Decentralized exchanges have revolutionized the way we trade cryptocurrencies, offering users enhanced security, transparency, and control over their assets. Among the top players in this space are Uniswap and 1inch, two leading decentralized exchanges that have gained significant popularity.

Uniswap, often referred to as the pioneer of decentralized exchanges, is built on the Ethereum blockchain. It operates based on an automated market maker (AMM) model, allowing users to trade directly from their wallets without the need for intermediaries. Uniswap’s unique feature is its use of liquidity pools, where users can provide liquidity and earn fees in return.

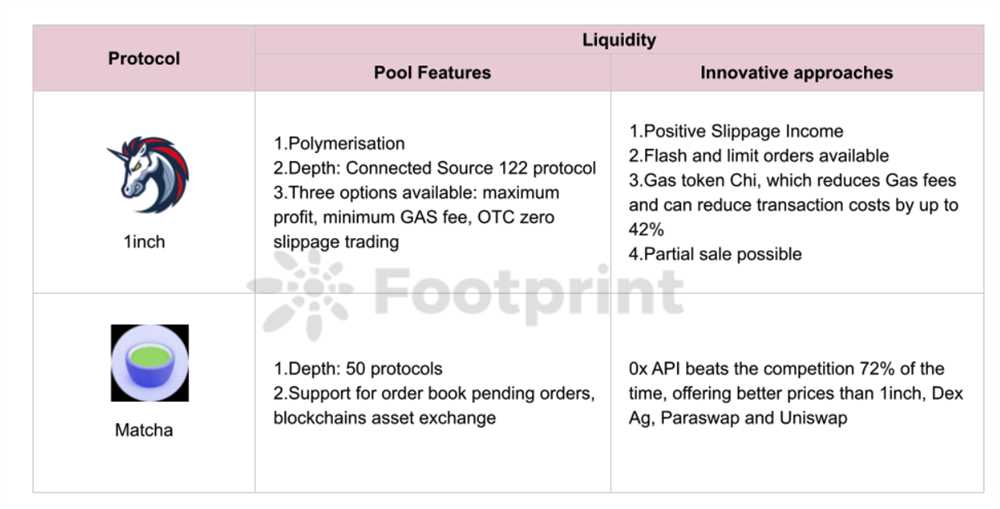

1inch, on the other hand, is a decentralized exchange aggregator that aims to provide users with the best possible trading rates across multiple decentralized exchanges. It scans different platforms, including Uniswap, to find the most favorable rates and executes trades on behalf of the user. 1inch also offers other features like limit orders and gas fee optimization to enhance the trading experience.

When comparing Uniswap and 1inch, both platforms have their own strengths and weaknesses. Uniswap’s simplicity and ease of use make it a popular choice for beginners. However, its limited functionality and high gas fees during periods of high network congestion can be drawbacks.

On the other hand, 1inch’s aggregator model provides users with access to a wide range of liquidity sources, maximizing their chances of getting the best possible rates. The platform’s advanced features also make it more suitable for experienced traders. However, navigating its interface may require some technical knowledge, and it may not be as user-friendly for beginners.

In conclusion, both Uniswap and 1inch offer unique features and advantages in the decentralized exchange ecosystem. Choosing between them depends on individual preferences, trading goals, and experience. It is important for users to consider factors such as fees, liquidity, user interface, and additional features when deciding which platform to use.

Overview of Uniswap

Uniswap is a decentralized exchange (DEX) that operates on the Ethereum blockchain. It was launched in November 2018 and has quickly become one of the most popular DEXs in the decentralized finance (DeFi) space.

Unlike traditional centralized exchanges, Uniswap eliminates the need for intermediaries and allows users to trade directly from their wallets. It operates using an automated market maker (AMM) model, which means that trades are executed against liquidity pools rather than individual buyers and sellers. This model enables users to trade assets without relying on a centralized order book.

Uniswap’s core functionality is its ability to provide liquidity for any ERC-20 token on the Ethereum blockchain. Users can add their tokens to liquidity pools by depositing an equal value of both the token they want to provide and an equivalent value of another token in the pool. In return, they receive liquidity tokens that represent their share of the pool. These liquidity tokens can be traded or redeemed for the underlying assets at any time.

Key Features of Uniswap

- Decentralization: Uniswap operates without a central authority, making it censorship-resistant and less prone to hacking or downtime.

- No KYC: Uniswap does not require users to go through a know-your-customer (KYC) process, allowing for anonymous trading.

- Anyone can trade: Uniswap is open to anyone with an Ethereum wallet, enabling anyone to access and participate in the exchange.

- High liquidity: Uniswap’s AMM model ensures that liquidity is always available in the pools, enabling quick and efficient trades.

