Understanding the 1inch Whitepaper: A Comprehensive Guide to Decentralized Exchanges

Decentralized exchanges, or DEXs, have seen immense growth and popularity in recent years. As the name suggests, these exchanges operate on decentralized platforms, allowing users to trade cryptocurrencies directly from their wallets without relying on a centralized authority.

One of the most prominent DEXs in the market today is 1inch. In order to fully understand how 1inch works and the principles it is built upon, it is crucial to dive into their whitepaper. The 1inch whitepaper provides a comprehensive guide to the intricacies of this decentralized exchange, shedding light on the underlying technology and mechanisms that power the platform.

The whitepaper introduces the concept of “DEX aggregators” – a crucial component of the 1inch protocol. DEX aggregators are algorithms that scan multiple DEXs to find the best available price for a particular trade, taking into account fees and liquidity. This approach ensures that users get the most favorable rates and reduces fragmentation in the decentralized exchange landscape.

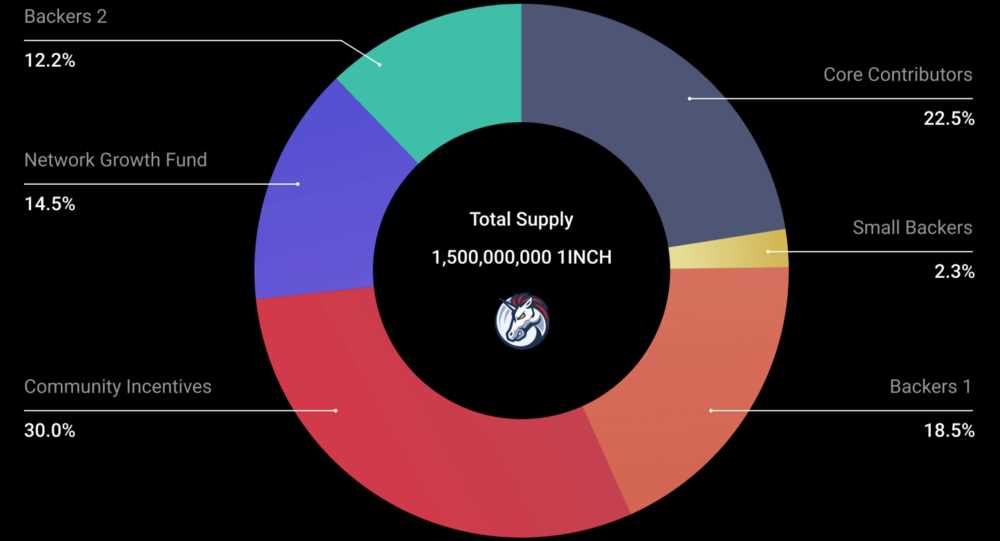

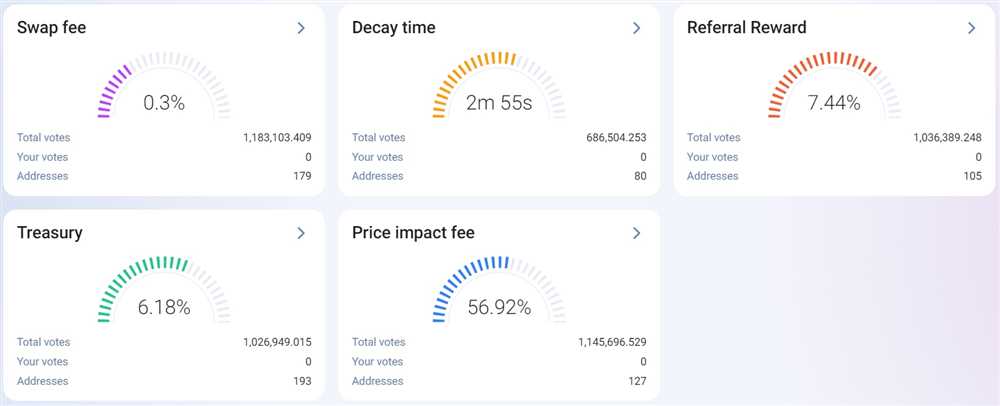

The 1inch whitepaper also delves into the details of the 1inch governance token (1INCH), which plays a vital role in the ecosystem. Holders of the 1INCH token have the power to vote on important protocol upgrades and proposals, thus shaping the future direction of the exchange. The whitepaper further explains the token distribution model, highlighting its fair and transparent nature to ensure a balanced participation from the community.

