap is a decentralized exchange aggregator that allows users to find the best prices for swapping tokens across multiple platforms.

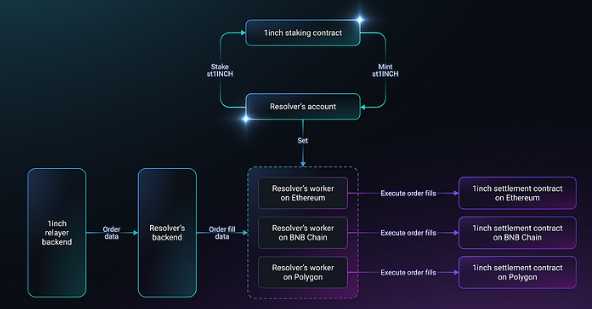

How does automated trading work on 1inchswap?

Automated trading on 1inchswap is facilitated through the use of smart contracts and algorithms. Users can set up trading strategies and parameters that are executed automatically based on certain conditions.