How Uniswap Works

Uniswap uses a constant product formula to determine token prices and trade execution. The formula, called the “x*y=k” formula, ensures that the product of the number of tokens in a pool remains constant as trades occur. When a trade is executed, the token price adjusts based on the new quantities of tokens in the pool.

| Step | Action |

|---|---|

| 1 | A user sends a transaction to the Uniswap smart contract, specifying the token they want to trade and the token they want to receive in return. |

| 2 | Uniswap calculates the appropriate token swap amount based on the available liquidity in the pool and the price impact. |

| 3 | The transaction is executed, and the user receives the swapped tokens in their wallet. |

Uniswap’s protocol also includes a mechanism called “flash swaps,” which allows users to borrow tokens from the liquidity pools without requiring upfront collateral. This feature has opened up new opportunities for arbitrage and capital efficiency in the DeFi ecosystem.

Overall, Uniswap has revolutionized the decentralized exchange landscape by providing a simple and secure way to trade ERC-20 tokens without the need for a trusted third party. Its innovative AMM model and user-friendly interface have contributed to its widespread adoption and popularity within the DeFi community.

Overview of 1inch

1inch is a decentralized exchange aggregator that aims to provide users with the most efficient and cost-effective trades across various decentralized exchanges. It was launched in 2019 by Sergej Kunz and Anton Bukov.

One of the key features of 1inch is its ability to split a single trade across multiple decentralized exchanges in order to achieve the best possible price for the user. This is done by leveraging smart contract technology and liquidity protocols.

1inch also enables users to easily compare and choose between different liquidity providers, allowing them to make informed decisions and maximize their profits. This is particularly valuable in the decentralized finance (DeFi) space where liquidity can be fragmented across multiple platforms.

The 1inch protocol is built on top of the Ethereum blockchain, which means that it benefits from the security and transparency of the underlying network. It also supports a wide range of tokens, including ERC-20, ERC-721, and ERC-1155 tokens, giving users access to a diverse selection of assets.

Overall, 1inch offers a user-friendly interface, low slippage rates, and competitive trading fees, making it a popular choice for traders and investors in the DeFi space.

Features and functionality comparison

When comparing Uniswap and 1inch, it’s important to consider the features and functionality each platform offers. Here’s a breakdown of how they stack up:

- User Interface: Uniswap provides a simple and intuitive user interface that allows users to easily navigate and trade tokens. 1inch also offers a user-friendly interface, but it includes additional features and functionalities that can be overwhelming for beginners.

- Liquidity: Uniswap is known for its high liquidity, thanks to its automated market-making mechanism. 1inch also benefits from the liquidity of various decentralized exchanges, as it aggregates liquidity from multiple sources.

- Token Support: Both platforms support a wide range of ERC-20 tokens. However, Uniswap has a larger selection of tokens listed on its platform compared to 1inch.

- Swap Rates: Uniswap offers competitive swap rates, and users can trade tokens at market prices without the need for order books. 1inch, on the other hand, uses an algorithm that finds the most efficient and cost-effective trading routes across various decentralized exchanges.

- Slippage: Uniswap allows users to set their desired slippage tolerance, while 1inch offers more advanced slippage settings, allowing users to customize their trading experience to a greater extent.

- Gas Fees: Both platforms operate on the Ethereum network, meaning users have to pay gas fees for transactions. However, 1inch provides a GasToken feature that can help reduce gas costs for users.

- User Experience: Uniswap focuses on simplicity and ease of use, making it a popular choice for beginners. 1inch caters to more experienced traders who are looking for advanced features and functionalities.

- Security: Uniswap and 1inch are both decentralized exchanges, which means that users have full control over their funds. However, it’s important to note that the security of the underlying smart contracts and platforms themselves can be a concern.

In conclusion, while both Uniswap and 1inch are prominent decentralized exchanges, they differ in terms of their user interfaces, liquidity, token support, swap rates, slippage settings, gas fees, user experience, and security. Choosing between the two ultimately depends on the user’s trading preferences and requirements.

Question-answer:

What is Uniswap?

Uniswap is a decentralized exchange that operates on the Ethereum blockchain. It allows users to trade ERC20 tokens directly from their wallets without the need for intermediaries.

What is 1inch?

1inch is also a decentralized exchange that operates on multiple blockchains, including Ethereum. It aggregates liquidity from various sources to provide users with the best possible trading rates.

How do Uniswap and 1inch compare in terms of trading fees?

Uniswap charges a flat fee of 0.3% on each trade. On the other hand, 1inch’s fees depend on the liquidity sources it uses for a particular trade, which can vary. However, 1inch aims to provide the most competitive rates and lower fees compared to traditional centralized exchanges.

Which exchange offers better liquidity, Uniswap or 1inch?

Both Uniswap and 1inch offer high liquidity for popular tokens. Uniswap has established itself as one of the leading decentralized exchanges and has a wide range of tokens available for trading. 1inch, on the other hand, aggregates liquidity from various sources, including Uniswap, to provide users with the best rates and liquidity.