In conclusion, understanding the 1inch whitepaper is crucial for anyone looking to explore the world of DEXs. It provides a comprehensive insight into the inner workings of the platform, highlighting the innovative solutions that the 1inch team has implemented to create a seamless trading experience for its users. As DEXs continue to revolutionize the crypto space, delving into the whitepaper of industry leaders like 1inch becomes increasingly important.

What are Decentralized Exchanges?

A decentralized exchange (DEX) is a type of cryptocurrency exchange that operates on a blockchain network without the need for a central authority or third-party intermediaries. Unlike traditional centralized exchanges, which rely on a centralized authority to manage and facilitate transactions, DEXs enable peer-to-peer trading directly between users through smart contracts.

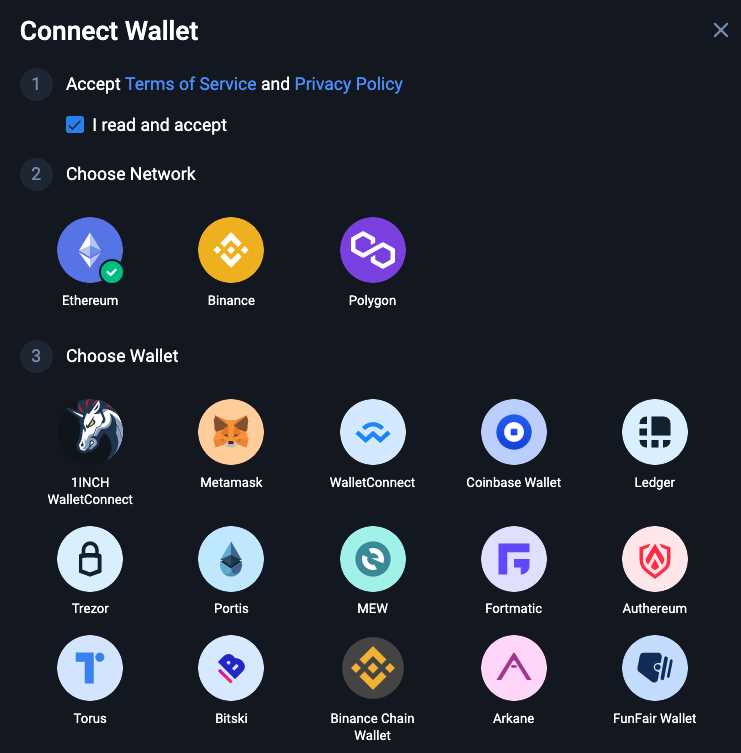

One of the key features of decentralized exchanges is that they allow users to maintain control of their funds throughout the trading process. Instead of depositing funds into a centralized exchange wallet, as is the case with centralized exchanges, users can connect their wallets directly to the DEX and trade directly from their own wallets.

Decentralized exchanges leverage the transparency and security of blockchain technology to facilitate trustless and censorship-resistant trading. By utilizing smart contracts, DEXs enable users to trade digital assets in a secure and immutable manner, without relying on a centralized authority to manage the exchange.

DEXs also offer advantages such as increased privacy and reduced counterparty risk. Since transactions on DEXs are executed on the blockchain, users do not need to share their personal information or undergo extensive KYC/AML procedures typically required by centralized exchanges. Additionally, DEXs eliminate the risk of theft or loss of funds due to exchange hacks, as users remain in control of their private keys and funds are not held on a centralized platform.

Overall, decentralized exchanges provide a more democratic and accessible way to trade cryptocurrencies, eliminating the need for intermediaries and enabling direct peer-to-peer transactions. As the popularity and adoption of blockchain technology continue to grow, DEXs are expected to become an increasingly important part of the cryptocurrency ecosystem.

Advantages of Decentralized Exchanges

Decentralized exchanges (DEXs) offer several advantages over traditional centralized exchanges. These advantages include:

1. Security and Data Privacy

One of the key advantages of DEXs is the enhanced security they provide. In a decentralized exchange, users retain control of their funds and trade directly from their wallets, eliminating the need to trust a centralized platform with their assets. This reduces the risk of hacks or data breaches, as there is no central point of failure.

Additionally, DEXs prioritize data privacy. Users do not need to provide personal information, such as KYC (know your customer) details, to use most DEXs. This protects user privacy and reduces the risk of sensitive data being compromised.

2. Transparency and Trustlessness

DEXs operate on public blockchains, which means that all transactions and order books are transparent and accessible to anyone. This transparency builds trust in the ecosystem, as users can verify the accuracy of trade history and market data themselves.

Furthermore, DEXs are trustless in nature. Smart contracts, which govern the trading process, are written in code and automatically execute trades based on predefined rules, eliminating the need for intermediaries or middlemen. This reduces the risk of fraud or manipulation.

In summary, decentralized exchanges offer enhanced security, data privacy, transparency, and trustlessness. These advantages make DEXs an attractive option for users seeking a more secure, private, and trustworthy trading experience.

Understanding the 1inch Whitepaper

In the world of decentralized finance (DeFi), understanding the underlying technology and principles behind projects is crucial. One such project is 1inch, a decentralized exchange aggregator that aims to provide users with the best possible prices by sourcing liquidity from various exchanges.

The 1inch whitepaper serves as a comprehensive guide to understanding the platform’s architecture, protocols, and economic incentives. It outlines the problems with traditional exchanges and how 1inch addresses these issues through its innovative approach.

The whitepaper starts by discussing the limitations of centralized exchanges, such as high trading fees, limited liquidity, and the potential for market manipulation. It then introduces the concept of decentralized exchanges (DEXs) as a solution to these problems, highlighting their benefits in terms of transparency, lower fees, and improved security.

Next, the whitepaper delves into the specifics of 1inch’s design and functionality. It explains the concept of decentralized exchange aggregation, where 1inch sources liquidity from multiple DEXs to provide users with the best possible prices. The paper also explains the role of the 1inch token (1INCH) and how it incentivizes liquidity providers and users of the platform.

Furthermore, the whitepaper discusses the technical aspects of 1inch, including the smart contracts that power the platform. It explores the use of algorithms and advanced routing strategies to optimize trades and reduce slippage. It also highlights the importance of security measures and audits to protect users’ funds.

Overall, the 1inch whitepaper is an essential resource for anyone looking to gain a deeper understanding of the platform. It provides a detailed explanation of the problems addressed by 1inch and how its technology and protocols offer a more efficient and user-friendly alternative to traditional exchanges. By studying the whitepaper, users can grasp the underlying principles that drive the 1inch ecosystem and make informed decisions when using the platform.

The Role of 1inch in the DEX Ecosystem

1inch plays a crucial role in the decentralized exchange (DEX) ecosystem as it aims to provide users with the best possible prices for their trades. As a decentralized exchange aggregator, 1inch searches multiple DEXs to find the most optimal routing for a trade, allowing users to benefit from lower slippage and better rates.

With the growing popularity of DEXs, the number of available platforms and liquidity sources has increased significantly. This presents a challenge for users, as they need to manually search and compare prices across multiple DEXs in order to get the best deal. This is where 1inch comes in.

1inch uses an algorithm called Pathfinder to search multiple DEXs and find the most efficient and cost-effective route for a trade. By splitting large trades across multiple DEXs, 1inch is able to minimize slippage and ensure users get the best possible price.

In addition to its routing capabilities, 1inch also provides users with access to liquidity from a wide range of DEXs. This means that users can trade assets that are not available on a single DEX by leveraging the liquidity available on other platforms. This significantly expands the trading options for users, resulting in greater liquidity and a more competitive market.

Furthermore, 1inch uses a unique token swap mechanism that allows users to exchange one token for another in a single transaction. This feature eliminates the need for users to manually execute multiple trades across different DEXs, saving time and reducing the complexity of the trading process.

In summary, 1inch plays a vital role in the DEX ecosystem by providing users with the best possible prices, access to a wide range of liquidity sources, and a simplified trading experience. By leveraging its smart routing algorithm and unique token swap mechanism, 1inch aims to create a more efficient and user-friendly decentralized trading environment.

What is 1inch?

1inch is a decentralized exchange aggregator that provides users with the best rates by splitting orders across multiple decentralized exchanges (DEXs). It was created to solve the issue of fragmented liquidity and high slippage often encountered when trading on DEXs.

1inch uses an algorithm called Pathfinder to find the most efficient and cost-effective paths for trading tokens across different DEXs. It takes into account not only the exchange rates but also the fees and liquidity of each DEX to ensure users get the best possible rates for their trades.

By leveraging smart contract technology, 1inch allows users to execute trades directly from their wallets without the need to deposit funds on any centralized exchange. This eliminates the risk of losing funds due to hacks or security breaches.

1inch also offers a variety of features to enhance the trading experience, such as limit orders and gas optimization. Additionally, it provides users with detailed information about liquidity pools, gas fees, and estimated transaction times.

Overall, 1inch is on a mission to make decentralized trading more accessible, efficient, and cost-effective for users, ultimately contributing to the growth of the decentralized finance (DeFi) ecosystem as a whole.

Key Features of 1inch

1inch is a decentralized exchange aggregator that offers several key features to users:

1. Best Price Execution

1inch uses a unique algorithm that splits users’ orders across multiple decentralized exchanges to ensure they get the best possible prices for their trades. By leveraging its aggregation protocol, 1inch is able to find the most efficient trading routes across different liquidity sources, resulting in optimal price execution for users.

2. Gas Optimization

1inch helps users save on gas fees by automatically routing their trades through the most cost-effective paths. By analyzing gas prices across different networks and exchanges, 1inch is able to minimize transaction costs and ensure that users can trade with minimal overhead.

3. Liquidity Aggregation

1inch aggregates liquidity from various decentralized exchanges, allowing users to access a wider range of trading options and better prices. By connecting to multiple liquidity providers, 1inch helps users tap into deeper liquidity pools, reducing slippage and improving overall trading efficiency.

4. Security and Privacy

1inch prioritizes the security and privacy of its users. It employs various security measures, such as smart contract audits and bug bounties, to ensure the safety of user funds. Additionally, 1inch does not require users to create an account or provide any personal information, preserving their privacy throughout the trading process.

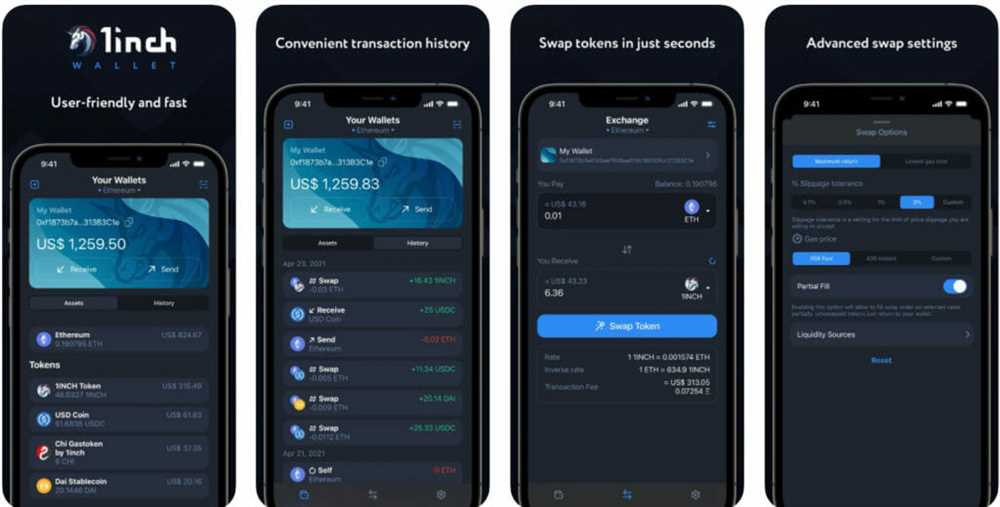

5. User-Friendly Interface

1inch offers a simple and intuitive interface that makes it easy for users to navigate and execute trades. The platform provides detailed information on price quotes, liquidity sources, and transaction costs, enabling users to make informed decisions. Additionally, 1inch integrates seamlessly with popular wallets, making it convenient for users to connect their accounts and start trading.

In summary, 1inch combines innovative technology, liquidity aggregation, gas optimization, security measures, and a user-friendly interface to provide a comprehensive decentralized exchange solution. By leveraging these key features, 1inch aims to offer users the best possible trading experience in the DeFi space.

Question-answer:

What is a DEX?

A DEX, or decentralized exchange, is a type of cryptocurrency exchange that operates on a distributed ledger, such as a blockchain, and allows users to trade digital assets directly with each other, without the need for intermediaries.

How does 1inch work?

1inch is a decentralized exchange aggregator that sources liquidity from various DEXs. It uses an intelligent routing algorithm to split a user’s trade across multiple DEXs to get the best possible price. The platform also offers liquidity pools and yield farming opportunities.

What advantages does 1inch offer over other DEXs?

One of the main advantages of 1inch is its ability to provide users with the best possible prices by routing trades across multiple DEXs. It also offers a user-friendly interface, low fees, and a wide range of digital assets to trade. Additionally, 1inch has a strong focus on security and offers various layers of protection for users.

Can I use 1inch with any cryptocurrency?

Yes, 1inch supports a wide range of cryptocurrencies, including popular ones like Bitcoin (BTC), Ethereum (ETH), and many others. However, the availability of specific cryptocurrencies may vary depending on the liquidity of each DEX that 1inch sources from.